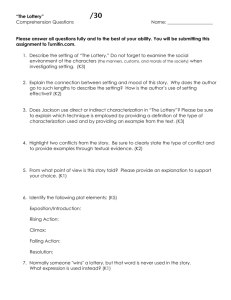

Paper - Department of Economics

advertisement