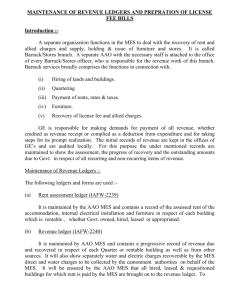

MES (AAO) Manual - National Academy of Defence Financial

advertisement