8 Rental Rebates

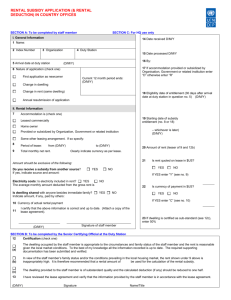

advertisement

Housing Services Operational Policy Manual Rental Rebates 8 Rental Rebates A rental rebate is a subsidy of the market rent of a dwelling. This results in eligible tenants only contributing an amount towards the rent that is affordable. Under Regulation 5 of the Housing Regulations, the CEO Housing is able to apply a rental rebate to eligible tenants only. Housing Services operates a rental rebate scheme whereby eligible tenants pay a contribution towards the market rent based on a percentage of household income. This is called the ‘rebated rent’. This percentage of their income is based on national housing affordability benchmarks. However as the cost of living in the Territory is the highest in Australia, the percentage of income contributed towards the rent by Housing Services tenants is one of the lowest charged by any State Housing Authority. The rent payable by a tenant is based on a percentage of the household income. The rental rebate is the difference between rent payable by the tenant and the market rent for the dwelling. Housing Services receives funding from the Territory Government in the form of a Community Service Obligation (CSO) payment equivalent to the amount of rental rebate given to tenants. The CSO recognises the Government’s obligation to assist low and medium income Territorians and enables Housing Services to utilise its resources efficiently as a Government Business Division. When a rental rebate calculation is completed on the income of some tenants, the resulting rent is above the market rent even though their income is below the eligibility limit. In these cases the tenant will be charged a reduced rent called Maximum Rebated Dwelling Rent. Refer to section 7.3 for further details on Maximum Rebated Dwelling Rents. Housing Services also operates an Employment Incentive Scheme, which aims to encourage Public Housing tenants to gain employment or increase their hours of employment. Refer section 8.8 for full details. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.1 Eligibility Eligibility to receive a rental rebate is determined by the household’s assessable income, assets and whether or not they own or partly own habitable property within Australia. Tenants, who are not eligible to receive a rental rebate, must pay the Market rent applicable to the dwelling they occupy. Refer to section 7.2 for details of Market rents. Section 31 of the Housing Act (NT) requires tenants to furnish correct and up to date information to Housing Services. Any person furnishing false information renders themselves liable for a penalty of $1,000 or imprisonment for 6 months. The determining factor will be whether the applicant/tenant furnished information to the best of their knowledge. Suspected cases are to be referred to the Housing Manager, with serious cases referred to a Director of Operations. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.1.1 Property Ownership Just as with the eligibility criteria for access to public housing, tenants who own or partly own a habitable property will be ineligible to receive a rental rebate. See section 2.4 for further details including exemptions. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.1.2 Income Limits The income limits for eligibility for rental rebates is the same as the income for access to public housing outlined in section 2. Assessable Income Income assessable for the purposes of calculating rental rebates has the same definition as assessable income for the purpose of determining eligibility for access to public housing. Refer to section 2.2.1 for details on assessable income. Exempt Sources of Income Some sources or types of income are not included as assessable income for the eligibility to receive a rental rebate. The types of incomes exempted are generally the same as those income types that are excluded in the calculation of eligibility for public housing. See Appendix 1 Included/Excluded Income for a full list of types of income and their treatment. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.1.3 Asset Limits Different asset limits for eligibility for rental rebates apply to tenants depending on their age and household size. The definition of an asset included for the purpose of eligibility for a rental rebate, is the same as those for access to public housing (refer to section 2.3 of the Housing Services Operational Policy Manual). The asset limit for tenants under the age of 55 years is the same as the asset limit for access to public housing (refer to section 2.1 of the Housing Services Operational Policy Manual). The asset limits detailed in the table below apply to tenants aged 55 years and over as at 9 November 2009. HOUSEHOLD SIZE HOUSEHOLD ASSET LIMIT 1 $171,100 2 $171,100 3 $240,700 4 $240,700 5 $240,700 6 $240,700 These asset limits are reviewed in line with the income and asset limits in section 2.1 of the Housing Services Operational Policy Manual. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.2 Rebated Rent Calculation As stated above, in general terms, the rebated rent payable by eligible tenants is calculated as a percentage of the combined assessable weekly income. The assessable income is first established and then the applicable percentage is applied to the assessable income to determine the rent payable by the household. When determining rent, different calculations are used depending on whether the income: belongs to the tenant or their spouse; belongs to those household members classed as ‘Others’; is from an aged pensioner; is Family Tax Benefit Part A; or is Child Maintenance Payments. Also the status of the tenant in relation to Housing 2003 policies will affect the percentage of income charged as rent. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.2.1 Assessable Income for Rebated Rent Calculation Different calculations are used to determine the rebated rental amount payable by tenants, their spouses and other members of the household. The types of income included in the calculation of rebated rent will differ depending on whether the income is received by tenants or other household members. Income of Tenant/s and Spouse The assessable income of the tenant/s and their spouse, upon which rebated rent is calculated, is the gross weekly income received by the tenant and their spouse from all sources except those which are made for a specific purpose or on a one off basis. See Appendix 1 Included/Excluded Income for a full list of types of income and their treatment in relation to rental rebate calculation for tenants and their spouses. Income of other Household Members On the 1st July 2004, the age of other household members, whose income was used in the calculation of rent, changed from 17 to 18 years of age. This change automatically applied to all rental rebate applications submitted, on or after 1 July 2004. Assessable income for other household members is defined as gross income from all sources. Other exemptions contained within Appendix 1 Included/Excluded Income do not apply to household members aged 18 years of age and over, other than tenant/s and spouse. No contribution towards rent is made by other household members whose income is below the limit of the current Single Youth allowance (living at home) paid at the dependant rate if they are under the age of 21. Those other household members, above the age of 21, who are not receiving at least the dependant rate of Single Youth allowance (living at home), will be deemed as receiving such, except in the cases where they receive Ab/Austudy. Housing Services Housing Services Operational Policy Manual Rental Rebates Treatment of Minimal or Nil Income Where tenants or other household members provide substantiated proof of minimal or nil income, the assessable income will be deemed to be the Centrelink benefit applicable to the tenant's age and family structure. An example of this may be a self-employed tenant whose statement of income confirms a very low income, no income or an income loss for the trading year. An exception would be where Austudy/Abstudy is the main source of income and the amount paid is less than Centrelink benefits, or where the spouse of a tenant is not entitled to Centrelink payments until permanent Australian resident status is granted. Income earned by non-permanent residents through employment or selfemployment will be used when calculating the amount of rent to be paid. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.2.2 Percentage of Income Charged as Rent Different percentages of income are charged on the income of the tenant and their spouse, as opposed to other household members. Also differing percentages will apply depending on the tenant’s status in relation to Housing 2003 policies. Refer to section 8.2.1 for details on assessable income. Family Tax Benefit Part A Households who receive Family Tax Benefit Part A will have rent calculated, on that payment only, at the concession rate of 10%. This does not apply to Family Tax Benefit Part A received by household members classed as ‘Others’ where the additional rent is calculated as: 10% of assessable income of all household members aged 18-24 years 20% of assessable income for all household members aged 25 years and over Where a parent/guardian has shared care of a child/children and receives Famiy Tax Benefit A proportionate to their share care arrangement (eg. receives less than 100% of Famiy Tax Benefit through Centrelink) then rent is calculated on the amount received. Family Tax Benefit Part B Family Tax Benefit Part B is not taken into account when assessing rental rebates or eligibility. Child Maintenance Payments Households who receive Child Maintenance Payments will have rent calculated at a concession rate of 10%, on that payment only and effective as of 14 March 2005. This does not apply to Child Maintenance Payments received by household members classed as ‘Others’. Post Housing 2003 The income of tenants and their spouses to whom Post Housing 2003 policies apply will pay the following percentage as rebated rent: for tenants other than aged pensioners, 23% of current assessable income, excluding Family Tax Benefit Part A and Child Maintenance Payments, which are assessed at 10%; Housing Services Housing Services Operational Policy Manual Rental Rebates for aged pensioners (refer to Glossary for definition of Aged pensioner), 18% of current assessable income, excluding Family Tax Benefit Part A and Child Maintenance Payments, which are assessed at 10%. Post-Housing 2003 percentage rates apply to: new tenants having been allocated public housing dwellings from 25 January 1999; new applicants for rental rebates from 25 January 1999; tenants voluntarily transferring, whose rebate is assessed on Pre Housing 2003 percentage rates, unless as a move to correct entitlement or on medical/social grounds or have been requested to by Housing Services (refer section 10.1.9); tenants assessed on the Pre Housing 2003 percentage rates who have a change of income type, for example tenants receiving the Newstart Allowance who then become eligible for the Aged Pension. Pre Housing 2003 The percentage of income paid as rebated rent by tenant/s and their spouses to whom Pre Housing 2003 policies apply, will depend on the type of the main source of income they receive: Recipients of Aged, Widows, Veterans Affairs, or Disability Pensions or the Mature Allowance - 14% of assessable income to the allowable Centrelink income threshold and 20% of the income in excess of that amount, excluding Family Tax Benefit Part A and Child Maintenance Payments which are assessed at 10%. Tenants of an age to qualify for an age pension but receiving an alternative income may be being assessed as a pensioner in accordance with former policy, eg special benefit paid in lieu of age pension, superannuation; Recipients of Sole Parenting Payment plus Family Tax Benefit Part A - 18% of income to the allowable Centrelink income threshold and 20% of income in excess of that amount, excluding Family Tax Benefit Part A and Child Maintenance Payments which are assessed at 10%; Other Income Types (wages etc) - 20% of income to the NT Weekly Minimum Adult Wage and 28% of income in excess of that amount, excluding Family Tax Benefit Part A which is assessed at 10%. Pre Housing 2003 percentage rates apply to tenants who were eligible to receive a rebate on 25 January 1999 and have not had any changes to their circumstances such as those outlined in the Post Housing 2003 section above Housing Services Housing Services Operational Policy Manual Rental Rebates Other Household Members Rent calculated on the assessable income of other household members, other than the tenant/s and their spouse, is paid in addition to the rent calculated on the tenant/s and their spouse. The rate charged on the income of other household members is the same, regardless whether the tenant is Pre or Post Housing 2003. The additional rent for other household members is calculated as: 10% of assessable income of all household members aged 18 to 24 years; 20% of assessable income for all household members aged 25 and over. It should be noted that no contribution towards rent is made by other household members whose income is below the limit of the current Newstart allowance paid at the dependant rate. Visitors Bona-fide visitors may stay for up to 6 weeks without affecting the tenant’s rent. Bona-fide visitors are defined by Housing Services as persons who: have a residential address other than the public housing dwelling and who normally reside at that address; are not wait listed for accommodation; who are staying for purposes other than employment; do not have the intention of seeking an extension to the initial visit; Persons on Newstart Benefit seeking work accommodation are not regarded as visitors. and persons awaiting other If visits are extended, rent will be charged after 6 weeks in accordance with policies relating to other household members. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.2.3 Maximum Rebated Dwelling Rent In some circumstances, when the rental rebate calculation is undertaken in accordance with the policies in this section, the resulting figure may be higher than the Market Rent applicable to the dwelling occupied. Maximum Rebated Dwelling Rent is the maximum rent charged to those tenants who are still eligible to receive a rental rebate because they are below the income, asset and property ownership criteria. Refer to section 8 for further details on eligibility to receive a rental rebate and section 7.3 for further details on Maximum Rebated Dwelling Rents. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.3 Rental Rebate Renewal Rental rebates are assessed on the commencement of the tenancy and then renewed periodically depending on the main income type received by the tenant/spouse. At the expiry of the defined period, as shown below, the rent payable is adjusted in accordance with any changes in income and/or family structure. The rebate type is defined as the major source of the tenant/s and their spouse’s income. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.3.1 Renewal Periods The following renewal periods apply to the following income types, irrespective of whether the tenant’s rent is calculated at Pre or Post Housing 2003 rates: Tenants receiving Aged, Widows, Veterans Affairs, or Disability Pensions or the Mature Allowance will be required to renew their rebates every 12 months (52 weeks). All other tenants will be required to renew their rebates every six months (26 weeks) unless their income is considered variable (refer 8.3.3), in which case it will be renewed every three months (13 weeks). Housing Services Housing Services Operational Policy Manual Rental Rebates 8.3.2 Backdating Rental Rebates Rent will be backdated to the date the household’s income increased/decreased if the rent payable is affected by more than $2 per week. Refer to section 8.5.2 for further details. A Tenancy Manager may backdate a rental rebate up to 6 weeks; a Housing Manager may approve backdating of a rental rebate between 6 and 12 weeks. A Director Operations may approve backdating of a rental rebate greater than 12 weeks. Tenants are required to notify Housing Services within 28 days of any change in household income or increase/reduction in the number of household occupants. Refer to section 8.5.1 for further details. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.3.3 Variable Income Where income varies considerably, eg. wages with seasonal overtime, casual employment etc, rebates can be renewed or adjusted on a three month (13 week) basis. In this situation, no adjustments will be made for periods less than 13 weeks. The assessable weekly income will be calculated as the average weekly income over the period the rebate is granted. In some other circumstances a tenant’s income may vary considerably over the course of a year but is stable from year to year, such as casual staff employed during school terms only. In these cases Housing Services may calculate the rental rebate over a 12-month period. The Housing Manager has the discretion to allow the calculation of rental rebates on income received over a period of 12 months. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.4 Proof of Income Tenants applying for a rental rebate will be required to provide satisfactory proof of current income from all sources received by them, their spouse and all other household members aged 18 and over. If the tenant refuses to provide the required confirmation of income, an application for a rental rebate cannot be processed and market rent will apply. The documentation required as evidence of income is the same as that required when establishing eligibility for public housing. However the documentation must be current at the time that an application for a rental rebate is made or renewed. Refer to section 2.2.4 for further details. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.5 Notification of Income Changes Under section 31(a) of the Housing Act, tenants receiving a rental rebate are required to notify Housing Services of any change to their income not later than 28 days after the change occurs. Failure to do so renders the tenant liable for a penalty of $1,000. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.5.1 Types of Notifiable Changes The following are circumstances where the tenant must notify Housing Services within 28 days, and not wait until their next rental rebate renewal. In these circumstances Housing Services will adjust the rebated rental payable immediately. any occupant commences, ceases or changes employment; any occupant receives a wage or salary increase such as an annual increment or pay rise through promotion; any occupant has a pension or benefit granted, withdrawn, reduced or increased (other then increases through indexing); there is an increase or reduction in the number of household occupants. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.5.2 Failure to Notify Changes The onus is on the tenant to advise the Department of changes to income or household structure at the time of these changes. Changes not declared until renewal of a rental rebate will be treated as follows: Changes to wages/salaries and pensions/benefits other than indexing Debit/credit adjustments back dated to the date of the change will apply if rent payable is affected by more than $2 per week. Charges for additional/departing resident Additional rent will be charged from the declared date of occupancy of the additional resident. Decreases to rent payable due to the departure of other residents will only be applied from the Monday following the date of notification to Housing Services. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.6 Tenants Occupying Dwellings above their Entitlement Changes in the household can result in a tenant residing in a dwelling that is above their entitlement (refer to Chapter 3 for further details on dwelling entitlements). To ensure that Housing Services stock aligns with its tenant’s requirements, these tenants will be encouraged to transfer to a dwelling of their correct entitlement. Refer to sections 10.1.1 and 10.1.2 for further details on transfers to a tenant’s correct entitlement. However, under current tenancy legislation, Housing Services cannot force a tenant to relocate during the fixed term of their lease. Tenants therefore will be formally requested in writing to relocate. Tenants electing to remain in housing above the standard entitlement for their household size will be required to pay an additional amount of rent on top of their rebated rent. This is referred to as Superior Rent. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.6.1 Superior Rent Applicable to Rebated Tenants Tenants receiving a rental rebate, who are housed above entitlement, will be given three months to decide whether they wish to move to correct entitlement. The 3month period will begin from the date the Department is advised of the reduction in household size. If they elect to remain in the property at the end of the three (3) month period or subsequently refuse to accept two (2) offers of allocations of a dwelling to which they are entitled to, an additional rental charge, on top of their rebated rent, will apply. This is known as Superior rent. Superior rent is calculated as the difference between the Maximum Rebated Dwelling Rent for the correct entitlement and the Maximum Rebated Dwelling Rent payable on the occupied property, and will be added to the rent currently paid. Refer to section 7.3 for further details on Maximum Rebated Dwelling Rents. An example of the calculation of rent payable by a tenant who is occupying a dwelling above entitlement is as follows:A single tenant is occupying a three (3) bedroom house in Tennant Creek. Based on their income, their rebated rent is calculated as $70 per week. The Maximum Rebated Dwelling Rent for a three (3) bedroom house is $155 per week and the one (1) bedroom unit is $105 per week. The Superior rent payable by the tenant is $120 per week, being $70 + $50($155 - $105). Housing Services Housing Services Operational Policy Manual Rental Rebates 8.6.2 Exemptions Additional rent charges will not apply in the following instances: where the tenant is required to or has elected to move to correct entitlement and is awaiting transfer; where the tenant occupied the property for five years or more prior to July 1998 (the implementation of Housing 2003) and was approved to remain in residence, until such time as alternative housing in accordance with current housing entitlement policies (refer section 3.1) is offered; to aged pensioners housed above entitlement; where approval has been granted for allocation to a non-standard bedroom entitlement for medical or other reasons (refer to section 3.2) provided no change in household structure occurs during tenancy. Housing Managers have the discretion to waive the charging of Superior rent in other circumstances where there are extenuating welfare considerations, eg custody issues, pending marital reconciliation, etc. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.7 Dwelling Amenities As Market rents are now determined on a suburb basis, no adjustment to the standard of amenities will be made. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.8 Employment Incentive Scheme The Employment Incentive Scheme was introduced on 1 February 2002. Its purpose is to reduce the financial disincentives that may apply when a tenant gains employment or increases their participation in the workforce. The sudden increase in rent payable can act as a disincentive to employment, particularly as some tenants may not experience any significant financial gain. This scheme aims to reduce this disincentive by gradually increasing a tenant’s rent to the correct level. This enables the tenant time to experience the non-financial benefits of participation in the workforce prior to their rent being increased. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.8.1 Eligibility for Participation in Scheme All current public housing households, who were eligible under the income and assets test prior to gaining employment, are eligible for the Scheme. To ensure that the household receives a significant benefit from the Scheme, a minimum household income from wages of $200 gross will be required to be eligible. The household’s income need not rise above the eligibility income limits to participate in the Scheme. Households in these circumstances will only benefit from the first stage of the scheme; normal policies will then apply to the calculation of their rebated rent. It should be noted that the addition of a household member whose employment commenced prior to them joining the household will not make the household eligible for the Employment Incentive Scheme. The purpose of the Scheme is to increase the participation of public housing tenants and household members in the workforce. A household is only eligible to access the Scheme once within a 12-month period. A Director of Operations does however, have the discretion to waive this requirement in cases of hardship caused by factors associated with casual or contractual employment beyond the tenants control. Housing Services Housing Services Operational Policy Manual Rental Rebates 8.8.2 Stepped Rent Increases over 6 months The main feature of the policy is a series of stepped rent increases over the first six (6) months of employment. The purpose of this is to gradually ease the household’s rent to market rent if their increase in income would normally result in them being required to pay full market rent immediately. Below is a diagrammatic demonstration of the application of the stepped rent increases:- Months STAGE 1 1-3 Rent is frozen at rebated level that was applicable before increase in income STAGE 2 4-6 If the household’s new income means that they are ineligible for a rental rebate, the household’s rent is calculated at 23% of income, except FTB Part A which is still calculated at 10%, (provided the rent so calculated is at least $5 per week less than market rent). If the tenant is still eligible their rebated rent will be calculated on the increased household income as per normal rental rebate policies STAGE 3 7 Housing Services Rent calculated at full market rent if the tenant’s income makes them ineligible Housing Services Operational Policy Manual Rental Rebates 8.8.3 Security of Lease Normally when a tenant’s income increases to such a level where they become ineligible, they would be required to vacate at the expiry of their lease. Tenants may be discouraged from gaining employment or increasing their hours of employment just before their lease expires, as under normal policy, it renders them ineligible and they would be required to vacate. Under the Employment Incentive Scheme a new lease of 12 months from the date of employment or increase in hours, will be offered to those tenants who have less than 12 months to expiry date on their current lease. Housing Services