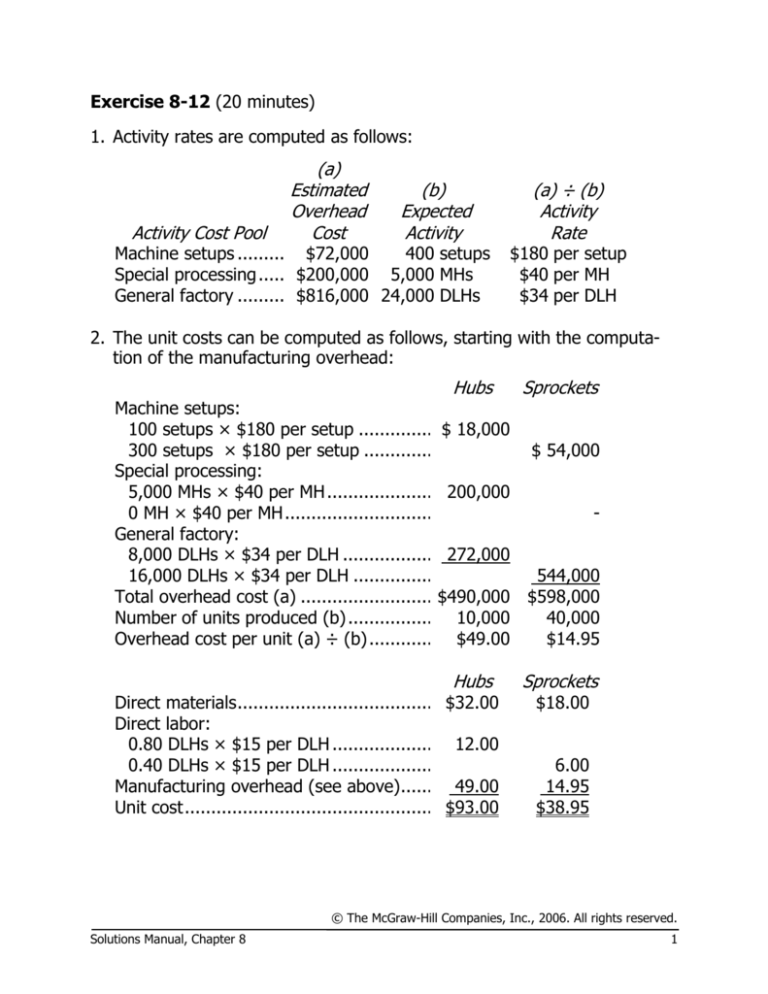

Exercise 8-12 (20 minutes)

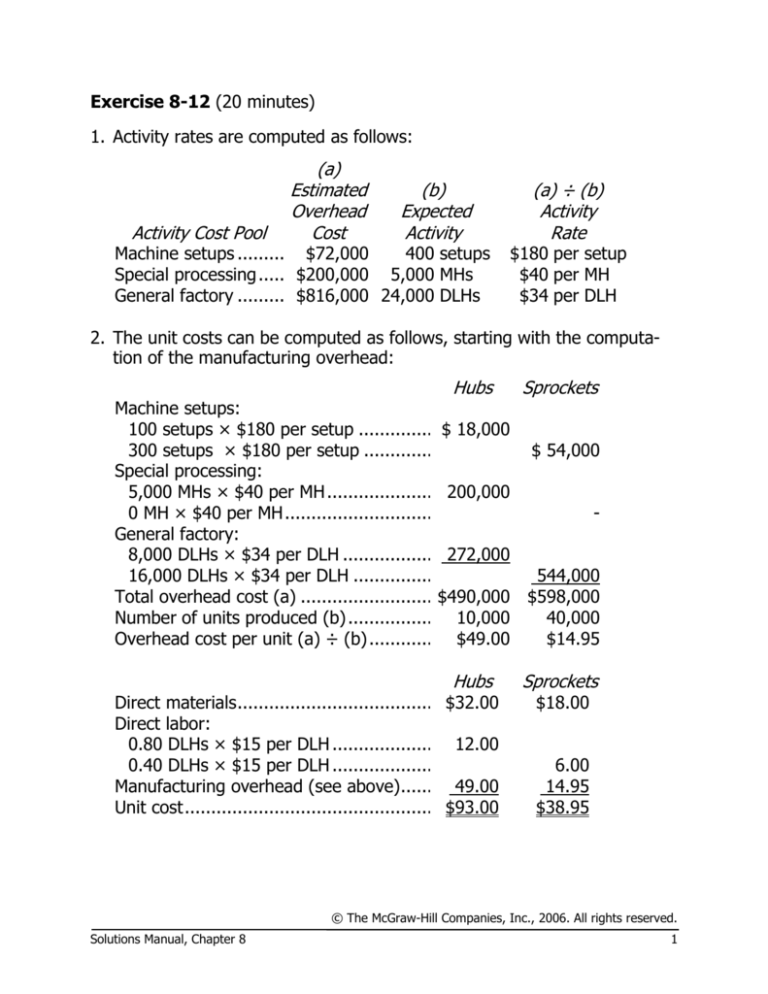

1. Activity rates are computed as follows:

Activity Cost Pool

(a)

Estimated

Overhead

Cost

(b)

Expected

Activity

(a) ÷ (b)

Activity

Rate

Machine setups ..............................................................

$72,000

400 setups $180 per setup

Special processing ..........................................................

$200,000 5,000 MHs

$40 per MH

General factory ..............................................................

$816,000 24,000 DLHs

$34 per DLH

2. The unit costs can be computed as follows, starting with the computation of the manufacturing overhead:

Hubs

Sprockets

Hubs

Sprockets

Machine setups:

100 setups × $180 per setup .......................................

$ 18,000

300 setups × $180 per setup ......................................

$ 54,000

Special processing:

5,000 MHs × $40 per MH .............................................

200,000

0 MH × $40 per MH .....................................................

General factory:

8,000 DLHs × $34 per DLH ..........................................

272,000

16,000 DLHs × $34 per DLH ........................................

544,000

Total overhead cost (a) ..................................................

$490,000 $598,000

Number of units produced (b) .........................................

10,000

40,000

Overhead cost per unit (a) ÷ (b) .....................................

$49.00

$14.95

Direct materials ..............................................................

$32.00

$18.00

Direct labor:

0.80 DLHs × $15 per DLH ............................................

12.00

0.40 DLHs × $15 per DLH ............................................6.00

Manufacturing overhead (see above)...............................

49.00

14.95

Unit cost ........................................................................

$93.00

$38.95

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 8

1

Exercise 8-13 (30 minutes)

1. The first step is to determine the activity rates:

(a)

Activity Cost Pools Total Cost

(b)

Total Activity

(a) ÷ (b)

Activity Rate

Serving parties ...............................................................

$33,000 6,000 parties

$5.50 per party

Serving diners ................................................................

$138,000 15,000 diners

$9.20 per diner

Serving drinks ................................................................

$24,000 10,000 drinks

$2.40 per drink

According to the activity-based costing system, the cost of serving each

of the parties can be computed as follows:

a. Party of 4 persons who order a total of 3 drinks:

Activity Cost Pool

(a)

Activity Rate

(b)

Activity

(a) × (b)

ABC Cost

(b)

Activity

(a) × (b)

ABC Cost

(b)

Activity

(a) × (b)

ABC Cost

Serving parties ...............................................................

$5.50 per party

1 party

$ 5.50

Serving diners ................................................................

$9.20 per diner

4 diners

36.80

Serving drinks ................................................................

$2.40 per drink

3 drinks

7.20

Total .............................................................................

$49.50

b. Party of 2 persons who order no drinks:

Activity Cost Pool

(a)

Activity Rate

Serving parties ...............................................................

$5.50 per party

1 party

$ 5.50

Serving diners ................................................................

$9.20 per diner

2 diners

18.40

Serving drinks ................................................................

$2.40 per drink

0 drinks

0

Total .............................................................................

$23.90

c. Party of 1 person who orders 2 drinks:

Activity Cost Pool

(a)

Activity Rate

Serving parties ...............................................................

$5.50 per party

1 party

$ 5.50

Serving diners ................................................................

$9.20 per diner

1 diner

9.20

Serving drinks ................................................................

$2.40 per drink

2 drinks

4.80

Total .............................................................................

$19.50

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

2

Managerial Accounting, 111thEdition

Exercise 8-13 (continued)

2. The average cost per diner for each party can be computed by dividing

the total cost of the party by the number of diners in the party as follows:

a. $49.50 ÷ 4 diners = $12.375 per diner

b. $23.90 ÷ 2 diners = $11.95 per diner

c. $19.50 ÷ 1 diner = $19.50 per diner

3. The average cost per diner differs from party to party under the activitybased costing system for two reasons. First, the cost of serving a party

($5.50) does not depend on the number of diners in the party. Therefore, the average cost per diner of this activity decreases as the number

of diners in the party increases. With only one diner, the cost is $5.50.

With two diners, the average cost per diner is cut in half to $2.75. With

five diners, the average cost per diner would be only $1.10. And so on.

Second, the average cost per diner differs also because of the differences in the number of drinks ordered by the diners. If a party does not

order any drinks, as was the case with the party of two, no costs of

serving drinks are assigned to the party.

The average cost per diner differs from the overall average cost of $16

per diner for several reasons. First, the average cost of $16 per diner includes organization-sustaining costs that are excluded from the computations in the activity-based costing system. Second, the $16 per diner

figure does not recognize differences in the diners’ demands on resources. It does not recognize that some diners order more drinks than

others nor does it recognize the economies of scale in serving larger

parties. (The batch-level costs of serving a party can be spread over

more diners if the party is larger.)

We should note that the activity-based costing system itself does not

recognize all of the differences in diners’ demands on resources. For example, there are undoubtedly differences in the costs of preparing the

various meals on the menu. It may or may not be worth the effort to

build a more detailed activity-based costing system that would take such

nuances into account.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 8

3

Exercise 8-19 (45 minutes)

1. The unit product costs under the company's conventional costing system

would be computed as follows:

Number of units produced (a) .....................

Direct labor-hours per unit (b) .....................

Total direct labor-hours (a) × (b) ................

Total manufacturing overhead (a) ...............

Total direct labor-hours (b) .........................

Predetermined overhead rate (a) ÷ (b) ........

Direct materials ..........................................

Direct labor ................................................

Manufacturing overhead applied:

0.40 DLH per unit × $24.00 per DLH .........

0.20 DLH per unit × $24.00 per DLH .........

Unit product cost ........................................

Rascon

20,000

0.40

8,000

Parcel

80,000

0.20

16,000

Total

24,000

$576,000

24,000 DLHs

$ 24.00 per DLH

Rascon

$13.00

6.00

9.60

$28.60

Parcel

$22.00

3.00

4.80

$29.80

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

4

Managerial Accounting, 11th Edition

Exercise 8-19 (continued)

2. The unit product costs with the proposed ABC system can be computed as follows:

Activity Cost Pool

Labor related ...........

Engineering design ...

Estimated

Overhead

Cost*

$288,000

$288,000

(b)

Expected Activity

(a) ÷ (b)

Activity Rate

24,000 direct labor-hours $12.00 per direct labor-hour

6,000 engineering-hours $48.00 per engineering-hour

*The total overhead cost is split evenly between the two activity cost pools.

Rascon

Expected

Activity

Amount

Labor related at $12.00 per direct labor-hour ...................

Engineering design at $48.00 per engineering-hour ..........

Total overhead cost assigned (a).....................................

Number of units produced (b) .........................................

Overhead cost per unit (a) ÷ (b ......................................

8,000

3,000

$ 96,000

144,000

$240,000

20,000

$12.00

Parcel

Expected

Activity

Amount

16,000 $192,000

3,000

144,000

$336,000

80,000

$4.20

The unit product costs combine direct materials, direct labor, and overhead costs:

Rascon

Parcel

Direct materials ..............................................................

$13.00 $22.00

Direct labor ....................................................................

6.00

3.00

Manufacturing overhead (see above) ...............................

12.00

4.20

Unit product cost ............................................................

$31.00 $29.20

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 8

5

Exercise 8-19 (continued)

3. The unit product cost of the high-volume product, Parcel, declines under the activity-based costing

system, whereas the unit product cost of the low-volume product, Rascon, increases. This occurs because half of the overhead is applied on the basis of engineering design hours instead of direct laborhours. When the overhead was applied on the basis of direct labor-hours, most of the overhead was

applied to the high-volume product. However, when the overhead is applied on the basis of engineering-hours, more of the overhead cost is shifted over to the low-volume product. Engineering-hours is

a product-level activity, so the higher the volume, the lower the unit cost and the lower the volume,

the higher the unit cost.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

6

Managerial Accounting, 10th Edition