TAX FORMS WE HAVE

advertisement

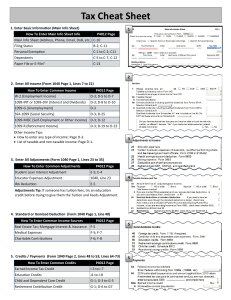

2011 ~ TAX FORMS for Year 2012 (Highlighted items have been received & displayed for patron use) FEDERAL TAX FORMS Form 1040 Form 1040 A Form 1040 EZ Form 1040 Schedule A Re-Ordered 2/7/12 Form 1040 Schedule B Re-Ordered 2/14/12 Instructions 1040-ALL Instructions 1040 A Re-Ordered 2/7/12 Instructions 1040 EZ Form 1040 Schedule C (Profit/Loss Business) Form 1040 Schedule C ez (Profit/Loss Bus short) Form 1040 Schedule D(Capital Gains & Loses) For Sch D-1 use Form 8949 Re-Ordered 2/14/12 Form 1040 Schedule E(Supplemental Income/Loss) Re-Ordered 2/14/12 Form 1040 EIC (Earned Income Credit) Re-Ordered 2/14/12 Form 1040 Schedule F(Profit or Loss from Farming) Form 1040 Schedule R(Credit Elderly or Disabled) Instructions 1040 Schedule R Form 1040 Schedule SE(Self-Employment Tax) Form 1040 ES(Estimated Tax Individuals) Form 1040 NR(US Nonresident Alien Income Tax Return) Instructions 1040 NR Form 1040 NR-EZ(Nonresident Alien w/o Dependent) Instructions 1040 NR-EZ Form 1040 Schedule V(Payment Vouchers) Form 1040 X(Amended Individual Return) Instructions 1040 X Form 2106 (Employee Business Expenses) Re-Order 2/14/12 Instructions 2106 Form 2441 (Child & Dependent Care Expenses) Instructions 2441 Form 3903(Moving Expenses) Form 4562(Depreciation & Amortization) Instructions 4562 Form 4868(Application Extension to File) Form 5695(Residential Energy Credits) Form 6251(Alternative. Mini. Tax - Individual) Instructions 6251 Form 8283(Noncash Charitable Contributions) Instructions 8283 Form 8606(Nondeductible IRAs) Instructions 8606 Form 8812(Add. Child Tax Credit) Form 8822(Change of Address) Form 8829(Expenses Business Use of Home) Instructions 8829 Form 8863(Education Credits) Instructions 8863 Form 8949(Sales and Other Dispositions of Capital Assets) Replaces Schedule D-1 FEDERAL TAX PUBLICATIONS Pub 1(Your Rights as a Taxpayer) Pub 17(Your Federal Income Tax) Re-ordered 1/25/12 Pub 225(Farmer's Tax Guide) Pub 334(Tax Guide for Small Business) Pub 501(Exemptions/Deductions/Info) Pub 505(Tax Withholding & Estimated Tax) Pub 523(Selling Your House) Pub 529(Misc. Deductions) Pub 535(Business Expenses) Pub 550(Investment Income & Expenses) Pub 590(IRAs) Re-ordered 1/25/12 Pub 596(Earned Income Credit) Pub 936(Mortgage Interest Deduction) Pub 970(Tax Benefits for Higher Educ.) Pub 4604(Use the Web for IRS tax Products and Info) Pub 1132(Repro. Fed. Tax Forms) See below for available forms Ask at the desk for these forms 15¢ a page Reproducible Federal Tax Forms & Instructions available @ Front Desk 15¢ a page Form 1040 Schedule R (Form 1040 or 1040 A) Form 2441 Instructions for Form 1040 Schedule A (Form 1040) Instructions for Sch A Schedule B (Form 1040 or 1040A) Instructions for Sch R Schedule SE (Form 1040) Instructions for Sch SE Form 1040 A Instructions for Form 2441 Form 4684 Instructions for Form 4684 Form 4868 Schedule C (Form 1040) Instructions for Sch C Schedule C-EZ (Form 1040) Schedule D (Form 1040) Instructions for Sch D Schedule E (Form 1040) Instructions for Sch E Schedule EIC(Form 1040 or 1040A) Instructions for Form 1040 A Form 1040 EZ Instructions for Form 1040 EZ Form 1040NR Instructions for Form 1040NR Form 1040-V Form 2106 Instructions for Form 2106 Form 4868 (SP) Form 4797 Form 8379 Instructions for Form 8379 Form 8812 Form 8863 Instructions for Form 8863 Form 8880 Schedule F (Form 1040) Instructions for Sch F Form 8917 Form 8949 WI TAX FORMS Form WI-Z - Tax Form Schedule WD - Instructions Capital Gains and Losses Schedule WD -Capital Gains and Losses Schedule H - Homestead Credit Booklet Form 1 - Tax Form Form 1NPR - Non/Part Year Resident Tax Form Form 1NPR - Instructions - Non/Part Year Tax Form Form 1A - Tax Form Forms 1A and WI-Z – Instructions Form 1 – Instructions Schedule H - Rent Certificate Re-ordered 1/26/12 Re-Ordered 2/1/12 Re-Ordered 2/20/12 Re-ordered 1/26/12 Re-ordered 2/1/12 Re-ordered 1/26/12 Re-ordered 2/8/12 Re-ordered 2/8/12