Phillipines - Nielsen Media Research

advertisement

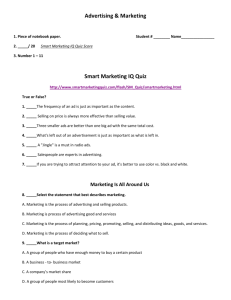

ADVERTISING SPEND IN PHILIPPINES: TOPLINE ANALYSIS 2001 Total media advertising expenditure increased only by 14% - Print advertising had a negligible 2% increase from previous year. - On Television - Quite a number of publication titles stopped their circulation before the end of the first semester. Print Lineage data shows that smaller sized ads had become popular while Full-Page sized ads were not published as frequently as the previous years. Total spots of major network ABS-CBN-2 was reduced by 12%. This contraction was a major factor why total adspend on terrestrial TV grew only by 13%. On the other hand, its major competitor GMA 7 grew its expenditure by 11%. Studio 23, a premium UHF channel of ABS-CBN suffered a major cut-back on spots and expenditure by 50% and 25%, respectively. It was only IBC 13 that had a significant gain on expenditure at 78%, brought by a 30% increase on commercial spots. Cable advertising is increasing. Given the sets of cable channels covered in current adex measurement, total ad expenditure of cable is already 5% of combined FTA and Cable channel adspend. Increase on Radio expenditure was within its normal level. Media war between two major telecom companies Globe Telecom and Smart Communications ended the year with a heightened 34% increase on total expenditure for the entire Telecommunication category. Procter & Gamble’s total expenditure grew by a remarkable 61% due to its push for Pantene and Ariel brands and its introduction of Old Spice Deodorant to the market. 37% of its media expenditure went to its shampoo category. Some leading advertisers narrowed their advertising budgets and this had significant impact on total expenditure for certain categories. - A notable example is Fortune Tobacco, a leading cigarette company that cut its advertising budget by 20%, resulting in a decreased expenditure of total Cigarette category by 20%. - While Unilever maintains the lead in media advertising expenditure, it is among the advertisers that had significant cuts on advertising budget. Unilever decreased its total ad expenditure by 11%. Total number of new TV campaigns was 8% lower than previous year and this has resulted in a prolonged run of older campaigns of major advertisers. - TVC lengths longer than the standard 30 seconds were no longer popular. Less of the 45 and 60 second ads were aired until last quarter of 2001. On Broadsheets, we saw less Full-Page sized ads. Print lineage data show smaller sized ads have become popular Outlook for the first 6 months of 2002 Release of Rate cards may be delayed due to a foreseen difficult negotiation between networks and advertisers. Popularity of 15 seconds TVC commercial spots may continue due to tightening on research budgets of advertisers. This will have significant effect on TV advertising expenditure. Heightened adspend of Telecommunications may persist considering the product innovations that both Globe Telecom and Smart Communications need to convey to consumers. Contributing unique local factors to 2001 Adspend Political Ads account for a 5% increase in adspend for the first half of 2001. Unique local factors or events that may affect the Philippine markets’ adspend in 2002 Prevailing state of economic and political situations may either progress or regress media advertising. If we expand our coverage on TV to include another cable provider (Destiny). If Star TV resumed its broadcast on Sky/Home Cable. Note: All mentions of expenditure in this analysis are based on published rate cards.