D. Undergraduate Honors Thesis Supervision

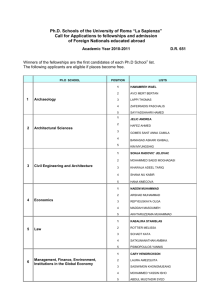

advertisement