Accounting - Penn APALSA

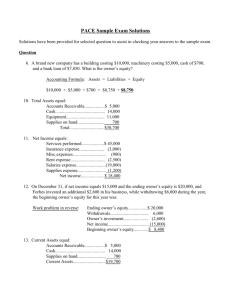

advertisement