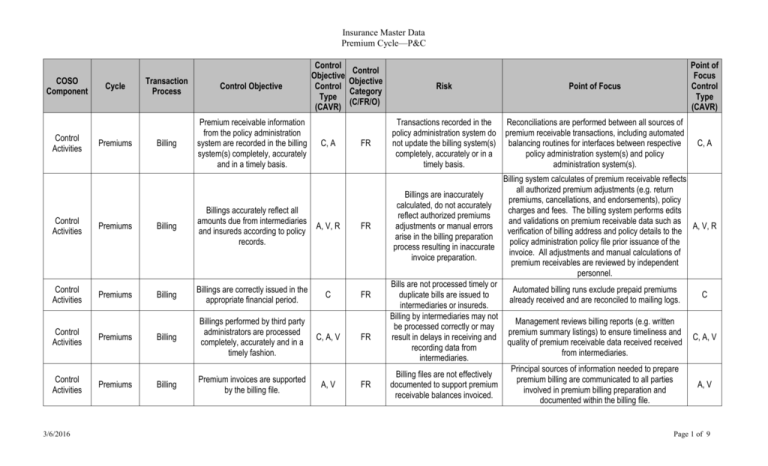

Premiums

advertisement

Insurance Master Data Premium Cycle—P&C COSO Component Control Activities Cycle Premiums Control Activities Premiums Control Activities Premiums Transaction Process Control Objective Billing Premium receivable information from the policy administration system are recorded in the billing system(s) completely, accurately and in a timely basis. C, A Control Objective Category (C/FR/O) Risk Point of Focus Point of Focus Control Type (CAVR) FR Transactions recorded in the policy administration system do not update the billing system(s) completely, accurately or in a timely basis. Reconciliations are performed between all sources of premium receivable transactions, including automated balancing routines for interfaces between respective policy administration system(s) and policy administration system(s). C, A Billing Billings accurately reflect all amounts due from intermediaries and insureds according to policy records. A, V, R FR Billing Billings are correctly issued in the appropriate financial period. C FR C, A, V FR A, V FR Control Activities Premiums Billing Billings performed by third party administrators are processed completely, accurately and in a timely fashion. Control Activities Premiums Billing Premium invoices are supported by the billing file. 3/6/2016 Control Objective Control Type (CAVR) Billing system calculates of premium receivable reflects all authorized premium adjustments (e.g. return Billings are inaccurately premiums, cancellations, and endorsements), policy calculated, do not accurately charges and fees. The billing system performs edits reflect authorized premiums and validations on premium receivable data such as adjustments or manual errors A, V, R verification of billing address and policy details to the arise in the billing preparation policy administration policy file prior issuance of the process resulting in inaccurate invoice. All adjustments and manual calculations of invoice preparation. premium receivables are reviewed by independent personnel. Bills are not processed timely or Automated billing runs exclude prepaid premiums duplicate bills are issued to C already received and are reconciled to mailing logs. intermediaries or insureds. Billing by intermediaries may not Management reviews billing reports (e.g. written be processed correctly or may premium summary listings) to ensure timeliness and result in delays in receiving and C, A, V quality of premium receivable data received received recording data from from intermediaries. intermediaries. Principal sources of information needed to prepare Billing files are not effectively premium billing are communicated to all parties documented to support premium A, V involved in premium billing preparation and receivable balances invoiced. documented within the billing file. Page 1 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Control Activities Cycle Premiums Transaction Process Billing Control Objective Control Objective Control Type (CAVR) Billing policies and procedures are documented and communicated to C, A, V, R all billing personnel. Control Objective Category (C/FR/O) FR Risk Point of Focus Control Type (CAVR) Point of Focus Billing policies and procedures Billing policies and procedures are effectively have not been effectively C, A, V, communicated and readily accessible by personnel communicated to a premium R and management responsible for premium billing. billing personnel. Fraudulent billing activity results in Segregation of duties is enforced between those invoices not being issued for valid authorized to modify billing master file data and R amounts due from intermediaries personnel issuing bills. and insureds. Intermediaries’ access to the billing system is restricted Intermediaries process and access levels reviewed periodically by an R unauthorized billing transactions appropriate official. Delays in receiving policy data Incomplete data submissions from intermediaries are from intermediaries results in isolated and rejected prior to input into the billing C billing delays. system. Reconciliation is performed over amounts invoiced Amounts due from policyholders between the billing, policy administration system and C, A are not billed. financial ledger. Errors in the billing run result in Automated balancing routines within batch processing A incomplete of inaccurate invoicing. ensures that invoices are issued for all policies in-force. Billing Effective segregation of duty is maintained over the billing function. R FR Premiums Billing Programmed controls restrict third party access to Company records. R FR Control Activities Premiums Billing All relevant data required to issues bills is available on a timely basis C FR Control Activities Premiums Billing Invoices are issued for all amounts due form policyholders. C, A FR Control Activities Premiums Billing Invoices are issued for all amounts due form policyholders. A FR Control Activities Premiums Billing Effective segregation of duty is maintained over the billing function. R FR Fraudulent data entry understates Segregation of duties is enforced between invoicing billing activity for the purpose of and premium collection. misappropriating cash receipts. R Control Activities Payments are completely and Payment accurately applied to policies in Premiums Application and force and recorded in the proper Collection period. FR Cash received from intermediaries All cash receipts are logged and recorded in the cash or insureds is not completely and sub ledger on a timely basis and supported by accurately applied to premium remittance advices receivable. C, A Control Activities Premiums Control Activities 3/6/2016 C, A Page 2 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Control Activities Cycle Transaction Process Control Objective Payment Receivables listing represents a Premiums Application and complete and accurate record of Collection outstanding premiums. Control Objective Control Type (CAVR) C, A Control Objective Category (C/FR/O) Risk Point of Focus Point of Focus Control Type (CAVR) FR The billing system is not updated to reflect cash receipts, resulting in the overstatement of receivables. The cash sub ledger is reconciled to the General Ledger and billing system. C, A Control Activities Payment Cash receipts are allocated Premiums Application and against polices on a timely basis Collection C, A, V FR Control Activities Payment Credit control activities identify Premiums Application and and monitor delinquent accounts Collection V FR Control Activities Payment Premiums Application and Collection C, A FR V, R FR R FR Control Activities Control Activities 3/6/2016 Premiums paid equal amounts billed and recorded by intermediaries. Payment Management reviews nonPremiums Application and standard cash application Collection transactions Payment Cash receipts are appropriately Premiums Application and safeguarded upon receipt. Collection Payments received cannot be matched against premiums due Cash is matched and applied to specific invoices with resulting in the misallocation unallocated cash suspense accounts being cleared on C, A, V between cash assets and a timely basis and the reconciliation reviewed by receivables for financial appropriate management. statements disclosures. Delinquent accounts are identified through monthly aging analysis (by intermediary and insured) and the Premiums due are not collectible. V need for monitored for bad debt allowance or termination monitored by credit controllers. Amounts due from intermediaries, reflecting premiums paid and Receipts from intermediaries are reconciled to applied against receivables, is not C, A accompanying bordereaux statements. completely and accurately passed on to the Company. Misappropriation of cash receipts All adjustments to amounts due and collected are due to fraudulent or errant V, R approved by independent personnel. adjustments to receivables. Misappropriation of cash assets. Cash receipts are securely stored, restrively endorsed and access restricted to authorized personnel only. R Page 3 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Cycle Transaction Process Control Objective Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) Control Activities Premium Recognition/ Written premium transactions are Premiums Premium Audits recorded in the proper period. Experience Rating C, A FR Control Activities Premium Premiums are recognized as Recognition/ revenue over the period of the Premiums Premium Audits contract in proportion to the Experience amount of insurance protection Rating provided. A FR A, V FR Control Activities Control Activities 3/6/2016 Premium Recognition/ The unearned premium reserve is Premiums Premium Audits adjusted for reinsurance or Experience premium adjustments. Rating Premium Recognition/ Premium audits are performed to Premiums Premium Audits assess the accuracy and validity Experience of earned premium. Rating A, V FR Risk Point of Focus Control Type (CAVR) Point of Focus Formal period end cut-off procedures are established and communicated to underwriting/financial personnel, and adherence monitored by an appropriate official. Prepaid premiums relating to the current period are Incorrect gross and net written recognised as earned, and additional prepaid amounts premiums recorded for the period. recorded as unearned premiums. The policy/premium administration systems calculate written premium using the inception and expiration dates of the insurance risk assumed rather than the date the transaction was recorded. Underwriters establish an earning profile for each line of business to appropriately reflect the nature of the Earned/unearned premium does risk insured, and compliance with applicable not approximate the portion of local/overseas regulations. The policy administration written premiums relating to the system performs automated calculations of earned period of expired/unexpired risk. premium by line of business. Any manual intervention is reviewed by independent personnel. Unearned premium calculations are performed using Incorrect amounts of unearned current written premium data recorded in the policy premium recorded in the financial administration system and premium sub ledgers, which ledger. incorporate retrospective and late premium adjustments Earned premiums are not Renewal premiums are accurately calculated using accurately recorded due to authorized premium rates and adjusted upon validation through a premium audit completion of premium audits as applicable for the function. respective line of business. C, A A A, V A, V Page 4 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Monitoring Monitoring Monitoring Control Activities Control Activities Control Activities 3/6/2016 Cycle Transaction Process Premium Recognition/ Premiums Premium Audits Experience Rating Premium Recognition/ Premiums Premium Audits Experience Rating Control Objective Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) Risk Point of Focus Premium audits are performed accurately and on a timely basis. A, V FR Earned premiums are not accurately recorded due to lack of effective premium audit function. Management monitors the quality and timeliness of completion of premium audits, including the timely processing of voluntary audits. Management monitors and tests C, A, V, R the internal control environment. FR Premium Management monitors and tests Recognition/ the internal control environment Premiums Premium Audits C, A, V, R operated by third party service Experience providers. Rating FR Premiums The Company’s records reflect the Allowance for amount of premiums due expected Uncollectible to be recoverable under insurance Premiums contract. Premiums Allowance for Uncollectible Premiums Consistent treatment of doubtful debts by third party service providers. Premiums Allowance for Effective credit control procedures Uncollectible mitigate the risk of uncollectible Premiums premiums V FR V FR V FR Point of Focus Control Type (CAVR) Internal control weaknesses result Internal Audit (where applicable) involvement in the in the fraudulent, invalid, selection, planning and execution of premium audits. C, A, V, inaccurate and incomplete Findings are formally documented and issued to senior R recording of premium activity in management. the Company’s record. Internal control weaknesses at third party service providers result Formalized review of the control environments in the fraudulent, invalid, C, A, V, operated by MGAs and TPAs. All material service inaccurate and incomplete R providers are selected at least on a rotational basis. recording of premium activity in the Company’s record. Unidentified delinquent accounts Overdue premiums are compared to policy terms and exist without any allowance for cancellation notices issued where required. doubtful debts being established. Third party service providers do not monitor premium collection Intermediaries are advised of delinquent accounts on a activity and fail to identify timely basis and initiate collection procedures in delinquent accounts on a timely accordance with the Company’s credit control policy. basis The Company continues to write direct and intermediary business Credit controllers establish credit limits and payment with persons considered to be terms to appropriately reflect the risk of non-payment. high credit risk. V V V Page 5 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Cycle Control Activities Premiums Allowance for Premiums receivable are adjusted Uncollectible to reflect allowances for delinquent Premiums accounts. Control Activities Premiums Fraud Investigations Control Activities Premiums Control Activities Premiums Control Activities Premiums Transaction Recording Control Activities Premiums Control Activities Premiums Control Activities 3/6/2016 Premiums Transaction Process Control Objective The company has sufficient resources and expertise to investigate fraud. All new and renewal premiums are Transaction recorded in the policy Recording administration system and actuarial records. All new and renewal premiums are Transaction accurately recorded in the policy Recording administration system and actuarial records. Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) V FR Risk Point of Focus Control Type (CAVR) Point of Focus Allowances for uncollectible amounts are determined Inadequate allowance is provided by credit controllers and based upon the debtors’ credit against doubtful debts status and payment history. Fraud investigations fail to resolve Fraud investigations are performed in accordance with internal control weaknesses or pre-determined guidelines by experienced underwriting recover losses. and (where applicable) Internal Audit personnel. All new policies are not considered Written premium data is reconciled to the policy for reinsurance, resulting in the administration system to identify all in-force direct and retention of inappropriate levels of assumed polices prior to the calculation of reinsurance risk. cessions. Rejected policy data is isolated, analysed and Inaccurate recording of policy data corrected on a timely basis through programmed due to incorrect/ invalid data entry controls, batch headers and suspense accounts. Management reviews resulting exception reports. An appropriate level of review is in place to ensure that Processing backlogs exist and are policy data is entered on a timely basis and any not cleared on a timely basis. backlogs addressed. Incorrect amounts of gross and Calculation of premium adjustments (including return net written premium recorded in premiums and retrospective premium adjustments are the financial statements. approved by an appropriate official. V V FR C, A FR V FR All transactions are recorded on a timely basis C, A FR Transaction Recording Only valid transactions are recorded in the underlying records. V FR Transaction Recording Only valid transactions are recorded in the underlying records. A FR Incorrect amounts of gross and Suspense accounts are reconciled and reviewed by an net written premium recorded in appropriate official for unusual or aged items. the financial statements. A Transaction Recording Effective segregation of duties exists between those recording premiums transactions and personnel handling cash receipts. FR Fraudulent data entry understates Segregation of duties exists between those recording premium activity for the purpose of premiums transactions and personnel handling cash misappropriating cash receipts. receipts. R R V C, A V C, A V Page 6 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) Transaction Process Control Objective Premiums Transaction Recording Management monitors completeness and accuracy of data input into the Company's administrative system Control Activities Premiums Transaction Recording Premium transactions are accurately reflected and classified C, A, V in the financial ledgers FR Control Activities Premiums Transaction Recording Premiums are correctly stated in the reporting currency. A FR Control Activities Premiums Transaction Recording Tax information derived from premium activities is accurately and promptly reported. C, A FR Control Activities 3/6/2016 Cycle C, A FR Risk Point of Focus Point of Focus Control Type (CAVR) Management reviews policy information to critically Management is unable to identify analyze premium activity, including current and significant data entry problems in historical premiums trends, new and renewal business, C, A the recording of premium billing premiums by lines of business, intermediary and and cash application transactions. insured. Inaccurate data input results in the misclassification of policy data and The financial sub ledgers are reconciled to the general financial records and the ledger. Reconciliations are reviewed and approved by C, A, V miscalculation of ADIAL due to financial management. inaccurate premium data. Misstatement of premium and Translation of foreign currency written premiums is related income due to inaccurate calculated using prevailing exchange rates at the date A or incomplete foreign currency of policy inception. translation. Documented procedures for developing, summarizing, and reporting required tax information. Review of Erroneous data may be used in major transactions or major classes of transactions by tax computations and result in individuals who are knowledgeable about tax C, A overpayments or underpayments requirements. Programmed sub ledger coding of taxes. facilitates the automated classification, summarization, and retrieval of required tax information. Page 7 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Control Activities Control Activities Control Activities Control Activities Control Activities 3/6/2016 Cycle Transaction Process Control Objective Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) Risk Point of Focus Control Type (CAVR) Point of Focus Premiums Transaction Recording Relevant disclosure data is gathered completely, accurately and on a timely basis. C, A, V FR Recorded transactions capture and aggregate required account disclosures including: - gross and net written premiums Required GAAP/ MD&A/ 10-K - earned premium (including changes in unearned disclosures are incomplete or premium) C, A, V inaccurate for presentation in the - allowance for bad debts financial statements - insurance balances receivable - appropriate segmental and geographical analysis - associated cash flows - material legal proceedings Premiums Adjustments and Ledger Maintenance Prevention or detection of incorrect entries to policyholder accounts, agents' balances and reinsurance data. R FR Unauthorized adjustments are made to the financial sub ledgers. Premiums Appropriate segregation of duties between the entry and approval of Adjustments journal entries (related to and Ledger underwriting transactions not Maintenance recorded in the Company's administrative systems). R FR Unauthorized adjustments are Appropriate segregation of duties exists between the made to the financial sub ledgers. entry and approval of journal entries R Premiums Adjustments and Ledger Maintenance A, V FR Incorrect/ inconsistent treatment of A chart of accounts is maintained and updated on a manual adjustments between sub timely basis, establishing procedures and account ledgers. mappings for processing journal entries to sub ledgers. A, V Premiums Adjustments Sub ledger journal entries and Ledger represent valid adjustments to the Maintenance Company’s financial records. V FR Polices and procedures exist for processing journal entries. Incorrect of fraudulent journal entries are recorded. Access to ledger journal entries is restricted to appropriate finance personal through programmed authority levels. All journal vouchers are approved by management and attached to supporting documentation. R V Page 8 of 9 Insurance Master Data Premium Cycle—P&C COSO Component Cycle Transaction Process Control Objective Premiums Adjustments and Ledger Maintenance Sub ledger journal entries are recorded on a timely basis. Control Activities Premiums Adjustments and Ledger Maintenance Control Activities Premiums Adjustments and Ledger Maintenance Control Activities 3/6/2016 Prevention or detection of incorrect entries to policyholder accounts, agents' balances and reinsurance data. Sub ledgers are reconciled to policy administration, billing and reinsurance systems. Control Objective Control Type (CAVR) Control Objective Category (C/FR/O) V FR C, A FR C, A FR Risk Point of Focus Control Type (CAVR) Point of Focus Ledger maintenance activities are Manual adjustments are reviewed by an appropriate not recorded in the correct official to ensure accuracy of cut-off. financial period. The financial sub ledgers do not The financial sub ledgers are reconciled to the accurately reflect current policy underlying policy administration, actuarial and data, reinsurance terms and reinsurance systems. Reconciliations are reviewed and billings. approved by financial management. Unreconciled suspense accounts Suspense accounts are reconciled and reviewed by an exist and are not cleared on a appropriate official to identify and clear unusual or timely basis. aged balances. V C, A C, A Page 9 of 9