capturing your personal financial information

advertisement

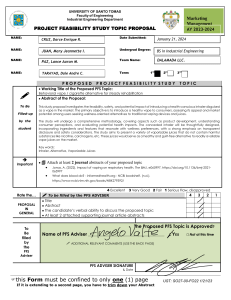

CAPTURING YOUR PERSONAL FINANCIAL INFORMATION Maintaining proper personal financial records is a real struggle for many just as is restraining impulsive spending. It is however important that you start right by capturing those critical information in a manner that can be easily retrieved and updated. For any individual seeking a better control of their personal finances, using a Personal Financial Snapshot (PFS) is a good start as it helps bring together information that could support better decisions when considered all together in their wholeness, rather than individually. An analogy could be drawn to having your Medical or Health Card accessible when you visit a Doctor without which it would be difficult to trace your Health records. A Doctor would typically check your file to review your medical history for a record of documented allergies or reactions before any prescriptions are made. The Personal Financial Snapshot (PFS) helps you achieve the needed structure and makes it easier to identify gaps in critical decisions or actions that are often deferred like having a Will when this is detected during the process. With the (PFS) you are able to get a single view of your financial obligations as well as the resources that you have available to meet these obligations in the form of a Personal Balance Sheet. You will be better acquainted with your true net-worth and also have a sound basis for making adjustments or even plans based on a full view of your current situation. It is an accepted fact that it is quite impossible to find your destination if you don’t know where you are starting from. The Personal Financial snapshot is that start that every individual should have in terms of gaining a proper control of their finances. I have often heard men boast that they have all their critical financial information stored up mentally, and even support such arguments with the strong needs for secrecy to protect themselves. The sad part though is that the financial systems in many jurisdictions carry significant amounts in unclaimed balances from bank accounts simply because such balances were never accounted for by their owners while they were living, nor captured in Wills nor disclosed to their next of Kins either !!! Keeping proper Personal Financial records therefore is not only a practice that is critical to the well being of the individual but also a strong indication of financial responsibility that should be well encouraged. For record keeping, a simple Word file that can be updated, together with an Excel sheet covering the critical areas would suffice (See Sample PFS). With the proper financial records you will find that it is so much easier to take long term financial decisions which are based on facts rather than emotion, and in a very logical manner too. Your records would also aid planning and serve as an invaluable reference point for reviewing future plans against actual outcomes. It is incontestable therefore that the financial success of any individual starts with initiating and maintaining accurate personal financial records. Financial success has never been based on happenstance or chance. Author: Thompson (October 2012)