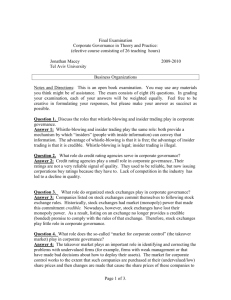

Financial Reporting and Analysis

advertisement