Request for Deferment

advertisement

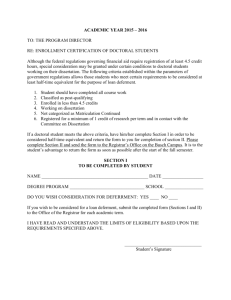

Request for Deferment Perkins, UILT, and HPSL/LDS Programs Mail Completed Form To: UNIVERSITY OF ILLINOIS Student Loan Department 162 Henry Administration Bldg. 506 S. Wright Street Urbana, IL 61801 SECTION 1 – TO BE COMPLETED BY THE BORROWER • • All Dates should be entered in Month/Day/Year format. Refer to Page 2 of this document for deferment criteria. Name: Address: City: Home Telephone #: ( BORROWER SIGNATURE: SSN: ) - Work Telephone #: ( State: - ) - - Zip Code: Birthdate: / / / DATE: / THIS IS TO CERTIFY THAT I AM / WAS (COMPLETE ONE CATEGORY ONLY). ALL FORMS MUST BE SUBMITTED IN A TIMELY MANNER. UNIVERSITY LONG TERM (UILT) LOANS PERKINS LOANS: Pursuing a course of study in an institution of higher education At least half-time Full-time A member of the Armed Forces on active duty (for loans made thru 6/30/1993) In: Peace Corp VISTA – ACTION programs (for loans made thru 6/30/1993) A full-time volunteer in a tax-exempt organization performing service comparable to the Peace Corps or ACTION program (for loans made on or after 11/7/1980 thru 6/30/1993) Preceding a professional practice as a (for loans made on or after 11/7/1980 thru 6/30/1993): Resident Intern Field: _______ Officer in the U.S. Public Health Service Commissioned Corps (for loans made on or after 11/7/1980 thru 6/30/1993) Temporary Total Disability – Documentation Required (for loans made on or after 11/7/1980 thru 6/30/1993) On active duty in the National Oceanic and Atmospheric Administration (for loans made on or after 7/1/1987 thru 6/30/1993) Parental Leave or Working Mothers – Documentation Required (for loans made on or after 7/1/1987 thru 6/30/1993) Temporarily Totally Disabled or Supporting Disabled Dependent – Documentation Required (for loans made on or after 7/1/1987 thru 6/30/1993) Fellowship/Rehabilitation programs – see Page 2 of this document – (all loans) Pursuing a course of study in an institution of higher education At least half-time Full-time Note: Interest is NOT deferrable unless registered at University of Illinois at UrbanaChampaign HEALTH PROFESSIONS STUDENT LOANS (HPSL/LDS) Continuing my pursuit of a full-time course of study at a school of veterinary medicine (Cannot have used grace period or received DVM degree) Pursuing Advanced Professional Training including internships and residencies in veterinary medicine A member of the uniformed services on active duty A volunteer under the Peace Corps Act Engaged in full time educational activity directly related to Health Profession for which I am preparing with the intent to return to U of I prior to DVM (for loans made on or after 10/22/1985) Participating in fellowship program or educational activity directly related to Health Profession in which I have prepared and within 12 months of completing Advanced Professional training or prior to the completion of such training (for loans made on or after 10/22/1985) Returning to a full-time course of study of veterinary medicine at a health profession school eligible for participation in the USPHS Student Loan Program from which I borrowed (for loans made on or after 11/4/1988) COMPLETE FOR ALL DEFERMENT REQUESTS: Deferment Starting Date: / / Ending Date: / / SECTION 2 – TO BE COMPLETED BY CERTIFYING OFFICIAL, REGISTRAR, OR COMMANDING OFFICER Name and address of institution of higher education, military organization, Peace Corps or Vista headquarters, or other qualifying agency: Name (organization): Telephone #: ( Address: City: State: )- - Zip Code: Invalid without official seal, stamp or letter of certification. If no seal or stamp is available, include letterhead certification. OPEID#: TO THE AUTHORIZED OFFICIAL: Please indicate the entire period the above named borrower has either been: 1. enrolled at your institution as at least a half-time student; or 2. actively serving in your organization I certify that the information in Section 1 is true and correct: **Indicate ALL DATES Attended / Served** From (Mo/Day/Yr): To (Mo/Day/Yr): Estimated Degree Date: SIGNATURE OF AUTHORIZED OFFICIAL: / / / / / / TITLE: DATE: / / SECTION 3 – FOR OFFICE USE ONLY Signature of Approving Officer: Title: Date: Approved Disapproved End Date Next Pay Due Loan No. Postponed To DUE AFTER THIS TRANSACTION: Principal Interest Late/Collection Charges Total Due Comments: / / INSTRUCTIONS FOR REQUESTING DEFERMENT OF REPAYMENT ON YOUR LOAN YOU are responsible for submitting the proper forms on time. YOU must provide the Student Loan Department with the appropriate forms if you wish to relieve yourself of the obligation to pay cash, or you will be required to make cash payment when due. A Late/Penalty Charge will be assessed if you fail to file properly completed forms in a timely manner. ACCOUNT MUST BE UP TO DATE PRIOR TO BEGINNING DATE OF SERVICE/ATTENDANCE Our proper mailing address is: UNIVERSITY OF ILLINOIS Student Loan Department 162 Henry Administration Building 506 S. Wright St. Urbana, IL 61801 Telephone Number: (217) 333-4849 Email: studentloans@uiuc.edu PERKINS STUDENT LOAN DEFERMENT A. B. C. You must be registered as at least a half-time student at a recognized institution of Higher Education. The school you are attending determines “HALF-TIME.” All payments must be up to date to the time of enrollment. On loans received prior to 11/7/1980, you will not receive another grace period if you have already used it prior to your re-enrollment. If you received your loans on or after 11/7/1980, you will receive a six month grace period after each eligible deferment period. DEFERMENTS FOR SERVICE IN THE MILITARY, PEACE CORPS, VISTA, OR IN A TAX EXEMPT ORGANIZATION, THE COMMISSIONED CORPS OF U.S. PUBLIC HEALTH SERVICE, OR THE NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION --- Does not apply to loans made after 7/1/1993. A. If eligible, your deferment begins only after your grace period has expired. On loan(s) received prior to 11/7/1980, you will not receive another grace period after your term of service. On loans received on or after 11/7/1980, you will receive a six month grace period after your term of service. B. The maximum period of deferment is THREE YEARS. INTERNSHIP PROGRAM --- Deferments granted ONLY on loans received on or after 11/7/1980 and only if required in order to receive professional recognition in order to begin practice or service. Does not apply on loans made after 7/1/1993. A. A letter, on official letterhead, from an authorized official stating dates and purpose of program must accompany form. B. Maximum period of deferment is TWO YEARS. (NOT ALL INTERNSHIP PROGRAMS QUALIFY FOR THIS BENEFIT). C. Deferment begins after original grace period expires. You will receive a six month grace period at the end of deferment. FOR ALL LOANS MADE ON OR AFTER 11/7/1980 THROUGH 6/30/93 Temporarily totally disabled as established by an affidavit of a physician or unable to be employed because of providing continuous care of spouse who is totally disabled up to 3 years. ONLY FOR LOANS MADE TO FIRST TIME BORROWERS ON OR AFTER 7/1/1987 THROUGH 6/30/1993 A. Temporarily totally disabled as established by an affidavit of a physician or unable to be employed because of providing continuous care of dependent who is disabled. 3 year maximum deferment. B. Pregnant, caring for a newborn or caring for a child immediately after placement of the child through adoption and is not attending an eligible institution of higher education or gainfully employed, not to exceed 6 months and begin no later than 6 months after borrower was at least a half-time student at a recognized institution of higher education. C. A mother of preschool age children who is entering the workforce and is being compensated at a rate which is not more than $1.00 over the minimum hourly wage --- not to exceed 1 year. D. A six month grace period follows these deferments. FOR ALL LOANS A. Upon written request, the Institution may grant a borrower forbearance of principal and interest or principal only, renewable at 12-month intervals for a period not to exceed three years (36 months), if --a. The borrower’s debt burden equals or exceeds 20% of such borrower’s gross income; or b. The institution determines that the borrower should qualify for other reasons. Please call (217)333-5395 for information and forms. B. Enrolled and in attendance as a regular student in a course of study that is part of a graduate fellowship program approved by the Secretary, or engaged in graduate or post-graduate fellowship supported study (such as a Fulbright grant) outside the United States, or enrolled and in attendance in a course of study that is part of a rehabilitation program training program for disabled individuals. A six month grace follows this deferment. No limit. UNIVERSITY LONG-TERM LOAN(S) (UILT) Repayment of a University Long-Term Loan will be deferred if the borrower reenrolls as at least a half-time student at a recognized institution or higher education PROVIDED the required forms are completed and submitted. You should notify your cosigner (if you have one) of this “Request for Deferment of Repayment.” Note: Principal only will be deferred, you will be responsible for all interest accrued unless you are registered at the U of I at Urbana-Champaign Campus. Interest will be billed monthly. HEALTH PROFESSIONS STUDENT LOAN DEFERMENT (HPSL/LDS) Student Status: If you cease to be a full-time student pursuing an eligible course of study, but reenter the same or another health professions school (in a health discipline covered by the HPSL program) as a full-time student within the grace period, the grace period is not considered to have begun. The repayment period does not begin until you have been away from an eligible course of study continuously for the full duration of the grace period. When you transfer from one health professions school to another health professions school as a full-time student within the grace period, you must file a request for deferment form with the school from which you received a Health Professions Student Loan in order to maintain your student status until you cease to pursue an eligible course of study at any health professions school. DEFERMENTS --- On All Loans Once the repayment period has begun, you may be eligible for deferment for the following reasons: 1. Up to three years as a volunteer in the Peace Corps. 2. Up to three years as a member on full-time active duty in the Navy, Army, Air Force, Marine Corps, Coast Guard, National Oceanic Atmospheric Administration Corps or U.S. Public Health Service. 3. Periods of advanced professional training, including internships and residencies in the field of Veterinary Medicine. ADDITIONAL DEFERMENT BENEFITS ON LOANS MADE ON OR AFTER 10/22/1985 Periodic installments of principal and interest need not be paid and interest shall not accrue if you: 1. 2. Leave the institution, with the intent to return as a full-time student, to engage in a full-time educational activity which is directly related to the health profession for which you are preparing as determined by the Secretary of Health and Human Services, for up to two years; or Participate in a fellowship training program or a full-time educational activity which is directly related to the health profession for which you have prepared at the institution, and are engaged in, within 12 months after the completion of your participation in advanced professional training described in 3 above or prior to the completion of your participation in such training, for up to two years. ADDITIONAL DEFERMENT BENEFITS ON LOANS MADE ON OR AFTER 11/4/1988 Periodic installments of principal and interest need not be paid if you return to a fulltime course of study of Veterinary Medicine at a health profession school eligible for participation in the USPHS Student Loan Program from which you borrowed. USPHS PROGRAM LOAN REPAYMENTS You could be eligible for loan repayments by the USPHS program if you fail to complete your studies or if you practice your profession in a shortage area. Contact the Student Loan Department for more information on these subjects. For further clarification, please contact your lending institution. To claim deferment, a request for deferment form must be submitted: a. when your first installment is due during deferment status b. annually thereafter, and c. upon termination of such status