USI: Dane Partridge -- Mngt 341 Syllabus

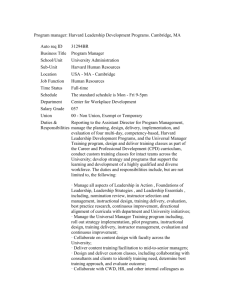

advertisement

UNIVERSITY OF SOUTHERN INDIANA College of Business MNGT 361.001 Business Environmental Factors (Business, Government, & Society) Spring 2009 TR 3-415p OC 2033 Dane M. Partridge, Ph.D. OC 3066C 465-7085 465-1044 (fax) dpartrid@usi.edu http://business.usi.edu/dpartrid/ Office Hours: TR 930-1145a and by appt. INTRODUCTION This course builds on the introductory courses in Management and Marketing to provide students with a broader view of the business organization. “If the challenge for executives in the 1990s was to transform corporate behemoths into nimble competitors, the challenge in the coming years will be to create corporate cultures that encourage and reward integrity as much as creativity and entrepreneurship” (Business Week Special Report, “The Crisis in Corporate Governance,” May 6, 2002). How can an organization create such a culture? Upon completion of this course, students should be better able to … Evaluate public issues and their significance to the modern corporation Assess how business meets its economic and legal obligations while being socially responsible Assess how corporate citizenship differs among various countries Analyze ethical problems using generally accepted ethics theories Analyze the benefits and costs of the globalization of business Compare the costs and benefits of regulation for business and society Recognize the key issues in contemporary antitrust policy Assess the costs and benefits of environmental regulation Understand how businesses manage technological change Understand how recent corporate scandals have affected corporate governance Assess the ways in which government regulatory agencies protect consumers Formulate how companies can best manage workforce diversity Analyze how businesses can most effectively manage a crisis situation College of Business Skill Development As a part of the College’s strategic planning process, learning goals/educational objectives have been identified (see http://www.usi.edu/business/strategic/learning.asp). This course will help to develop students’ critical thinking skills, oral and written communication skills, ethical decision-making skills, and analytical problemsolving skills. Note: MNGT 201: Survey of Management or MNGT 305: Principles of Management and MKTG 201: Introduction to Marketing or MKTG 305: Principles of Marketing, are prerequisites for this course. READINGS Students should obtain the following book: Lawrence, Anne T., and James Weber. Business and Society, 12e (McGraw-Hill Irwin, 2008). Copies of the text should be available for purchase in the Bookstore. Students are also expected to subscribe to the Wall Street Journal; subscription forms will be available from the instructor. All other assigned readings will be available via the David L. Rice Library’s online databases or the instructor’s website. Supplements to the course outline and reading assignments may be distributed during the session. COURSE REQUIREMENTS, METHODS OF EVALUATION, AND RESPONSIBILITIES In addition to the required reading, there will be four exams and a number of individual and group exercises. Any assignments turned in late will be penalized by 50 percent (and any late assignments must be submitted no later than one week following the original due date). Any in-class assignment missed due to absence must be submitted within one week. Grading will be determined on the basis of the following weights: Exams Cases and Exercises Briefings and class participation 60% (4 @ 15% each) 30% 10% Regular attendance is recommended, as the required readings and class meetings are intended to be complements, not substitutes. On the exams, students will be responsible for both material covered by the readings and material discussed in class. Students are expected to keep up with the required reading, as assigned, and to come to class prepared for discussion. Students are reminded that under the credit hour system a three-credit class requires on average six hours of outside preparation per week during the academic year; during a summer session, this would translate to 18 hours per week. While research indicates that the average U.S. college student spends less time in outside study and class preparation than the instructor might expect, when full-time students devote only part-time effort to their coursework, less-than-desired outcomes may well result. Students often observe that they would like their classes to “better relate to the real world.” For students to apply what they have learned in the classroom to actual work environments students have responsibility for active, rather than passive, involvement in the learning process. The instructor’s role in active or experiential learning is to serve as a facilitator of student-directed learning, rather than being the provider of teacher-directed instruction. Some have called this a shift from “teaching by talking” toward “learning by doing.” The responsibility for learning is borne by the learner, while the teacher makes resources available and helps the learning process. As one college president has put it, “[I]t isn't enough just to learn -- one must learn how to learn, how to learn without classrooms, without teachers, without textbooks. Learn, in short, how to think and analyze and decide and discover and create…. [W]hile mastery of specific content is important, we want our graduates to learn how to think critically and creatively, express themselves coherently, work collaboratively, and develop a global consciousness…. A college is not a trade school. A college education ultimately must be designed to help students develop the skills needed to become lifelong learners, capable of finding new information, evaluating it, and using it in both the real world and the world of the mind.” Case Assignments Each student will participate in several case assignments, which will include (1) the preparation of a written case note and (2) presentation of the note and leading of class discussion of the case (plan for 1020 minutes). One case assignment (team) will involve a Case in Business and Society at the end of the 2 text, while at least one other case (individual) will involve a Discussion Case at the end of one of the chapters in the text. The Text-end Case note should be no more than five pages, typed, double-spaced; the Chapter Discussion Case note should be no more than two pages, typed, double-spaced. Case notes are due at the beginning of class the day the case is scheduled for discussion. When preparing your case note, assume the reader is familiar with the case; there is no need to summarize the facts of the case. The case note should include an analysis of the case and consideration of the questions posed at the end of the case. The class presentation should discuss the problem, the alternatives, and the recommended solution. Presenters should be prepared to answer questions from the instructor and/or their classmates, and are encouraged to use appropriate visual aids. Further details of these requirements and grading procedures will be discussed in class as is necessary. Students are encouraged to stop in during office hours to talk about any problems or suggestions you may have concerning the course, about careers, or just about management or things in general. If the scheduled office hours are inconvenient feel free to make an appointment. WHAT (SOME) STUDENTS LIKED LEAST… “Hardly anybody got involved in discussion” o Many students report that they prefer classes with discussion to straight lecture, but they also report that participation should be voluntary – seems to me that means many students prefer to be in a room where discussion is occurring, provided they’re not expected to contribute… “We talked more about current events than course material that was on exams” o The required reading is the foundation for the course; the class meetings build on that foundation. My task in class is not to read the chapter to you, but to provide an overview and supplemental material. Your job is to come to class prepared for discussion and ask questions about anything you don’t understand. “Calls on students; participation should be voluntary” o Exams aren’t optional, projects aren’t optional, why should participation be voluntary? Student Rights and Responsibilities: Academic Misconduct Truth and honesty are necessary to a university community. Each student is expected to do his or her academic work without recourse to unauthorized means of any kind. Both students and faculty are expected to report violations of the expectations of academic honesty. USI policies and regulations governing the conduct of students and the procedures for handling violations of these policies and regulations are found in the USI Bulletin and on the Dean of Students' website (http://www.usi.edu/stl/index.htm). Students are reminded of the College of Business expectations regarding the avoidance of plagiarism. Plagiarism includes: (1) failing to cite quotations and borrowed ideas, (2) failing to enclose borrowed language in quotation marks, and (3) failing to put summaries and paraphrases in your own words. (Source: Diana Hacker, A Pocket Style Manual 2e (Boston: Bedford/St. Martin’s, 1997), p. 92.) Students are specifically reminded that electronically copying text from a source document such as a web page and pasting that into one’s own document, without putting the borrowed language in quotation marks, is plagiarism, even if the source of that language is included in a reference list or an in-text citation. Point of Information: 3 From Business Week, December 9, 2002: College students are disturbed by recent corporate scandals: Some 84% believe the U.S. is having a business crisis, and 77% think CEOs should be held personally responsible for it. But when students are asked about their own ethics, it’s another story. Some 59% admit cheating on a test. And only 19% say they would report a classmate who cheated…. “There’s a lack of understanding about ethics and how ethics are applied in real life,” says Alvin Rohrs [CEO of Students in Free Enterprise]. “We have to get young people to stop and think about ethics and the decisions they’re making.” THE INSTRUCTOR DANE M. PARTRIDGE -- Associate Professor of Management; B.A., Michigan State University; M.S., Cornell University; Ph.D., Cornell University. Dr. Partridge's primary teaching and research interests involve human resource management and labor relations. His research has been published in the Journal of Collective Negotiations in the Public Sector, the Employee Responsibilities and Rights Journal, the Journal of Labor Research, and the Denver University Law Review. Current research areas include the effect of pay structures on worker attitudes and gender differences in perceptions of sexual harassment. Dr. Partridge has presented management development programs on topics including employee involvement in quality improvement and managing workforce diversity. Dr. Partridge has also taught at Virginia Tech, Radford University, and Roanoke College, and has received several awards for teaching excellence. COURSE OUTLINE, TENTATIVE SCHEDULE, AND READING ASSIGNMENTS Note: only those supplemental readings marked with a “*” are assigned to all; others will be divided for presentation by individual students. Those readings marked with a “@” will be divided for presentation by a pair of students. Presentations of supplemental readings are expected to be a brief summary of the several key points in the article and the implications for managers; these presentations will be expected to make use of PowerPoint. The briefings are intended to reinforce students’ analytical and communication skills: every USI business graduate should be able to read a Wall Street Journal, Harvard Business Review, or other practitioner publication article, identify the key points (the implications for managers), and communicate those points effectively to their colleagues. Consistent with the active learning approach, if you’re not sure what the point of a briefing is (the “so what”), ask! All supplemental readings are intended to reinforce, elaborate upon, or provide additional examples of material contained in the text and lecture. INTRODUCTION AND OVERVIEW (1/13) “Tapping the Trust Fund,” Fortune, April 29, 2002. (*) “Only the ethical need apply,” Christian Science Monitor, March 30, 2005. “Nervous about ethics, firms are fast to fire,” New York Times, March 30, 2005. 1. THE CORPORATION IN SOCIETY a. The Corporation and Its Stakeholders (1/15, 1/20) Joseph Fuller, “A Letter to the Chief Executive,” Harvard Business Review, October 2002. (@) “Culture Wars Hit Corporate America,” Business Week, May 23, 2005. (*) Cisco in the Coyote Valley b. Managing Public Issues (1/22) “Wal-Mart Boss’s Unlikely Role: Corporate Defender-in-Chief,” Wall Street Journal, July 26, 2005. “Wal-Mart Extends Its Influence to Washington,” Washington Post, November 24, 2007. 4 Wal-Mart and Its Public Opponents 2. BUSINESS AND THE SOCIAL ENVIRONMENT a. Corporate Social Responsibility (1/27) “Should Companies Care?” Fortune, June 11, 2001. (*) Roger Martin, “The Virtue Matrix,” Harvard Business Review, March 2002. (@) “The Debate Over Doing Good,” Business Week, August 15, 2005 (*) Michael E. Porter and Mark R. Kramer, “Strategy & Society: The Link Between Competitive Advantage and Corporate Social Responsibility,” Harvard Business Review, December 2006. Jeb Brugmann and C.K. Prahalad, “Cocreating Business’s New Social Compact,” Harvard Business Review, February 2007. (@) Joshua D. Margolis and Hillary Anger Elfenbein, “Do Well by Doing Good? Don’t Count on It,” Harvard Business Review, January 2008. “Does Being Ethical Pay?” Wall Street Journal, May 12, 2008. Hurricane Katrina – Corporate Social Responsibility in Action b. Global Corporate Citizenship (1/29) “God and Business,” Fortune, July 9, 2001. (*) “Enlisting Multinationals in Battle,” Wall Street Journal, November 30, 2001. “How to Save the World? Treat It Like a Business,” New York Times, December 20, 2003. “Managing by the (Good) Book,” Wall Street Journal, October 9, 2006. The Gap Inc.’s Social Responsibility Report GlaxoSmithKline and AIDS Drugs for Africa EXAM I (2/3) 3. BUSINESS AND THE ETHICAL ENVIRONMENT a. Ethics and Ethical Reasoning (2/5, 2/10) “Photo Processors Face a Tough Dilemma: When to Call Police,” Wall Street Journal, June 1, 2001. “Company’s Silence Countered Safety Fears About Asbestos,” New York Times, July 9, 2001. “P&G’s Covert Operation,” Fortune, September 17, 2001. “How Corrupt Is Wall Street?” Business Week, May 13, 2002. (*) “Why the Bad Guys of the Boardroom Emerged en Masse,” Wall Street Journal, June 20, 2002. “Spinning the numbers,” HRMagazine, November 2002. (*) Max H. Bazerman, George Loewenstein, and Don A. Moore, “Why Good Accountants Do Bad Audits,” Harvard Business Review, November 2002. (@) “Ex-Executives Tell How Bristol Burnished Its Financial Results,” Wall Street Journal, December 12, 2002. “None of Our Business?” Harvard Business Review, December 2004. (*) “Hank’s Big Fall,” Fortune, July 25, 2005. (*) “The Other Victims of Bernie Ebbers’s Fraud,” Fortune, July 25, 2005. (*) “The Diamond Industry Rocked by Allegations of Bribery,” Wall Street Journal, December 20, 2005. “Hewlett-Packard Was Far From First to Try ‘Pretexting’,” Wall Street Journal, December 16, 2006. “Big Retail Chains Dun Mere Suspects in Theft,” Wall Street Journal, February 20, 2008. “In Germany, Scandals Tarnish Business Elite,” Wall Street Journal, March 4, 2008. 5 The Warhead Cable Test The Collapse of Enron “Behind Wave of Corporate Fraud, A Change in How Auditors Work,” Wall Street Journal, March 24, 2004. “Four Years Later, Enron’s Shadow Lingers as Change Comes Slowly,” New York Times, January 5, 2006. “In Enron Case, a Verdict on an Era,” New York Times, May 26, 2006. b. Organizational Ethics and the Law (2/12) Constance E. Bagley, “The Ethical Leader’s Decision Tree,” Harvard Business Review, February 2003. (@) Eric M. Pillmore, “How We’re Fixing Up Tyco,” Harvard Business Review, December 2003. (@) “For Financial Whistle-Blowers, New Shield Is an Imperfect One,” Wall Street Journal, October 4, 2004. Lynn Paine, Rohit Deshpande, Joshua D. Margolis, and Kim Eric Bettcher, “Up to Code: Does Your Company’s Conduct Meet World-Class Standards?” Harvard Business Review, December 2005. (@) “Inside Abbott’s Tactics to Protect AIDS Drug,” Wall Street Journal, January 3, 2007. “The Ethical Mind,” Harvard Business Review, March 2007. (@) Ben W. Heineman, Jr., “Avoiding Integrity Land Mines,” Harvard Business Review, April 2007. (@) PPG’s Corporate Ethics Program 4. BUSINESS AND GOVERNMENT IN A GLOBAL SOCIETY a. The Challenges of Globalization (2/17) “Globalization,” Fortune, November 26, 2001. (*) Joseph E. Stiglitz, “You Have to Walk the Talk,” Fortune, November 26, 2001. “The American Way,” Fortune, November 26, 2001. (*) Michael Yaziji, “Turning Gadflies into Allies,” Harvard Business Review, February 2004. (@) Case Study: “The Shakedown,” Harvard Business Review, March 2005. (*) “In Indonesia, Tangle of Bribes Creates Trouble for Monsanto,” Wall Street Journal, April 5, 2005. “How a Global Web of Activists Gives Coke Problems in India,” Wall Street Journal, June 7, 2005. “In Trade Talks, Western Farmers Hold Their Ground,” Wall Street Journal, December 13, 2005. “French Resistance to Trade Accord Has Cultural Roots,” Wall Street Journal, May 16, 2006. Conflict Diamonds Shell Oil in Nigeria “Oil Giant Could Do Better in Nigeria,” Fortune, October 1, 2001. “Flow of Oil Wealth Skirts Nigerian Village,” New York Times, December 22, 2002. “As Exxon Pursues African Oil, Charity Becomes Political Issue,” Wall Street Journal, January 10, 2006. b. Business-Government Relations (2/19) Ginger L. Graham, “The Leader as Lobbyist,” Harvard Business Review, June 2001. (@) “Bush Forces a Shift in Regulatory Thrust,” Washington Post, August 15, 2004. 6 “In Terrorism Fight, Government Finds a Surprising Ally: FedEx,” Wall Street Journal, May 26, 2005. Protecting the U.S. Steel Industry c. Influencing the Political Environment (2/24) “A Quiet Revolution in Business Lobbying,” Washington Post, February 5, 2005. “More Lawmakers Take Trips Funded by Corporations,” Wall Street Journal, April 15, 2005. “Did a Group Financed by Exxon Prompt IRS to Audit Greenpeace?” Wall Street Journal, March 21, 2006. “Under Attack, Big Oil Finds Reserves of Clout Running Low,” Wall Street Journal, May 24, 2006. “Lender Lobbying Blitz Abetted Mortgage Mess,” Wall Street Journal, December 31, 2007. The New Business Political Activist: Behind the Scenes, Less Visible d. Antitrust, Mergers, and Competition Policy (2/26) “U.S. Gains More Antitrust Cooperation Abroad,” Wall Street Journal, December 22, 2005. Microsoft’s Antitrust Troubles in Europe and Asia EXAM II (3/3) 5. THE CORPORATION AND THE NATURAL ENVIRONMENT a. Ecology and Sustainable Development in Global Business (3/5, 3/17) “As Biotech Crops Multiply, Consumers Get Little Choice,” New York Times, June 10, 2001. Chad Holliday, “Sustainable Growth, the DuPont Way,” Harvard Business Review, September 2001. (@) “Tree Huggers, Soy Lovers, and Profits,” Fortune, June 9, 2003. (*) “Global Warming,” Business Week, August 16, 2004. (*) “To Preserve Forests, Supporters Suggest Cutting Some Trees,” Wall Street Journal, May 5, 2005. “Exxon Chief Makes a Cold Calculation on Global Warming,” Wall Street Journal, June 14, 2005. “On Climate Change, a Change of Thinking,” New York Times, December 4, 2005. “Yelling ‘Fire’ on a Hot Planet,” New York Times, April 23, 2006. Elizabeth Economy and Kenneth Lieberthal, “Scorched Earth,” Harvard Business Review, June 2007. (@) Damming the Yangtze River Kimpton Hotels’ EarthCare Program b. Managing Environmental Issues (3/19) Auden Schendler, “Where’s the Green in Green Business?” Harvard Business Review, June 2002. “How Green Is BP?” New York Times Magazine, December 8, 2002. (*) “Once Targeted by Protestors, Home Depot Plays Green Role,” Wall Street Journal, August 6, 2004. “Ex-Activists Find Grass Is Greener on Corporate Side,” Wall Street Journal, November 17, 2004. “It’s Easier Being Green at the Local Level,” Wall Street Journal, May 17, 2006. “Environmentalists, Loggers Near Deal on Asian Rainforests,” Wall Street Journal, February 23, 2006. “Big Businesses Have New Take on Warming,” Wall Street Journal, March 28, 2006. 7 “Companies and Critics Try Collaboration,” New York Times, May 17, 2006. “What’s Kind to Nature Can Be Kind to Profits,” New York Times, May 17, 2006. Jonathan Lash and Fred Wellington, “Competitive Advantage on a Warming Planet,” Harvard Business Review, March 2007. (@) Michael E. Porter and Forest L. Reinhardt, “A Strategic Approach to Climate,” Harvard Business Review, October 2007. Daniel C. Esty, “What Stakeholders Demand,” Harvard Business Review, October 2007. Andrew J. Hoffman, “If You’re Not at the Table, You’re on the Menu,” Harvard Business Review, October 2007. Gregory C. Unruh, “The Biosphere Rules,” Harvard Business Review, February 2008. (@) Digging Gold “Green Gold?” Fortune, September 15, 2008. The Transformation of Shell 6. BUSINESS AND TECHNOLOGICAL CHANGE a. Technology: A Global Economic-Social Force (3/24) “For Big Vendor of Personal Data, a Theft Lays Bare the Downside,” Wall Street Journal, May 3, 2005. “Europe Zips Lips; U.S. Sells ZIPs,” New York Times, August 7, 2005. The Dark Side of the Internet “Protecting Kids From Adult Spam,” Wall Street Journal Online, January 12, 2006. “Internet Transforms Child Porn Into Lucrative Criminal Trade,” Wall Street Journal, January 17, 2006. b. Managing Technological Challenges (3/26) “Big Companies Quietly Pursue Research on Embryonic Stem Cells,” Wall Street Journal, April 12, 2005. “Security Fears Prod Many Firms to Limit Staff Use of Web Services,” Wall Street Journal, March 30, 2006. We’re Simply Downloading Music – So What’s the Big Deal? EXAM III (3/31) 7. BUILDING RELATIONSHIPS WITH STAKEHOLDERS a. Stockholder Rights and Corporate Governance (4/2, 4/7) “How to Fix Corporate Governance,” Business Week, May 6, 2002. (*) “Reining In the Imperial CEO,” New York Times, September 15, 2002. “A Boss for the Boss,” New York Times, December 14, 2003. “Democracy Looks for an Opening – In the Boardroom,” Wall Street Journal, March 22, 2004. David A. Nadler, “Building Better Boards,” Harvard Business Review, May 2004. (@) “Accounting Rule Exposes Problems But Draws Complaints About Costs,” Wall Street Journal, March 2, 2005. Stephen Wagner and Lee Dittmar, “The Unexpected Benefits of Sarbanes-Oxley,” Harvard Business Review, April 2006. (@) “At AIG, a First Glance at ‘Good Governance’,” Wall Street Journal, May 17, 2006. “When Chairman and CEO Roles Get a Divorce,” Wall Street Journal, January 14, 2008. Turmoil in the Magic Kingdom 8 Johnson & Johnson and the Human Life International Shareholder Proposal b. Consumer Protection (4/9, 4/14) “Popularity of Breast Implants Rising,” Washington Post, September 22, 2002. “Teenage Shooting Opens a Window On Safety Agency,” Wall Street Journal, April 29, 2004. “For More Teenage Girls, Adult Plastic Surgery,” Washington Post, October 26, 2004. Robert Reich, “A Suitable Remedy,” Washington Post, January 9, 2005. “How to Fix the Tort System,” Business Week, March 14, 2005. (*) “Makers of Luxury Goods Try New Legal Tactics Against Those Who Aid Counterfeiters,” Wall Street Journal, January 31, 2006. “Beware the Afterglow,” New York Times, May 3, 2007. Big Fat Liability “Taking the Cake,” Harvard Business Review, March 2004. (*) “Defensive Coke Backs Research That Asks: Is Sugar All Bad?” Wall Street Journal, October 22, 2004. “Why Kraft Decided to Ban Some Food Ads to Children,” Wall Street Journal, October 31, 2005. Odwalla, Inc., and the E. Coli Outbreak “Despite Mad-Cow Warnings, Industry Resisted Safeguards,” New York Times, December 28, 2003. “In Global Food-Trade Skirmish, Safety Is the Weapon of Choice,” Wall Street Journal, December 15, 2004. “FDA Issues Guidelines for Prepared Produce,” Wall Street Journal, March 2, 2006. “U.S. Falls Behind in Tracking Cattle to Control Disease,” Wall Street Journal, June 21, 2006. Merck, the FDA, and the Vioxx Recall “Celebrex Drama May Finally Prompt Changes at the FDA,” Wall Street Journal, December 20, 2004. “Vioxx Verdict Stokes Backlash That Hit FDA, Manufactures,” Wall Street Journal, August 22, 2005. c. The Community and the Corporation (4/16) Michael E. Porter and Mark R. Kramer, “The Competitive Advantage of Corporate Philanthropy,” Harvard Business Review, December 2002. (@) “The Corporate Givers,” Business Week, November 29, 2004. (*) Anisya Thomas and Lynn Fritz, “Disaster Relief, Inc.,” Harvard Business Review, November 2006. (@) “Nonprofit Hospitals Leave the City for Greener Pastures,” Wall Street Journal, October 14, 2008. Timberland’s Path to Service d. Employees and the Corporation (4/21) “In limbo on a new hire,” HRMagazine, November 2001. (*) Case Study: “The Moonlighter,” Harvard Business Review, November 2002. (*) “Year of the Whistleblower,” Business Week, December 16, 2002. (*) “Persons of the Year,” Time, December 22, 2002. (*) “Gap Offers Unusual Look at Factory Conditions,” Wall Street Journal, May 12, 2004. Elliot Schrage, “Supply and the Brand,” Harvard Business Review, June 2004. “Pharmacists’ Rights at Front of New Debate,” Washington Post, March 28, 2005. “Culture war hits local pharmacy,” Christian Science Monitor, April 8, 2005. “Gift-Wrapped Guilt,” Washington Post, December 18, 2005. “Endemic Problem of Safety in Coal Mining,” New York Times, January 10, 2006. 9 e. f. “Can boss insist on healthy habits?” Christian Science Monitor, January 11, 2006. Joel Brockner, “Why It’s So Hard to Be Fair,” Harvard Business Review, March 2006. (@) “As Demand for Coal Rises, Risky Mines Play Bigger Role,” Wall Street Journal, June 1, 2006. “Immigration Crackdown Targets Bosses This Time,” Wall Street Journal, February 27, 2007. “WellPoint Finds Itself Embroiled in Private Drama,” Wall Street Journal, June 12, 2007. No Smoking Allowed – On the Job or Off Nike’s Dispute with the University of Oregon Managing a Diverse Workforce (4/23) “When a Workplace Dispute Goes Very Public,” New York Times, November 25, 2001. “The 10 Percent Solution,” New York Times, April 14, 2002. “Why Diversity Is Good Business,” Business Week, January 17, 2003. (*) Dukes v. Wal-Mart Stores, Inc. Business and the Media (4/28, 4/30) Case Study: “When No News Is Good News,” Harvard Business Review, April 2001. (*) “S.U.V. Tire Defects Were Known in ’96 but Not Reported,” New York Times, June 24, 2001. “The World Health Organization Takes on Big Tobacco (But Don’t Hold Your Breath),” Fortune, September 17, 2001. “Wal-Mart Pushes to Soften Its Image,” Washington Post, October 29, 2005. “A New Weapon for Wal-Mart: A War Room,” New York Times, November 1, 2005. Joe Nocera, “If It’s Good for Philip Morris, Can It Also Be Good for Public Health?” New York Times Magazine, June 18, 2006 (@) “Grand Theft Auto”: Honest Mistake or Intentional Indecency FINAL EXAM: Thursday, May 7, 3-5p 10