DISPARATE DISABILITY BENEFITS NOT ADEA BREACH The

advertisement

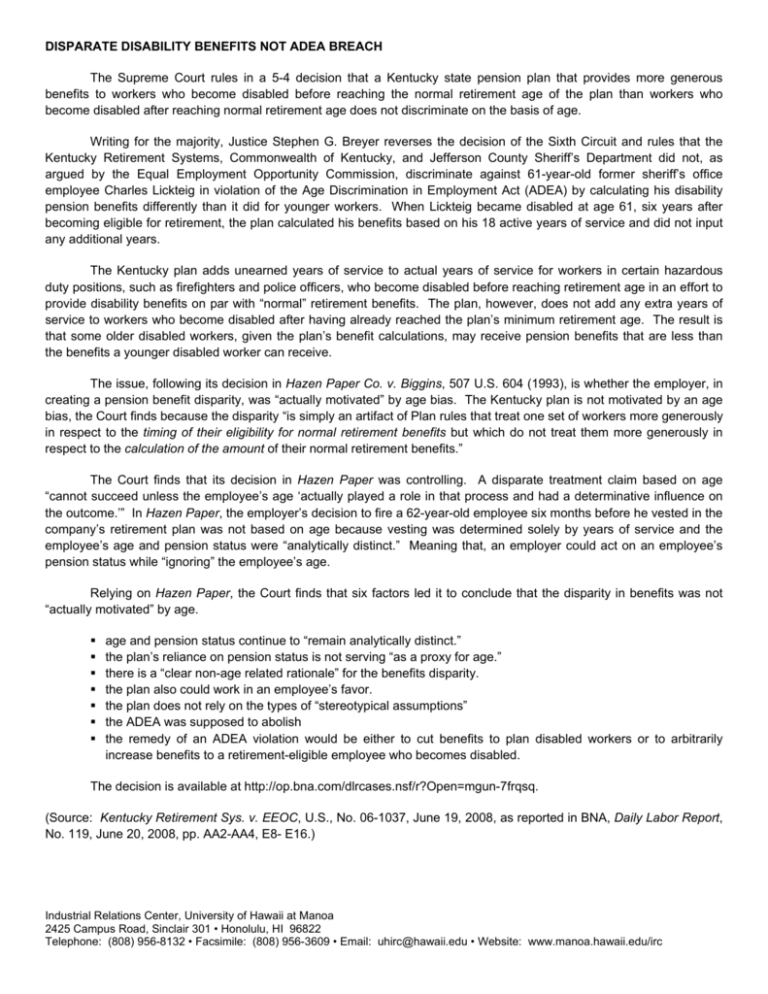

DISPARATE DISABILITY BENEFITS NOT ADEA BREACH The Supreme Court rules in a 5-4 decision that a Kentucky state pension plan that provides more generous benefits to workers who become disabled before reaching the normal retirement age of the plan than workers who become disabled after reaching normal retirement age does not discriminate on the basis of age. Writing for the majority, Justice Stephen G. Breyer reverses the decision of the Sixth Circuit and rules that the Kentucky Retirement Systems, Commonwealth of Kentucky, and Jefferson County Sheriff’s Department did not, as argued by the Equal Employment Opportunity Commission, discriminate against 61-year-old former sheriff’s office employee Charles Lickteig in violation of the Age Discrimination in Employment Act (ADEA) by calculating his disability pension benefits differently than it did for younger workers. When Lickteig became disabled at age 61, six years after becoming eligible for retirement, the plan calculated his benefits based on his 18 active years of service and did not input any additional years. The Kentucky plan adds unearned years of service to actual years of service for workers in certain hazardous duty positions, such as firefighters and police officers, who become disabled before reaching retirement age in an effort to provide disability benefits on par with “normal” retirement benefits. The plan, however, does not add any extra years of service to workers who become disabled after having already reached the plan’s minimum retirement age. The result is that some older disabled workers, given the plan’s benefit calculations, may receive pension benefits that are less than the benefits a younger disabled worker can receive. The issue, following its decision in Hazen Paper Co. v. Biggins, 507 U.S. 604 (1993), is whether the employer, in creating a pension benefit disparity, was “actually motivated” by age bias. The Kentucky plan is not motivated by an age bias, the Court finds because the disparity “is simply an artifact of Plan rules that treat one set of workers more generously in respect to the timing of their eligibility for normal retirement benefits but which do not treat them more generously in respect to the calculation of the amount of their normal retirement benefits.” The Court finds that its decision in Hazen Paper was controlling. A disparate treatment claim based on age “cannot succeed unless the employee’s age ‘actually played a role in that process and had a determinative influence on the outcome.’” In Hazen Paper, the employer’s decision to fire a 62-year-old employee six months before he vested in the company’s retirement plan was not based on age because vesting was determined solely by years of service and the employee’s age and pension status were “analytically distinct.” Meaning that, an employer could act on an employee’s pension status while “ignoring” the employee’s age. Relying on Hazen Paper, the Court finds that six factors led it to conclude that the disparity in benefits was not “actually motivated” by age. age and pension status continue to “remain analytically distinct.” the plan’s reliance on pension status is not serving “as a proxy for age.” there is a “clear non-age related rationale” for the benefits disparity. the plan also could work in an employee’s favor. the plan does not rely on the types of “stereotypical assumptions” the ADEA was supposed to abolish the remedy of an ADEA violation would be either to cut benefits to plan disabled workers or to arbitrarily increase benefits to a retirement-eligible employee who becomes disabled. The decision is available at http://op.bna.com/dlrcases.nsf/r?Open=mgun-7frqsq. (Source: Kentucky Retirement Sys. v. EEOC, U.S., No. 06-1037, June 19, 2008, as reported in BNA, Daily Labor Report, No. 119, June 20, 2008, pp. AA2-AA4, E8- E16.) Industrial Relations Center, University of Hawaii at Manoa 2425 Campus Road, Sinclair 301 • Honolulu, HI 96822 Telephone: (808) 956-8132 • Facsimile: (808) 956-3609 • Email: uhirc@hawaii.edu • Website: www.manoa.hawaii.edu/irc