Road Not Taken: The Next Step for Texas Education Finance, The

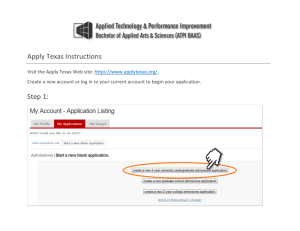

advertisement