Understanding business structures worksheet

advertisement

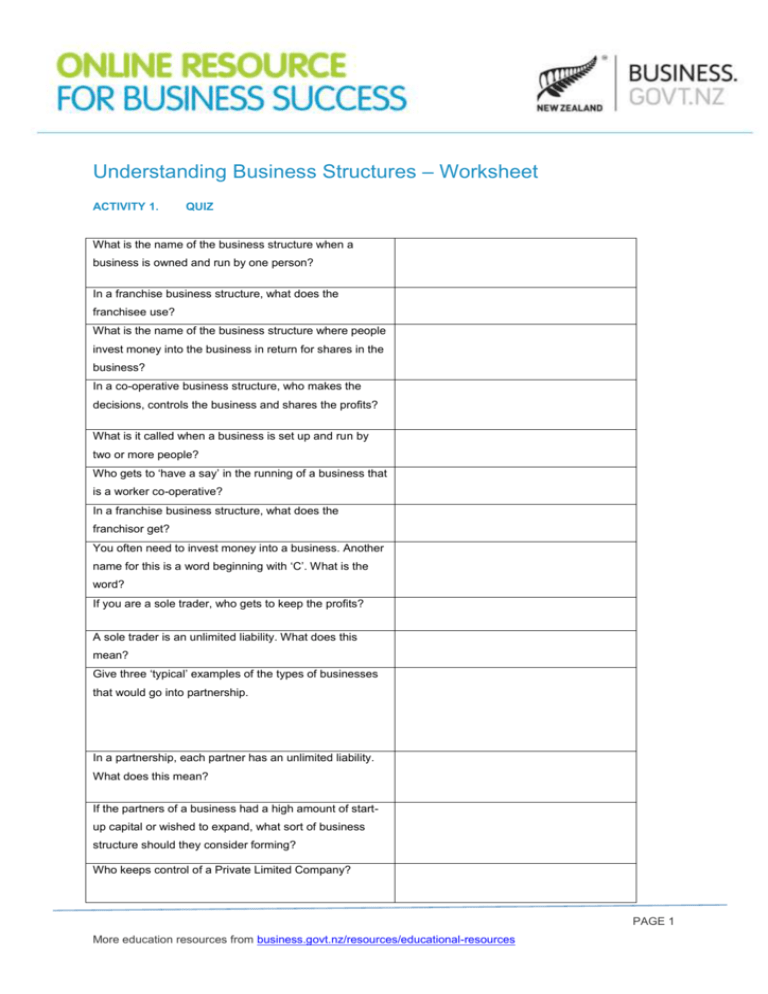

Understanding Business Structures – Worksheet ACTIVITY 1. QUIZ What is the name of the business structure when a business is owned and run by one person? In a franchise business structure, what does the franchisee use? What is the name of the business structure where people invest money into the business in return for shares in the business? In a co-operative business structure, who makes the decisions, controls the business and shares the profits? What is it called when a business is set up and run by two or more people? Who gets to ‘have a say’ in the running of a business that is a worker co-operative? In a franchise business structure, what does the franchisor get? You often need to invest money into a business. Another name for this is a word beginning with ‘C’. What is the word? If you are a sole trader, who gets to keep the profits? A sole trader is an unlimited liability. What does this mean? Give three ‘typical’ examples of the types of businesses that would go into partnership. In a partnership, each partner has an unlimited liability. What does this mean? If the partners of a business had a high amount of startup capital or wished to expand, what sort of business structure should they consider forming? Who keeps control of a Private Limited Company? PAGE 1 More education resources from business.govt.nz/resources/educational-resources Who can buy shares in a Public Limited Company? PAGE 2 More education resources from business.govt.nz/resources/educational-resources ACTIVITY 2. SOURCES OF FINANCE When businesses start up, in addition to deciding on the control and structure of the company, they must also make sure they have capital to invest. There are various sources of finance that are available for owners to use for this purpose. Write the correct word from the list below, next to the correct definition. Leasing Mortgage Retained profit Loan Sale of Assets Grants Overdraft Debenture Share issue Hire purchase Borrowing a sum of money which then has to be repaid with interest over a period of time, usually in fixed instalments, e.g., repay $100 a month for three years. Borrowing money from a bank by drawing more money than is actually in a current account. Interest may be charged on the overdraft, some banks offer interest free overdrafts. The bank has the power to recall the overdrawn amount at any time. A loan where property is used as security. Legally renting equipment prior to buying it. Pay a fixed amount over a certain period of time, e.g., two years at $500 per month. The asset is not owned until the final payment is made. Renting equipment or premises. The asset is never owned but the leasing company is usually responsible for maintenance and repairs. A Plc can sell shares in the company to raise additional finance. The investor’s reward is dividends. A long-term loan to a business, normally between five to 25 years. Interest is paid on loan. Funds given to businesses that do not have to be repaid. Normally provided by government agencies. This is when a company sells off its equipment or property to raise money, and then usually hires them from another company. Part of the profit made remains in the business for the future accounting period, e.g., the next year. PAGE 3 More education resources from business.govt.nz/resources/educational-resources ACTIVITY 3. CASE STUDY SOLE TRADER Small buildings Chris Davenport was made redundant from his job eight years ago. He used his redundancy payment to set up a business making wooden outdoor buildings. These are more substantial than just garden sheds; they are properly insulated, permanent structures, which can be used for anything from an office to a classroom. They are built to be an attractive feature in say, a garden. Because they are well designed using high-quality materials, they are more expensive than a typical prefabricated temporary building. Chris has built up his business over time. In the first year, he sold $53,000 worth of products. Today, sales turnover is averaging $300,000 per year. This has not been without its problems. Three years ago, orders seemed to dry up and the business made a loss of $20,000. Without a sympathetic bank manager, who increased the overdraft by $15, 000, the business would have been in serious trouble. However, Chris has never thought of giving up. He enjoys running his own business and being his own boss, even if he does have to work long hours. His six workers are highly valued. Without them, he would not be able to deliver the quality product that he guarantees to customers. One problem facing the business is Chris’s age. As he gets older, he knows he might have a period of long illness or even die. None of his family work in the business. Use examples and evidence from the case study to answer the following questions. List TWO advantages for Chris of being a sole trader. List TWO disadvantages for Chris of being a sole trader. During the period when sales ‘dried up’, Chris considered cutting his prices by reducing the quality of his structures. Discuss whether this would have been a good strategy for Chris to adopt. Suggest how Chris can deal with the potential problem for his business of illness or even death. Are there any potential disadvantages to your suggestions? PAGE 4 More education resources from business.govt.nz/resources/educational-resources ACTIVITY 4. CROSSWORD ON ‘PARTNERSHIPS’ 1 2 3 4 5 6 7 Across 2 The owners of a partnership 4 The maximum number of people in a partnership Down 1 The legal contract that states how a partnership is organised 3 The type of partner who is not involved in the day-to-day running 5 These will be distributed according to the Deed of 4 The minimum number of people in a Partnership partnership 6 Another word for the money invested by each partner in the business 7 If there is no deed of partnership, the law states each partner is this PAGE 5 More education resources from business.govt.nz/resources/educational-resources