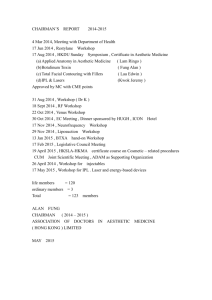

Case Analysis: Li & Fung Trading Co. - KSU Web Home

advertisement

Case Analysis: Li & Fung Trading Co. Herbie Smedlap Kennesaw State University IS 8700 October 5, 2009 1 Background Li & Fung, one of the oldest trading companies, now operates as the largest operating Supply Chain Management Company in Hong Kong. Founded in 1906, Li & Fung was originally established in Guangzhou, China as an export trading company selling to overseas merchants. Li & Fung began their export trading business by partnering with the U.S. to export porcelain and silk. From the 1920’s to 1930’s Li & Fung expanded into manufacturing and warehousing. In 1973, due to the insistence of Fung’s son, Li & Fung transformed from a family business to a publically traded company on the Hong Kong Stock Exchange. The goal was clear; transform the company to a modern corporation. Family members who weren’t directly involved in the day to day business were now able to extract value from their share holdings. Decision making was voted upon by leadership versus established over dinner. The next step after becoming public was to revolutionize the company from a trading company to a global supply chain management company. Li & Fung is a worldwide company with over 13,000 employees in over 80 offices. Li & Fung’s strategy has paid off in growth. In 2000 they were a $2 Billion global export trading company and in 2005 Li & Fung posted revenues of $8.5 billion. Business Strategy Li & Fung uses the holistic supply chain management (SCM) strategy to benefit their clients by shortening order fulfillment from months to weeks which allows clients to reduce the amount of inventory they hold. In addition they remained as the middle man, which allowed them to reduce matching and credit risks. Business Model Li & Fung’s supply chain management services offer Total Value-Added Package: from product design and development, through raw material and factory sourcing, production planning and management, quality assurance and export documentation to shipping consolidation. The company determines which supplier manufactures which element at the lowest cost possible to shorten order fulfillment and provide competitive prices to their customers. Problem Li & Fung need to expand their holistic supply change management strategy to an online venture to avoid disintermediation. SWOT Analysis Strengths (1) Conduct business in hard and soft market (2) Integration with client base (3) Decentralized corporate structure (4) Managers followed entrepreneurial structure 2 (5) Acquisition strategy (6) No physical inventory (7) Customer with private labeling Weaknesses (1) Lack of B2B knowledge (2) Lack of B2B SME’s (3) The unknown effect of an online portal Opportunities (1) Streamline supply chain management orders faster (2) Online inspections (3) Customer become part of the design process (4) eSO- Electronic Stock offer-suppliers can post surplus inventory on the internet for sale Threats (1) When businesses started utilizing the internet, the challenge that Li & Fung faced was to avoid being disintermediated. The internet had the possibility of placing customers directly with manufacturers and bypassing middle man companies like Li & Fung. (2) Internet companies hiring the key people of their competitors. (3) Online companies acquiring old trading companies and teaming up with a dot-com company to become an overnight competitor. Porter’s 5 Competitive Forces Analysis Li & Fung saw its future from a combination of organic growth, expansion and acquisition. (1) Rival- Most rival companies were acquired, thereby gaining new client accounts, integrating operations and bringing the operating margins up tie Li & Fung’s level. (2) Threat of substitutes- Li & Fung remained competitive in this area by continuing in the hard and soft market then expanding to selling raw materials to suppliers. (3) Buyer Power(4) Supplier Power (5) Barriers to Entry/Threat of Entry Alternatives With the ever increasing business over the internet, Li & Fung had a few choices. They could continue with their current strategy and bypass getting into the online arena. The second alternative is to completely have the supply chain management company function online which will give more customers input into the design phase. An alternate solution was to target specific markets with the online portal. The do-nothing approach doesn’t coincide with Li & Fung’s current strategy of growth. Their three-year planning system ensured that they would continue to take an introspective look at the company’s strategy. The benefit of adding a B2B portal would ensure they’ve positioned the company to continue to be the largest SCM company in a competitive market. The downfall may require reduction in staff as well as risking the 3 decentralization of the corporate structure. The third alternative allows Li & Fung to focus on the same market customer while giving allowing the targeted market customers to leverage some of their business. But for the markets that don’t move to B2B, they may partner with Li & Fung’s competitors. Recommendations Li & Fung should continue using their B2B, refining it to be a user- friendly interface. Since 75% of its customers are large retailers in the US, a portal from the retailer to Li & Fung should be established so retailers can manage their internal inventory in real-time in conjunction with the ordering process of Li & Fung. For example, if Kohl’s is selling a particular shirt which appears to be very popular. Kohl’s would predetermine at what minimum to reorder. When the inventory system confirms that the specific number has been met, there is an automatic order placed with Li & Fung through their partnering portal. 4