Tax Cheat Sheet: Form 1040 Guide

advertisement

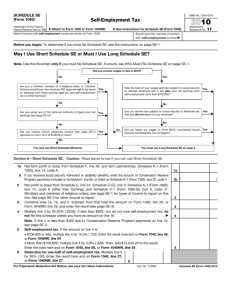

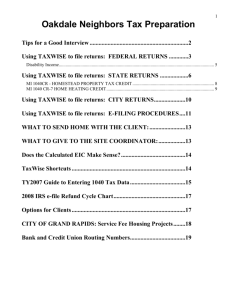

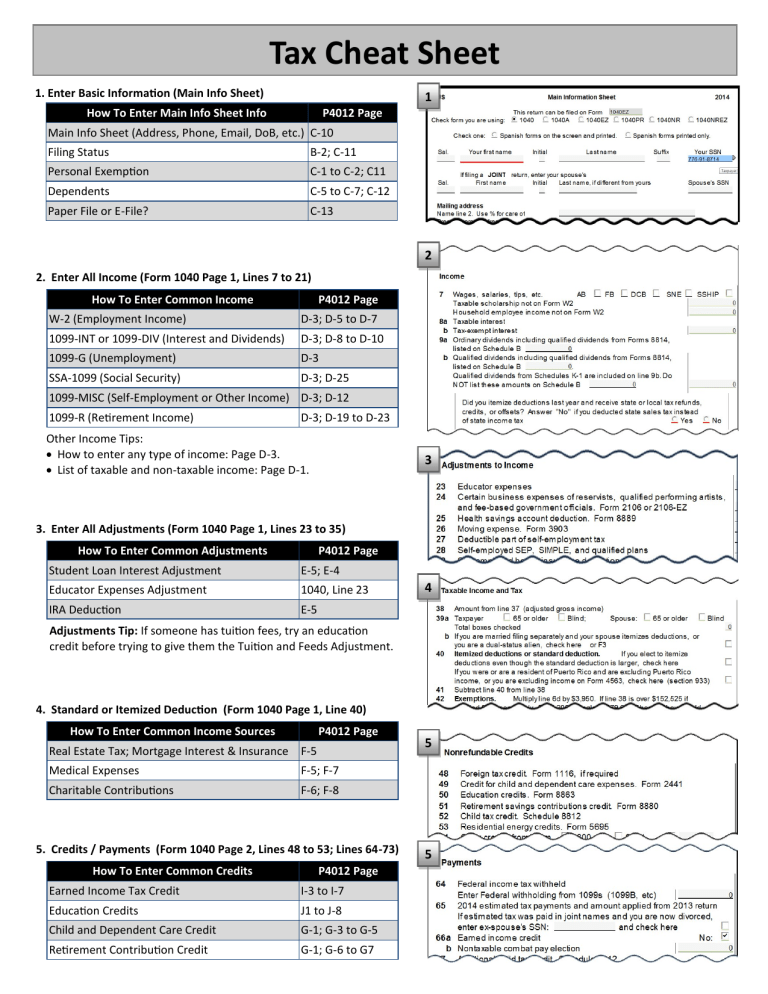

Tax Cheat Sheet 1. Enter Basic Information (Main Info Sheet) 1 How To Enter Main Info Sheet Info P4012 Page Main Info Sheet (Address, Phone, Email, DoB, etc.) C-10 Filing Status B-2; C-11 Personal Exemption C-1 to C-2; C11 Dependents C-5 to C-7; C-12 Paper File or E-File? C-13 2 2. Enter All Income (Form 1040 Page 1, Lines 7 to 21) How To Enter Common Income P4012 Page W-2 (Employment Income) D-3; D-5 to D-7 1099-INT or 1099-DIV (Interest and Dividends) D-3; D-8 to D-10 1099-G (Unemployment) D-3 SSA-1099 (Social Security) D-3; D-25 1099-MISC (Self-Employment or Other Income) D-3; D-12 1099-R (Retirement Income) D-3; D-19 to D-23 Other Income Tips: How to enter any type of income: Page D-3. List of taxable and non-taxable income: Page D-1. 3 3. Enter All Adjustments (Form 1040 Page 1, Lines 23 to 35) How To Enter Common Adjustments P4012 Page Student Loan Interest Adjustment E-5; E-4 Educator Expenses Adjustment 1040, Line 23 IRA Deduction E-5 4 Adjustments Tip: If someone has tuition fees, try an education credit before trying to give them the Tuition and Feeds Adjustment. 4. Standard or Itemized Deduction (Form 1040 Page 1, Line 40) How To Enter Common Income Sources P4012 Page Real Estate Tax; Mortgage Interest & Insurance F-5 Medical Expenses F-5; F-7 Charitable Contributions F-6; F-8 5. Credits / Payments (Form 1040 Page 2, Lines 48 to 53; Lines 64-73) How To Enter Common Credits P4012 Page Earned Income Tax Credit I-3 to I-7 Education Credits J1 to J-8 Child and Dependent Care Credit G-1; G-3 to G-5 Retirement Contribution Credit G-1; G-6 to G7 5 5 More Complicated Issues Affordable Care Act Refer to Tab ACA of your 4012 to help tax clients with ACA-related tax issues. Go through the flowcharts for each person on the return individually. The first question you ask is: “Did the person being screened have insurance all year, have no insurance all year, or have insurance part of the year?” From there, you choose which flowchart to use. For example, if you have a married couple with a child, you would screen each individual (the taxpayer, the spouse, and the child) with that question. Simplified Tax Formula Income E.g. Wages / Salary, interest (1040 Pg 1, Lines 7-22) MINUS Adjustments E.g. Student Loan Interest (1040 Pg 1, Lines 23-37) MINUS Exemptions E.g. Dependents (1040 Pg 2, Line 42) MINUS Response to “Did the person being screened have insurance all year, have no insurance all year, or have insurance part of the year?” P4012 Deductions Person on the return had insurance all year ACA-1 Person on the return had NO insurance all year ACA-2 Person on the return had insurance PART of the year ACA-3 Does the client have to pay an Individual Shared Responsibility Payment? If so, try to see if they qualify for an exemption using page ACA-5. Taxable Income Tax Computation Standard or Itemized (1040 Pg 2, Line 40) What the tax calculation is based on (1040 Pg 2, Line 43) Done by TaxWise Complicated 1099-Rs Early Withdrawal Exemptions Did the taxpayer take out of their retirement early? (Hint: they will have a 1099-R with a code “1” in Box 7) Check to see if they are eligible for an exemption on Page H-2. If so, look at page H-1 on how to apply the exemption. Simplified Method Does the taxpayer have a 1099-R with “Taxable amount not determined” checked? If so, go to Page D-23 for detailed instructions how to complete the Simplified Method Worksheet. Tax Liability Taxes owed (1040 Pg 2, Line 44) MINUS Non-Refundable Credits E.g. Dependent Care Credit (1040 Pg 2, Lines 47-54) MINUS Finishing a Return Item Reference Document Direct Deposit? Enter Bank Acct Info K-1; C-13 Savings Bonds; Split Refund K-2 Handling Balance Due Returns K-3 and K-4 E-File PINs C-14 General Use and Disclosure Details Taxpayer Disclaimer Form Running Diagnostics N-12 or O-6 Quality Review N/A Print Return N-14 or O-7 Payments E.g. Withholdings (1040 Pg 2, Lines62-63) MINUS Refundable Credits Refund / Balance E.g. EITC, ACTC (1040 Pg 2, Lines 64-67) (1040 Pg 2, Line 73 or 76)