Teens And Identity Theft

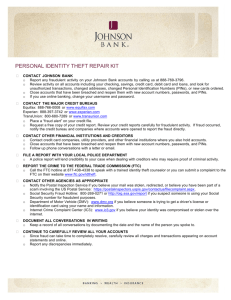

advertisement

Better Business Bureau Teen Smart Program TEENS AND IDENTITY THEFT ID thieves target teens. According to a PBS report on identity theft, young people like you are now the number one target. Most teens and young adults do not have credit histories. That makes you are a lucrative target for thieves who want to steal your fresh slate to take out loans or purchase clothes, cars, stereos and vacations they never intend to pay for-all in your good name. Having your identity stolen can prevent you from getting your first driver's license or a student loan for college. It's true. Identity thieves are not always strangers lurking in the shadows but often people you may least expect, such as friends, classmates, neighbors, acquaintances or even relatives. You don't have to be skeptical of everyone, just follow safe practices. Here are some tips to keep your identity where it belongs: with you. What is identity theft? ID theft is the criminal practice of deliberately using false or stolen information such as person's name, birth date, Social Security Number, address and bank account information to obtain merchandise and cash. What do I do if I'm a victim? Act immediately as soon as you realize, or highly suspect, your identity has been stolen. Place a fraud alert on your credit file by contacting one of the three national major credit bureaus. Keep these numbers in a handy place: Equifax: 1-800-525-6285; www.equifax.com; Experian: 1-888-397-3742; www.experian.com; TransUnion: 1-800-680-7289; www.transunion.com; Close accounts that have been tampered with or opened fraudulently. File a police report and get copies as proof of the crime to submit to creditors. File a complaint with the Federal Trade Commission. What can I do to prevent myself from becoming a victim? Always keep track of your purse or wallet while at school, the mall or even at home. Guard your Social Security Number. Don't carry your Social Security card in your wallet or purse. Don't have your Social Security Number printed on your checks or driver's license. Be wary of businesses or individuals who want your Social Security Number, especially if they request it by phone or e-mail. Start reviewing your credit report through one of the three major credit bureaus at least once a year. It's not too early to start: www.annualcreditreport.com Don't give your computer password out to anyone. Keep your personal documents (birth certificates, checking account information, credit cards and card statements) safe and private. If you have a part-time job, sign up for automatic payroll deposits. Make a habit of shredding any documents you no longer need that have your name and account information. Greater Cleveland Better Business Bureau - 2217 East 9th Street, Suite 200 Cleveland Ohio 44115-1299 216-241-7678- www.bbb.org www.cleveland.bbb.org