Tenant Purchase Apartments Scheme

advertisement

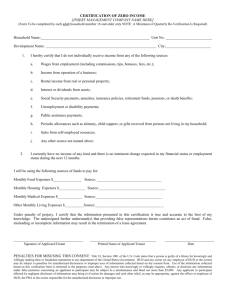

Scheme for tenant purchase of apartments under Part 4 of the Housing (Miscellaneous Provisions) Act 2009 Tenant Means Guidelines issued by the Minister for the Environment, Community and Local Government on 21 December 2011 under section 5 of the Housing (Miscellaneous Provisions) Act 2009 Page 2 of 6 1. 1.1 Background & purpose of Tenant Means Guidelines These guidelines have been approved by the Minister for the Environment, Community and Local Government under section 5 of the Housing (Miscellaneous Provisions) Act 2009 for issue to housing authorities and set out, in respect of the scheme for the tenant purchase of apartments (TPAS) (a) the manner in which a housing authority will assess the financial circumstances of a purchase applicant for the purposes of determining: (i) whether he or she meets the minimum income requirement set down in these guidelines, and (ii) the level of discount to which he or she is entitled under Regulations 35 to 37 of the Housing (Tenant Purchase of Apartments) Regulations, 2011 (S.I. No. 679 of 2011); (b) the minimum income requirement for eligibility to purchase; (c) circumstances in which a tenant is ineligible to purchase; and (d) evidential information about assessable income that a housing authority should seek from a purchase applicant under Regulation 31(b) of the apartment regulations. 1.2 Section 5(1) of the 2009 Act empowers the Minister, from time to time, to issue guidelines to housing authorities in relation to the performance of their functions under the Housing Acts 1966 to 2009 and requires housing authorities to have regard to such guidelines in the performance of those functions. 1.3 In accordance with section 5(2), the Minister is publising these guidelines by making them available on the internet (www.environ.ie). Subsection (3) requires housing authorities to make a copy of the guidelines available for inspection by members of the public, without charge, on the Internet and at their offices and such other places as they consider appropriate, during normal working hours. 2. Income to be assessed is gross annual income 2.1 The determination of whether a tenant meets the minimum income requirement set down in these guidelines and the level of discount to be applied (Regulations 35 to 37) shall be based on a calculation of gross annual income, that is to say, annual income before deduction of income tax, Universal Social Charge, pension contributions, pension-related reductions and PRSI, etc. Page 3 of 6 3. Whose income is assessable under TPAS? 3.1 The income of the following persons is assessable for the purposes of calculating income under TPAS: the tenant or, where applicable, joint tenants applying to purchase the apartment, and the spouse or civil partner of the tenant or joint tenant, provided he or she is living with the tenant or joint tenant 3.2 The incomes of household members other than those referred to in paragraph 3.1 are disregarded for the purposes of the income assessment. 4. 4.1 Assessable types of income under TPAS Subject to paragraphs 4.2 and 5.1, the following types of incomes are assessable for the purposes of TPAS: income from employment; overtime payments, bonuses and commission, as follows: o overtime – generally restricted to a maximum of 10% of basic income, but regular overtime may be taken into account ; o bonuses – restricted to a maximum of 10% of basic income; o commission – restricted to a maximum of 30% of basic income; income from self-employment; maintenance payments received (see paragraph 6.4), income from rental properties, dividends, capital investments and other similar sources of income; occupational and social welfare pensions, from whatever source, including from abroad, and income from other social welfare, etc., payments but only where these payments constitute a secondary source of income, i.e. where a tenant is in receipt of an assessable social welfare payment in addition to income from employment, or where the spouse or civil partner of a tenant in employment is in receipt of such a payment, whether in addition to the spouse’s or civil partner’s income from employment or not. Note that the social welfare payments listed in paragraph 5.1 are not assessable income under any circumstances. 4.2 In assessing income for the purposes of the tenant means guidelines, a housing authority may disregard income that is once-off, temporary or short-term in nature and that is outside the regular pattern of a person’s annual income. Page 4 of 6 5. Types of income that are not assessable for TPAS 5.1 Income from the following sources shall, in all cases, be disregarded for the purposes of assessing income: 5.2 child benefit or guardian’s payment; exceptional or urgent needs payments; carer’s allowance or carer’s benefit; scholarships or higher education grants; foster care payments; domiciliary care allowance; allowances/assistance from charities; fuel allowance; mobility allowance; living alone allowance; rent or mortgage interest supplements; and payments under FÁS schemes. Income from social welfare payments other than pensions is not assessable under TPAS where such payments constitute the main source of income of a tenant or the main or secondary source of income of a spouse or civil partner of a tenant not in employment (see paragraph 4.1). 6. Break-up of marriage/civil partnership 6.1 In the case of a tenant applying to purchase under TPAS who is separated from his or her spouse or civil partner, is divorced or whose civil partnership is dissolved by a decree of dissolution granted under either the Civil Partnership and Certain Rights and Obligations of Cohabitants Act 2010 or the law of a country or jurisdiction other than the State and the decree is recognised in the State, and a separation agreement is in place, a copy of the agreement must be included with the apartment purchase application. The agreement must identify: the amount of maintenance being received or paid by the applicant, if any; the circumstances under which any maintenance payments can cease; details of any payment to be made in respect of buy-out of spousal rights to the existing family home or other property that could have a bearing on the applicant’s capacity to purchase the dwelling; that no onerous conditions exist. Page 5 of 6 6.2 Where there is a reluctance to provide the full agreement due to sensitivity about some of the contents, a letter from the applicant’s solicitor confirming details is acceptable. 6.3 If there is no separation agreement, a letter from the applicant’s solicitor should be obtained, confirming: 6.4 that there is no formal separation agreement; that there are no court proceedings pending under family law legislation; the position in relation to maintenance and other payments. As indicated in paragraph 4.1, maintenance payments received are assessable as income under TPAS. Evidence should be sought that the required payments have been received for the previous 12 months without interruption, and account taken of any provision for maintenance payments to cease on a certain date. 7. Minimum tenant income 7.1 In order for a tenant to be eligible to purchase his or her apartment under TPAS, he or she must have a minimum income, calculated in accordance with these guidelines, of €15,000. 8. Tenants ineligible to purchase 8.1 A tenant purchase applicant shall be considered not to have sufficient means to purchase his or her apartment under TPAS if he or she(a) is declared bankrupt or is currently subject to bankruptcy proceedings, or (b) has a court order (judgement) for recovery of debts granted against him or her, which has not been paid off, or (c) is the subject of legal action for debt recovery. 9. Information to accompany TPAS application 9.1 The following documentation about the income of assessable persons in the tenant’s household should be sought from the tenant purchase applicant, under Regulation 31(b) of the apartment regulations: Employment – an up-to-date P60 and/or a minimum of 4 out of the last 6 payslips; Page 6 of 6 Employer’s Salary Certificate – an up-to-date certificate stating employment terms, basic salary, overtime, commission, bonuses and any other payments, signed and stamped by the applicant’s employer Self-Employment – a minimum of 2 year’s accounts with an Auditor’s/Accountant’s Report, together with an up-to-date tax balancing statement and a preliminary tax receipt for the current year; Social Welfare Income – documentary evidence of all assessable social welfare, etc., payments being received by the tenant and his or her spouse or civil partner. 9.2 A housing authority may, as necessary, seek further information under Regulation 32 of the apartment regulations in relation to any aspect of assessable income.