inflation - pantherFILE

advertisement

210

VIII

INFLATION

Inflation deals with the purchasing power of dollars. Over a period of time, cost of most goods and

services increase. As an example, following data shows approximate prices paid for a typical lunch in a fast

food restaurant over a period of 25 years.

1974

1984

1994

Hamburger

0.30

0.45

0.59

French fries

0.25

0.40

0.55

Soft drink

0.30

0.45

0.69

The increase in the amount paid for the hamburger, 0.30 to 0.59, is due to inflation as we have to pay

$0.29 more to buy the same hamburger in 1994 than in 1974.

As stated earlier, in general, we have to pay more to buy same goods or services but this is not true

for all items. Personal computers are a good example. Prices of computers is actually declining. Same is true

for many electronic goods; color TVs and VCRs etc.

8.1

MEASURING INFLATION

Inflation is measured by changes in the consumer price index, CPI. The consumer price index, and

inflation rates are reported annually by the Federal Government. The consumer price index is calculated

by determining the cost of a basket of same items, approximately one thousand, periodically. The cost of the

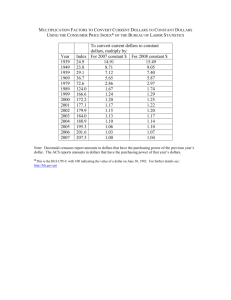

basket, relative to the cost of the same basket at some fixed point in time, is the CPI. Table 8.1.1 shows CPI

211

values with a base value of 100 in between 1983 and 1984. The cost of this basket at the end of 1988 was

118.3. Producer price index are also reported by the Federal government and can be used but CPI is more

commonly used in determining inflation rates.

Table 8.1.1

CPI and Annual Inflation Rates

Year

CPI

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

99.6

103.9

107.6

109.6

113.6

118.3

124.0

130.7

136.2

140.3

144.5

148.2

Inflation Rate

3.21

4.32

3.56

1.86

3.65

4.14

4.82

5.40

4.21

3.01

2.99

2.56

Source: Bureau of Labor Statistics, Washington D.C., US Govt. Printing Office

The annual inflation rate, for year (t+1), is calculated as follows:

Inflation Rate for year (t+1) = {CPI(t+1) - CPI(t)}/{CPI(t)}

(8.1.1)

For example, the inflation rate for 1988 is calculated as follows:

Inflation Rate for year 1988 = {CPI(1988) - CPI(1987)}/{CPI(1987)

= {118.3 - 113.6}/{113.6}

= 4.14%

In engineering economy studies, as the life of projects is generally more than one year, average

inflation rate for the life of a project is used. This simplifies calculations. The average inflation rate, f, can

be calculated as follows:

212

CPIf = CPIi (F/P, f, N) = CPIi (1+ f )N

(8.1.2)

where

CPIf = Consumer price index at the end of the final year

CPIi = Consumer price index at the start of the initial year

The value of CPIf, in Eq. (8.1.2), is found by using the factor (F/P, i, N). Here, P = CPIi is known

and F = CPIf is to be determined. Appropriate interest rate is the inflation rate, f. As both CPIf and CPIi are

known, Eq.(8.1.2) can be solved for the unknown average inflation rate, f. Average inflation rate for three

years, 1985 to 1986, and 1987 is calculated as follows:

CPIi = CPI(1984) = 103.9

CPIf = CPI(1987) = 113.6

Substituting these values in Eq. (8.1.2), we get

113.4 = 103.9(1 + f )3

or

8.2

f = 3.01%

ACTUAL AND CONSTANT DOLLARS

Actual are constant dollars are defined as follows:

Actual Dollars: These are out of pocket dollars used in daily transactions. Examples are: pay $350

this month on May 15th for car payment; deposit $200 in a savings account today.

Constant Dollars: These are hypothetical dollars which have same buying power at some base

point in time as future actual dollars.

If annual inflation rate is known then actual dollars can be converted to constant dollars and vice

versa. If f is the annual inflation rate (average inflation rate) and elapsed time period between actual and

constant dollars is N years, then constant dollars can be determined by following equation

Constant dollars = Actual dollars (1 + f ) -N

(8.2.1)

213

or

Constant dollars = Actual dollars (P/F, f, N)

Eq.(8.2.1) can be solved for finding actual dollars as follows:

Actual dollars = Constant dollars (1 + f )N

or

(8.2.2)

Actual dollars = Constant dollars (F/P, f, N)

Following examples illustrate the meaning and conversion of actual and constant dollars.

Example 8.2.1

Cost of a new standard three bedroom home in a subdivision in 1995 is $96,750.

What was the cost of this home in 1991? Assume annual inflation rate of 5% for such homes in this

subdivision.

Solution: We need to find constant dollar equivalent of $96,750 with base in 1991. The cost of home

in 1995 is in actual dollars and the elapsed time between actual dollars (1995) and constant dollars (1991)

is four years. Using Eq.(8.2.1) we get

Constant dollars = Actual dollars (1 + f)-N

= 96,750(1 + 0.05) -4

= $79,596.23

The cost of purchasing this home in 1991 was $79,596.23 and it is lower. The increase to $96,750

in 1995, four years, is due to inflation at the rate of 5% per year. In other words, it takes only 79,596.23

constant dollars or (1991) dollars to buy the home which costs $96,750 in 1995 (now).

Example 8.2.2 A person is planning to a buy a new car in two years. The cost of the car now

(1992) is $12,500. How much the person will expect to pay for this same car in two years if annual inflation

rate is 4%?

Solution: We need to find the actual dollar equivalent of the cost of the new car. Using Eq.(8.2.2)

Actual dollars = Constant dollars (1 + f)N

214

= Constant dollars (F/P, f, N)

= 12,500 (F/P, 4, 2)

= 12,500(1.082)

= $13,525.00

The person will have to pay $13,525.0 (actual dollars) in two years to buy the same car.

It should be pointed out that the constant dollar amount is same as long as the base point remains the

same. For Example 8.2.2, the base point is 1992. The cost of car is $12,500 in 1992. In 1992, actual and

constant dollars both are $12,500. The actual and constant dollar (base 1992) cost of this car for several

years is shown below:

Year

Constant Dollar

Actual Dollar

1992

$12,500

$12,500

1993

12,500

12,500(F/P, 4, 1) = 13,000.00

1994

12,500

12,500(F/P, 4, 2) = 13,525.00

1995

12,500

12,500(F/P, 4, 3) = 14,062.50

Note that the constant dollar cost of this car is $12,500 if the base point is 1992. However, if the base

point changes, the cost of car in constant dollars will also change. For example, the constant dollar cost of the

car, if base point is 1993, is $13,000.

8.3

EQUIVALENCE CALCULATIONS

Equivalence calculations can be done using either actual or constant dollars. If actual dollars are used

interest rate, i, is used. However, if constant dollars are used then an inflation free interest rate, i', should be

used. An expression for i' is derived in Section 8.3.2. In using any of these methods, all the cash flows must

215

be same type, all actual or all constant dollars.

8.3.1

Equivalence Using Actual Dollars

The first step is to convert all the cash flows to actual dollars. After this, factors or interest formulas

with an interest rate of i are used in equivalence calculations.

Example 8.3.1 A family of four is planning to take a vacation in five years. The cost of vacation

is $2,000 now. They are planning to save for it by making four equal annual deposits (A) with first deposit

at t = 1 (end of the 1st year). The bank pays 6% compounded yearly. If annual inflation rate is estimated to

be 5%, how much should be deposited every year to provide for this vacation?

Solution: The amount of equal annual deposit (A) can be obtained by equating the cost of vacation

to the value of the deposits at the end of the 5th year.

The first step is to convert all cash flows to actual dollars. The four deposits will be made at the end

of the 1st, 2nd, 3rd, and 4th years. These are all actual cash flows as the deposits are made from out of

pocket dollars. The cost of vacation, $2,000, is at t = 0 or in constant dollars. Using t = 0 as the base, cost of

vacation at t = 5 (actual dollars) can be calculated using Eq. (8.2.2)

Actual dollar cost of vacation at the end of the 5th year = Constant $ (F/P, 5, 5)

= 2,000(1.276)

= $2,552

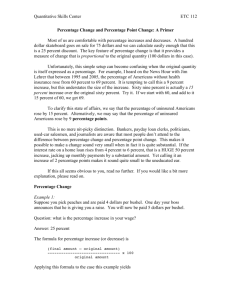

Now all the cash flows, deposits as well as the cost of vacation are in actual dollars. A cash flow

diagram is shown in Fig. 8.3.1. We equate the values of deposits and cost of vacation at t = 5 using i = 6%

compounded yearly and solve for A.

2,552 = A(F/A, 6, 4)(F/P, 6, 1)

= A(4.375)(1.06)

or

A

= $550.30

216

Annual deposits of $550.30 for four years in the bank will provide enough money for the vacation

which will be taken at the end of the 5th year.

2,552

1

2

3

4

A

8.3.2

5

Figure 8.3.1 Actual Dollar

Cash Flows for Example 8.3.1

A

Using Constant Dollars

In using constant dollars, the first step is convert all actual dollars to constant dollars. This can be

done by using Eq.(8.2.1). For carrying out equivalence calculations, inflation free interest rate, i', is used. The

derivation of a formula for determining i' follows:

As stated earlier, there are two different ways for calculating equivalent cash flows. One is to work

in actual dollars and use i as the interest rate and the other is to use constant dollars and i' as the interest rate.

To derive an expression for i', the inflation free interest rate, we find the value of F at t = N for a given

amount P using both the methods . The following terminology will be used.

(i)

PA

= Amount at t = 0 in actual dollars

PC

= Amount at t = 0 in constant dollars

FA

= Amount at t = N in actual dollars

FC

= Amount at t = N in constant dollars or constant $ equivalent of FA .

Using actual dollars and i as the interest rate we find F given P.

FA = PA (F/P, i, N)

(8.3.1)

217

(ii)

Using constant dollars and i', we find F given P as follows:

FC = PC(F/P, i', N)

(8.3.2)

The constant dollar equivalent of FA is FC. Using Eq.(8.2.1) and annual inflation rate, f, the value of

FC is

FC = FA (P/F, f, N)

(8.3.3)

The two values of FC from Eqs.(8.3.3) and (8.3.2) can be equated.

FA (P/F, f, N) = PC(F/P, i', N)

or

FA

= PC(F/P, i', N)(1.0/(P/F, f, N))

(8.3.4)

Equating the two values of FA from Eqs.(8.3.4) and (8.3.1), we get

P C(F/P, i', N)(1.0/(P/F, f, N)) = PA (F/P, i, N)

(8.3.5)

It should be noted that P A is equal to P C as at the base point, t = 0, actual dollars and constant dollars

are same. Solving for (F/P, i', N) from Eq.(8.3.5), we get

(F/P, i', N) = (F/P, i, N)(P/F, f, N)

Substituting the interest formulas for all the factors

(1 + i')N

= (1 + i)N (1 + f)-N

or

(1 + i')

= (1 + i)/(1 + f)

or

i'

= {(1 + i)/(1 + f)} - 1

(8.3.6)

Eq.(8.3.6) allows us to calculate inflation free interest rate, i' when i and f are known.

Example 8.3.2

Using constant dollar analysis, determine the amount of equal annual deposit in

Example 8.3.1.

Solution: The first step is to convert all actual dollars to constant dollars. Note that all four deposits

are in actual dollars and should be converted to constant dollars using Eq.(8.2.1). The cost of vacation, $2,000,

at t = 5 is already in constant dollars.

218

Constant $ equivalent of first unknown A = Actual dollar(P/F, f, 1)

= A(P/F, 5,1)

= (0.9524)A

Similarly, for remaining three equal deposits

Constant $ equivalent of 2nd A = A(P/F, 5, 2) = (0.9070)A

Constant $ equivalent of 3rd A = A(P/F, 5, 3) = (0.8638)A

Constant $ equivalent of 4th A = A(P/F, 5, 4) = (0.8227)A

A cash flow diagram with all cash flows (dollars) is shown in Fig. 8.3.2.

2,000

1 2

3

4

5

0.8227 A

0.9524 A

Next, equate the value of deposits to the cost of vacation at t = 5 using inflation free interest rate, i'.

Inflation free interest rate, i' ,is determined using Eq. (8.3.6).

i' = {(1 + i))/(1 + f)} - 1

= {(1+0.06)/(1+0.05)} - 1

= 0.0095 or 0.95%

Equating the value of deposits to the cost of vacation at t = 5, we get

2,000 = [(0.9524)A(F/P, 0.95,4) + (0.9070)A(F/P,0.95,3) + (0.8638)A(F/P,0.95,2)

+(0.8227)A(F/P,0.95,1)]

For each of the factor, the interest formula is used to find its value as the value of the factor for

0.95% is not tabulated. Solving for A, we get

A

• $502

219

Note that this answer is approximately the same as obtained using actual dollar analysis. However,

the amount of calculations needed in the constant dollar analysis are more than the actual dollar analysis.

Example 8.3.3

A 40 year old man is trying to save for his retirement. He has estimated that he

will need $35,000 per year for 5 years, in today’s dollars, starting at the age of 61 years. The money for

retirement will be saved by making twenty equal annual deposits with first deposit at t =1 or at the age of

41 years. If inflation rate is 4% and bank will pay 10% interest compounded annually, how much money

should be deposited each year so that the man will meet his retirement needs.

Solution:

This problem, like equivalence problems without inflation, can be solved in many

different ways.

1st Method:

Use actual dollars and interest rate i: A cash flow diagram for this problem is

shown in Fig. 8.3.3.

35,000

1 2

21

A

A

35,000

25

Figure 8.3.3 Cash Flow

Diagram for Example 8.3.3

Note that deposits, A, are actual dollars while withdrawals of $35,000 are constant dollars with

base at t = 0. These constant dollars are converted to actual dollars using Eq. (8.2.2).As the values of

factor for 21, 22, 23 and 24 years are not tabulated, we use either the interest formulas or product of two

factors from the table. Using the product of two factors,

220

At t = 21; Actual dollars

= 35,000 (F/P, 4, 21)

= 35,000(F/P, 4, 20)(F/P,4,1)

= 79,752.4

Similarly;

t = 22; Actual dollars = 35,000(F/P, 4, 22) = 82,973.2

t = 23; Actual dollars = 35,000(F/P, 4, 23) = 86,270.6

t = 24; Actual dollars = 35,000(F/P, 4, 24) = 89,721.5

t = 25; Actual dollars = 35,000(F/P, 4, 25) = 93,310.0

The meaning of the actual dollars of $93,325.6 at t = 25 is that at the age of 65 years, the man will

need $93,325.6 to purchase same goods/services as he could for $35,000 at t = 0 or at the age of 40

years.

Now both the deposits and withdrawals are in actual dollars. Equating the values of deposits and

withdrawals at t = 20 , we get

A(F/A, 10, 20) = 79,752.4(P/F, 10, 1) +........ + 93,325.6(P/F, 10, 5)

Solving for A

A = $5,676.30

The man will need to deposit $5,676.3 for 20 years to meet his retirement needs.

2nd Method: Use constant dollars and i': Withdrawals of $35,000 are constant dollars. We need

to convert the 20 annual deposits(A) to constant dollars. Eq. (8.2.1) is used for each A. For example

First A at t = 1; Constant dollar = A(P/F, 4, 1) = 0.9615A

2nd A at t = 2; Constant dollar = A(P/F, 4, 2) = ).9246A

Similarly, we find constant dollar equivalent for all A's.

221

Next, find inflation free interest rate, i', using Eq. (8.3.6)

i' = {(1+i)/(1+f)} - 1

= {(1+0.10)/(1+0.04)} - 1

= 0.0576

We equate the value of deposits and withdrawals at t = 20 as follows:

0.9615A(F/P, 5.76, 19) + 0.9246(F/P, 5.76, 18) +....... = 35,000(P/A, 5.76, 5)

Solving for A, we get

A = $5,676.3

3rd Method:

Use a combination of actual and constant dollars: In some cases, this may provide

a better solution.

We first use constant dollars, $35,000, and find their equivalent value at t = 20. Note that as these

are constant dollars for equivalence i' should be used. Let this value we PC20 (present value in constant

dollars at t =20)

PC20 = 35,000(P/A, 5.76, 5)

= 149,100

Next we convert this constant dollar equivalent to actual dollars at t = 20.

Actual dollars at t = 20; Actual PA20 = PC20(F/P, 4, 20)

= 149,100(2.191)

= $326,678.1

It should be pointed out that N = 20 is used because base for all the constant dollars is at

t = 0.

222

Next we equate value of deposits, A, and withdrawal of $326,678.1 at t = 20 using i = 10%.

A(F/A, 10, 20) = 326,678.1

or

A = $5,703.6

This value of A is little bit different because the value of the factor for i' = 5.76% is not tabulated

and interpolation was used.

223

PROBLEMS

8.1

Using Table 8.2.1 determine the following:

(a) Average inflation rate for three years, 1988 to 1990, using CPI values. (4.79%)

(b) Average inflation rate for four years, 1990 to 1993, using CPI values.

8.2

The cost of a standard lawn mower in 1992 was $650. The average inflation rate is estimated to

be 5%. Determine the cost of this lawn mower in 1994 and 1995. (716.53; 752.46)

8.3

The cost of a new motorcycle is $24,600 in 1997. If annual inflation rate is 4.5%, determine the

constant dollar prices of this motorcycle with bases in 1992 and 1994.

8.4

Determine inflation free interest rates for following:

(i) Inflation rate = 8% and interest rate = 10%

(ii) Inflation rate = 5% and interest rate = 7%

8.5

A new college graduate is planning to save a fixed percentage of her salary to buy a new car five

years from now (t=5). The car presently costs $9,000 and its price is expected to increase at the rate of

inflation (8% per year). The first deposit will be made one year from now and her present salary of

$30,000 per year will be assumed to occur at t=0. She expects her salary to increase at the rate of inflation.

If she can earn 14% per year compounded annually, what fixed % of her salary must be saved each year

(for 5 years) for purchase of the car. Solve using:

(i) Actual dollar analysis. (5.37%)

(ii) Constant dollar analysis.

8.6

A young couple with a 9 year old son (now t=0) wants to save for their son's college expenses in

advance. He will start college at the age of 18 years ( t = 18). It is estimated that $6,000 per year in terms

of today's dollars (constant $) will be required to support his college expenses for four years. Inflation rate

will be 8% per year and savings can earn 12% per year compounded annually. Determine the equal

amount this couple must save each year for the college expenses. (First deposit at t=0, last deposit t=9, and

first withdrawal at t=9).

224

APPENDIX A

INTEREST FACTORS