The Courant Institute

advertisement

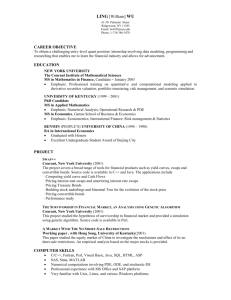

Class of 2012 Summer Internship Resume Book Mathematics in Finance M.S. Program Courant Institute of Mathematical Sciences New York University April 26, 2012 For the latest version, please go to http://math.nyu.edu/financial_mathematics Job placement contact: Michelle Shin, (212) 998-3009 shin@cims.nyu.edu New York University A private university in the public service U Courant Institute of Mathematical Sciences Mathematics in Finance MS Program 251 Mercer Street New York, NY 10012-1185 Phone: (212) 998-3104; Fax: (212) 995-4195 Dear Colleague, Attached are the resumes of second semester students in the Courant Institute's Mathematics in Finance Master's Program. We encourage you to consider them for internship positions at your firm during the summer of 2012. These are full-time students, who will graduate from our Master’s program in December 2012. We believe ours is the most elite, the most capable, and the best trained group of students of any program. We admitted less than 10% of those who applied to be a part of this class. Their resumes describe their distinguished backgrounds. For the past five years we have a placement record nearing 100% both for summer internships and full-time positions – even during the recent financial crisis. They enter into front office roles such as trading or risk management, both on the buy and the sell side. Their computing and hands on practical experience make them productive from day one. The curriculum is dynamic and challenging. For example, the first semester investments class does not end with CAPM and APT, but is a serious data driven class that examines the statistical principles and practical pitfalls of covariance matrix estimation. During the second and third semesters electives include classes such as algorithmic trading strategies, interest rate and foreign exchange, credit markets and models, corporate finance, times series models, advanced risk management, and energy and mortgage backed securities. Instructors are high level industry professionals and faculty from the Courant Institute, the top ranked department worldwide in applied mathematics. You can find more information about the curriculum and faculty at the end of this document, or at http://math.nyu.edu/financial_mathematics/. Sincerely yours, Peter Carr, Executive Director Bob Kohn, Chair Petter Kolm, Director Weihui Chee 311 E 3rd Street, New York, NY10009 Tel: 646 309 2148 Email: weihui.chee@nyu.edu EDUCATION NEW YORK UNIVERSITY New York, NY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance (expected – December 2012) Fall 2011 coursework: Black Scholes model, Option pricing and hedging, Risk-neutral valuation, the Greeks, Mean-variance analysis, Monte-Carlo simulations, VAR, Principal component analysis and Brownian motion Spring and Fall 2012 coursework: Active portfolio management, Quantitative investment strategies, Timeseries analysis and statistical arbitrage, Continuous time finance and Advanced risk management Projects: Optimized portfolios by constructing efficient frontiers of S&P500 index data that are cleaned with a Hampel filter Performed principal component analysis on treasury rates of various maturities, S&P500 index returns and volume data, and analyzed the results NATIONAL UNIVERSITY OF SINGAPORE (2001-2005) Singapore, Singapore Honors Degree in Physics (First class) with a minor in Mathematics. GPA 4.55/5 Awarded the Lijen industrial medal for best honors year project, “Wave-particle duality in multi-path interferometers” Publication: “Wave-particle duality in multi-path interferometers: General concepts and three-path interferometers”, B.-G Englert, D. Kaszlikowski, L.C. Kwek and W.H. Chee, International Journal of Quantum Information, 6.1 (2008) 129-157 EXPERIENCE UNITED OVERSEAS BANK Singapore, Singapore Credit Risk (Manager: January 2011-July 2011) Performed stress testing on bank’s portfolio with Visual Basic to assess potential losses from plausible adverse economic events Implemented and enhanced bank’s Economic Capital model with Visual Basic and SAS to ensure economic solvency of bank (Senior Officer: August 2010-December 2010) Developed and maintained the Enterprise Risk Management system for managing all risks of the bank simultaneously, together with the market risk and liquidity risk departments MINISTRY OF EDUCATION Singapore, Singapore Research and Evaluation Officer (June 2006-July 2010) Analyzed data with SAS to evaluate and to table key policy findings for senior management Lectured and tutored high school students for the GCE “A” level physics examinations SKILLS Programming languages: Visual Basic (VBA), SQL and Java Other software: Bloomberg, Matlab, SAS and Mathematica OTHERS Passed level 1 and level 2 of the Chartered Financial Analyst (CFA) examinations Li Jun Chen 53 E. 97th St. Apt 2C New York, New York 10029 (602) 400-4856 lj663@nyu.edu EDUCATION NEW YORK UNIVERSITY New York, NY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance (expected – January 2013) Finance: The theory and practice of portfolio management, Black-Scholes formula and its applications, advanced risk management techniques, index and ETF arbitrage, statistical arbitrage, volatility arbitrage, interest-based derivatives Computing: Java programming with applications in financial asset trading, hedging, and portfolio management. Mathematical analysis of numerical algorithms and practical problem solving in Matlab Math: Topics in Bernoulli trials and random walk, law of large numbers and central limit theorem, conditional expectation and martingales, etc. Future courses: Time Series, Computational Methods in Finance, Financial Engineering Models ARIZONA STATE UNIVERSITY (2008-2010) Tempe, AZ BS in Mathematics & BS in Finance, GPA: 3.97/4.0 Extensive course work in calculus, probability and statistics, differential equations, corporate finance, financial and managerial accounting, portfolio management and financial derivatives Detailed analysis of Enron Corporations’ Weather Derivatives case, including analysis of historical weather pattern, profit and loss analysis for swaps, caps and floors and the company’s risk tolerance to decide on the most suitable derivative contract to hedge cold weather EXPERIENCE Arizona State University Registrar’s Office Tempe, AZ Office Assistant (2008-2010) 20 hours/week Assisted students in registration related activities and handled confidential information Mercer Government Human Services Consulting Phoenix, AZ Health & Benefits Intern (summer 2009) Used Chronic Illness and Disability Payment System and Medicaid Rx model for risk adjustment project for Pennsylvania State Medicaid program to adjust capitated payments; developed models and analyzed data using Microsoft Excel and Access for clients Reviewed teammates’ models to ensure quality Generated $15,000 in revenue in 3 months based on billable hours COMPUTER SKILLS Programming languages: Java, Matlab Other Software: Microsoft Office OTHER Native speaker in both Mandarin Chinese and Cantonese Secretary of Christians on Campus at Arizona State University Yilin Dai 1347 64th Street, Brooklyn, NY, 11219; (616)309-6966; yd489@nyu.edu EDUCATION NEW YORK UNIVERSITY (expected – January 2013) New York, NY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance Fall courses: Brownian motion, Stochastic Calculus, Black-Scholes model, Finite-difference method, Options Pricing, CAPM, Portfolio Optimization, Econometrics, Monte Carlo Simulation Spring Courses: Market impact models, Optimal betting and execution strategies, Interest rate models, FX derivatives, Static and dynamic hedges, Statistical arbitrage, Back-testing MICHIGAN TECHNOLOGICAL UNIVERSITY (expected –October 2012) Houghton, MI PhD candidate (ABD) in Statistics Dissertation: Statistical methods for multi-marker testing in genetic association studies Four publications. Research focuses on multiple testing and statistical genetics Selected Coursework : Mathematical Statistics, Regression Analysis, Applied Multivariate Statistics, Computational Statistics, Mixed Models, Numerical ODEs, Numerical Optimization Outstanding Research Award, Department of Mathematical Sciences, 2009 BEIJING FORESTRY UNIVERSITY (2003-2007) BS in Mathematics and Applied Mathematics, Department of Science Beijing, China PROJECT First Annual Academic Competition of International Association of Financial Engineers Team Captain, Honorable mention, top 3 among 27 teams. (November-December, 2011) Performed literature reviews of sovereign credit risk models. Organized group meeting. Generated modeling idea. Guided data collection of sovereign CDS spread and macro econometric factors. Developed a hybrid model based on the contingence claim method and factor model. Applied it to the case studies of Greece and California. Contributed in manuscript drafting. Computing in Finance (in Java) (Fall, 2011) Implemented portfolio framework with iterator and observer pattern, capable to subscribe to market feed Constructed simulation pricing framework for European, Barrier and Asian options, capable to interact with database MySQL and Redis. Implemented multithreading for sample path simulation. Built an order book with good-till-cancelled mechanic in tree structure. Had exposure to the TAQ data EXPERIENCE Van Andel Institute Grand Rapid, MI Biostatistics Intern, Lab of Neurogenetics and Canine Behavior (September -December, 2010) Pursued statistical strategies for dog genetic mapping. Designed and developed automatic workflow pipeline for genome-wide association studies on inherited traits of domestic dogs in R and Perl University of Southern California Biostatistics Intern, Bioinformatics Support Program (June-August, 2010) Los Angelas, CA Designed and developed graphical user interface in R for microarray data analysis. Software is released in campus. Manuscript is submitted for publication. COMPUTER SKILLS Programming languages: proficient in Java, R, Matlab; moderate in C++, SAS, VBA, MySQL Operating Systems: Window, Linux WON KOOK KIM 33 3rd Avenue, RM3J2 New York, NY, 10003 (646) 203-6319 / w.kim@nyu.edu EDUCATION NEW YORK UNIVERSITY New York, US The Courant Institute of Mathematical Science M.S. Mathematics in Finance (expected – December 2012) GPA : 3.85/4.0 Quantitative Finance : Options, Futures, Black-Scholes Model, Mean-Variance Optimization, CAPM, BlackLitterman Model, Ito Calculus, Monte Carlo Simulation, Finite Difference Method Current/Future Coursework : Interest Rate & FX Models, Quantitative Investment Strategies, Continuous Time Finance, Scientific Computing, Credit Markets and Models, Time Series Analysis Academic Projects : Built LIBOR/OIS curves using B-splines; constructed efficient frontier using 500 stocks; implemented multi-threaded Monte Carlo simulation; backtested correlation decay of a LETF and its inverse KOREA UNIVERSITY Seoul, S. Korea B. Economics, B. Financial Engineering, and B.S. Mathematics (February 2011) Overall GPA : 4.23/4.5, Math GPA : 4.47/4.5 Extensive coursework in economics and mathematics including Micro/Macroeconomics, Econometrics, Probability and Statistics, Real Analysis, and Stochastic Processes Studied and implemented the Least Squares-Monte Carlo method using C++ at the Financial Engineering Lab One-year exchange program at the University of London, SOAS (September 2004 ~ June 2005) EXPERIENCE UBS AG Seoul, S. Korea Intern, FICC Trading (March 2011 – June 2011) Assisted rates traders with booking bonds, IRS, CCS, and FX deals and communicating with back office Developed Excel spreadsheets that extract market rates data from Reuter and summarized daily rates market issues in South Korea Researched the impact of the Libyan political uprising in 2011 on the world economy and developed client presentation materials PCA ASSET MANAGEMENT Seoul, S. Korea Intern, Fixed Income (September 2009 – December 2009) Analyzed weekly changes in Korean government bond yield curve and conducted linear regressions to find relationships between yield spreads and market indices Prepared presentation materials for weekly fund strategy meetings; wrote daily reports on PCA’s bond funds to compare performances with market peers Analyzed changes in the CDS spreads of Korean financial firms using Bloomberg and updated weekly reports IRAQ PEACE & RECONSTRUCTION DIVISION, REPUBLIC OF KOREA ARMY Erbil, Iraq Corporal, Zaytun Vocational Training Center (February 2008 – September 2008) Served as an English-Korean interpreter and administered the car/generator maintenance center for civilians OTHER Programming language: Java, VBA Other software: MATLAB, MS Office(Excel,Word, PowerPoint) Languages : Korean(Native), English(Fluent) Zhiwei Min 30 Newport Parkway, Apt#2406, Jersey City, NJ 07310 Tel: (347) 342-7317 Email: zhiwei.min@nyu.edu EDUCATION NEW YORK UNIVERSITY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance (Expected – January 2013) § § § GPA: 3.85/4.0 Finance & Pricing: Forward, Future and Option (Vanilla & Exotic) Pricing & Trading Strategies, Greeks, Equity Linked Note, Variance Swap, CAPM, Black-Litterman Model Math & Statistics: Tower Property, Markov Chain, Martingale, Doob Stopping Time Theorem, Ito’s Lemma, SDE, Forward & Backward Equation, Girsanov Theorem, Linear Regression & Large Sample Property Future Coursework: Quantitative Investment Strategies & Hedge Fund, Continuous Time Finance, Interest Rate & FX Model, Advanced Risk Management WUHAN UNIVERSITY The School of Mathematics and Statistics BS in Mathematics and Applied Mathematics (September 2007 – June 2011) § § New York, NY Wuhan, China Major GPA: 95.0/100.0 (3.95/4.0), top one in mathematics out of 204 students Relevant Coursework: Probability, ODE, PDE, Real Analysis, Optimization, Functional Analysis, Numerical Analysis, Financial Mathematics EXPERIENCE STANDARD CHARTERED BANK (CHINA) LIMITED Summer Intern, Global Market (July 2010- August 2010) § § Beijing, China Conducted research on future trend of gold price under global economic circumstances, analyzed its demand, supply and relative price to USD, and made a positive forecast on gold appreciation under global economics background Gained exposure to bank operations and studied structure of Yield Enhancement Products linked to FX ACADEMIC PROJECTS Interest Rate Model (with Excel VBA) (Spring, 2012) § § Constructed OIS and LIBOR curves implied by interest rate swap, Euro Dollar and basis swap with B-Splines Implemented normal, lognormal and SABR swaption models, calibrated implied volatility respectively § § Builded a framework for Monte Carlo simulation, with variance reduction techniques implemented Priced barrier option with finite difference method and Monte Carlo simulation with time-dependent volatility; Discovered the reason why prices from these two methods were slightly different Option Pricing (with Java & Matlab) (Fall, 2011) WUHAN UNIVERSITY Arbitrage with CIS 300 Index Future (with Matlab) (Spring, 2011) § Analyzed stocks’ performance using 5 year real data; Constructed optimized portfolio under CAPM with positive Alpha and relatively stable Beta using Matlab; Completed strategy by shorting CIS 300 Index Future SKILLS § § Wuhan, China Programming Language & Software: Java, C, Matlab, Excel VBA Languages: Manderin (native), English (fluent) Yitao Wang 1 River Court, Apt 3108, Jersey City, NJ, 07310 (917)-969-7183 yw888@nyu.edu EDUCATION NEW YORK UNIVERSITY The Courant Institute of Mathematical Sciences (GPA: 3.7/4.0) MS in Mathematics in Finance (expected – January 2013) Mathematics & Finance: Ito’s Calculus, Forward & Backward Equations, Options Pricing Theory, Black-Scholes Model, Greeks, Monte Carlo Simulation, CAPM, Black-Litterman Model, LMM Model Computing: Options Pricing using Monte Carlo and Trinomial Scheme(Java), Market impact model(Java), Data Cleaning, Portfolio Optimization, PCA & CAPM Back-testing(Matlab) NANJING UNIVERSITY (2007-2011) BS in Statistics and Applied Mathematics (GPA: 4.45/5.0 Ranking: 4/70) New York, NY Nanjing, China Relevant Courses: Time Series Analysis, Linear/non-linear Regression in Matlab, Basic Statistical Analysis in SAS and SPSS EXPERIENCE China Development Bank Summer Intern (July – August 2010) Nanjing, China Summarized government reports of Nanjing’s city construction to seek for potential need for loans in highway construction Provided supervisor basic statistical analysis of three highway construction companies’ financial statements to help measure their performance PROJECTS Risk & Portfolio Management (Matlab) Performed time series regression on CRSP and Fama-French factor data sets to test CAPM. Analyzed 15-year S&P 500 stocks’ returns using PCA Computing in Finance (Java) Built portfolio management framework for options, stocks and bonds Developed Monte Carlo option pricing program in REDIS and JSON Interest Rate & FX models (Excel&Matlab) Constructed instantaneous LIBOR/OIS forward rate curve using B-Spline Implemented pricing framework for fixed income derivatives based on the curve Quantitative Investment Strategies (Excel&Matlab) Studied the impact of US downgrade event on the short-short trading strategy of LETFs FAS/FAZ from July 2011 to March 2012 Back-tested contango trading and contrarian trading strategies of VXX/VXZ COMPUTER SKILLS Programming languages: Java (intermediate),C++ (basic) Other Software: Matlab (intermediate), Microsoft Office (intermediate) Qiaoxi Xu 60th Street Woodside Queens, NY 11377 (917)972-1056 xqx890404@gmail.com 3462 EDUCATION NEW YORK UNIVERSITY New York, NY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance (expected – December 2012) § Financial theory and modeling, covering topics ranging from binomial trees , Black-Scholes to CAPM and factor and principal-component models. § Strong mathematical background, covering topics such as the Brownian motion and the Ito calculus, statistical analysis of financial data, forward and backward equations. § Practical Financial applications, emphasizing trading and hedging strategies. § A broad range of software skills, and facility with computational methods such as optimization, Monte Carlo simulation, and the numerical solution of partial differential equations. RENMIN UNIVERSITY OF CHINA Beijing,China BS in Applied Mathematics (2007 - 2011) § Extensive coursework in applied mathematics including analysis, differential equations, algebra, probability, statistics and computer science. § Successive 4-year Scholarship for outstanding students in Renmin University of China . Cumulative GPA:3.77 Major GPA: 3.88 GRE:1540 § Second Prize for National Undergraduate Mathematical Contest § Exchange student to Victoria University of Wellington (2010 February--July) . EXPERIENCE § Internship in Shanghai Great Wisdom Co Ltd (2010 Summer) Chengdu,China - Research gathering from company and stock exchange report - Comprehensive data analysis using Excel and generating quantitative reports §Course Project in New York University (2011) New York,NY -Analyzed S&P 500 historical data and constructed optimal portfolios using CAPM - Built Object-oriented portfolio management framework and Constructed Monte Carlo based framework to price options with Java - Priced barrier options with changing volatility using vba code. COMPUTER SKILLS § Programming language: JAVA , VBA § Other software: MATLAB, Microsoft Office, SQL Server OTHER § Language: Mandarin(native) , English(fluent) The Mathematics in Finance Masters Program Courant Institute, New York University Academic Year 2011-2012 The curriculum has four main components: 1. Financial Theory and Econometrics. These courses form the theoretical core of the program, covering topics ranging from equilibrium theory to Black-Scholes to Heath-JarrowMorton. 2. Practical Financial Applications. These classes are taught by industry specialists from prominent New York financial firms. They emphasize the practical aspects of financial mathematics, drawing on the instructor’s experience and expertise. 3. Mathematical Tools. This component provides appropriate mathematical background in areas like stochastic calculus and partial differential equations. 4. Computational Skills. These classes provide students with a broad range of software skills, and facility with computational methods such as optimization, Monte Carlo simulation, and the numerical solution of partial differential equations. Track First Semester Second Semester Third Semester Advanced Risk Management ___ Interest Rate and FX Models ___ MBS and Energy Derivatives Practical Financial Applications Derivative Securities ___ Algorithmic Trading & Quant. Strategies ___ Risk & Portfolio Mgmt. with Econometrics Continuous Time Finance Mathematical Tools Stochastic Calculus PDE for Finance Computational Skills Computing in Finance Scientific Computing Financial Theory and Econometrics Fin. Eng. Models for Corp. Finance ___ Credit Markets and Models ___ Case Studies in Financial Modeling Project and Presentation ___ Time Series Analysis & Stat. Arbitrage Computational Methods for Finance Practical Training. In addition to coursework, the program emphasizes practical experience. All students do Masters Projects, mentored by finance professionals. Most full-time students do internships during the summer between their second and third semesters. See the program web page http://math.nyu.edu/financial_mathematics for additional information. MATHEMATICS IN FINANCE MS COURSES, 2011-2012 PRACTICAL FINANCIAL APPLICATIONS: G63.2753 ADVANCED RISK MANAGEMENT Spring term: K. Abbott Prerequisites: Derivative Securities, Computing in Finance or equivalent programming. The importance of financial risk management has been increasingly recognized over the last several years. This course gives a broad overview of the field, from the perspective of both a risk management department and of a trading desk manager, with an emphasis on the role of financial mathematics and modeling in quantifying risk. The course will discuss how key players such as regulators, risk managers, and senior managers interact with trading. Specific techniques for measuring and managing the risk of trading and investment positions will be discussed for positions in equities, credit, interest rates, foreign exchange, commodities, vanilla options, and exotic options. Students will be trained in developing risk sensitivity reports and using them to explain income, design static and dynamic hedges, and measure value-at-risk and stress tests. Students will create Monte Carlo simulations to determine hedge effectiveness. Extensive use will be made of examples drawn from real trading experience, with a particular emphasis on lessons to be learned from trading disasters. G63.2797 CREDIT MARKETS AND MODELS Fall term: V. Finkelstein Prerequisites: Computing for Finance, or equivalent programming skills; Derivative Securities, or equivalent familiarity with financial models; familiarity with analytical methods applied to Interest Rate derivatives. This course addresses a number of practical issues concerned with modeling, pricing and risk management of a range of fixed-income securities and structured products exposed to default risk. Emphasis is on developing intuition and practical skills in analyzing pricing and hedging problems. In particular, significant attention is devoted to credit derivatives. We begin with discussing default mechanism and its mathematical representation. Then we proceed to building risky discount curves from market prices and applying this analytics to pricing corporate bonds, asset swaps, and credit default swaps. Risk management of credit books will be addressed as well. We will next examine pricing and hedging of options on assets exposed to default risk. After that, we will discuss structural (Merton-style) models that connect corporate debt and equity through the firm’s total asset value. Applications of this approach include the estimation of default probability and credit spread from equity prices and effective hedging of credit curve exposures. A final segment of the course will focus on credit structured products. We start with cross-currency swaps with a credit overlay. We will next analyze models for pricing portfolio transactions using Merton-style approach. We also will discuss portfolio loss model based on a transition matrix approach. These models will then be applied to the pricing of collateralized debt obligation tranches and pricing counterparty credit risk taking wrong-way exposure into account. G63.2798 INTEREST RATE AND FX MODELS Spring term: L. Andersen and A. Lesniewski Prerequisites: Derivative Securities, Stochastic Calculus, and Computing in Finance (or equivalent familiarity with financial models, stochastic methods, and computing skills). The course is divided into two parts. The first addresses the fixed-income models most frequently used in the finance industry, and their applications to the pricing and hedging of interest-based derivatives. The second part covers the foreign exchange derivatives markets, with a focus on vanilla options and first-generation (flow) exotics. Throughout both parts, the emphasis is on practical aspects of modeling, and the significance of the models for the valuation and risk management of widely-used derivative instruments. G63.2796 MORTGAGE BACKED SECURITIES AND ENERGY DERIVATIVES Spring term: G. Swindle and L. Tatevossian Prerequisites: basic bond mathematics and bond risk measures (duration and convexity); Derivative Securities, Stochastic Calculus. The first part of the course will cover the fundamentals and building blocks of understanding how mortgage-backed securities are priced and analyzed. The focus will be on prepayment and interest rate risks, benefits and risks associated with mortgage-backed structured bonds and mortgage derivatives. Credit risks of various types of mortgages will also be discussed. The second part of the course will focus on energy commodities and derivatives, from their basic fundamentals and valuation, to practical issues in managing structured energy portfolios. We develop a risk neutral valuation framework starting from basic GBM and extend this to more sophisticated multifactor models. These approaches are then used for the valuation of common, yet challenging, structures. Particular emphasis is placed on the potential pitfalls of modeling methods and the practical aspects of implementation in production trading platforms. We survey market mechanics and valuation of inventory options and delivery risk in the emissions markets. G63.2709 FINANCIAL ENGINEERING MODELS FOR CORPORATE FINANCE Fall term: D. Shimko and B. Humphreys Prerequisites: Risk & Portfolio Management with Econometrics and Derivative Securities. This course covers advanced stochastic modeling applications in finance. Combining capital markets, corporate finance and statistical knowledge, this course uses simulation as a unifying tool to model all major types of market, credit and actuarial risks. Emphasis is placed on rigorous application of financial theory to the conceptualization and solution of multifaceted real-world problems. These problems arise in security design and risk management strategy. G63.2754 CASE STUDIES IN FINANCIAL MODELING Fall term: J. Dash This course will consist of five parts: (1) Securities Modeling (6 classes): Barrier Options, Exotic Options, CVR and other Deals, Path Integrals (Introduction). (2) Risk Modeling (4 classes): Fat Tail Volatility, Stressed Correlations, Stressed VAR and Economic Capital, 1001 Risks (Systems, Models, Data, Systemic). (3) Underlying Variables Modeling at both Long and Short Time Scales (1 class): The Macro Micro Model. (4) Student Presentations (1 class). (5) Guest Lecture (1 class). FINANCIAL THEORY AND ECONOMETRICS: G63.2791 DERIVATIVE SECURITIES Fall term: M. Avellaneda and Spring term: TBA An introduction to arbitrage-based pricing of derivative securities. Topics include: arbitrage; risk-neutral valuation; the log-normal hypothesis; binomial trees; the Black-Scholes formula and applications; the Black-Scholes partial differential equation; American options; one-factor interest rate models; swaps, caps, floors, swaptions, and other interest-based derivatives; credit risk and credit derivatives. G63.2792 CONTINUOUS TIME FINANCE Fall term: P. Carr and A. Javaheri and Spring term: B. Dupire and F. Mercurio Prerequisites: Derivative Securities and Stochastic Calculus, or equivalent. A second course in arbitrage-based pricing of derivative securities. The Black-Scholes model and its generalizations: equivalent martingale measures; the martingale representation theorem; the market price of risk; applications including change of numeraire and the analysis of quantos. Interest rate models: the Heath-Jarrow-Morton approach and its relation to shortrate models; applications including mortgage-backed securities. The volatility smile/skew and approaches to accounting for it: underlyings with jumps, local volatility models, and stochastic volatility models. G63.2751 RISK AND PORTFOLIO MANAGEMENT WITH ECONOMETRICS Fall term: P.Kolm and Spring term: M.Avellaneda Prerequisites: univariate statistics, multivariate calculus, linear algebra, and basic computing (e.g. familiarity with Matlab or co-registration in Computing in Finance). A comprehensive introduction to the theory and practice of portfolio management, the central component of which is risk management. Econometric techniques are surveyed and applied to these disciplines. Topics covered include: factor and principal-component models, CAPM, dynamic asset pricing models, Black-Litterman, forecasting techniques and pitfalls, volatility modeling, regime-switching models, and many facets of risk management, both theory and practice. G63.2708 ALGORITHMIC TRADING AND QUANTITATIVE STRATEGIES Spring term: P. Kolm and L. Maclin Prerequisites: Computing in Finance, and Capital Markets and Portfolio Theory, or equivalent. In this course we develop a quantitative investment and trading framework. In the first part of the course, we study the mechanics of trading in the financial markets, some typical trading strategies, and how to work with and model high frequency data. Then we turn to transaction costs and market impact models, portfolio construction and robust optimization, and optimal betting and execution strategies. In the last part of the course, we focus on simulation techniques, back-testing strategies, and performance measurement. We use advanced econometric tools and model risk mitigation techniques throughout the course. Handouts and/or references will be provided on each topic. G63.2707 TIME SERIES ANALYSIS AND STATISTICAL ARBITRAGE Fall term: F. Asl and R. Reider Prerequisites: Derivative Securities, Scientific Computing, and familiarity with basic probability. The term "statistical arbitrage" covers any trading strategy that uses statistical tools and time series analysis to identify approximate arbitrage opportunities while evaluating the risks inherent in the trades (considering the transaction costs and other practical aspects). This course starts with a review of Time Series models and addresses econometric aspects of financial markets such as volatility and correlation models. We will review several stochastic volatility models and their estimation and calibration techniques as well as their applications in volatility based trading strategies. We will then focus on statistical arbitrage trading strategies based on cointegration, and review pairs trading strategies. We will present several key concepts of market microstructure, including models of market impact, which will be discussed in the context of developing strategies for optimal execution. We will also present practical constraints in trading strategies and further practical issues in simulation techniques. Finally, we will review several algorithmic trading strategies frequently used by practitioners. G63.2755 PROJECT AND PRESENTATION Fall term and spring term: P. Kolm Students in the Mathematics in Finance program conduct research projects individually or in small groups under the supervision of finance professionals. The course culminates in oral and written presentations of the research results. MATHEMATICAL TOOLS: G63.2902 STOCHASTIC CALCULUS Fall term: J. Goodman and Spring term: A. Kuptsov Prerequisite: Basic Probability or equivalent. Discrete dynamical models: Markov chains, one-dimensional and multidimensional trees, forward and backward difference equations, transition probabilities and conditional expectations. Continuous processes in continuous time: Brownian motion, Ito integral and Ito’s lemma, forward and backward partial differential equations for transition probabilities and conditional expectations, meaning and solution of Ito differential equations. Changes of measure on paths: Feynman-Kac formula, Cameron-Martin formula and Girsanov’s theorem. The relation between continuous and discrete models: convergence theorems and discrete approximations. G63.2706 PARTIAL DIFFERENTIAL EQUATIONS FOR FINANCE Spring term: O. Buhler Prerequisite: Stochastic Calculus or equivalent. An introduction to those aspects of partial differential equations and optimal control most relevant to finance. Linear parabolic PDE’s and their relations with stochastic differential equations: the forward and backward Kolmogorov equation, exit times, fundamental solutions, boundary value problems, maximum principle. Deterministic and stochastic optimal control: dynamic programming, Hamilton-Jacobi-Bellman equation, verification arguments, optimal stopping. Applications to finance – including portfolio optimization and option pricing – are distributed throughout the course. COMPUTATIONAL SKILLS: G63.2041 COMPUTING IN FINANCE Fall term: E. Fishler and L. Maclin This course will introduce students to the software development process, including applications in financial asset trading, research, hedging, portfolio management, and risk management. Students will use the Java programming language to develop object-oriented software, and will focus on the most broadly important elements of programming - superior design, effective problem solving, and the proper use of data structures and algorithms. Students will work with market and historical data to run simulations and test strategies. The course is designed to give students a feel for the practical considerations of software development and deployment. Several key technologies and recent innovations in financial computing will be presented and discussed. G63.2043 SCIENTIFIC COMPUTING Fall term: M.Shelley and Spring term: A. Donev Prerequisites: multivariable calculus, linear algebra; programming experience strongly recommended but not required. A practical introduction to scientific computing covering theory and basic algorithms together with use of visualization tools and principles behind reliable, efficient, and accurate software. Students will program in C/C++ and use Matlab for visualizing and quick prototyping. Specific topics include IEEE arithmetic, conditioning and error analysis, classical numerical analysis (finite difference and integration formulas, etc.), numerical linear algebra, optimization and nonlinear equations, ordinary differential equations, and (very) basic Monte Carlo. G63.2045 COMPUTATIONAL METHODS FOR FINANCE Fall term: A. Hirsa Prerequisites: Scientific Computing or Numerical Methods II, Continuous Time Finance, or permission of instructor. Computational techniques for solving mathematical problems arising in finance. Dynamic programming for decision problems involving Markov chains and stochastic games. Numerical solution of parabolic partial differential equations for option valuation and their relation to tree methods. Stochastic simulation, Monte Carlo, and path generation for stochastic differential equations, including variance reduction techniques, low discrepancy sequences, and sensitivity analysis.