Do Nonprofessional Investors React to Fraud Red Flags?

Joseph F. Brazel*

Department of Accounting

College of Management

North Carolina State University

Campus Box 8113

Nelson Hall

Raleigh, NC 27695

919-513-1772

joe_brazel@ncsu.edu

Keith L. Jones

Department of Accounting

George Mason University

Enterprise Hall, MSN 5F4

Fairfax, VA 22030-4444

703-993-4819

kjonesm@gmu.edu

Rick C. Warne

Department of Accounting

George Mason University

Enterprise Hall, MSN 5F4

Fairfax, VA 22030-4444

703-993-1763

rwarne@gmu.edu

August 2010

We appreciate the helpful comments from Chris Agoglia, Ted Christenson, Brooke Elliott, Karen

Kitching, David Wood, and Mark Zimbelman. We thank workshop participants at Brigham

Young University, North Carolina State University, and George Mason University. We are

grateful for the research assistance provided by Meredith Fincher. This study was funded by a

research grant from the Financial Industry Regulatory Authority Investor Education Foundation.

* Corresponding Author

Do Nonprofessional Investors React to Fraud Red Flags?

ABSTRACT

We conducted an experiment to determine if and how nonprofessional investors react to red flags

related to fraudulent financial reporting. We also examined if making red flag data more

transparent affects investor judgments. Investors reviewed information related to a hypothetical

company and decided whether to increase or decrease their investment. We manipulated the

presence and non-presence of two specific red flags between investors: (1) a large difference in

sales growth and growth in related nonfinancial measures (e.g., number of employees, size of

production space), and (2) a large difference between net income and cash flow from operations

(i.e., high accruals). In general, we do not find that investors react uniformly to red flags. We do

not observe investors decreasing investment levels when the accrual red flag is present, even

when it is made more transparent. Conversely, we find that making a large difference in sales

growth and growth in corresponding nonfinancial measures (NFMs) transparent leads to lower

investment levels. Analyses reveal that investors perceive the NFM red flag to be more intuitive

and this difference likely drives our conflicting results. Interestingly, if the NFM red flag is not

made transparent to investors, investors appear to interpret the abnormal inconsistency as a

positive signal regarding operational efficiency and, in turn, increase their investment levels. We

also present evidence that a complementary effect occurs between red flags (i.e., the presence of

high accruals is needed to increase the salience of the transparent NFM red flag). Finally, we

illustrate that making it transparent that the NFM red flag is not present (i.e., sales growth is

consistent with NFM growth) can serve as a “green flag” for investors and spawn increased

investment.

Keywords: accruals; fraud; investor; nonfinancial measures; red flag

Data availability: Contact the authors

I. INTRODUCTION

With the growth of the financial markets, nonprofessional investors remain a significant

component of the overall equity market (Elliott, Hodge, and Jackson 2008), owning

approximately 34% of shares outstanding (Bogle 2005). Thus, nonprofessional investors are

susceptible to significant losses from financial statement fraud (e.g., NASAA 2006). Indeed,

Brazel, Jones, and Warne (2010) find that 25% of their sample of nonprofessional investors had

previously held shares of a company that committed fraudulent financial reporting. The primary

objective of this study is to examine nonprofessional investors’ reactions to red flags related to

fraudulent financial reporting (hereafter, fraud). We evaluate if greater transparency of red flag

data can improve the investment decisions of nonprofessional investors (hereafter, investors). In

addition, we study if more intuitive red flags illicit stronger investor reactions. Finally, we

consider if making positive information (i.e., lack of red flags or “green flags”) transparent also

improves the investment decisions of nonprofessionals.

Firms that commit financial statement fraud often exhibit basic “red flags” that investors

either do not notice or simply chose to ignore (Schilit 2002). During the course of the fraud at

HealthSouth, the company periodically reported an increase in sales and assets while

simultaneously reporting a decrease in the total number of facilities (WSJ 2005a). During the

second year of the Xerox fraud, the company’s 10-Ks reported net income ($395 million) that

differed substantially from cash flow from operations (-$1,165 million). In hindsight, these red

flags appear to be glaring indicators that the financial results at these companies were suspect.

However, as one would expect, these red flags are rarely transparent to investors.

Transparency and accessibility of financial information to investors is a major concern

for policymakers. In a 2009 speech about the current financial crisis, SEC Commissioner Luis A.

1

Aguilar stated, “We must act now to re-establish transparency and accountability to investors by

looking to Congress and the SEC for immediate action.”1 President Obama renewed this call to

protect investors in his 2010 State of the Union Address: “We need to make sure consumers and

middle-class families have the information they need to make financial decisions.”2

We examine investors’ reactions to two empirically validated red flags that are disclosed

in 10-K filings, but are not typically transparent: (1) a large difference between sales growth and

related nonfinancial measures (Brazel, Jones, and Zimbelman 2009); and (2) a large

inconsistency between net income and cash flow from operations (a high level of accruals as

described by Lee, Ingram, and Howard 1999). Consistent with Elliott, Krische, and Peecher

(2010), we consider red flags to be transparent when the relevant information is presented in

close proximity and in a layout that allows users to more easily identify and process the red flags

(e.g., sales growth and growth in nonfinancial measures are calculated and compared side by

side).3 As currently presented in the financial statements, sales data resides on the income

statement while nonfinancial measures (NFMs) are dispersed throughout the Management

Discussion and Analysis (Brazel, Jones, and Zimbelman 2009). Information related to accruals is

contained within the financial statements; however, net income and cash flow from operations

are not compared side by side.

Despite calls from policymakers for greater transparency, little research exists on

investors’ use of fraud red flags and whether greater transparency of red flags will actually

provide greater investor protection with respect to fraud. For transparency to significantly affect

1

http://www.sec.gov/news/speech/2009/spch020609laa.htm

http://abcnews.go.com/Politics/State_of_the_Union/state-of-the-union-2010-president-obama-speechtranscript/story?id=9678572&page=2

3

Elliott, Krische, and Peecher (2010) argue that greater transparency occurs when information is more accessible,

comprehensible, or understandable. Other studies use similar terms such as “opacity” (Bhattacharya, Daouk, and

Welker 2003), “clarity” (Hirst and Hopkins 1998), “salience” (Elliott 2006), and “prominence” (Hunton, Libby, and

Mazza 2006) to describe similar constructs. While we use the term “transparency”, other terms could also be used to

describe the same theoretical construct.

2

2

investors’ reactions to a red flag, investors must: (1) ignore the red flag in its current, nontransparent state; but still (2) analyze fraud risk when making investment decisions. If investors

already identify and react to a red flag, then making it more transparent will not affect its use.

Conversely, if investors do not ordinarily consider the possibility of fraud when making

investment decisions, then investors are unlikely to rely on fraud red flags in general. For

example, nonprofessional investors may not feel qualified to assess fraud risk and rely on others

who are more qualified (e.g., auditors and regulators) to detect fraud. Finally, for transparency to

affect behavior, investors must understand the intuition behind the red flag. For example, if

investors do not understand why net income may be different from cash flow from operations,

then making large accruals (e.g., Xerox) more transparent would not affect investor decision

making.

We therefore address two important and compelling empirical questions: (1) Do investors

react to non-transparent red flags? (2) Is greater transparency of red flags needed to protect

investors? Despite the possibilities that investors may not specifically screen for fraud (e.g., they

rely on auditors or the SEC) or that investors do not understand the intuition behind many red

flags, we expect that transparency will affect investor decision making for two reasons. First, we

study two red flags that investors with basic accounting and/or business backgrounds should find

intuitive.4 Second, concurrent survey research finds that nonprofessional investors report relying

4

For example, fictitious sales will have no related increase in nonfinancial measures (e.g., number of retail outlets or

employees) or corresponding cash flow. However, we chose red flags that require different types of intuition.

Understanding how large accruals can serve as a red flag requires a basic knowledge of accounting. Understanding

how a large difference between sales and NFMs could indicate fraud requires more of a general knowledge of

business (e.g., fewer employees and products would not likely lead to greater sales). In follow up questions, we

assess whether the intuitiveness of the red flag (to investors) can explain why investors might not react to

transparent red flags in a uniform manner.

3

on these red flags when investing (Brazel, Jones, and Warne 2010).5 Thus, investors should react

to these red flags. However, prior research finds that nonprofessional investors do not typically

follow any systematic data evaluation method, misinterpret financial information, often fail to

recognize relations among various data that are not proximate to each other, and sometimes

become overwhelmed by the complexities associated with investment-related data (Bouwman

1982; Maines and McDaniel 2000; Hodder, Hopkins, and Wood 2008). Given the dispersed state

of the accrual and NFM red flag data in the financial statements and elsewhere, we expect that

investors’ reactions to these red flags will be more pronounced when they are made transparent.

In addition, we investigate positive signals (i.e., “green flags”) vis-à-vis fraud. In the

absence of red flags, consistency exists between (1) sales and NFMs and/or (2) net income and

cash flow. For example, low accruals can signal greater earnings persistence and consequently

higher earnings quality (Sloan 1996). Making green flags transparent should boost investor

confidence and illicit higher investment levels. We therefore posit that investors will not react

significantly to non-transparent red flags, but that transparent red (green) flags will lead to lower

(higher) investment levels. Finally, we predict that making a red flag transparent will have a

greater effect if another red flag is present.

We experimentally tested our hypotheses by asking 237 investors to assume that they

owned stock in a hypothetical company. Our sample consisted of a diverse set of experienced

investors who actively trade individual shares of stock (similar to our experimental setting). We

provided them with the information that investors reportedly use when investing (c.f., Elliott,

Hodge, and Jackson 2008) and asked whether they would increase, maintain, or decrease their

investment in the company. We conducted a 2X2X2 experimental design by manipulating

5

The questionnaire in Brazel, Jones, and Warne (2010) asked investors to rate the importance of each red flag when

making investment decisions (on a scale where 1 = “very unimportant” and 7 = “very important”). The average

response was approximately 5 for each measure (accrual and NFM red flags).

4

accruals (high vs. low), the difference between sales growth and NFM growth (high vs. low), and

the transparency of the red flags (transparent vs. not transparent). For example, when accruals

are high, the accrual red flag is present. When accruals are low, the accrual red flag is not present

(i.e., a green flag is present).

Overall, our results suggest that the effect of transparency depends on the intuitiveness of

the red flag. When the NFM red flag is transparent, we observe lower investment levels.

Conversely, when the accrual red flag is transparent, we do not observe lower investment levels.

Post-experimental questions provide evidence that investors possess a greater understanding of

the intuition behind the NFM red flag (versus the accrual red flag). However, the NFM red flag

must be transparent to reduce investment levels. When NFM red flag is not transparent, investors

appear to misinterpret the abnormal inconsistency between sales and NFM growth as a positive

signal regarding operational efficiency. Alarmingly, a non-transparent NFM red flag leads

investors to increase investment levels. We therefore find compelling evidence that the

transparency of the NFM red flag, and potentially other intuitive red flags, can substantially

affect investor behavior and improve investor protection.

We also observe that the aforementioned effect of the transparent NFM red flag is

dependent on the presence of another red flag. When the accrual red flag is not present,

providing a transparent NFM red flag does not have a significant effect on investment levels.

This result is important and relevant as fraud firms typically exhibit several red flags

concurrently (e.g., Brazel, Jones, and Zimbelman 2009; Dechow et al. 2010). Finally, we provide

limited evidence that making a “green” flag (i.e., sales growth is consistent with NFM growth)

transparent can boost investor confidence and generate increased investment.

5

Our results make a significant contribution to both the academic literature and public

policy. First, while investors often fall prey to fraud and extensive research has examined the

usefulness of red flags to identify fraudulent financial reporting (see Hogan et al. 2008), we

provide the first empirical evidence of how investors react to red flags. We also illustrate that

investor decision-making related to fraud is ill-defined and substantial future research is required

to enhance our understanding of these processes. As standard-setters continue to consider

investor behavior when forming public policy (Zweig 2009), this line of research should

ultimately lead to greater investor protection. Second, our results provide practical guidance to

regulators in their efforts to promote investor protection and improve the transparency of

information used by investors. For example, regulators could require companies to report and

tabulate NFM data (along with relevant financial data) in a footnote to the financial statements.

This regulatory change would be relatively costless because companies already report NFM data

throughout the 10-K.6 Importantly, our evidence suggests that public policy actions towards

greater transparency are critical. Even the most intuitive red flags are misinterpreted or often go

unnoticed if not presented explicitly to investors.

The remainder of the paper is organized as follows. Section II presents the background

and hypotheses development. Sections III and IV contain the method and results of the study,

respectively. Section V concludes the paper and provides guidance for future research.

6

See Appendix A for an example of how NFMs are commonly reported and how Tenet Healthcare Corporation

provides financial data and related NFMs in a very transparent manner. If NFM data are disclosed in a footnote to

the financial statements, the NFM data would then fall subject to the external audit and could be tagged for XBRL

purposes. Auditing (Tagging) NFM data would improve their reliability (allow for an easy analysis of the NFM red

flag as described in this study). Currently, the majority of NFM data disclosed by companies resides in

Management’s Discussion and Analysis (MD&A) section of their 10-K filings. At this time, the SEC has indicated

that the use of interactive tagged data is not appropriate for the MD&A because current tagging sets provided under

XBRL are considered inadequate (SEC 2008; Rummell 2008; Laux 2009; Schneider and So 2009).

6

II. BACKGROUND AND DEVELOPMENT OF HYPOTHESES

Statement of Financial Accounting Concept No.1 asserts that “financial reporting should

provide information that can be used by all – nonprofessionals as well as professionals – who are

willing to learn how to use it properly. Efforts may be needed to increase the understandability of

financial information” (FASB 2008, 11). The Financial Accounting Standards Board (FASB)

concept statement specifically notes that nonprofessionals are the baseline for assessing whether

financial reporting is useful (FASB 2008). Congress (Public Law [107-204] 2002) and the

Securities and Exchange Commission (Cox 2005) have explicitly stated their intent to protect

nonprofessional investors. This paper ties prior archival research in fraud detection to research in

psychology to help regulators and researchers identify methods to improve investor decisionmaking with respect to fraud.

Researchers have identified red flags that indicate an elevated risk of fraudulent financial

reporting. For example, Brazel, Jones, and Zimbelman (2009) examine a sample of fraud firms

and non-fraud firms and report that the difference between growth in sales and growth in related

NFMs is higher for fraud firms. Similarly, Dechow, Sloan, and Sweeney (1996) and Lee,

Ingram, and Howard (1999) find that a large difference between net income and cash flow from

operations is also a red flag with respect to fraud. Hogan et al. (2008) provide a review of the red

flag literature, highlighting that fraud firms tend to exhibit these and other red flags (e.g., less

independent boards). Thus, while investors fall victim to fraud and extensive research has

examined the usefulness of red flags to identify fraudulent financial reporting, our study

advances the literature by taking an important next step: studying investors’ reactions to red

flags.

7

Brazel, Jones, and Warne (2010) survey nonprofessional investors about their use of

fraud red flags. They find that investors who report greater reliance on financial statement

information to make investment decisions perceive fraud risk assessment to be a more important

investment activity. This relation is stronger when investors’ perceptions of the current rate of

fraudulent financial reporting are higher. Investors who place more importance on fraud risk

assessment are, in turn, more likely to use fraud red flags as part of their investment decisions.

While Brazel, Jones, and Warne (2010) survey investors about their use of red flags, we extend

this new stream of literature by experimentally examining if investors recognize red flags when

they are not transparent, what types of red flags are more likely to influence investor decisionmaking, and to what extent transparency can improve investor decisions.

We investigate the aforementioned red flags related to NFMs and accruals for several

reasons. First, these measures both differ significantly between fraud and non-fraud firms as

documented in the fraud literature (e.g., Brazel, Jones, and Zimbelman 2009; Dechow et al.

2010). Second, as described previously, both measures are fairly intuitive regarding their

indication of elevated fraud risk. Investors are more likely to incorporate intuitively appealing

information into their judgments (Hodder, Hopkins, and Wood 2008). However, these red flags

represent two separate types of intuition. Investors must have a basic level of accounting

knowledge to understand why net income can differ from cash flow from operations. In contrast,

investors need some general business knowledge to understand that a large difference between

sales growth and growth in underlying NFMs (e.g., retail outlets) can be a red flag. This

knowledge differential could lead to non-uniform reactions to the red flags. Third, these

measures can be represented on a continuum of egregiousness, whereas other red flags are binary

in nature (e.g., the presence of an SEC investigation or pending litigation). The presence of

8

“obvious” binary red flags may present demand effects in an experiment.7 Fourth, Brazel, Jones,

and Warne (2010) report that investors are inclined to use our two red flags when assessing fraud

risk. The red flags investors report using most often are typically manifest later in the fraud

discovery process and usually revealed to investors ex post (i.e., after the fraud has been

detected) (Brazel, Jones, and Warne 2010).8 Consequently, investors’ attention and reaction to

such ex post red flags would not likely reduce their losses due to fraud. Conversely, the two red

flags we investigate are ex ante (i.e., prior to the fraud detection) indicators of fraud. Ex ante

fraud indicators can help investors detect fraud early and avoid financial losses.

Information Processing of Fraud Red Flags

The Elaboration Likelihood Model (ELM) explains that individuals process information

via one of two possible routes: the central route or the peripheral route (Petty and Cacioppo

1986).9 The central route involves deliberate, conscious consideration of the information. In

contrast, the peripheral route involves limited cognitive effort to process information. Prior

research suggests that professional analysts process information via valuation models and

directly search financial statements for data necessary to perform their analyses (Bouwman,

Frishkoff, and Frishkoff 1987; Hunton and McEwen 1997). This structured method of gathering

data would allow analysts to process red flag information via the central route and cause them to

attend to red flag data regardless of how the data is presented in the financial statements or

elsewhere.

7

Furthermore, Levitt and Dubner (2009) describe how red flags used to identify terrorist subjects are more

effective/accurate if they are measured on a continuous (vs. binary) scale.

8

Brazel, Jones, and Warne (2010) find that investors report to use four fraud red flags relatively more often than

other red flags: SEC investigations, pending litigation, violations of debt covenants, and high management turnover.

Though high management turnover may occur before or after the market discovers the fraud, the other three red

flags can be considered ex post fraud indicators.

9

The Heuristic Systematic Model (Chen and Chaiken 1999) also describes decision-makers’ behaviors using two

“routes,” a simple route (heuristic processing) and a route that involves the comprehensive consideration of the

information (systematic processing). These two dual-processing theories yield similar descriptions of individuals’

judgments and are sometimes referenced together in accounting research (e.g., Alexander 2003).

9

On the other hand, nonprofessional investors utilize non-structured data-gathering

techniques and process information in sequential order (Bouwman 1982; Hunton and McEwen

1997; Maines and McDaniel 2000). Since financial statements and related disclosures contain a

significant amount of information, and red flag data is typically dispersed; nonprofessional

investors likely process red flag data using the peripheral route. In fact, the FASB has

acknowledged that some Board members “believe that at some point the sheer volume of all

required disclosures may overwhelm users’ ability to assimilate information and focus on the

more important matters” (FASB 1990, p. 101). We expect that investors will process nontransparent red flags via the peripheral route. Thus, we do not predict a significant investor

reaction to non-transparent red flags.

We posit that greater transparency (i.e., placing red flag data in close proximity and

providing red flag analyses) will have a moderating effect on investor attention to red flags. We

expect that nonprofessional investors will attend to accrual and NFM red flags and process this

red flag information via the central processing route if the information is made transparent.

Investors who observe a transparent red flag will choose to maintain lower investment levels

relative to investors who are presented with a non-transparent red flag.

Conversely, we expect that investors who receive a transparent green flag (i.e., the red

flag is not present) will increase their investment levels relative to those who receive a nontransparent green flags. For example, we expect that investors who deliberately consider the

implications of having net income that is consistent with cash flow from operations will more

fully appreciate the consistency and its future implications on stock price (e.g., Sloan 1996). We

therefore predict a disordinal interaction. As shown in Figure 1, transparency will lead investors

10

who observe a red flag to decrease investment levels and investors who observe a green flag to

increase investment levels.

Insert Figure 1 here

We formally state our first hypothesis as follows:

H1: A transparent red (green) flag leads to lower (higher) investment levels than a nontransparent red (green) flag.

We separately test this prediction for two specific red flags: the NFM red flag and the

accrual red flag. As previously stated, the intuition behind the two red flags could influence the

effect of making a red flag transparent. For example, prior literature suggests that investors may

not fully appreciate earnings that are fully supported by cash flow (e.g. Sloan 1996; Hewitt

2009). Thus, the possibility exists that transparency will not uniformly affect both red flags. In

follow up questions, we post-experimentally assess whether the intuitiveness of the red flag (to

investors) can explain why investors might not react to even a transparent red flag.

Transparency and Multiple Red Flags

Though a single red flag may indicate fraud, companies that commit financial statement

fraud typically exhibit multiple red flags throughout their 10-K filings. For example, Enron’s

financial statements from 1995 include multiple red flags related to the accuracy of its statements

(Hubbard 2002). Prior academic research has produced similar findings. For example, Brazel,

Jones, and Zimbelman (2009) and Dechow et al. (2010) both find that fraud firms have

significantly higher levels of accruals (vs. non-fraud firms). Additionally, both studies also

document that fraud firms have greater differences between their financial measures and NFMs.

However, the joint effect of multiple red flags on investor decision making has yet to be studied.

We investigate the potential for joint effects between multiple red flags.

11

The Lens Model describes human judgment in a variety of contexts (Brunswick 1952,

Bonner 2008; see Karelaia and Hogarth 2008 and Kaufmann and Athanasou 2009 for reviews

and meta-analyses). Based on established criteria, individuals use external cues to predict an

unknown event or outcome (e.g., the likelihood of fraud). Each cue either provides support for or

against a given outcome. Individuals weigh each cue according to its relative importance in

predicting an outcome. Additional relevant cues that point to an outcome increase the likelihood

an individual will make a correct judgment (Karelaia and Hogarth 2008). Thus, if an investor

observes a transparent red flag (e.g., a large difference between sales and NFMs) in the presence

of no other red flags (e.g., green flags or low accruals), that investor may consider the transparent

red flag to be an anomaly and assign very little weight to its relevancy. However, if that same

investor observes an additional red flag (e.g., high accruals), the investor would likely sense a

trend and assign a greater weight to the transparent red flag. Thus, we predict that the effect of

making a red flag transparent will be greater in the presence of another red flag. We formally

state Hypothesis 2 as follows:

H2: Making a red flag transparent will have a more negative effect on investment levels

when another red flag is present (vs. not present).

III. METHOD

Sample

Two hundred and thirty-seven nonprofessional investors completed online experimental

instruments for this study. Given (1) the objective of this study is to examine causal effects or

investor reactions to red flags, and (2) data related to nonprofessional investor decisions are not

publicly available, the experimental method is most appropriate for this study. Greenfield Online

(http://www.greenfield.com) distributed the instruments. For the purposes of our study,

Greenfield screened its database for participants who actively traded individual shares of stock

12

(vs. simply investing in mutual funds). We further screened participants by requiring that they

answer “yes” to the following question in order to complete the instrument: “Have you bought or

sold individual shares of company stock (i.e., not mutual funds) in the last six months?” Further,

to ensure exclusion of professional investors, participants were required to answer “no” to the

following question: “As part of your full-time job responsibilities, do you analyze or trade stocks

or other securities?” Greenfield distributed the survey to 649 participants. Thus, our response

rate is 36.5%, which is comparatively high given the response rates of previous studies that have

attempted to access active investors (e.g., the response rate for Elliott, Hodge, and Jackson 2008

was approximately 3%). Participants completed the survey from August 25 – 29, 2009.10

Participants resided in 41 different states and Washington D.C., were 48.5% male and

well educated (67% had a bachelor’s degree or higher). Mean responses to demographic

questions reveal that our participants were between 40-49 years old, had an annual household

income of $60,000-$90,000, and had 6-10 years of investing experience. Given that researchers

commonly use MBA students to proxy for nonprofessional investors, our sample of investors

appears relatively diverse and experienced. We provide demographic data in Table 1.

Insert Table 1 here

We collected data related to participants’ red flag usage, their fraud

experiences/perceptions, and their general investment experiences, activities, and returns. Of

particular note is that, consistent with Brazel, Jones, and Warne (2010), participants reported

10

The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed

by S&P 500 stock index option prices. Since its introduction in 1993, the VIX has been considered by many to be

the world's premier barometer of investor sentiment and market volatility (see

http://www.cboe.com/micro/vix/vixwhite.pdf). In short, higher indices are indicative of greater market fear. During

the period our data was collected the highest measure of the index was 25.13, whereas in mid-September 2008, the

index rose above 30 and did not fall below 30 until June 1, 2009 (see Lauricella 2009 and

http://www.cboe.com/micro/vix/historical.aspx). As of July 2, 2010, the VIX was 22.59 and the 52-week range for

the index was 15.23 – 48.20 (http://finance.yahoo.com/q/bc?s=%5EVIX&t=2y).

13

moderate use of (1) the specific red flags used in this study, and (2) red flags in general

(Variables 5, 6, and 8 in Table 1). Approximately 22% of participants (Variable 7) also selfreported using other sources for red flags (e.g., data collected from the Internet, broker-provided

assessment tools, and financial statement footnotes). Participants felt that managers fraudulently

misstate financial statements at an alarming rate (34.9%, Variable 9). This high rate is likely due

to the fact that 16% of the sample had previously invested in a company that committed fraud

(Variable 10). For example, ten and five of our participants were invested in Enron and

WorldCom, respectively. Brazel, Jones, and Warne (2010) find similar rates in their sample of

nonprofessional investors and provide additional discussion of these relatively high rates.11

Experimental Task, Independent Variables, and the Dependent Variable

We provided participants with a case which placed them in the role of an individual

investor who currently held 1,000 shares of stock in Madison Sporting Goods Co., a

manufacturer of athletic equipment. We instructed them that their main task was to decide

whether to increase or decrease their investment in Madison, and by how many shares, based on

the information provided in the case. Participants were instructed to “feel free to use a calculator

or any other tool that you would use to make a real investment decision.” We then supplied all

investors with an overview of Madison, industry data, audited financial statements, financial

ratios, a financial analyst’s research report, and NFM data related to Madison’s operations.12 All

participants were informed, and the financial statements illustrated, that both Madison and its

industry were experiencing steady, modest growth (e.g., sales growth of between 4-6%). The

11

With the exception of the use of other red flags (Variable 7 in Table 1), all the variables presented in Table 1 are

not significantly different between conditions (all p’s > 0.40). The use of other red flags was significant at p = 0.052.

As such, we include the use of other red flags as a covariate in our analysis of H1 and H2 (see Table 2).

12

Nonprofessional investors surveyed by Brazel, Jones, and Warne (2010) report that they use these six information

sources when making investment decisions. Others studies report similar findings (e.g., Elliott, Hodge, and Jackson

2008).

14

analyst report also highlighted stable growth for Madison. We adopted both the financial

statements and the analyst report from Elliott et al. (2007). Participants took, on average, 32.51

minutes to complete the case. Time to complete the case was not significant between

experimental conditions (p = 0.45).

We manipulated three independent variables at two levels between participants in our

study (2X2X2 design). Participants received a case where a large difference between sales

growth and NFM growth (NFM RED FLAG) was either present or not present in the current

year. For all participants, current year Madison sales growth was 6%. We relied on the

descriptive data of Brazel, Jones, and Zimbelman (2009) to manipulate the consistency of the

sales/NFM relation in a realistic manner. For non-fraud firms, sales growth exceeds NFM growth

by approximately 8% (NFM RED FLAG not present), whereas sales growth exceeds NFM

growth by approximately 25% for fraud firms (NFM RED FLAG present). Brazel, Jones, and

Zimbelman (2009) describe the types of capacity-related NFMs that publicly-traded companies

typically disclose in their 10-Ks (i.e., NFMs available to investors). We provided participants

with the following prior year and current year NFMs specifically related to Madison sales:

number of patents, number of customer accounts, number of new products introduced to the

market, square footage of production space, number of employees, and number of product

lines.13 Participants receiving the NFM RED FLAG not present (green flag) manipulation were

provided with current year NFM growth of, on average, 0% (6 percentage points different from

sales growth). For participants in the NFM RED FLAG present treatment group, current year

NFM growth was, on average, -19% (25 percentage points different from sales growth).

13

Brazel, Jones, and Zimbelman (2009) find that, for non-fraud firms, these NFMs are typically highly correlated

with sales (i.e., diagnostic). For example, when regressing change in sales on change in number of employees, they

report a highly significant, positive relation and an R2 of 0.28.

15

Similarly, we manipulated the ACCRUAL RED FLAG based upon the findings of Lee,

Ingram, and Howard (1999).14 For the ACCRUAL RED FLAG present (not present) group, the

current year difference between net income and cash flow from operations represented 11% (1%)

of total assets.15 Financial statement data on the income statement and balance sheet were kept

constant between all participants, while current year cash flow from operations was changed to

achieve the accrual manipulation. For all participants, the NFM and ACCRUAL RED FLAGS

were not present (e.g., green flags) in the prior year.16

After receiving the two red flag manipulations, we either provided or did not provide

participants with TRANSPARENT information related to the aforementioned red flags.

Participants in the TRANSPARENT condition received a chart which provided the data that

constituted the red flag manipulations (i.e., changes in sales, changes in NFMs, net income

levels, cash flow from operations) and the red flag calculations/percentages (noted above) related

to their experimental condition. For example, a participant in the TRANSPARENT, NFM RED

FLAG present, ACCRUAL RED FLAG not present condition received a table that explicitly

documented that the current year sales growth exceeded NFM growth by 25% and the difference

between current year net income and cash flow from operations represented 1% of total assets

(and the information used to calculate these percentages). Participants in the nonTRANSPARENT condition were not provided with this information. See Appendix B for the red

14

Because the measurements of the ACCRUAL RED FLAG for fraud (15% of total assets) and non-fraud firms

(1%) provided by Lee, Ingram, and Howard (1999) may be currently dated, we average their findings with the

ACCRUAL RED FLAG measure of Brazel, Jones, and Zimbelman (2009). Brazel, Jones, and Zimbelman observe

the ACCRUAL RED FLAG for fraud (non-fraud) firms to be 7% (0% (rounded)) of total assets.

15

Alternatively, we could have manipulated a measure of discretionary accruals or working capital accruals (e.g.,

Jones 1991, Dechow and Dichev 2002); however, Jones, Krishnan, and Melendrez (2008) find a simple measure of

total accruals is equally as likely to detect fraudulent financial reporting. In addition, we felt it was extremely

unlikely that nonprofessional investors would have the training/experience to run models of discretionary or

working capital accruals.

16

Manipulation checks for our red flag manipulations (requesting participants to recall the size of the NFM and

ACCRUAL RED FLAGs) provided differences in means in the expected direction and p’s < 0.05.

16

flag-related information provided to participants in the TRANSPARENT, NFM RED FLAG

present, ACCRUAL RED FLAG present condition.17

We then asked participants two questions: (1) “Would you increase or decrease your

investment in Madison (SELL)?” and (2) “By how many shares would you increase or decrease

your investment (INVESTMENT LEVEL)?” (ranging from -1,000 to more than 1,000 shares).

Question (2) is our dependent variable of interest in this study (i.e., do red flags affect investment

levels?). As noted previously, we instructed participants that they held 1,000 shares of Madison.

We also perform additional analyses related to question (1) to determine if red flags cause

investors to sell/avoid questionable investments. Participants then answered a series of caserelated and demographic questions.

IV. RESULTS

Hypothesis One Testing

H1 predicts that a transparent red flag leads to lower investment levels (vs. a nontransparent red flag); however, a transparent green flag leads to higher investment levels (vs. a

non-transparent green flag). To test H1 (and H2), we perform a 2X2X2 ANCOVA and analyze

differences in means to determine the nature of any significant terms. We include USE OF

OTHER RED FLAGS as a covariate due to its significance between experimental conditions (see

footnote 11).18 Table 2 Panel A provides the results of H1 testing. Importantly and consistent

with our theory, we do not observe significant main effects for either ACCRUAL RED FLAG (A)

or NFM RED FLAG (B) on INVESTMENT LEVEL. Investors do not appear to react to the mere

17

Our TRANSPARENT manipulation is fairly similar to the one used by Elliott, Krische and Peecher (2010). They

placed the effects of the firm’s available-for-sale securities transactions in a separate performance statement

immediately following the income statement for their transparent condition and in the statement of changes in

shareholders’ equity for their non-transparent condition.

18

USE OF OTHER RED FLAGS is not significant in Table 2 Panel A (and all other analyses) and results related to

our variables of interest are not qualitatively affected by the inclusion or exclusion of USE OF OTHER RED

FLAGS. For purposes of parsimony, we exclude this covariate from all other tabulated results.

17

presence of either of these red flags (e.g., high accruals do not lead to lower levels of

investment). Also, we do not observe a significant interaction between ACCRUAL RED FLAG

and NFM RED FLAG (A X B). Thus, without considering the effects of making red flags

TRANSPARENT, we do not see a complimentary effect between red flags (e.g., the effect of the

NFM RED FLAG is not stronger when the ACCRUAL RED FLAG is present).

Insert Table 2 here

Contrary to expectations, we do not find that TRANSPARENT moderates the effect of

ACCRUAL RED FLAG on INVESTMENT LEVEL (p = 0.38 for ACCRUAL RED FLAG X

TRANSPARENT [A X C]). However, and supporting H1, we find a marginally significant

interaction between NFM RED FLAG and TRANSPARENT (B X C) on INVESTMENT LEVEL (p

= 0.06). One might therefore conclude that investors perceive the TRANSPARENT, NFM RED

FLAG as more diagnostic or intuitive than the TRANSPARENT, ACCRUAL RED FLAG. In other

words, investors better understand the ramifications of a large difference between reported

financial results and operational results vs. the opacity involved with accrual information.

Indeed, Sloan (1996) finds investors fixate on earnings and have difficulty distinguishing

between earnings derived from cash flows and earnings derived from accruals. In an

experimental setting, Hewitt (2009) reports similar findings when examining the earnings

forecasts of professional and nonprofessional investors. Thus, nonprofessional and professional

investors likely fail to understand the ramifications of the ACCRUAL RED FLAG.

However, data presented in Table 1 suggests that investors in our sample perceive the

NFM and ACCRUAL RED FLAGs as equally intuitive and report to use them equally (see

Variables 3, 4, 5, and 6 in Table 1). However, Ball (2008, p. 427) suggests that “people do not

always do what they say they do, or even what they think they do.” Indeed, declared preferences

18

are often not supported when revealed preferences are exposed (Levitt and Dubner 2009). Our

H1 results reveal that, despite investors reporting to use both red flags equally, they appear to

prefer/use the NFM RED FLAG over the ACCRUAL RED FLAG. To provide evidence related to

why they might prefer NFM RED FLAG, we post-experimentally asked our participants to

explain what might cause the presence of a NFM RED FLAG and an ACCRUAL RED FLAG.

Responses were coded as plausible or implausible by one of the authors and a research assistant

who was unaware of the study’s objectives (based on the discussions of the red flags by Brazel,

Jones, and Zimbelman 2009 and Lee, Ingram, and Howard 1999). The Cohen’s (1960) kappa

measure of agreement between coders was significant at p < 0.001. Investors were significantly

more likely to articulate plausible explanations for the NFM RED FLAG (50% of investors) than

the ACCRUAL RED FLAG (21% of investors) (p < 0.01). Consequently, investors appear to

better understand the ramifications of a TRANSPARENT NFM RED FLAG despite investors

reporting to find both red flags equally intuitive. This knowledge differential potentially explains

our mixed H1 result.

We analyze and illustrate the nature of the significant NFM RED FLAG X

TRANSPARENT (B X C) interaction in Table 2 Panel B. When NFM RED FLAG is present, we

observe a significantly lower INVESTMENT LEVEL when the red flag is made TRANSPARENT

to investors. Mean INVESTMENT LEVEL is 338.60 shares when the NFM RED FLAG is present

and not TRANSPARENT. Making the NFM RED FLAG transparent to investors led to a

significantly lower mean INVESTMENT LEVEL of 171.19 shares (p = 0.04, see footnote d in

Panel B).19 On the other hand, when NFM RED FLAG is not present (a green flag), the

19

As described in the Method section, our experimental materials (with the exception of red flag-related data)

presented a generally positive view of Madison. As such, it is not surprising that our cell means indicate that

participants were, on average, buying additional vs. selling their existing shares in Madison. Our experimental

materials were largely drawn from Elliott et al. (2007). Similar to our participants, the participants in Elliott et al.

19

difference in means between making the positive information/green flag transparent is in the

expected direction (TRANSPARENT leads to higher investment levels), but not significant (p =

0.31, see footnote c in Panel B). These differences in means support an ordinal interaction (see

the graph in Table 2 Panel B). Making it TRANSPARENT that an NFM RED FLAG is present

leads to lower investment levels. However, H1 posits a disordinal interaction (see Figure 1).

Thus, we provide only limited evidence, related to the NFM RED FLAG, in support of H1 (i.e.,

the NFM RED FLAG X TRANSPARENT interaction is significant, but ordinal in nature).

However, this result for H1 should be considered in light of our results for H2.

In addition to finding mixed results in relation to H1, we find that INVESTMENT

LEVELs in the non-TRANSPARENT conditions actually increase as we move from NFM RED

FLAG not present to NFM RED FLAG present (see the upward sloping line in the Table 2 Panel

B graph). Note that we predicted a flat line as we posited minimal investor reactions to nonTRANSPARENT red flags (see Figure 1). We randomly assigned investors to experimental

conditions, and this random assignment appears successful (see footnote 11). Thus, we provide

evidence that these two groups do not differ significantly on many traits that would likely

explain investor reactions to red flags or the propensity to purchase stock (other than the

presence of an NFM RED FLAG). Future research may investigate why we observe the highest

INVESTMENT LEVEL in the NFM RED FLAG present/non-TRANSPARENT condition (mean =

338.60 shares). However, one explanation is that investors consider an NFM RED FLAG, when

not TRANSPARENT, to be a positive signal. In other words, investors feel that sales growth

substantially outpacing NFM growth signals that the company is obtaining better results (sales)

with fewer resources (NFMs), cutting slack, and operating more efficiently. Indeed, when we

(2007), on average, viewed the company as a good investment. In additional analyses, we examine if our findings

with respect to selling Madison stock (SELL) are consistent with those related to INVESTMENT LEVEL.

20

asked participants in the NFM RED FLAG present/non-TRANSPARENT condition to explain

why an abnormal difference between sales and NFM growth might exist (i.e., an NFM RED

FLAG), we find that 27 of the 57 participants (47.4%) in that condition perceived the difference

as a positive signal.20 This is an interesting/alarming finding and further supports the need for

investors to have access to the TRANSPARENT, NFM RED FLAG. The large NFM RED FLAG

used in this study was drawn from the NFM RED FLAG observed by Brazel, Jones, and

Zimbelman (2009) for a sample of fraud firms and thus, at minimum, should not cause more

investment. Our data suggest that, only when the large NFM RED FLAG is made

TRANSPARENT, do investors question the large difference between sales and NFM growth and

reduce investment.

Hypothesis Two Testing

H2 posits a three-way interaction between ACCRUAL RED FLAG, NFM RED FLAG, and

TRANSPARENT on INVESTMENT LEVEL. Specifically, we expect that the effect of making a

red flag transparent will be greater in the presence of another red flag. Table 2 Panel A provides

the results of H2 testing. The three-way interaction of ACCRUAL RED FLAG X NFM RED

FLAG X TRANSPARENT (A X B X C) is significant (p = 0.04).

In Table 3, we analyze and illustrate the nature of the significant ACCRUAL RED FLAG

X NFM RED FLAG X TRANSPARENT interaction. Because only the NFM RED FLAG X

TRANSPARENT interaction was significant in Table 2 Panel A, we will examine if, consistent

with H2, the NFM RED FLAG X TRANSPARENT interaction is stronger when the ACCRUAL

20

Examples of participant responses include: It could mean they are being more productive with less people and

equipment - being more efficient, downsizing to make the company more lean/profitable, selling better per

operational unit, better sales from reduced sales personnel, and it suggests that the existing stores and other

resources are becoming more effective at generating sales.

21

RED FLAG is present (vs. not present).21 To perform this analysis, we (1) split our sample

between participants that received either the present or not present ACCRUAL RED FLAG

conditions, and (2) performed two 2X2 ANOVAs with NFM RED FLAG and TRANSPARENT as

independent variables and INVESTMENT LEVEL as the dependent variable. As noted in Table 3

Panel A, NFM RED FLAG X TRANSPARENT is not significant when the ACCRUAL RED

FLAG is not present (p = 0.45). Thus, making a NFM RED FLAG TRANSPARENT does not

significantly affect investment levels when the ACCRUAL RED FLAG is not present. One

potential explanation for this result is that the proximity of net income to cash flow from

operations (ACCRUAL RED FLAG not present) calmed investors enough to not react

substantially to the TRANSPARENT, NFM RED FLAG signal.

Insert Table 3 here

Consistent with H2, we find that, when the ACCRUAL RED FLAG is present, the NFM

RED FLAG X TRANSPARENT interaction is significant (p = 0.01, see Table 3 Panel B). We

analyze and illustrate the nature of this significant NFM RED FLAG X TRANSPARENT

interaction in Table 3 Panel C. Similar to results documented in Table 2 Panel B, when

ACCRUAL RED FLAG is high, we observe a significantly lower INVESTMENT LEVEL when

the presence of an NFM RED FLAG is made TRANSPARENT vs. not TRANSPARENT (mean

INVESTMENT LEVELs = 130.00 shares vs. 386.67 shares, respectively (p = 0.04, see footnote

d)). Consequently, making a NFM RED FLAG TRANSPARENT has a more negative effect on

investment levels when the ACCRUAL RED FLAG is present (vs. not present). We find

empirical support for H2.

As one would expect, given ACCRUAL RED FLAG’s insignificant results in relation to H1, in non-tabulated

analyses we do not find support for the following application of H2: making an ACCRUAL RED FLAG

TRANSPARENT has a more negative effect on investment levels when NFM RED FLAG is present (vs. not present).

21

22

While not explicitly posited by H2, we see the opposite effect when the NFM RED FLAG

is not present (i.e., when an NFM green flag is observed). Given the presence of an ACCRUAL

RED FLAG, as described in our H1 development, we see that making a NFM RED FLAG not

present (green flag) TRANSPARENT leads to a higher INVESTMENT LEVEL (p = 0.09, see

footnote c in Panel C).

Our results related to H2 should be considered in light of the archival findings of Brazel,

Jones, and Zimbelman (2009) and Dechow et al. (2010). Both studies find that fraud firms

generally exhibit both higher NFM RED FLAGs and ACCRUAL RED FLAGs than non-fraud

firms. Therefore, in a fraud setting, investors would more likely experience the right sides of the

table and graph of Table 3 Panel C (vs. the left sides where accruals are high, the NFM RED

FLAG is not present, and we observe the the aforementioned green flag effect). As such, we

stress that caution should be taken in interpreting the generalizeability of our green flag finding.

However, our finding of H2 support should spur policymakers (e.g., SEC) to develop

disclosure requirements or tools that make red flag analysis easier for investors. In short, in the

typical fraud setting (both red flags present), investors would likely utilize and react

appropriately to a TRANSPARENT NFM RED FLAG. Whether this finding holds for other

intuitive and ex ante fraud red flags (e.g., management turnover) is a question for future research.

Additional Analyses

While the aforementioned analyses examine how transparent red flags can affect

INVESTMENT LEVELs (i.e., the number of shares bought or sold by investors), it does not

consider if our independent variables can impact whether the investor sells (vs. buys) the stock of

a company with high fraud risk (i.e., a company exhibiting one or more red flags). As noted in

the Method section, before collecting data on the INVESTMENT LEVEL, we asked participants,

23

“Would you increase or decrease your investment in Madison (SELL)?” Participants were

informed that they held 1,000 shares of Madison. Because SELL is a binary dependent variable

(1= sell, 0 = buy), similar to Kadous (2001) and Jamal and Tan (2009), we examine the effects of

ACCRUAL RED FLAG, NFM RED FLAG, and TRANSPARENT on SELL via a 2X2X2

categorical ANOVA (see Table 4). Results are qualitatively similar (and in fact stronger) to those

presented in Table 2. One exception is that we observe a marginally significant main effect for

ACCRUAL RED FLAG (p = 0.08). A non-tabulated analysis of means suggests that the presence

of an ACCRUAL RED FLAG (regardless of being TRANSPARENT or non-TRANSPARENT)

increases the likelihood that the investor SELLs the stock they hold in a company. Thus, using

SELL as the dependent variable, we provide limited evidence that investors react to the

ACCRUAL RED FLAG. Other non-tabulated tests of means (for the NFM RED FLAG X

TRANSPARENT and three-way interactions) provide qualitatively similar results to those noted

above for H1 and H2 (substituting SELL as the dependent variable and noting that a lower

INVESTMENT LEVEL should equate to a higher likelihood to SELL).

Insert Table 4 here

V. CONCLUSION

This study examines nonprofessional investors’ reactions to fraud red flags when making

investment decisions. We conducted an experiment to investigate whether investors react to

fraud red flags in their natural, dispersed state and whether making red flags more transparent

affects investor behavior. In addition, we consider whether the saliency of one transparent red

flag increases if another red flag is also present.

While investors are victims of fraud and extensive research has examined the efficacy of

various fraud red flags, this is the first study to examine investor reactions to red flags. Overall,

24

we provide the first empirical evidence that: (1) investors do not react uniformly to red flags; (2)

investors should benefit from mechanisms which make intuitive red flags more transparent; (3)

there are complementary effects between red flags; and (4) a transparent green flag can boost

investor confidence and increase investment levels.

While Table 1 suggests that investors are willing to use these and other red flags to avoid

investing in fraudulent companies, investors currently have few tools that make red flags

transparent. In fact, only one participant in our study reported using an automated tool to gather

information and assess fraud risk (vs. performing his/her own analysis of fraud red flags).

Investors could have access to this information at minimal expense. For example, web scraping

uses computer algorithms to extract and compile publicly-available information in a meaningful

way. Researchers have documented the usefulness of web scraping in a variety of contexts from

determining optimal inventory prices (Dewan, Freimer, and Jiang 2007) to ascertaining investor

sentiment (Das and Chen 2007). Web scraping techniques could likely extract the appropriate

information necessary to produce the transparent red flag information proposed in this study.

Brokerage companies, investor protection groups, and/or regulators could house such a red flag

tool on their websites. In a more direct fashion, policymakers could require firms to more

explicitly disclose red-flag related information to investors in financial statement footnote

disclosures (e.g., changes in NFMs and relevant financial measures). These data would then be

subject to an external audit and tagged for XBRL purposes, giving management the opportunity

to explain any abnormal inconsistencies that exist (e.g., how sales growth is positive, while retail

outlets and employee headcount have decreased). As previously mentioned, in Exhibit B of

Appendix A we provide an example of one firm that provides NFM and financial data in a very

transparent format. Our finding that investors have the propensity to consider NFMs as a

25

benchmark for financial data supports calls by internal and external stakeholders for companies

to report more NFMs (Ballou et al. 2006; Holder-Webb et al. 2009a and 2009b).

Our findings shine light on investors’ use of red flags and should help researchers and

regulators understand how to best protect investors from fraudulent financial reporting. If

investors are provided with tools that explicitly identify and explain red flags, then investors

should sell potentially fraudulent investments more quickly, reduce the extent to which they

suffer losses and, in turn, reduce the extent and length of frauds perpetrated by companies.

26

REFERENCES

Alexander, R. M. 2003. The effect of source credibility on tax professionals’ judgments in

consulting engagements. Journal of the American Taxation Association 25 (Supp): 33-50.

Ball, R. 2008. What is the actual economic role of financial reporting? Accounting Horizons

22(4): 427-432.

Ballou B., D. Heitger, and C. Landes. 2006. The future of corporate sustainability reporting.

Journal of Accountancy 202 (December): 65-74.

Bhattacharya, U., H. Daouk; and M. Welker. 2003. The world price of accounting opacity. The

Accounting Review 78 (July): 641–78.

Bogle, J. 2005. The ownership of corporate America – rights and responsibilities. Remarks by

John C. Bogle, Founder and Former Chairman, The Vanguard Group, 20th Anniversary

Meeting of the Council of Institutional Investors, April 11, 2005. Website,

http://johncbogle.com/speeches/JCB_CII0405.pdf

Bonner, S. 2008. Judgment and Decision Making in Accounting. Upper Saddle River, NJ:

Pearson Prentice Hall

Bouwman, M. 1982. The use of accounting information: Expert vs. novice behavior. In Decision

Making: An Interdisciplinary Inquiry, edited by G. Ungson and D. Braunstein, 134-167.

Boston, MA: Kent.

Bouwman, M., P. Frishkoff and P. Frishkoff. 1987. How do financial analysts make decisions? A

process model of the investment screen decision. Accounting, Organizations and Society

12 (January): 1-30.

Brazel, J. F., K. L. Jones, and M. Zimbelman. 2009. Using nonfinancial measures to assess fraud

risk. Journal of Accounting Research. 47 (December): 1135-1166.

Brazel, J. F., K. L. Jones and R.C. Warne. 2010. Investor perceptions about financial statement

fraud and their use of red flags. Available at SSRN: http://ssrn.com/abstract=1460820.

Brunswick, E. 1952. The Conceptual Framework of Psychology. Chicago: University of

Chicago Press.

Chen, S. and S. Chaiken. 1999. The heuristic-systematic model in its broader context. In DualProcess Theories in Social Psychology, edited by S. Chaiken and Y. Thrope, 73-96. New

York, NY: Guilford Press.

Cohen, J. 1960. A coefficient of agreement for nominal scales. Educational and Psychological

Measurement 20 (Spring): 37-46.

27

Cox, C. 2005. Speech by SEC chairman: Speech to SEC staff. August 4. Securities and

Exchange Commission. Available at http://www.sec.gov/news/speech/spch080405cc.htm

Das, S. R. and Chen, M. Y. 2007. Yahoo! for Amazon: Sentiment extraction from small talk on

the web. Management Science 53 (September): 1375-1388.

Dechow, P. M., and I. D. Dichev. 2002. The quality of accruals and earnings: The role of accrual

estimation errors. The Accounting Review 77 (Supplement): 35–59.

Dechow, P. M., R. G. Sloan, and A.P. Sweeney. 1996. Causes and consequences of earnings

manipulation: An analysis of firms subject to enforcement actions by the

SEC. Contemporary Accounting Research 13 (Spring): 1–36.

Dechow, P. M., W. Ge, C. R. Larson and R. G. Sloan. 2010. Predicting material accounting

misstatements. Contemporary Accounting Research (forthcoming). Available at SSRN:

http://ssrn.com/abstract=997483.

Dewan, R. M., Freimer, M. L., and Jiang, Y. 2007. A temporary monopolist: Taking advantage

of information transparency on the web. Journal of Management Information Systems 24

(Fall): 167-194.

Elliott, W. B. 2006. Are investors Influenced by pro forma emphasis announcement?” The Accounting

Review 81 (January): 113–33.

Elliott, W. B., F. D. Hodge, J. J. Kennedy, and M. Pronk. 2007. Are M.B.A. students a good

proxy for nonprofessional investors? The Accounting Review 82 (January): 139-168.

Elliott, W. B., F. D. Hodge, K. E. Jackson. 2008. The association between nonprofessional

investors’ information choices and their portfolio returns: The importance of investing

experience. Contemporary Accounting Research 25 (Summer): 473-498.

Elliott, W.B., S.D. Krische, and M.E. Peecher. 2010. Expected mispricing: The joint influence of

accounting transparency and investor base. Journal of Accounting Research 48 (May):

343-381.

Financial Accounting Standards Board (FASB). 1990. Statement of Financial Accounting

Standards No. 106, Employers’ Accounting for Postretirement Benefits other than

Pensions. Stamford, CT: FASB.

Financial Accounting Standards Board (FASB). 2008. Original Pronouncements as Amended:

Statement of Financial Accounting Concepts No. 1. Stamford,CT: FASB.

Glass Lewis & Co. 2005. Control deficiencies—finding financial impurities analysis of the 2004

and early 2005 of deficiency disclosures. Control deficiencies trend alert (June 24).

Available at: http://www.glc.com.

28

Glover, S. M., D. F. Prawitt, and T. J. Wilks. 2005. Why do auditors over-rely on weak

analytical procedures? The role of outcome and precision. Auditing: A Journal of

Practice & Theory 24 (Supplement): 197-220.

Hewitt, M. 2009. Improving investors’ forecast accuracy when operating cash flows and accruals

are differentially persistent. The Accounting Review 84 (November): 1913-1931.

Hirst, E., and P. Hopkins. 1998. Comprehensive Income Reporting and Analysts' Journal of Accounting

Research 36 (Supplement): 47–75.

Hodder, L., P. E. Hopkins, and D. A. Wood. 2008. The effects of financial statement and

informational complexity on analysts’ cash flow forecasts. The Accounting Review 83

(July): 915-956.

Hogan, C.E., Z. Rezaee, R.A. Riley, and U. Velury. 2008. Financial statement fraud: Insights

from the academic literature. Auditing: A Journal of Practice & Theory 27(November):

231-252.

Holder-Webb, L., J. Cohen, L. Nath, and D. Wood. 2009(a). A survey of governance disclosures

among US firms. Journal of Business Ethics 83 (December): 543-563.

Holder-Webb, L., J. Cohen, L. Nath, and D. Wood. 2009(b). The supply of corporate social

responsibility disclosure among US Firms. Journal of Business Ethics 84 (February):

497-527.

Hubbard, G. D. 2002. Warning signs found in Enron reports from 1995. Birmingham Business

Journal. May 3.

Hunton, J E., R. Libby, and C. Mazza. 2006. Financial reporting transparency and earnings management.”

The Accounting Review 81 (January): 135–57.

Hunton, J. E. and R. A. McEwen. 1997. An assessment of the relation between analysts’ earnings

forecast accuracy, motivational incentives, and cognitive information search strategy. The

Accounting Review 72 (October): 497-516.

Investment Company Institute and the Securities Industry and Financial Markets Association.

2008. Equity and Bond Ownership in America.

www.ici.org/pdf/rpt_08_equity_owners.pdf

Jamal, K. and Tan, H. T. 2010. Joint effects of principles-based versus rules-based standards

and auditor type in constraining financial managers’ aggressive reporting. The

Accounting Review 85 (July): 1325-1346.

Jones, J. 1991. Earnings management during import relief investigations. Journal of Accounting

Research 29 (2): 193–228.

Jones, K., G. Krishnan, K. Melendrez. 2008. Do models of discretionary accruals detect actual

29

cases of fraudulent and restated earnings? An empirical analysis. Contemporary

Accounting Research 25 (2): 499-531.

Kadous, K. 2001. Improving jurors' evaluations of auditors in negligence cases. Contemporary

Accounting Research. 18 (Fall): 425-444.

Karelaia, N. and R. M. Hogarth. 2008. Determinants of linear judgment: A meta-analysis of lens

model studies. Psychological Bulletin 134 (3): 404-426.

Kaufmann, E. and J. A. Athanasou. 2009. A meta-analysis of judgment achievement defined by

the lens model equation. Swiss Journal of Psychology 68(2): 99-112.

Lauricella, T. 2009. Investors see silver lining, as bad news clouds outlook. The Wall Street

Journal. (May 4).

Laux, B. 2009. EBRC proposes new XBRL taxonomy for the MD&A. Hitachi Data

Interactive.com (August 10: http://hitachidatainteractive.com/2009/04/15/ebrc-proposesnew-xbrl-taxonomy-for-the-mda/).

Lee, T. A., R.W. Ingram, and T. P. Howard. 1999. The difference between earnings and

operating cash flow as an indicator of financial reporting fraud. Contemporary

Accounting Research 16 (Winter): 749-786.

Levitt, S. D. and S. J. Dubner. 2009. SuperFreakonomics: Global cooling, patriotic prostitutes

and why suicide bombers should buy life insurance. New York, NY: HarperCollins.

Maines, L. A. and L. S. McDaniel. 2000. Effects of comprehensive income

characteristics on nonprofessional investors’ judgments: The role of financial statement

presentation format. The Accounting Review 75 (2): 179-207.

North American Securities Administrators Association (NASAA). 2006. NASAA Year in

review 2006: Advancing a legacy of investor protection. Available at:

http://www.nasaa.org/content/Files/2006YIR.pdf.

Petty, R. E. and J. T. Cacioppo. 1986. Communication and Persuasion: Central and Peripheral

Routes to Attitude Change. New York: Springer-Verlag.

Public Law 107-204. 2002. 15 USC 7201. 107th United States Congress. H.R. 3763. July 30.

Rummell, N. 2008. XBRL: IR. Financial Week (October 12).

Securities and Exchange Commission (SEC). 2008. SEC Approves Interactive Data for

Financial Reporting by Public Companies, Mutual Funds – Press Release 2008-300

(Securities and Exchange Commission: Washington, D.C.) December 18.

Schick, A. G., L.A. Gordon, and S. Haka. 1990. Information overload: A temporal approach.

30

Accounting Organizations and Society 15:199–220.

Schilit, H. 2002. Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in

Financial Reports. New York, NY: McGraw-Hill.

Schneider, B., and W. So. 2009. XBRL: An Interview with Amy Pawlicki of the AICPA (Part 1).

Hitachi Data Interactive.com (July 24, http://hitachidatainteractive.com/2009/07/24/xbrlan-interview-with-amy-pawlicki-of-the-aicpa-part-1/).

Sloan, R. G. 1996. Do stock prices fully reflect information in accruals and cash flows about

future earnings? The Accounting Review 71 (July): 289-315.

Wall Street Journal (WSJ). 2005a. Defense expert: Healthsouth fraud too complex for

detection. May 6.

Wall Street Journal (WSJ). 2005b. Delphi discloses accounting problems. March 7.

Zweig, J. 2009. About time: Regulation based on human nature. The Wall Street Journal. (June

20-21).

31

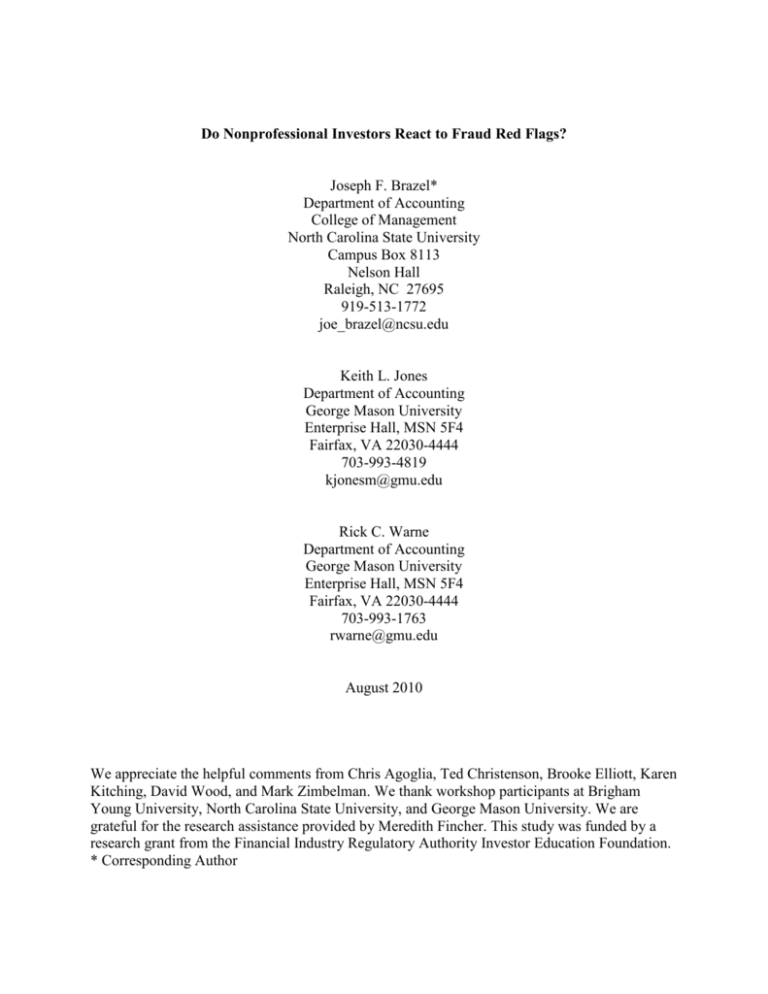

FIGURE 1

Graph depicting the disordinal interaction between Red Flag Presence (not present vs.

present) and Transparent/Not Transparent on the Level of Investment (Hypothesis 1).

HIGH

Investment Level

LOW

NOT

PRESENT

(GREEN FLAG)

Red Flag Presence

PRESENT

(RED FLAG)

Notes:

indicates the red flag information is transparent.

indicates the red flag information is not transparent.

The above disordinal interaction is predicted for both of the specific red flags examined in this

study: the NFM red flag and the accrual red flag.

32

TABLE 1

Demographic Data

Response

[n = 237]

Mean (Std. Dev.)

Variables

Screening Questions a

1.

% that bought or sold individual company stock in the last

the last six months

100.00

2.

100.00

% that were not a professional investor

Fraud Red Flag-related Measures b

3.

Intuitiveness of accrual red flag

4.10 (1.59)

4.

Intuitiveness of NFM red flag

4.24 (1.58)

5.

Use of accrual red flag when assessing fraud risk

3.93 (1.86)

6.

Use of NFM red flag when assessing fraud risk

3.83 (1.91)

7.

% that used fraud red flags other than accruals or NFM

21.50

8.

Use of fraud red flags

3.81 (1.67)

Fraud-related Measures b

9.

Perception of the rate (%) of fraudulent financial reporting

34.90

10.

% that owned the stock of a fraud company

16.00

11.

% that had received fraud training

7.20

12.

Importance of fraud risk assessment

4.28 (1.61)

Investing Experience, Activity, and Return b

13.

Investing experience

3.34 (1.59)

14.

Trading activity

2.09 (1.34)

15.

Value of portfolio

3.80 (2.26)

16.

Return on investments

5.84 (2.94)

33

Other Demographic Data b

17. Education

3.16 (1.22)

18.

% with at least an undergraduate degree

61.20

19.

% Male

48.50

20.

Age

4.46 (1.43)

21.

Household income

3.12 (1.46)

a

Participants were asked to respond to the following two questions (screening questions): (1)

Have you bought or sold individual shares of company stock (i.e., not mutual funds) in the last

six months? (2) As part of your full-time job responsibilities, do you analyze or trade stocks or

other securities? Participants could respond “yes” or “no.” Question (1) is coded 1 for “yes”

and 0 for “no”. Question (2) is coded 1 for “no” and “0” for “yes.”

b

Intuitiveness of accrual red flag = One possible way to assess whether a company’s financial

statements are fraudulent is to compare net income to cash flows from operations (i.e., accrual

levels). For you, how intuitive (intuitive = easy to understand) is this fraud risk assessment tool

or red flag? Measured 1 = “not intuitive” and 7 = “very intuitive.”

Intuitiveness of NFM red flag = One possible way to assess whether a company’s financial

statements are fraudulent is to compare growth in sales to growth in operational measures (e.g.,

number of employees, square footage of operating space)? For you, how intuitive (intuitive =

easy to understand) is this fraud risk assessment tool or red flag? Measured 1 = “not intuitive”

and 7 = “very intuitive.”

Use of accrual red flag when assessing fraud risk = How often do you compare net income to

cash flows from operations (i.e., accrual levels) when assessing the risk of financial statement

fraud for a company, measured 1 = “never” and 7 = “always.”

Use of NFM red flag when assessing fraud risk = How often do you compare sales to growth in

operational measures (e.g., number of employees, square footage of operating space) when

assessing the risk of financial statement fraud for a company, measured 1 = “never” and 7 =

“always.”

% that used fraud red flags other than accruals or NFM = As an investor, do you use another tool

or red flag to assess the risk of fraudulent financial reporting at a company? “Yes” responses

coded 1 and “no” responses coded “0.”

Use of fraud red flags = To what extent do you use red flags to try to assess the risk of financial

statement fraud for companies that you currently hold in your personal investment portfolio?

Measured on a scale where 1 = “never” and 7 = “always.”

Perception of the rate (%) of fraudulent financial reporting = In your opinion, how often do

managers of publicly-traded companies commit financial statement fraud, measured on a scale

from “0% of the time” to “100% of the time.”

% that owned the stock of a fraud company = Have you ever owned the stock of an individual

company when it was found to have been committing financial statement fraud, measured 1 =

“yes” and 0 = “no.”

% that had received fraud training = Have you ever received training in relation to assessing

fraud risk or detecting financial statement fraud? Responses coded 1 for “yes” and 0 for “no.”

34

Importance of fraud risk assessment = How important is your assessment of the risk of financial

statement fraud, relative to other factors, when making buy/sell decisions for stocks that you

currently hold in your portfolio? Measured on a scale where 1 = “not at all important” and 7 =

“extremely important.”

Trading activity = Approximately, how many times, on average, do you buy or sell stocks of

individual companies in a one-year period, measured on a scale where 1 = “1-5 times” and 5 =

“more than 20 times.”

Value of portfolio = What is the approximate value of your personal investment portfolio,

measured on a scale where 1 = “less than $10,000” and 8 = “more than $1,000,000.”

Return on investments = Over the last twelve months, what was the approximate return on your

personal investment portfolio, measured on a scale where 1 = “less than -20 percent” and 11 =

“more than 20%.”

Education = Please indicate the highest level of education you have completed, measured on a

scale where 1 = “high school” and 5 = “post-graduate degree.”

% with at least an undergraduate degree = coded 1 if participant obtained an undergraduate

degree or higher, 0 otherwise.

% Male = Coded 1 if male, 0 otherwise.

Age = Measured on a scale where 1 = “under 20” and 8 = “80 or above.”

Household income = What is your total annual household income, measured on a scale where 1

= “$0 - $30,000” and 7 = “more than $200,000.”

35

TABLE 2

Hypotheses One and Two: INVESTMENT LEVEL a

PANEL A: 2X2X2 ANCOVA

Independent Variables b

USE OF OTHER RED FLAGS

ACCRUAL RED FLAG (A)

NFM RED FLAG (B)

TRANSPARENT (C)

AXB