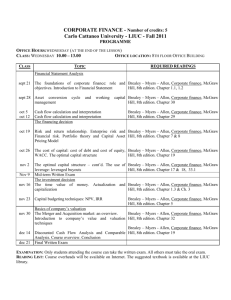

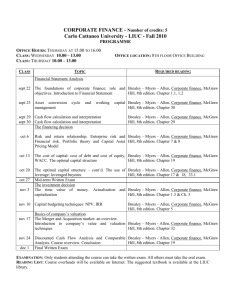

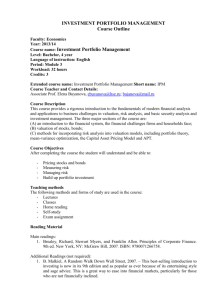

Corporate Finance II

advertisement

NEW ECONOMIC SCHOOL MASTERS IN FINANCE 2011 Corporate Finance II Prof. Sergey Sanzhar London Business School E-mail: ssanzhar@london.edu Phone: +44 207 000 8286 Office hours: flexible 1. Course Description and Objective The objective of the course is to provide a solid grounding in the principles and practice of corporate finance. The course covers two broad themes: corporate financial policy and company valuation. Specific topics covered in this course include: capital budgeting, cost of capital, capital structure, corporate payout policy, and company valuation. For all questions relating to class assignments, you should get in touch with the tutor. 2. Course textbook and readings There are two textbooks for the course: Berk and DeMarzo, Corporate Finance, Pearson International Edition, First Edition, 2007. Brealey, Myers, and Allen “Principles of Corporate Finance” (9th edition). We will be working together on a number of case studies to illustrate the practical application of the principles and techniques covered in the course. Case solutions will be distributed during the lectures. In addition to these books and cases, there will also be a number of other readings - including lecture slides and case solution notes – that will be made available as the sessions progress. A full list of all weekly readings is given in the detailed course outline below. As we progress through the term, you should use this as a checklist to ensure that you have received and read all the relevant material. 3. Classes Classes (as opposed to lectures) will be held by the tutor (TA). Classes are designed to help you consolidate your understanding of the lectures. The emphasis will be on reinforcement rather than new topics. 4. Course assessment and examination The course grade is based on the individual assignment, case write-ups, a group valuation assignment, and a final exam. The overall course grade will be made up as follows: Assignment Due date Problem Set 3 Case Write-ups Paramount Case Final Exam Fri, January 28 Beginning of the relevant lecture February 19 TBD Contribution to course grade 15% 20% 20% 45% Problem Set There will be one individual Problem Set. The Problem Set is due to be handed in by the start of the relevant lecture as hard copies or emailed to the TA. Late submission will be given a grade of 0. Problem Set will be assigned in due course. Case write-ups for 3 short cases Each student must turn in an individual case write-up for all 3 of following cases: FPL, Intel, and Arch. Turn in your write-up at the beginning of the relevant lecture. E-mailing to me (ssanzhar@london.edu) is fine. The write-up should be (strictly) one page featuring a summary of the case and a brief description of what you think should be the two or three key aspects of the analysis. Grading of the write-ups is Pass/Fail. That is, you fail if your write-up has no analytical content at all. Reading the case and writing up should take approximately two hours. Paramount case For Paramount case, the write up should be in groups of 4-5 people and with full analysis and calculations. You must work in groups. Please select your groups now. Each group should submit one report with the names of group members on the first page. Paramount case write-up should be strictly no more than three pages in length with tables and figures put in appendix (no more than 5 additional pages). Be clear and explicit about your assumptions and calculations. Presenting your work well (e.g. a sales pitch to a potential merger client or results of your analysis to your boss) is almost as important as the quality of your analysis. Therefore, each group should be prepared to present the results of the Paramount case in class for 10-15 minutes. I will call on 1 or 2 groups to present and will not announce in advance who has to present. Each member of the group should participate in the presentation. Final exam The final exam will assess your understanding of all concepts and ideas covered during the course. It is a closed-book examination. A double-sided A4 cheat sheet is allowed. As a rule, there are no “make-up” final exams. It is your responsibility to schedule the rest of your activities such that you are able to attend the final exam which is on ______TBD___. 5. Detailed Course Outline (subject to change) Lecture 1 (Jan 13) A: Course Introduction. Modigliani-Miller Theorem and Trade-off Theory: Lecture Preparation Read Berk and DeMarzo, Chapter 14, Chapter 16 Sections 16.416.7 Brealey, Myers and Allen, Chapter 18 Sections 18.1, 18.2, Chapter 19 except 19.4 B: Modigliani-Miller and Trade-off Theory: UST Case Preparation Read UST Inc. Case Lecture 2 (Jan 15) A: Pecking Order and Market Timing: Lecture Preparation Read Berk and DeMarzo, Chapter 16 Sections 16.8-16.9 Brealey, Myers and Allen, Chapter 19.4 B: Additional Capital Structure Topics (Convertibles,Warrants, etc.): Lecture Preparation Read Brealey, Myers and Allen, Chapter 25 Section 25.6 2 Lecture 3 (Jan 20) A: Equity Issuance- Rights/SEOs/IPOs/Underwriting: Lecture Preparation Read Berk and DeMarzo, Chapter 23 Brealey, Myers and Allen, Chapter 16 except 16.1 B: Equity Issuance- Rights/SEOs/IPOs/Underwriting: Lecture (cont.) Preparation Lecture 4 (Jan 22) A: Payout Policy: Lecture Preparation Read Berk and DeMarzo, Chapter 17 Brealey, Myers and Allen, Chapter 17 B: Payout Policy: FPL Case Preparation Read FPL Case Lecture 5 (Feb 3) A: Wrap-up on Financial Structure: Intel Case Preparation Read Intel Case B: Measuring the Cost of Capital: Lecture + Nike Inc. Case Preparation Read Nike Inc Case, Brealey, Myers and Allen, Chapter 10 Lecture 6 (Feb 5) A: DCF Valuation Techniques: Lecture Preparation Read Berk and DeMarzo, Chapters 18-19 Brealey, Myers and Allen, Chapter 20 B: DCF Valuation Techniques: Lecture (cont.)+GM-Hugues Mini-case Preparation Read Harvard Business School, “Valuation techniques” Read Harvard Business School, “Note on alternative methods for estimating terminal value” Read GM-Hugues Mini-case Lecture 7 (Feb 19) A: Valuing Companies Using Multiples: The Arch Case Preparation Read Arch Communications Case B: Summary on Valuation: Paramount Communications Case Preparation Read Paramount case. Hand in written group case report. 3