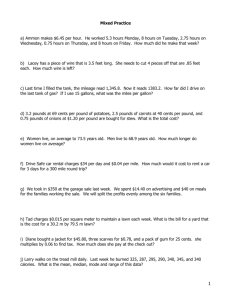

Answers to Homework #6

advertisement

Homework 6: Analysis of Perfect Competition; Monopoly (to be handed in on Tuesday 23rd March) 1. Suppose the supply curve for a good is completely inelastic. If the government imposed a price ceiling below the market-clearing level, would a deadweight loss result? Use a diagram to explain your answer. (1 point) If the supply curve is completely inelastic, then the imposition of an effective price ceiling transfers all the loss in producer surplus to consumers so no DWL occurs. 2. The burden of a tax is shared by producers and consumers. Under what conditions will consumers pay most of the tax? And when will producers pay most of it? (1 point) The burden of a tax depends on the elasticities of supply and demand. If demand is very inelastic relative to supply, then consumers pay most of the tax. If supply is very inelastic relative to demand, then producers pay most of the tax. 3. The US is a small producer in the world bean market, where the current world price is 60 cents per pound. Congress is considering a tariff of 20 cents per pound of beans. The domestic supply and demand curves for beans are as follows, where P = price (cents per pound), and Q = quantity (millions of pounds): (3 points) Demand: Supply: P = 200 – 2Q P = 50 + Q a) Drawing a supply and demand diagram, find the domestic equilibrium price and quantity of beans under autarky. 200 – 2Q = 50 + Q. Thus, Q = 50 (million pounds); P = 100 (cents) = $1 Intercepts: Demand: if P = 0; Q = 100; If Q = 0, P = 200 Supply: If q = 0, P = 50 b) Suppose the domestic market is opened up to trade. At the world price of 60 cents, find the domestic supply, the domestic demand, and the level of imports. If Pw = 60 cents, then Qd = 70, Qs= 10, and the level of imports = 60 million pounds. c) If the tariff were imposed, find the resulting domestic price of beans, domestic quantity supplied, and level of imports. If the tariff is imposed, then Pw + t = 80 cents. Qd = 60, Qs = 30, and imports = 30 million pounds d) Compute the dollar gain or loss to domestic consumers, domestic producers, and government revenue from the imposition of the tariff. What is the deadweight loss? Gain in PS: Gain in government revenue: DWL: Loss in CS: (10*20) + ½(20*20) = $4 million (30 million pounds * 20 cents per pound) = $6 million ½(20*20) + ½(10*20) = 200 + 100 = $3 million 4 + 6 + 3 = $13 million 4. Why is there no market supply curve under conditions of monopoly? (1 point) The monopolist is the single seller so we don’t need to aggregate all the individual firms’ marginal cost curves to obtain the industry supply curve. The monopolist’s output decision depends not only on its marginal cost, but also on the demand curve (unlike perfect competition). Thus, shifts in demand lead to changes in price, in output or both. There is no one-to-one correspondence between the price and the seller’s quantity, unlike in perfect competition. 5. If the government wants to set a price ceiling that maximizes the level of output the monopolist produces, what price should it set? (1 point) The government should set the price ceiling at p = MC to maximize the level of output the monopolist produces. 6. The table below shows the demand curve facing a monopolist who produces at a constant marginal cost of $6, with zero fixed costs. Fill in the Table below. What would the equilibrium price and quantity be in a perfectly competitive industry? (3 points). Price 27 24 21 18 15 12 9 6 3 Output 0 2 4 6 8 10 12 14 16 TR 0 48 84 108 120 120 108 84 48 MR 24 18 12 6 0 -6 -12 -18 TC 0 12 24 36 48 60 72 84 96 MC 6 6 6 6 6 6 6 6 Profit 0 36 60 72 72 60 36 0 -48 The monopolist produces where MR=MC, i.e. q = 8. In a perfectly competitive market, p = MC, so the equilibrium price would be $6, and the firm would produce at q= 14.