Monday, January 23, 2012

Tomorrow’s Headlines

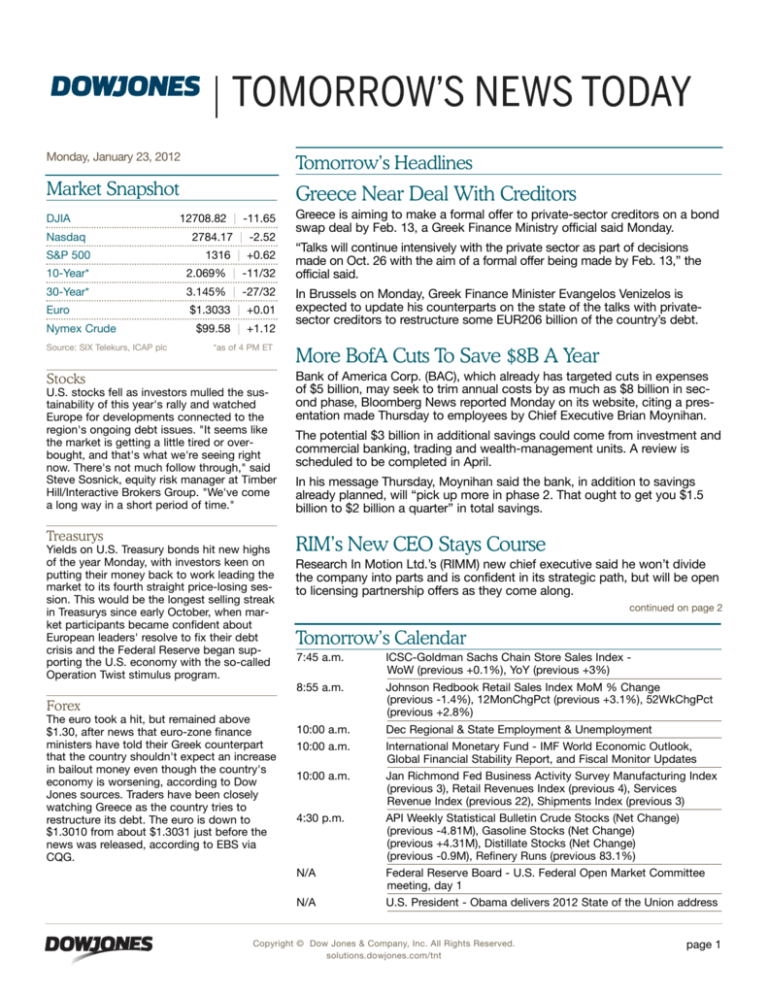

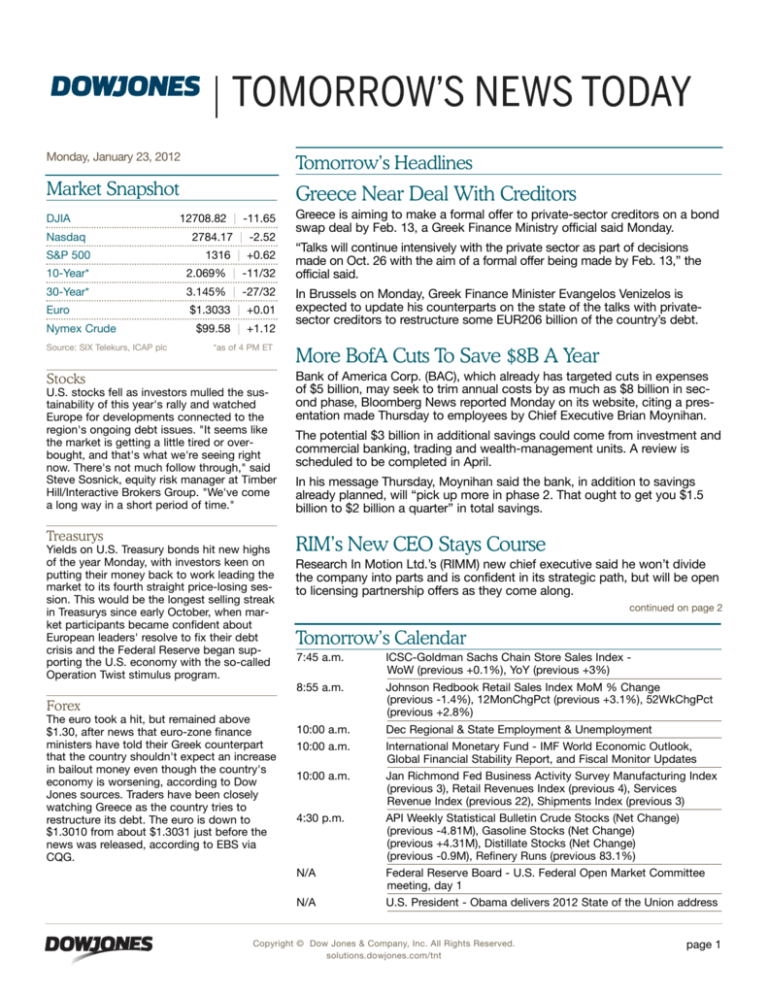

Market Snapshot

Greece Near Deal With Creditors

DJIA

Nasdaq

12708.82 | -11.65

2784.17 | -2.52

S&P 500

1316 | +0.62

10-Year*

2.069% | -11/32

30-Year*

3.145% | -27/32

Euro

$1.3033 | +0.01

Nymex Crude

Source: SIX Telekurs, ICAP plc

$99.58 | +1.12

*as of 4 PM ET

Stocks

U.S. stocks fell as investors mulled the sustainability of this year's rally and watched

Europe for developments connected to the

region's ongoing debt issues. "It seems like

the market is getting a little tired or overbought, and that's what we're seeing right

now. There's not much follow through," said

Steve Sosnick, equity risk manager at Timber

Hill/Interactive Brokers Group. "We've come

a long way in a short period of time."

Treasurys

Yields on U.S. Treasury bonds hit new highs

of the year Monday, with investors keen on

putting their money back to work leading the

market to its fourth straight price-losing session. This would be the longest selling streak

in Treasurys since early October, when market participants became confident about

European leaders' resolve to fix their debt

crisis and the Federal Reserve began supporting the U.S. economy with the so-called

Operation Twist stimulus program.

Greece is aiming to make a formal offer to private-sector creditors on a bond

swap deal by Feb. 13, a Greek Finance Ministry official said Monday.

“Talks will continue intensively with the private sector as part of decisions

made on Oct. 26 with the aim of a formal offer being made by Feb. 13,” the

official said.

In Brussels on Monday, Greek Finance Minister Evangelos Venizelos is

expected to update his counterparts on the state of the talks with privatesector creditors to restructure some EUR206 billion of the country’s debt.

More BofA Cuts To Save $8B A Year

Bank of America Corp. (BAC), which already has targeted cuts in expenses

of $5 billion, may seek to trim annual costs by as much as $8 billion in second phase, Bloomberg News reported Monday on its website, citing a presentation made Thursday to employees by Chief Executive Brian Moynihan.

The potential $3 billion in additional savings could come from investment and

commercial banking, trading and wealth-management units. A review is

scheduled to be completed in April.

In his message Thursday, Moynihan said the bank, in addition to savings

already planned, will “pick up more in phase 2. That ought to get you $1.5

billion to $2 billion a quarter” in total savings.

RIM’s New CEO Stays Course

Research In Motion Ltd.’s (RIMM) new chief executive said he won’t divide

the company into parts and is confident in its strategic path, but will be open

to licensing partnership offers as they come along.

continued on page 2

Tomorrow’s Calendar

7:45 a.m.

ICSC-Goldman Sachs Chain Store Sales Index WoW (previous +0.1%), YoY (previous +3%)

8:55 a.m.

Johnson Redbook Retail Sales Index MoM % Change

(previous -1.4%), 12MonChgPct (previous +3.1%), 52WkChgPct

(previous +2.8%)

10:00 a.m.

Dec Regional & State Employment & Unemployment

10:00 a.m.

International Monetary Fund - IMF World Economic Outlook,

Global Financial Stability Report, and Fiscal Monitor Updates

10:00 a.m.

Jan Richmond Fed Business Activity Survey Manufacturing Index

(previous 3), Retail Revenues Index (previous 4), Services

Revenue Index (previous 22), Shipments Index (previous 3)

4:30 p.m.

API Weekly Statistical Bulletin Crude Stocks (Net Change)

(previous -4.81M), Gasoline Stocks (Net Change)

(previous +4.31M), Distillate Stocks (Net Change)

(previous -0.9M), Refinery Runs (previous 83.1%)

N/A

Federal Reserve Board - U.S. Federal Open Market Committee

meeting, day 1

N/A

U.S. President - Obama delivers 2012 State of the Union address

Forex

The euro took a hit, but remained above

$1.30, after news that euro-zone finance

ministers have told their Greek counterpart

that the country shouldn't expect an increase

in bailout money even though the country's

economy is worsening, according to Dow

Jones sources. Traders have been closely

watching Greece as the country tries to

restructure its debt. The euro is down to

$1.3010 from about $1.3031 just before the

news was released, according to EBS via

CQG.

Copyright © Dow Jones & Company, Inc. All Rights Reserved.

solutions.dowjones.com/tnt

page 1

Monday, January 23, 2012 4 p.m. ET

horizontal drilling and hydraulic fracturing, or fracking, have

transformed its potential.

Tomorrow’s Headlines

continued

Thorsten Heins, previously one of RIM’s two chief operating officers, was named chief executive by the company’s

board late Sunday in a corporate shake-up and will face

immediate scrutiny as he takes over the struggling

BlackBerry maker.

In a conference call Monday, Mr. Heins said the moves at

RIM don’t signal a “seismic change,” and he will mostly

stay on the path set by his predecessors.

“I will not in any way split this up or separate this into different businesses,” Mr. Heins said. “If there [are] requests

coming towards Research In Motion to talk about licensing

that platform to other companies, I will entertain those discussions. I will listen.”

Two areas Mr. Heins said the company does need to

improve upon are marketing in the key U.S. smartphone

market, and executing better with product rollout.

EU Agrees To Embargo On Iran Oil

European Union foreign ministers Monday agreed to enact

an oil embargo on Iran to take effect immediately on new

contracts and to impose a full oil embargo, including existing contracts, by July 1, EU diplomats said Monday.

Under the policy, EU countries would be barred from signing new contracts to import Iranian oil as soon as the

measures are officially published, expected Tuesday. But

these countries could still import Iranian oil through July 1

under contracts signed before the embargo was enacted.

A formal announcement by EU foreign ministers is expected early Monday afternoon.

In its most sweeping moves yet, the EU also agreed sanctions on Iran’s central bank and decided to ban Iranian

exports of petrochemical products from May 1. It also

added trade bank Bank Tejarat to its sanctions list, diplomats said.

The EU has agreed “unprecedented” sanctions on Iran,

U.K. Foreign Secretary William Hague told reporters on the

sidelines of a Foreign Ministers meeting that was ongoing

Monday. Hague said the move “shows the resolve of the

EU” to respond to “Iran’s continual breach” of international

agreements.

Apache To Buy Cordillera For $2.85B

Apache Corp. (APA), one of the biggest U.S. energy

explorers, is buying privately held Cordillera Energy

Partners III LLC for $2.85 billion in a deal that underscores

how new drilling techniques are remaking the U.S. oil business.

The cash-and-stock deal gives Apache 254,000 acres atop

a deeply buried layer of rock in what is known as the

Granite Wash, which straddles the Texas-Oklahoma border. Apache has been drilling in the area for 35 years, but

new methods of recovering oil and natural gas, including

The deal marks only the second time in the past 16 years

that Apache has purchased a company for more than $500

million. Apache has been buying into mature and still-profitable oil fields around the globe, a strategy that is leading

the company back into the region where it was formed 57

years ago.

Chesapeake Energy To Cut Production

Chesapeake Energy Corp. (CHK), one of the oil and gas

producers at the origin of the current natural gas supply

glut, said it will reduce drilling activity this year amid cratering prices for natural gas.

The announcement from the second-largest U.S. natural

gas producer after Exxon Mobil Corp. (XOM) helped send

Nymex natural gas futures for February to $2.432 per million British thermal units mid-morning Monday, up 8 cents

from Friday.

After drilling more U.S. gas wells in recent years than any

other company, Chesapeake, based in Oklahoma City, said

it was cutting spending as natural gas prices had unexpectedly reached its lowest levels in a decade. “An exceptionally mild winter to date has pressured U.S. natural gas

prices to levels below our prior expectations and below

levels that are economically attractive for developing dry

gas plays in the U.S., shale or otherwise,” said Chief

Executive Aubrey K. McClendon.

Court Strikes J&J Stent Patents

A federal court ruled that stents marketed by Boston

Scientific Corp. (BSX), Abbott Laboratories (ABT), and

Medtronic Inc. (MDT) don’t infringe on Johnson & Johnson

(JNJ) patents, the latest decision in the companies’ longrunning battle over intellectual property.

The two patents have to do with a drug used on stents.

Pfizer Inc.’s (PFE) Wyeth manufactures the drug, called

sirolimus, and licenses it to Johnson & Johnson’s Cordis

unit. The drug is used on Johnson & Johnson’s Cypher

stent, the first drug-eluting stent approved in the U.S.,

Boston Scientific’s Promus stent and Abbott’s Xience—

essentially the same stent—as well as Medtronic’s

Endeavor, use derivatives of the drug.

The U.S. District Court in New Jersey ruled that the

patents brought by Johnson & Johnson in lawsuits were

invalid. Johnson & Johnson said it plans to appeal the ruling and declined to comment on any financial impact from

the ruling.

Diamondback To Pay $9M In Settlement

Diamondback Capital Management, a U.S. hedge fund,

agreed to pay the government more than $9 million to put

insider-trading allegations behind it, while entering into a

nonprosecution agreement with federal prosecutors in

connection with a criminal investigation, federal authorities

said Monday.

Copyright © Dow Jones & Company, Inc. All Rights Reserved.

solutions.dowjones.com/tnt

continued on page 3

page 2

Monday, January 23, 2012 4 p.m. ET

Tomorrow’s Headlines

Starbucks To Expand Evening Menu

continued

Starbucks Corp. (SBUX) said it would expand its nascent

attempt to drum up evening business with beer, wine and

premium food at select locations in new regions.

Last week, the Securities and Exchange Commission

accused Diamondback, two of its former employees,

another hedge fund and five other individuals of civil insider-trading violations. Under Diamondback’s proposed settlement, the money manager will pay the government more

than $6 million in alleged illegal gains and interest from

trading in shares of Dell Inc. (DELL) and Nvidia Corp.

(NVDA) in 2008 and 2009, plus a $3 million civil penalty to

settle the SEC matter, the regulator and Manhattan U.S.

Attorney’s office said Monday.

Halliburton 4Q Net Up

Halliburton Co.’s (HAL) fourth-quarter earnings rose 50%

as the raging U.S. energy boom brought the oilfield-service

provider’s revenues to record levels.

The second-largest oilfield-service company after

Schlumberger Ltd. (SLB), Halliburton is the top seller of

hydraulic fracturing, or fracking, services in North America.

That service is essential in cracking open deeply buried oiland-gas-bearing rocks, including shale, an area on which

energy companies have been making big bets for future

growth. Last week, Schlumberger said its fourth-quarter

earnings rose 36% as a global drilling frenzy continued

despite fears about the global economy.

Kodak Names Restructuring Head

Eastman Kodak Co. (EKDKQ) said Monday it has retained

James A. Mesterharm as its new chief restructuring officer

to help steer the struggling film company through bankruptcy court, after Dominic DiNapoli held the role for just a

few days.

Kodak said the change “does not reflect any disagreement

or difference of opinion” between DiNapoli, a vice chairman at FTI Consulting Inc. (FCN), and the company. Kodak

had named DiNapoli its chief restructuring officer

Thursday, the same day it put itself into bankruptcy court.

Officials Cut Shale Resource View

U.S. energy officials have cut their estimates of natural gas

resources, saying Monday there is far less natural gas in a

region known as the Marcellus Shale than previously

thought.

Despite the downward revision in the amount of shale gas

that can be recovered, but not yet proven to exist, officials

at the Energy Information Administration said the U.S. will

still produce more natural gas than it needs in coming

years and will likely become a net exporter of natural gas

by 2021.

In a sneak peek Monday of its closely watched annual

energy report for 2012, the EIA said it thinks there are

about 480 trillion cubic feet of shale gas in the U.S., down

from earlier estimates of 830 trillion cubic feet.

The coffeeshop operator already runs the concept at five

stores in the Seattle area—the company’s original stomping ground—and one in Portland, Ore.

2013 Budget To Be Relased Feb. 13

The White House will release on Feb. 13 President Barack

Obama’s proposed budget for the federal government,

according to an administration official.

The White House has offered few details about what would

be in the budget, but President Obama said it would

include eliminating tax breaks for U.S. companies moving

jobs overseas, as well as tax benefits for firms that bring

jobs back from abroad.

Merkel Presses EU For Binding Pact

German Chancellor Angela Merkel on Monday called on

European leaders to make good on promises to create a

strong fiscal union to rescue the euro currency.

Merkel, speaking at the Konrad Adenauer Foundation, said

Europe’s completing a political union to bolster Europe’s

monetary union is the “greatest challenge” in the coming

years.

Shakeup In DOJ Antitrust Unit

Sharis Pozen, the Justice Department’s chief antitrust

enforcer, is preparing to leave her post, likely as soon as

this spring, according to people familiar with the matter.

Pozen, who has served as the acting head of the department’s Antitrust Division since August, is likely to return to

private practice, these people said. They said Pozen has

informed the White House of her intentions.

During her short tenure, Pozen has overseen one of the

department’s biggest merger challenges in a generation: its

successful bid to block AT&T Inc.’s (T) proposed $39 billion

acquisition of T-Mobile USA.

W Pincus To Raise $1B For Oil Buy

New York-based Warburg Pincus is looking for coinvestors to help it raise $1 billion for Venari Resources

LLC, a new deepwater exploration and production company, LBO Wire has learned.

The planned investment comes as other private equity

firms are capitalizing on previous bets on oil development

in the Gulf of Mexico nearly two years after the Deepwater

Horizon disaster raised concerns about the future of exploration in the region.

Warburg is committing $500 million to the new venture,

according to people with knowledge of the situation.

Copyright © Dow Jones & Company, Inc. All Rights Reserved.

solutions.dowjones.com/tnt

page 3

Monday, January 23, 2012 4 p.m. ET

Copyright Dow Jones & Company, Inc.

Talking Points

Tomorrow's News Today is made available

as a complimentary service to Dow Jones

News Service paying subscribers. No further redistribution is permitted without written permission from Dow Jones.

Tomorrow’s News Today is intended to provide factual information, but its accuracy

cannot be guaranteed. Dow Jones is not a

registered investment adviser, and under

no circumstances shall any of the information provided be construed as a buy or sell

recommendation or investment advice of

any kind.

Small-Cap Index Eyes Record High

Want to send a co-branded daily

version to your valued clients?

Dow Jones offers subscribing firms the

opportunity to co-brand Tomorrow's News

Today for redistribution to their clients. If

your firm is interested in co-branding, please

contact us at newswires@dowjones.com or

1.800.223.2274.

Overbought readings aside, price action in the Russell 2000 index of small capitalization stocks suggests further upside, with a return to last year’s all-time

high a viable target.

After running up 5.5% since the start of 2012, and nearly 30% off the early

October closing low, it wouldn’t be a big surprise to see the Russell 2000 pull

back. But there are a number of technical thresholds the index has surpassed

to suggest the current rally is part of a long-term uptrend, indicating any weakness should be viewed as a buying opportunity.

First, the index has sustained gains above the 200-day simple moving average,

which has acted as a pivot point—both support and resistance—since the

index was carving out a bottom in mid 2010, for the last couple weeks.

In addition, the Russell 2000 has climbed above the key 61.8% Fibonacci

retracement level—766.63—of the decline from the all-time high of 868.57 seen

in intraday trading on May 2, 2010 to the Oct. 4 intraday low of 601.71.

Many chart watchers feel if a retracement surpasses the Fibonacci ratio of

0.618, a new trend has begun. And the initial target of that trend becomes a full

retracement of the prior move.

Third, the index is above a downtrend line starting at the October highs around

the same time it rose above the 200-day SMA. Schaeffer’s Investment Research

senior vice-president of research Todd Salamone said the break of this “neckline” confirms a bullish “inverse head-and-shoulders” pattern, in which the

early-November and mid-December lows are the upside down shoulders, and

the late-November low is the head.

A measured-move target following the completion of this pattern is derived by

adding the height of this pattern—the distance from the top of the pattern to

the bottom of the head—to the breakout point. In this case, the target is around

860, which is right around the all-time high.

Just getting above some key technical levels isn’t necessarily enough to suggest the advance can return to prior highs, or that the downside will be limited.

Especially since some underlying momentum indicators have reached upside

extremes. But there’s more to the rally than just technical breakouts.

New Stimulus Could Be CounterProductive

U.S. President Barack Obama’s State of the Union speech set for Tuesday is

expected to focus on ways to help the economy. But proposals for new aid may

end up hurting the outlook.

Recent data indicate the U.S. recovery is sturdier. Economists expect real gross

domestic product grew at a solid 3.0% in the fourth quarter. Data so far in January

from regional factory activity to jobless claims show growth continued in early 2012.

Existing government help ensures growth will not stall again as it did in 2010

and 2011. The social security tax cut and extended jobless benefits provide

cash for consumers to spend. State and local budgets would be in far worse

shape if past federal aid had been absent.

So why should Obama tread carefully when suggesting new programs?

The potential negative comes not from the ideas themselves. More stimulus

would provide insurance that would come in handy if the euro zone implodes,

or if geopolitical tensions push up energy prices.

The danger comes down to politics and the upcoming election.

Any new legislation will run into the buzzsaw of political fighting. The squabbling is

certain to inject uncertainty and pessimism back into economic decision-making.

continued on page 5

Copyright © Dow Jones & Company, Inc. All Rights Reserved.

solutions.dowjones.com/tnt

page 4

Monday, January 23, 2012 4 p.m. ET

Talking Points

continued

Remember the protracted fight over lifting the debt ceiling

last August. Consumer sentiment nose-dived, amid a

record low level of confidence in Washington’s ability to

guide the economy.

Surveys of business sentiment also showed more pessimism, with the debt-ceiling debate and the downgrade of

Treasury debt given as reasons for the sour mood. The end

result: businesses took a wait-and-see attitude—which

hurt hiring.

While the recovery is looking better, growth is not surging.

Headwinds have diminished, but obstacles such as oversupply in housing, household deleveraging, and high

unemployment still hold back the economy’s potential

growth rate. A new dose of political uncertainty raises the

odds that 2012 will be the third consecutive year to see a

stall in growth.

Meet The Slow-Growth S&P 500

The days of double-digit earnings growth are over.

S&P 500 companies are on track to post earnings growth

of 9.5% year-on-year for the fourth quarter, according to

FactSet Research. At first glance, that may seem only a

slight miss from the double-digit earnings growth that previously powered this profit cycle. That headline figure,

however, is inflated by the earnings rebound of one specific company: the notorious AIG.

American International Group Inc. (AIG), which is still more

than three-quarters owned by the U.S. government after its

near-collapse in 2008, is expected to post earnings of 62

cents a share when it turns in results Feb. 23. That compares with a year-ago loss of a whopping $16.20.

Exclude AIG, and the estimated earnings-growth rate for the

financials sector—one of only two expected to report a double-digit gain for the quarter, along with energy—turns negative. For the S&P 500 as a whole, it falls from 9.5% to just

2.2%. That is a marked slowing from the average 16.3%

earnings growth rate that prevailed in the first three quarters

of 2011, according to Thomson Reuters. And it wasn’t anticipated: The share of companies that have missed their earnings estimates so far is the highest yet this cycle.

A rebound back to double-digit earnings growth at this

point would be unlikely. Indeed, analysts have gone from

expecting 14% earnings growth for the full year back in

July to about 9.6% now. And that figure, based on bottoms-up earnings estimates, may still be too high.

According to Barclays Capital strategist Barry Knapp, the

high ratio of earnings misses for the fourth quarter points

to a further slide in full-year forecasts. Stocks will have to

find another handhold to continue their climb.

Discover

Hidden

Treasure

Take a FREE 2-week trial!

www.diversifiedmarkets.dowjones.com

Get a head start over your competitors. DBR will save you time

on research and can lead you directly to the hidden treasure.

Copyright © Dow Jones & Company, Inc. All Rights Reserved.

solutions.dowjones.com/tnt

page 5