Chapter 11 Solutions

advertisement

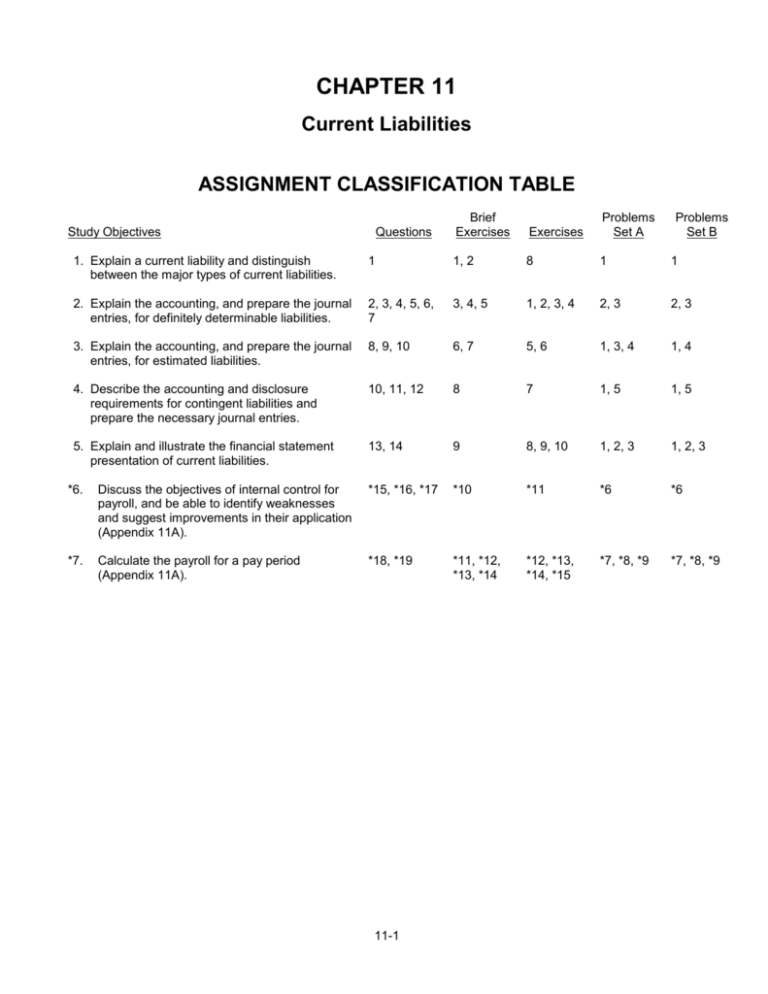

CHAPTER 11 Current Liabilities ASSIGNMENT CLASSIFICATION TABLE Study Objectives Questions Brief Exercises Exercises Problems Set A Problems Set B 1. Explain a current liability and distinguish between the major types of current liabilities. 1 1, 2 8 1 1 2. Explain the accounting, and prepare the journal entries, for definitely determinable liabilities. 2, 3, 4, 5, 6, 7 3, 4, 5 1, 2, 3, 4 2, 3 2, 3 3. Explain the accounting, and prepare the journal entries, for estimated liabilities. 8, 9, 10 6, 7 5, 6 1, 3, 4 1, 4 4. Describe the accounting and disclosure requirements for contingent liabilities and prepare the necessary journal entries. 10, 11, 12 8 7 1, 5 1, 5 5. Explain and illustrate the financial statement presentation of current liabilities. 13, 14 9 8, 9, 10 1, 2, 3 1, 2, 3 *6. Discuss the objectives of internal control for payroll, and be able to identify weaknesses and suggest improvements in their application (Appendix 11A). *15, *16, *17 *10 *11 *6 *6 *7. Calculate the payroll for a pay period (Appendix 11A). *18, *19 *11, *12, *13, *14 *12, *13, *14, *15 *7, *8, *9 *7, *8, *9 11-1 ASSIGNMENT CHARACTERISTICS TABLE Problem Number Description Difficulty Level Time Allotted (min.) Simple 10-15 Moderate 30-40 Simple 25-35 1A Identify liabilities. 2A Journalize and post note transactions. Show balance sheet presentation. 3A Prepare current liability entries, adjusting entries, and current liabilities section of balance sheet. 4A Record warranty. Moderate 15-25 5A Discuss contingency reporting. Moderate 15-25 *6A Identify internal control weaknesses and recommend improvements. Moderate 20-30 *7A Calculate payroll. Prepare payroll entries. Moderate 40-50 *8A Journalize payroll transactions. Simple 25-35 *9A Prepare entries for payroll, including employee benefit costs. Moderate 20-30 1B Identify liabilities. Simple 10-15 2B Journalize and post note transactions. Show balance sheet presentation. Moderate 30-40 3B Prepare current liability entries, adjusting entries, and current liabilities section of balance sheet. Simple 25-35 4B Record warranty. Moderate 15-25 5B Discuss contingency reporting. Moderate 15=25 *6B Identify internal control weaknesses and recommend improvements. Moderate 20-30 *7B Prepare payroll entries. Moderate 30-40 *8B Journalize and post payroll transactions. Calculate liability balances. Simple 25-35 *9B Calculate missing payroll amounts. Prepare all related journal entries. Complex 25-35 Cumulative coverage—Chapters 9 to 11 Moderate 50-60 11-2 BLOOM’S TAXONOMY TABLE Correlation Chart between Bloom’s Taxonomy, Study Objectives and End-of-Chapter Material Study Objectives 1. Explain a current liability and distinguish between the major types of current liabilities. Knowledge Comprehension Q11-1 BE11-1 BE11-2 Application 2. Explain the accounting, and prepare the journal entries, for definitely determinable liabilities. Q11-6 Q11-2 Q11-4 Q11-5 Q11-7 Q11-3 BE11-3 BE11-4 BE11-5 E11-1 E11-2 E11-3 E11-4 P11-2A P11-3A P11-2B P11-3B 3. Explain the accounting, and prepare the journal entries, for estimated liabilities. Q11-10 Q11-8 Q11-9 BE11-6 BE11-7 E11-5 E11-6 P11-1A P11-3A P11-4A P11-1B P11-4B 4. Describe the accounting and disclosure requirements for contingent liabilities and prepare the necessary journal entries. Q11-10 Q11-11 Q11-12 P11-5A P11-5B BE11-8 E11-7 P11-1A P11-1B 5. Explain and illustrate the financial statement presentation of current liabilities. Q11-14 Q11-13 BE11-9 E11-8 E11-9 E11-10 P11-1A *BE11-10 *Q11-16 *Q11-17 *Q11-15 *6. Discuss the objectives of internal control for payroll, and be able to identify weaknesses and suggest improvements in their application (Appendix 11A). Analysis E11-8 P11-1A P11-1B P11-2A P11-3A P11-1B P11-2B P11-3B *E11-11 *P11-6A *P11-6B 11-3 Synthesis Evaluation Study Objectives *7. Calculate the payroll for a pay period (Appendix 11A). Knowledge *Q11-19 Comprehension *Q11-18 Application *BE11-11 *BE11-12 *BE11-13 *BE11-14 *E11-12 *E11-13 *E11-14 *E11-15 *P11-7A *P11-8A *P11-9A *P11-7B *P11-8B Analysis BYP11-1 BYP11-2 BYP11-3 BYP11-4 BYP11-6 Broadening Your Perspective 11-4 Synthesis Evaluation BYP11-7 Cumulative Coverage BYP11-5 BYP11-8 *P11-9B ANSWERS TO QUESTIONS 01. Li Feng is not totally correct. A current liability is a debt that can reasonably be expected to be paid (a) from existing current assets or through the creation of other current liabilities and (b) within one year or the operating cycle, whichever is longer. 02. (a) Disagree. The company only serves as a collection agent for the taxing authority. It does not report sales taxes as an expense; it reports sales taxes as a currently liability. It merely forwards the amount paid by the customer to the government. (b) The entry to record the proceeds is: Cash....................................................................... 10,700 Sales ................................................................ GST Payable.................................................... 10,000 700 03. (a) The entry when the tickets are sold is: Cash (1,000 x $90) ................................................ 90,000 Unearned Football Ticket Revenue ............... 90,000 (b) The entry after each game is: Unearned Football Ticket Revenue .................... 18,000 Football Ticket Revenue ................................ ($90/5 games X 1,000 tickets) 18,000 4. No. When an employer withholds income tax from an employee pay cheque, the employer is merely acting as a collection agent for the taxing body. Since the employer holds employees' funds, these withholdings are a liability for the employer until they are remitted to the government. 5. Payroll deductions can be classified as either mandatory (required by the government) or voluntary (not required by the government). Mandatory deductions include income tax, Canada Pension Plan contributions, and employment insurance. Examples of voluntary deductions are health and life insurance premiums, union dues, pension contributions, and charitable contributions. 11-5 Questions Chapter 11 (Continued) 6. Mandatory payroll (employee benefit) costs include Canada Pension Plan, Employment Insurance and Workplace Health, Safety and Compensation. 7. $75,000 of the liability should be classified as long-term. $25,000 should be deducted from the long-term portion and shown as current. 08. I don’t agree. Although you don’t know which specific appliances will be returned for repair you can estimate the cost of repairs that will be required under warranties. This can be estimated based on past experience or industry information. If repairs costs are not recorded until units are brought in, liabilities on the balance sheet will be understated and the expenses will not be properly matched with revenue on the income statement. If sales are increasing, this will probably result in an overstatement of income. 09. This situation can arise because the property tax bill for the year is usually not known until the spring. In the interim, a company must accrue an expense and estimated liability (usually based on last year’s property tax bill) for property tax payable. Later in the year, when the company receives its property tax bill, it would record prepaid property tax (a current asset) and a property tax payable (a current liability). Once the property tax bill is paid, the liability will disappear. As time passes, the company would record the property tax expense and credit the prepaid property tax account. Therefore, the company can have both a prepaid asset and a current liability related to property taxes in the same period—at least until the property tax bill is paid. 10. Estimated and contingent liabilities are alike in that the amount of the claim is not known with certainty and must therefore be estimated. They are different in that an estimated liability is owed by the company –the liability does exist. The existence of a contingent liability depends on events outside the company’s control. 11-6 Questions Chapter 11 (Continued) 11. A contingent liability is an existing situation involving uncertainty as to a possible obligation, which will be resolved when one or more future events occur or fail to occur. Contingent liabilities are only recorded in the accounts if they are probable and the amount is reasonably estimable. An example of a contingency that is likely but not estimable is a lawsuit that the company expects to lose but cannot estimate the amount of the judgment. An example of a contingency that is not determinable—neither likely nor unlikely—is a loan guarantee. 12. If a contingent liability is both likely to occur and reasonably estimable, it is recorded in the accounts. If its likelihood is not determinable, or if it is not reasonably estimable, it is not recorded in the accounts but disclosed in a note. If it is unlikely to occur, but (if confirmed) could have a significant adverse effect, disclosure is desirable but not required. 13. In the balance sheet, Notes Payable of $25,000 and Interest Payable of $562.50 ($25,000 x 9% x 3/12) should be reported as current liabilities. In the income statement, Interest Expense of $562.50 should be reported under other expenses and losses. Further details of the note (interest rate, due date, etc.) can be reported in the notes to the financial statements. 14. Current liabilities are usually listed in order of their liquidity (due date). They are also often listed in order of magnitude with the largest items listed first. *15. The main internal control objectives associated with payrolls are (1) to safeguard company assets from unauthorized payments of payrolls and (2) to assure the accuracy and reliability of the accounting records pertaining to payrolls. *16. The employee earnings record is used in (1) determining when an employee has earned the maximum earnings subject to CPP and EI deductions, (2) filing information returns, and (3) providing each employee with a statement of gross earnings and tax withholdings for the year. 11-7 Questions Chapter 11 (Continued) *17. Examples of employee benefits include: (1) Paid absences—vacation pay, sick pay, and paid holidays. (2) Health care and life insurance benefits. (3) Pension plan benefits. *18. Gross pay is the amount an employee actually earns. Net pay, the amount an employee is paid, is gross pay reduced by both mandatory and voluntary deductions, such as income tax, union dues, etc. Gross pay should be recorded as wages or salaries expense. *19. Paid absences refer to compensation paid by employers to employees for vacations, sickness, and holidays. When the payment of such compensation is probable and the amount can be reasonably estimated, a liability should be accrued for paid future absences which employees have earned. When this amount cannot be reasonably estimated, the potential liability should be disclosed. 11-8 SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 11-1 (a) A note payable due in two years is a long-term liability, not a current liability. (b) $30,000 of the mortgage payable is a current maturity of long-term debt. This amount should be reported as a current liability. (c) Interest payable of $24,000 is a current liability because it will be paid out of current assets in the near future. (d) Accounts payable of $60,000 is a current liability because it will be paid out of current assets in the near future. BRIEF EXERCISE 11-2 1. 2. 3. 4. 5. 6. Current liability Current liability Current liability Current liability Current liability Current asset 7. 8. 9. 10. 11. Current liability Current asset Contingent liability Current liability Current liability BRIEF EXERCISE 11-3 July 1 Dec. 31 Cash ........................................................................ 60,000 Notes Payable ................................................. Interest Expense .................................................... Interest Payable .............................................. ($60,000 X 10% X 6/12 = $3,000) 11-9 60,000 3,000 3,000 BRIEF EXERCISE 11-4 Calculation of sales: Sales = $6,900 ÷ 1.15 = $6,000 Calculation of sales tax payable: GST payable = $6,000 X 7% = $420 PST payable = $6,000 X 8% = $480 Mar. 16 Cash .................................................................... Sales ............................................................ GST Payable................................................ PST Payable ................................................ 6,900 6,000 420 480 BRIEF EXERCISE 11-5 Cash ...................................................................................... 180,000 Unearned Basketball Ticket Revenue ......................... (2,000 tickets X $90 per ticket) Unearned Basketball Ticket Revenue ................................. Basketball Ticket Revenue ........................................... ($180,000/12 games or $90/12 X 2,000) 11-10 180,000 15,000 15,000 BRIEF EXERCISE 11-6 Property tax expense June 30 income statement $25,200 X 6/12 months = $12,600 Prepaid property tax June 30 balance sheet $2,100 x 6 months = $12,600 Property tax payable June 30 balance sheet $2,100 x 12 months = $25,200 Journal entries (not required): Jan. 1 to Mar. 31 (each month for 3 months; $6,000) Property Tax Expense ............................................ Property Tax Payable ..................................... Apr. 30 2,000 2,000 Prepaid Property Tax ($2,100 x 8 mos. May–Dec.) 16,800 Property Tax Expense ............................................ 2,400* Property Tax Payable ($25,200 - $6,000) ....... 19,200 *Property tax expense Jan. 1-March 31 $24,000 X 3/12 months = $6,000; Should have been $25,200 X 3/12 months = $6,300 $6,300 - $6,000 or $300 under-expensed from July 1 to March 31 + $2,100 for April = $2,400 May 31 June 30 July 15 Property Tax Expense ............................................ Prepaid Property Tax ..................................... 2,100 Property Tax Expense ............................................ Prepaid Property Tax ..................................... 2,100 2,100 2,100 Property Tax Payable ($6,000 + $19,200) .............. 25,200 Cash ................................................................ 25,200 11-11 BRIEF EXERCISE 11-7 Dec. 31 Warranty Expense .............................................. Warranty Liability....................................... [(1,000 X 5%) X $75] 3,750 3,750 BRIEF EXERCISE 11-8 Loss due to Environmental Lawsuit ................................... Liability for Clean up .................................................... 50,000 50,000 The arguments for recording this liability are that the outcome is likely (according to their lawyer) and the amount can be estimated. The argument against recording it is that it is not known for sure yet if a liability exists and the amount is uncertain. Management may be reluctant to disclose this information on the financial statements for fear it be taken as an admission of guilt. BRIEF EXERCISE 11-9 MGI SOFTWARE (Partial) Balance Sheet January 31, 2000 Liabilities Current liabilities Accounts payable and accrued liabilities ................... $10,632 Unearned revenue ........................................................ 1,013 Current portion of long term debt ............................... 167 Total current liabilities ....................................... $11,812 Note: this presentation lists the accounts in order of size–an alternative would be to estimate due dates and list them in order of maturity. 11-12 *BRIEF EXERCISE 11-10 1. 2. Timekeeping Hiring 3. 4. Preparing the payroll Paying the payroll *BRIEF EXERCISE 11-11 Gross earnings: Regular pay (40 X $15).................................................. $600.00 Overtime pay (3 X $22.50) ............................................ 67.50 $667.50 Less: Income tax payable .................................................... $120.20 CPP contributions ......................................................00 025.81 EI premiums ............................................................... 0 15.02 Net pay .................................................................................. 161.03 $506.47 *BRIEF EXERCISE 11-12 Jan. 15 Jan. 15 Wages Expense .................................................. Income Tax Payable ................................... Wages Payable ........................................... CPP Payable................................................ EI Payable ................................................... 667.50 Wages Payable ................................................... Cash ............................................................ 506.47 11-13 120.00 506.47 25.81 15.02 506.47 *BRIEF EXERCISE 11-13 Jan. 31 31 Salaries and Wages Expense ............................ CPP Payable................................................ EI Payable ................................................... Income Taxes Payable ............................... Salaries and Wages Payable...................... 70,000 Employee Benefits Expense.............................. CPP Payable................................................ EI Payable ($1,575 x 1.4) ............................ 4,935 2,730 1,575 15,300 50,395 2,730 2,205 *BRIEF EXERCISE 11-14 Jan. 31 Vacation Benefits Expense (50 X $150) ............ Vacation Benefits Payable ......................... 11-14 7,500 7,500 SOLUTIONS TO EXERCISES EXERCISE 11-1 (a) May 31 (b) June 30 (c) Nov. 30 Cash ............................................................. Notes Payable ..................................... 50,000 Interest Expense ......................................... Interest Payable .................................. ($50,000 X 9% X 1/12) 375 Notes Payable ............................................. Interest Payable ($50,000 x 9% x 1/12) ...... Interest Expense ($50,000 x 9% x 5/12) ..... Cash .................................................... 50,000 375 1,875 50,000 375 52,250 (d) $2,250 ($50,000 x 9% x 6/12) EXERCISE 11-2 (a) Briffet Construction Oct. 1 Cash ............................................................. 250,000 Notes Payable ..................................... Nov. 1 Interest Expense.......................................... Cash .................................................... ($250,000 X 10% X 1/12) 2,083 2,083 (b) TD Bank Oct. 1 Notes Receivable......................................... 250,000 Cash .................................................... Nov. 1 Cash ............................................................. Interest Revenue ................................ ($250,000 X 10% X 1/12) 11-15 250,000 250,000 2,083 2,083 EXERCISE 11-3 1. Sainsbury Company Apr. 10 2. Cash .................................................................... Sales ............................................................ PST Payable ............................................... GST Payable................................................ 28,756 25,000 2,006 1,750 Hockenstein Company Apr. 15 Cash .................................................................... Sales ($18,240 ÷ 1.14) ................................. GST Payable ($16,000 x 7%) ...................... PST Payable ($16,000 x 7%) ....................... 18,240 16,000 1,120 1,120 EXERCISE 11-4 (a) Nov. 30 (b) Dec. 31 (c) Mar. 31 Cash ............................................................ 216,000 Unearned Subscription Revenue ....... (6,000 X $36) Unearned Subscription Revenue .............. Subscription Revenue ........................ ($216,000 X 1/12) 18,000 Unearned Subscription Revenue .............. Subscription Revenue ........................ ($216,000 X 3/12) 54,000 11-16 216,000 18,000 54,000 EXERCISE 11-5 (a) Estimated warranties outstanding: Month November December Total Estimate of Defective Units Units Defective Outstanding at Dec. 31 0,700 0,500 1,200 500 780 1,280 30,000 X 4% = 1,200 32,000 X 4% = 1,280 2,480 Dec. 31 estimated warranty liability—1,280 X $10 = $12,800 (b) Dec. 31 31 (c) Jan. Warranty Expense (2,480 X $10) ................ Warranty Liability ................................ 24,800 Warranty Liability........................................ Repair Parts Inventory, Wages Payable, Cash, Etc. ................. 12,000 Warranty Liability (550 X $10) .................... Repair Parts Inventory, Wages Payable, Cash, Etc. ................. 5,500 11-17 24,800 12,000 5,500 EXERCISE 11-6 (a) Last calendar year Oct. 31 - Dec. 31 Property Tax Expense ($24,000 X 1/12)......... Prepaid Property Tax .............................. 2,000 2,000 This entry would be made monthly Oct. to Dec. ($2,000 X 3 mos. = $6,000). Current calendar year Jan. 31 - Apr. 30 Property Tax Expense ($24,000 X 1/12)......... Property Tax Payable .............................. 2,000 2,000 This entry would be made monthly Jan. to April ($2,000 X 4 mos. = $8,000). (b) May 1 Prepaid Property Tax ($26,400 x 8/12 mos. May-Dec.) ..................... 17,600 Property Tax Expense .................................... 800* Property Tax Payable ($26,400 - $8,000) 18,400 *[($2,200 - $2,000) x 4 mos. (Jan. to April) under-expensed] May 31 Property Tax Expense ($26,400 X 1/12)......... - June 30 Prepaid Property Tax .............................. 2,200 2,200 This entry would be made monthly May and June ($2,200 X 2 mos. = $4,400). (c) July 1 Property Tax Payable ($8,000 + $18,400) ...... 26,400 Cash ......................................................... (d) July 31 Property Tax Expense ($26,400 X 1/12)......... - Sept. 30 Prepaid Property Tax .............................. 2,200 This entry would be made monthly July, August, and September. 11-18 26,400 2,200 EXERCISE 11-7 The company should record an estimate of the cost of replacing the cribs in its financial statements. If it is unlikely that the lawsuit will be successful they do not have to report or disclose anything else. If it is either likely or if it cannot be determined if the lawsuit will be successful the lawsuit should be disclosed in the notes as a contingent liability. If it is likely the lawsuit will be successful and the $500,000 is a reasonable estimate it should be accrued. EXERCISE 11-8 (a) Account Accounts payable Classification Current liability Reason Due within one year Accrued benefit liability Current liability Due within one year Accrued liabilities Current liability Due within one year Advances on long-term contracts Long-term liability Advance (funds) provided by company, long-term related to contracts Current liability Due within one year Current portion of long term debt Deferred income taxes Other Income taxes payable Current liability Long-term debt Long-term liability Not due within one year Payroll related liabilities Current liability Due within one year Short-term borrowings Current liability Due within one year Unused operating line of credit NA Not a balance sheet item as unused – may be disclosed in notes 11-19 Income taxes payable in the future Due within one year EXERCISE 11-8 (Continued) (b) BOMBARDIER (Partial) Balance Sheet January 31, 2001 (in millions) Current liabilities Short-term borrowings...................................................... Accounts payable .............................................................. Accrued liabilities .............................................................. Current portion of long-term debt .................................... Accrued benefit liability .................................................... Payroll related liabilities ................................................... Income taxes payable........................................................ Total current liabilities ............................................... $2,531.2 2,142.3 1,534.9 974.6 494.4 359.4 91.3 $8,128.1 EXERCISE 11-9 (a) ATKINSON ON-LINE (Partial) Balance Sheet August 31, 2003 Current liabilities Accounts payable .................................................. Unearned revenue ................................................. Warranty liability.................................................... Provincial sales taxes payable ............................. Long-term debt due within one year .................... Interest payable ..................................................... Property tax payable ............................................. Total current liabilities .................................. (b) Current ratio = $300,000 ÷ $144,000 = 2.1:1 11-20 $ 66,000 24,000 18,000 10,000 10,000 8,000 8,000 $144,000 EXERCISE 11-10 (a) LOEW’S CINEPLEX ENTERTAINMENT CORPORATION (Partial) Balance Sheet February 28, 2001 (U.S. thousands) Current liabilities Current maturities of long-term debt and other obligations ........................................... Accounts payable and accrued expenses.................. Unearned revenue ........................................................ Total current liabilities ................................................. (b) 1. $739,665 88,059 22,423 $850,147 Current assets Cash and cash equivalents .................................. $47,200 Accounts receivable ............................................. 11,453 Prepaid expenses and other current assets ....... 7,340 Inventories ............................................................ 4,056 Total current assets ............................................. $70,049 2. Working capital $70,049 - $850,147 = $780,098 deficit 3. Current ratio $70,049 ÷ $850,147 = 0.08:1 11-21 *EXERCISE 11-11 (a) Internal controls: Contracts are issued to full-time employees (documentation) and their pay must be approved by Board of Directors (authorization) Time tracked in log books for hourly employees (documentation) Payroll service bureau (documentation and segregation of duties) Direct deposit (segregation of duties) Detailed and summary reports (independent verification) (b) Weaknesses in internal control: Verbal agreement for casual employees should be replaced by written, authorized agreement No mention is made of controls used to ensure the accurate recording of this log. Signatures should be supervised/authorized *EXERCISE 11-12 Sept. 13 Wages Expense ................................................ Income Tax Payable ............................... CPP Payable ........................................... EI Payable ............................................... Cash ........................................................ 11-22 516.00 79.70 19.29 11.61 405.40 *EXERCISE 11-13 (a) AHMAD COMPANY Payroll Register For the Week Ending January 31 Earnings Employee A. Hope B. Innes C. Stone Totals Total Hours 43 42 44 Regular $0,400.00 00,480.00 520.00 $1,400.00 Overtime $045.00 0036.00 78.00 $159.00 Deductions Gross Pay $0,445.00 00,516.00 00,598.00 $1,559.00 CPP EI $16.24 $10.01 0019.29 0011.61 022.82 013.46 $58.35 $35.08 11-23 Income Tax $074.00 0087.00 0118.00 $279.00 Health Insurance $10.00 015.00 015.00 $40.00 Total $110.25 0132.90 0169.28 $412.43 Net Pay $0,334.75 00,383.10 428.72 $1,146.57 *EXERCISE 11-13 (Continued) (b) Jan. 31 31 Wages Expense...................................... CPP Payable ................................... EI Payable ....................................... Income Tax Payable ....................... Health Insurance Payable .............. Wages Payable ............................... 1,559.00 Employee Benefits Expense ................. CPP Payable ($58.35 x 1) ............... EI Payable ($35.08 X 1.4) ................ Workers’ Compensation Payable ($1,559 X 2%) ............................... Health Insurance Payable .............. 178.64 58.35 35.08 279.00 40.00 1,146.57 58.35 49.11 31.18 40.00 *EXERCISE 11-14 (a) (1) (2) (3) (4) (5) (6) $12,016.67 $13,066.67 $507.40 $4,502.40 $8,564.27 $8,166.67 Calculations: (1) Total = EI deductions $294 2.25% = $13,066.67 Regular = Total $13,066.67 – Overtime $1,050 = $12,016.67 (2) Total = $12,016.67 + $1,050 = $13,066.67 (3) CPP = Pensionable earnings $11,800 X 4.3% = $507.40 (4) Total deductions = $507.40 + $294.00 + $3,262 + $139 + $300 = $4,502.40 (5) Net pay = Total $13,066.67 – Total deductions $4,502.40 = $8,564.27 (6) Store wages = Total $13,066.67 – Warehouse wages $4,900.00 = $8,166.67 11-24 *EXERCISE 11-14 (Continued) (b) CPP = $507.40 X 1.0 = $507.40 EI = $294.00 X 1.4 = $411.60 (c) Feb. 28 28 28 Warehouse Wages Expense............ Store Wages Expense...................... CPP Payable ............................. EI Payable ................................. Income Tax Payable ................. Union Dues Payable ................. United Way Payable.................. Wages Payable ......................... 4,900.00 8,166.67 Employee Benefits Expense ........... CPP Payable ............................. EI Payable ................................. 919.00 Wages Payable ................................. Cash .......................................... 8,564.27 507.40 294.00 3,262.00 139.00 300.00 8,564.27 507.40 411.60 8,564.27 *EXERCISE 11-15 Mar. 31 31 Vacation Benefits Expense ..................... (8 X 2 X $100) Vacation Benefits Payable............... 1,600 Medical Insurance Expense ($50 X 8) .... Medical Insurance Payable ............. 400 11-25 1,600 400 SOLUTIONS TO PROBLEMS PROBLEM 11-1A (a) 1. Current liabilities section 2. Current liabilities section 3. Current liabilities section 4. No current liability —relates to next period 5. Contingent liability 6. Current liabilities section Accounts payable Bonus payable Salaries payable CPP Payable EI payable Income tax payable Property tax payable Not on balance sheet Interest payable Current maturity Long-term liabilities section Note payable $150,000 $35,000 $1,7231 2582 1623 1,0804 0 0 $4,1675 $100,000 $400,000 Calculations: 1 ($5,000 X 3/5) – (4.3% X $3,000) – (2.25% X $3,000) – ($1,800 x 3/5) = $1,723 2 (4.3% X $3,000) X 2 = $258 3 (2.25% X $3,000) X 2.4 = $162 4 $1,800 x 3/5 = $1,080 5 $500,000 X 10% X 1/12 = $4,167 (b) The notes should disclose information on the contingent liability– the lawsuit, including the estimated loss and the fact that the likelihood of the loss cannot be determined. Information on the Note Payable should also be disclosed–including the interest rate and repayment terms and payments required in each of the next five years. 11-26 PROBLEM 11-2A (a) Jan. 12 Feb. 1 Mar. 31 Apr. July 1 1 Sept. 30 Oct. Dec. 1 1 Dec. 31 Merchandise Inventory ................................... 18,000 Accounts Payable .................................... 18,000 Accounts Payable ........................................... 18,000 Notes Payable .......................................... 18,000 Interest Expense ............................................. ($18,000 X 10% X 2/12) Interest Payable ....................................... 300 300 Notes Payable ................................................. 18,000 Interest Payable .............................................. 300 Cash ......................................................... 18,300 Equipment ....................................................... 36,000 Cash ......................................................... Notes Payable .......................................... 11,000 25,000 Interest Expense ............................................. ($25,000 X 10% X 3/12) Interest Payable ....................................... 625 625 Notes Payable ................................................. 25,000 Interest Payable .............................................. 625 Cash ......................................................... 25,625 Cash ................................................................. 20,000 Notes Payable .......................................... 20,000 Interest Expense ($20,000 X 9% X 1/12) ........ Interest Payable ....................................... 11-27 150 150 PROBLEM 11-2A (Continued) (b) Notes Payable 4/1 10/1 18,000 25,000 2/1 7/1 12/1 18,000 25,000 20,000 12/31 Bal. 20,000 Interest Payable 4/1 10/1 300 625 3/31 9/30 12/31 300 625 150 12/31 Bal. 150 Interest Expense 3/31 9/30 12/31 12/31 Bal. (c) 300 625 150 1,075 LEARNSTREAM COMPANY (Partial) Balance Sheet December 31, 2003 Current liabilities Notes payable .................................................... $20,000 Interest payable ................................................. 00 150 $20,150 (d) Total interest is $1,075 (as per the balance in the Interest Expense account). 11-28 PROBLEM 11-3A (a) Jan. 1 5 5 12 14 20 20 25 25 Cash ........................................................... 15,000 Notes Payable .................................... Cash ........................................................... Sales ($7,752 ÷ 1.14) .......................... PST Payable ($6,800 x 7%) ................ GST Payable ($6,800 x 7%) ................ 7,752 Cost of Goods Sold ................................... Merchandise Inventory ...................... 4,600 Unearned Service Revenue ...................... Service Revenue ................................ 8,000 PST Payable ............................................... GST Payable .............................................. Cash .................................................... 5,800 5,800 15,000 6,800 476 476 4,600 8,000 11,600 Accounts Receivable ................................ 29,640 Sales (500 X $52)................................ PST Payable ($26,000 x 7%) .............. GST Payable ($26,000 x 7%) .............. 26,000 1,820 1,820 Cost of Goods Sold (500 x $20) ................ 10,000 Merchandise Inventory ...................... 10,000 Cash ........................................................... 14,820 Sales ($14,820 ÷ 1.14) ........................ PST Payable ($13,000 x 7%) .............. GST Payable ....................................... 13,000 910 910 Cost of Goods Sold ................................... Merchandise Inventory ...................... 11-29 9,000 9,000 PROBLEM 11-3A (Continued) (b) (1) Jan. 31 (2) Jan. 31 Interest Expense ....................................... Interest Payable ................................ ($15,000 X 10% X 1/12) 125 Warranty Expense ($26,000 X 8%) ........... Warranty Liability .............................. 2,080 125 2,080 (c) MOLEGA SOFTWARE COMPANY (Partial) Balance Sheet January 31, 2003 Current liabilities Accounts payable .......................................................... $42,500 Notes payable ................................................................ 15,000 Unearned service revenue ($15,000 – $8,000) ............ 7,000 PST payable ($5,800 + $476 – $5,800 + $1,820 + $910) 3,206 GST payable ($5,800 + $476 - $5,800 + $1,820 + $910) 3,206 Warranty liability ............................................................ 2,080 Interest payable ...........................................................0 125 Total current liabilities ........................................... $73,117 11-30 PROBLEM 11-4A 2002 Warranty Expense ..................................... 19,800 Warranty Liability ............................... ($660,000 X 3%) Warranty Liability ...................................... 16,000 Cash .................................................... 2003 Warranty Expense ..................................... 42,000 Warranty Liability ............................... ($840,000 X 5%) Warranty Liability ...................................... 35,000 Cash .................................................... 11-31 19,800 16,000 42,000 35,000 PROBLEM 11-5A The company should disclose the fact that it is uninsurable under a discussion of risks in the general note to its financial statements. This is information that would be of concern to investors. 11-32 *PROBLEM 11-6A (a) Weaknesses (b) Recommended Procedures 1. Department managers The human resources department should do the hiring. The qualifications of each applicant should be determined and letters of recommendation should be obtained. The human resources department should notify the payroll department of new hires, through a hiring authorization form. have too much authority in hiring. An interview should not be the sole basis for hiring or rejecting an applicant. The pay rate should not be manually written on the TD-1 form. Hours worked are marked on the time card by the employee. Time cards should be punched by a time clock, and the punching of the clock by employees should be supervised so that one employee cannot punch more than one card. Employees give the approved cards to payroll. The manager should deliver the cards to payroll, in order to prevent possible alterations by employees during delivery. 2. 11-33 *PROBLEM 11-6A (Continued) (a) Weaknesses (b) Recommended Procedures 3. Department manager indicates the rates of pay. Rates of pay should be authorized in writing by the human resources department, and communicated to the payroll department. The department manager pays the employees. The controller's department should pay the employees. Payment is in cash. Payment should be made by cheque. 11-34 *PROBLEM 11-7A (a) SURE VALUE HARDWARE Payroll Register For the Week Ending March 15, 2003 Earnings Employee A. Pima C. Zuni E. Hopi G. Mohav Totals Hours Regular 40 42 44 46 0,520.00 0,520.00 0,520.00 0,520.00 2,080.00 Overtime 000.00 039.00 078.00 117.00 234.00 Deductions Gross Pay 0,520.00 0,559.00 0,598.00 0,637.00 2,314.00 Income Tax 089.65 99.65 110.50 123.65 423.45 CPP 019.47 21.14 22.82 24.50 87.93 11-35 EI 11.70 12.58 13.46 14.33 52.07 United Way 05.00 05.00 08.00 05.00 23.00 Total 125.82 138.37 154.78 167.48 586.45 Net Pay 394.18 420.63 443.22 469.52 1,727.55 Store Office Wages Wages Expense Expense 0,520.00 0,559.00 0,598.00 000 1,677.00 637.00 637.00 *PROBLEM 11-7A (Continued) (b) Mar. 15 15 (c) Mar. 16 (d) Mar. 31 Store Wages Expense............................ Office Wages Expense........................... CPP Payable ................................... Income Tax Payable ....................... EI Payable ....................................... United Way Contributions Payable Wages Payable ............................... 1,677.00 637.00 Employee Benefits Expense ................. CPP Payable ($87.93 x 1) ............... EI Payable ($52.07 X 1.4) ................ 160.83 Wages Payable ....................................... Cash ................................................ 1,727.55 CPP Payable ($87.93 + $87.93) .............. EI Payable ($52.07 + $72.90) .................. Income Tax Payable ............................... United Way Contributions Payable ....... Cash ................................................ 175.86 124.97 423.45 23.00 11-36 87.93 423.45 52.07 23.00 1,727.55 87.93 72.90 1,727.55 747.28 *PROBLEM 11-8A Jan. 10 12 15 20 31 31 31 Union Dues Payable......................................... Cash ........................................................... 1,250 CPP Payable ..................................................... EI Payable ......................................................... Income Tax Payable ......................................... Cash ........................................................... 2,978 1,811 16,400 Canada Savings Bonds Payable ..................... Cash ........................................................... 2,500 Workers’ Compensation Payable ................... Cash ........................................................... 5,634 Office Salaries Expense .................................. Store Wages Expense ..................................... CPP Payable .............................................. EI Payable .................................................. Income Tax Payable .................................. Union Dues Payable .................................. United Way Payable .................................. Wages Payable .......................................... 24,600 37,400 Wages Payable ................................................. Cash ........................................................... 44,811 Employee Benefits Expense ........................... CPP Payable .............................................. EI Payable ($1,395 X 1.4) .......................... Workers’ Compensation Payable ($62,000 X 7%) ........................................ Vacation Benefits Payable ($62,000 X 4%) 11,067 11-37 1,250 21,189 2,500 5,634 2,294 1,395 12,400 800 300 44,811 44,811 2,294 1,953 4,340 2,480 *PROBLEM 11-9A (a) Dec. 31 (b) Dec. 31 Administrative Salaries Expense ................. 180,000 Electricians' Wages Expense ....................... 370,000 CPP Payable............................................ Income Taxes Payable ........................... EI Payable ............................................... United Way Payable ................................ Dental Insurance Premiums Payable .... Long-term Disability Insurance Payable Salaries and Wages Payable ................. 21,450 123,000 12,375 5,000 2,400 1,500 384,275 Employee Benefits Expense ........................ 75,675 CPP Payable............................................ EI Payable ($12,375 X 1.4) ...................... Workers’ Compensation Payable .......... Long-term Disability Insurance Payable Medical Insurance Plan Payable............ 21,450 17,325 11,000 1,500 24,400 (c) Administrative Salaries Expense................................... Electricians' Wages Expense......................................... Employee Benefits Expense .......................................... Total Compensation Costs ............................................ 11-38 $180,000 370,000 75,675 $625,675 PROBLEM 11-1B (a) 1.Not on balance sheet 2. Current liabilities section 3. Current liabilities section 4. Current liabilities section 5. Current liabilities section 6. Current liabilities section FOB destination and arrived after year-end Bonus payable $36,000 Salaries payable $5,0761 CPP payable 6882 EI payable 4323 Income tax payable 2,4004 Unearned revenue $25,000 Environmental liability $250,0005 Interest payable $167 Note payable $25,000 Calculations: 1 ($10,000 X 4/5) – (4.3% X $8,000) – (2.25% X $8,000) – ($3,000 x 4/5) = $5,076 2 (4.3% X $8,000) X 2 = $688 3 (2.25% X $8,000) X 2.4 = $432 4 $3,000 x 4/5 = $2,400 5 Note: Because this contingent liability is likely and estimable, it should be recorded in the accounts 6 $25,000 X 8% X 1/12 = $167 (b) The notes should disclose information on the lawsuit, including the estimated loss and the fact that the likelihood of the loss cannot be determined. Information on the Note Payable should also be disclosed–including the interest rate and repayment term. 11-39 PROBLEM 11-2B (a) Mar. 2 31 Apr. 1 30 May 1 2 31 June 1 1 30 Bicycle Equipment .................................. Notes Payable—Mongoose ............. 8,000 Interest Expense ($8,000 X 9% X 1/12) ... Interest Payable ............................... 60 8,000 60 Land ......................................................... 20,000 Notes Payable—Mountain Real Estate Interest Expense...................................... [($20,000 X 12% X 1/12) + $60] Interest Payable ............................... 260 Interest Payable ....................................... Cash .................................................. 200 Cash ......................................................... Notes Payable—Western Bank ....... 15,000 Interest Expense...................................... [($15,000 X 6% X 1/12) + $60 + $200] Interest Payable ............................... 335 Interest Payable ....................................... Cash .................................................. 200 Notes Payable—Mongoose..................... Interest Payable ($8,000 x 9% x 3/12) ..... Cash .................................................. 8,000 180 Interest Expense ($200 + $75) ................ Interest Payable ............................... 275 11-40 20,000 260 200 15,000 335 200 8,180 275 PROBLEM 11-2B (Continued) (b) 6/1 Notes Payable 8,000 3/2 4/1 5/2 8,000 20,000 15,000 6/30 Bal. 35,000 5/1 6/1 6/1 Interest Payable 200 3/31 200 4/30 180 5/31 6/30 6/30 Bal. 60 260 335 275 350 Interest Expense 3/31 60 4/30 260 5/31 335 6/30 275 6/30 Bal. 930 (c) MILEHI MOUNTAIN BIKES (Partial) Balance Sheet June 30, 2003 Current liabilities Notes payable ..................................................................... Interest payable .................................................................. Total current liabilities ............................................... (d) Total interest expense is $930. 11-41 $35,000 350 $35,350 PROBLEM 11-3B (a) Jan. 5 12 14 20 21 25 (b) Jan. 31 Cash ........................................................... Sales ($16,632 ÷ 1.15)........................ GST Payable ($14,463 X 7%) ............. PST Payable ($14,463 X 8%) ............. 16,632 Unearned Service Revenue ...................... Service Revenue................................ 9,000 GST Payable .............................................. PST Payable .............................................. Cash ................................................... 7,500 8,570 Accounts Receivable ................................ Sales (500 X $50) ............................... GST Payable ($25,000 X 7%) ............. PST Payable ($25,000 X 8%) ............. 28,750 Cash ........................................................... Notes Payable—HSBC Bank............. 18,000 Cash ........................................................... Sales ($11,340 ÷ 1.15)........................ GST Payable ($9,861 X 7%) ............... PST Payable ($9,861 X 8%) ............... 11,340 Interest Expense ....................................... Interest Payable ................................. ($18,000 X 10% X 1/3/12 = $50) 50 11-42 14,463 1,012 1,157 9,000 16,070 25,000 1,750 2,000 18,000 9,861 690 789 50 PROBLEM 11-3B (Continued) (c) BURLINGTON COMPANY (Partial) Balance Sheet January 31, 2003 Liabilities Current liabilities Accounts payable ............................................................. Notes payable ................................................................... Unearned service revenue ($16,000 – $9,000) ................ GST payable ($7,500 + $1,012 - $7,500 + $1,750 + $690) PST payable ($8,570 + $1,157 - $8,570 + $2,000 + $789) Interest payable ................................................................ Total current liabilities ............................................. 11-43 $52,000 18,000 7,000 3,452 3,946 50 $84,448 PROBLEM 11-4B 2002 Dec. 31 Warranty Expense ..................................... Warranty Liability ............................... ($50,000 X 4%) Warranty Liability ...................................... Repair Parts Inventory....................... 2003 Dec. 31 Warranty Expense ..................................... Warranty Liability ............................... ($85,000 X 4%) - ($2,000 - $1,600) Warranty Liability ...................................... Warranty Expense ..................................... Repair Parts Inventory....................... 11-44 2,000 2,000 1,600 1,600 3,000 3,000 3,000 500 3,500 PROBLEM 11-5B The company should record an estimate of the liability for the replacement of the tires. The liability exists (based on past events) and the company should be able to estimate it. It should also disclose information on the replacement program. 11-45 *PROBLEM 11-6B (a) Weaknesses Procedures (b) Recommended 1. Manager prepares the payroll register, which is sent to the payroll department. The payroll department should prepare the payroll register, on the basis of the time cards approved by the manager. A payroll supervisor pays each employee by cheque. Payment to employees should be made by the controller's department. 2. The assignment of duties among the payroll clerks does not result in any independent verification. The duties of the payroll clerks should be assigned so that one clerk calculates the earnings for all employees. Then the calculations made should be verified by the clerk that did not make the initial determination of the data. Each month the duties of the clerks should be reversed. 11-46 *PROBLEM 11-6B (Continued) (a) Weaknesses Procedures (b) Recommended 3. The chief accountant manually signs the payroll cheques. An electronic cheque writer should be used. The department managers distribute the payroll cheques. A representative of the controller’s department should distribute the payroll cheques. The department managers are responsible for unclaimed cheques. A representative of the controller's department should have custody of unclaimed cheques. 11-47 *PROBLEM 11-7B (a) Feb. 15 15 (b) Feb. 15 (c) Mar. 14 Wages Expense........................................ 1,216.00 CPP Payable ..................................... EI Payable ......................................... Income Tax Payable ......................... United Way Contributions Payable . Wages Payable ................................. Employee Benefits Expense ................... CPP Payable ..................................... EI Payable ($27.37 X 1.4) .................. 79.02 40.70 38.32 Wages Payable ......................................... 1,002.23 Cash .................................................. CPP Payable ($40.70 + $40.70) ................ EI Payable ($27.37 + $38.32) .................... Income Tax Payable ................................. United Way Contributions Payable ......... Cash .................................................. 11-48 40.70 27.37 128.20 17.50 1,002.23 1,002.23 81.40 65.69 128.20 17.50 292.79 *PROBLEM 11-8B (a) , (b) & (c) 1/12 1/12 1/10 CPP Payable 3,508 1/1 1/31 1/31 1/31 EI Payable 2,133 1/1 1/31 1/31 1/31 Union Dues Payable 1,200 1/1 1/31 1/31 Income Tax Withholdings Payable 3,508 1/12 28,400 1/1 28,400 3,441 1/31 27,900 3,441 6,882 1/31 27,900 2,133 2,092 2,929 5,021 Workers’ Compensation Payable 1/20 5,689 1/1 5,689 1/31 5,580 1/31 5,580 1,200 1,200 1,200 Canada Savings Bonds Payable 1/1 1,210 1/31 1,210 1/31 2,420 Vacation Pay Payable 1/1 3,793 1/31 3,720 1/31 7,513 United Way Donations Payable 1/17 750 1/1 750 1/31 750 1/31 750 Salaries and Wages Payable 1/31 56,407 1/31 56,407 1/31 0 11-49 *PROBLEM 11-8B (Continued) (b) Jan. 10 12 17 20 31 31 31 Union Dues Payable .................................... Cash ..................................................... 1,200 CPP Payable ................................................ EI Payable .................................................... Income Tax Payable .................................... Cash ..................................................... 3,508 2,133 28,400 United Way Donations Payable .................. Cash ..................................................... 750 Workers’ Compensation Payable............... Cash ..................................................... 5,689 Office Salaries Expense ............................. Store Wages Expense................................. CPP Payable ........................................ EI Payable ............................................ Income Tax Payable ............................ Union Dues Payable ............................ United Way Payable............................. Canada Savings Bonds Payable ........ Wages Payable .................................... 44,600 48,400 Wages Payable ............................................ Cash ..................................................... 56,407 Employee Benefits Expense ...................... CPP Payable ($3,441 x 1) .................... EI Payable ($2,092 X 1.4) ..................... Workers’ Compensation Payable ($93,000 X 6%) .................................. Vacation Pay Payable ($93,000 X 4%) 15,670 11-50 1,200 34,041 750 5,689 3,441 2,092 27,900 1,200 750 1,210 56,407 56,407 3,441 2,929 5,580 3,720 *PROBLEM 11-9B (a) 1. 2. 3. 4. $13,600 $526.50 $9,473.50 $23,400 Calculation of item (4): Total Gross Earnings = Overtime earnings + Regular earnings = $1,500 + $21,900 = $23,400 Calculation of item (2): 2.25% x Gross Earnings = EI Deductions 2.25% x $23,400 = $526.50 Calculation of item (3): Gross Pay - Net Pay = Total Deductions $23,400 - $11,195 = $12,205 CPP + EI + Group Insurance + Income Taxes + Union Dues + United Way = Total Deductions $975 + $526.50 + $400 + X + $230 + $600 = $12,205 X = $9,473.50 Calculation of item (1): Store Wages = Total Gross Earnings - Warehouse Wages = $23,400 - $9,800 = $13,600 11-51 *PROBLEM 11-9B (Continued) (b) June 30 June 30 (c) July 15 15 Store Wages Expense..................... Warehouse Wages Expense........... CPP Payable.............................. EI Payable ................................. Group Insurance Plan Payable Income Tax Payable ................. Union Dues Payable ................. United Way Payable .................. Salaries and Wages Payable ... 13,600.00 9,800.00 Employee Benefits Expense .......... CPP Payable ($975 x 1) ............ EI Payable ($526.50 X 1.4) ........ 1,712.10 Salaries and Wages Payable .......... Cash .......................................... 11,195.00 CPP Payable ($975 + $975) ............. EI Payable ($526.50 + $737.10) ....... Income Tax Payable ........................ Cash .......................................... 1,950.00 1,263.60 9,473.50 11-52 975.00 526.50 400.00 9,473.50 230.00 600.00 11,195.00 975.00 737.10 11,195.00 12,687.10 CUMULATIVE COVERAGE: CHAPTERS 9 TO 11 (a) Johan Company Nordlund Company Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Total current assets $ 50,300 309,700 (13,600) 500,000 846,400 $ 48,400 312,500 (14,000) 520,200 867,100 Capital assets Accumulated amortization (1) Net capital assets 245,300 (180,996) 64,304 257,300 (189,850) 67,450 Total assets $910,704 $934,550 Current liabilities Long-term liabilities Total liabilities $440,200 78,000 518,200 $466,500 50,000 516,500 392,504 418,050 $910,704 $934,550 Owner’s equity (2) Total liabilities and owner’s equity 11-53 CUMULATIVE COVERAGE (Continued) (a) (Continued) Calculations: (1) Capital assets—Johan: Year 1 2 3 4 5 6 Net Book Value $245,300 196,240 156,992 125,594 100,475 80,380 DecliningBalance Rate (10% x 2) 20% 20% 20% 20% 20% 20% Amortization Expense $49,060 39,248 31,398 25,119 20,095 16,076 Accumulated Amortization $ 49,060 88,308 119,706 144,825 164,920 180,996 (2) Owner’s equity: Johan: $429,750 + $36,100 change in inventory value – $73,346 change in accumulated amortization = $392,504 Nordlund: $432,050 – $14,000 allowance for doubtful accounts = $418,050 11-54 CUMULATIVE COVERAGE (Continued) (b) Originally, from the unrevised financial statements, it appeared that Nordlund was the stronger company. After the revision of financial statements for purposes of comparability, this continues to be true. Nordlund Company is in a better financial position of the two companies. The difference between the net assets (assets minus liabilities) or owner’s equity of the two companies is $25,546 ($392,504 versus $418,050). Prior to the revision, this difference was a much closer $600 ($948,550 - $947,950). While Nordlund may have more equity than Johan, Johan is in a slightly stronger liquidity position. Johan has a current ratio of 1.93:1 ($846,400 ÷ $440,200) versus 1.86:1 ($867,100 ÷ $466,500) for Nordlund. Johan also has slightly more cash than Nordlund. Nordlund, though, has higher accounts receivable and inventory. Assuming that these receivables are collectible and the inventory saleable, the differences between the short-term liquidity are not significant between the two companies. 11-55 BYP 11-1 FINANCIAL REPORTING PROBLEM (a) Total current liabilities at June 24, 2000, were $6,405,000. There was a $46,000 decrease from the previous year ($6,405,000 – $6,451,000), which was equivalent to a 0.71% decline ($46,000 ÷ $6,451,000). (b) The components of total current liabilities on June 24, 2000 were Accounts payable and accrued liabilities; current portion, long-tem debt; and deposits. (c) The deposits must have been paid to The Second Cup by other parties – perhaps as deposits on containers, for example. When the deposits were received, the Second Cup debited Cash and credited Deposits. They are a liability because they represent an obligation to repay the money when the containers are returned. Alternatively, the deposits may represent unearned revenues, if, for example, they represent advance payments for franchise fees. These would be classified as liabilities until they have been earned by The Second Cup, when it has fulfilled its obligations under the franchise terms. (d) The Second Cup reports its contingent liabilities in the notes to the financial statements. Note 12 is titled “Minimum Lease Commitments and Contingent Liabilities.” The contingent liabilities relate to leases and subleases to franchisees. The Second Cup company is contingently liable for default of lease payments by franchisees. 11-56 BYP 11-2 INTERPRETING FINANCIAL STATEMENTS (a) La Senza Current assets Cash and short-term investments Accounts receivable Inventory Marketable securities Prepaid expenses Total Current liabilities Accounts payable and accrued liabilities Current maturity of long term debt Income tax payable Total Reitmans $ 33,018 4,728 41,418 20,746 2,607 $102,517 $20,008 2,556 38,481 $27,290 $35,187 14,892 2,043 $44,225 5,124 $40,311 $58,292 2.3:1 $29,550 1.7:1 8,816 $69,861 (b) Working capital Current ratio (c) La Senza’s ratio is better than that of the industry average, while Reitmans’s is not as good as either La Senza’s or the industry. 11-57 BYP 11-3 INTERPRETING FINANCIAL STATEMENTS (a) It is likely there will be some costs associated with the noncompliance. It appears that the amount of the liability cannot be estimated and therefore it has not been accrued. Based on this, Cott’s treatment of not disclosing the contingency is acceptable. (b) The contingent liability described in note (d) relate to lawsuits for various items such as governmental regulations, income taxes and other actions. Based on the note, these contingent liabilities are not estimable or determinable. I agree with their reporting. 11-58 BYP 11-4 ACCOUNTING ON THE WEB Due to the frequency of change with regard to information available on the world wide web, the Accounting on the Web cases are updated as required. Their suggested solutions are also updated whenever necessary, and can be found on-line in the Instructor Resources section of our home page <www.wiley.com/canada/weygandt2>. 11-59 BYP 11-5 COLLABORATIVE LEARNING ACTIVITY (a) The contingent loss is relevant to users of SAirGroup’s financial statements. It is a risk factor that the company faces and potentially impacts income and cash flow. (b) The estimate of the loss should be reasonably reliable–but it is an estimate and subject to more error than other financial statements elements based on historic cost and past transactions. In estimating the amount of the loss, the company should use information obtained from its legal counsel and insurance agent on this, and similar cases (c) The loss would be reported in the income statement as an extraordinary item. It is abnormal in size, unusual, and was not the result of any management determination. The liability would be reported in the current liability section if it is anticipated that it will be settled within one year, otherwise it would be reported as a long-term liability. The notes would disclose the details of the loss and anticipated recovery from insurance as well as the amount of the lawsuit. 11-60 *BYP 11-6 COLLABORATIVE LEARNING ACTIVITY (a) ATS Temporary Employees Month January-March April-May June-October November-December Total Cost Number of Workers Days Worked Daily Rate 3 2 2 3 180 (20 X 3 X 3) 100 (25 X 2 X 2) 180 (18 X 2 X 5) 138 (23 X 3 X 2) $100 0100 0100 0100 Cost $18,000 010,000 018,000 13,800 $59,800 DATIS PROCESSING COMPANY Permanent Employees Salaries (2 x $32,000) ........................................................ Additional payroll costs: CPP [2 x ($32,000 – $3,500) x 4.3%] ............................. $2,451 EI [2.0 x $32,000 x 2.25% X 1.4] .................................... 2,016 Worker’s Compensation (2 x $32,000 x 1.5%)............. 960 Medical and dental insurance (2 x $40 x 12) ............... 960 $64,000 0 6,387 $70,387 As shown, Datis Processing Company would save $10,587 ($70,387 $59,800) by discharging the two employees and accepting the Advanced Temp Services plan. 11-61 BYP 11-6 (Continued) (b) Denise should consider the following additional factors: (1) The effect on the morale of the continuing employees if two employees are terminated. (2) The anticipated efficiency of the Advanced Temp Services workers compared to the efficiency of the two employees who would be terminated. (3) The effect on management control and supervision of using Advanced Temp Services personnel. (4) The time that may be required to indoctrinate the different Advanced Temp Services personnel into the Datis Processing Company procedures. 11-62 BYP 11-7 COMMUNICATION ACTIVITY Dear Sir: In response to your request, I wish to answer your questions regarding the accounting for gift certificates in your theatre. (a) A liability is recorded when these certificates are sold because there is still a service to be provided by the theatre. They are considered unearned revenue until they are redeemed and the service provided. At this point, the theatre's obligation is fulfilled and the amounts can be transferred from a liability account to a revenue account. The foregoing applies even though the gift certificates may, as you suggest, generate additional revenues for the theatre. (b) Based upon the experience of your theatre and the theatre industry in general, estimates could be developed for the proportion of gift certificates that will never be redeemed. These unredeemed certificates will eventually be recognized as revenue. A reversing entry would be made to reduce the liability related to unearned revenue, and to record the estimated amount which will never be redeemed as earned (or perhaps as a gain). Sincerely, 11-63 BYP 11-8 ETHICS CASE (a) The stakeholders in this situation include: Shareholders Creditors Employees Government inspectors Customers flying in airplanes (b) The possible courses of action and their consequences include: 1. The CEO could inform the auditors. The auditors would then require that this information be disclosed in the annual report. When the lenders learn about this potential problem, they may decide to call their loans, and the company’s suppliers may decide to quit sending it goods. This could result in the bankruptcy of the company, even if the company was not at fault for the engine failures. However, this would be in compliance with his requirement to disclose all material facts. By not disclosing, the CEO is misinforming a large number of important stakeholders. 2. The CEO could conceal the information from the auditors. If the company is not ultimately found at fault, then the company will not have sustained any financial hardship. However, if the company is found to be at fault for the engine failures, then not only is it likely the company will go bankrupt, but the CEO could face prosecution for failing to disclose the existence of this problem to auditors. (c) Answer will vary according to student. 11-64 BYP 11-8 (Continued) (d) If the CEO conceals the information, and the company is subsequently found to be at fault, a number of stakeholders will suffer. First, the company’s creditors will lose money because it is likely the company won’t be able to repay its loans in full. The shareholders will lose because the value of their shares will plummet. The employees may well lose their jobs because the company is likely to go bankrupt. Also, it is possible that other engines might fail in the interim, possibly resulting in a crash. Answers as to whether the CEO should be punished for concealing this information will vary by student. 11-65