23 Exhibits and Forms Microsoft Word versions of the following

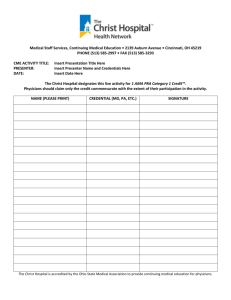

advertisement