JOHN SMITH - New York University > Courant Institute

advertisement

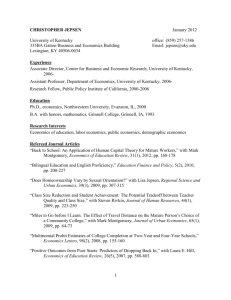

LING [William] WU 61-30 Palmetto Street Ridgewood, NY 11385 Email: lw429@nyu.edu Phone: 1-718-386-3878 CAREER OBJECTIVE To obtain a challenging entry-level quant position/ internship involving data modeling, programming and researching that enables me to learn the financial industry and allows for advancement. EDUCATION NEW YORK UNIVERSITY The Courant Institute of Mathematical Sciences MS in Mathematics in Finance, Candidate – January 2003 Emphasis: Professional training on quantitative and computational modeling applied to derivative securities valuation, portfolio structuring, risk management, and scenario simulation. UNIVERSITY OF KENTUCKY (1999 – 2001) PhD Candidate MS in Applied Mathematics Emphasis: Numerical Analysis; Operational Research & PDE MS in Economics, Gatton School of Business & Economics Emphasis: Econometrics; International Finance; Risk management & Statistics RENMIN (PEOPLE’S) UNIVERSITY OF CHINA (1994 – 1998) BA in International Economics Graduated with Honors Excellent Undergraduate Student Award of Beijing City PROJECT SWAP++ Courant, New York University (2001) The project covers a broad range of tools for financial products such as yield curves, swaps and convertible bonds. Source code is available in C++ and Java. The applications include · Computing yield curve and Cash Flows · Pricing interest-rate swaps and amortizing interest rate swaps · Pricing Treasury Bonds · Building stock underlings and binomial Tree for the evolution of the stock price · Pricing convertible bonds · Performance study THE SURVIVORSHIP IN FINANCIAL MARKET, AN ANALYSIS USING GENETIC ALGORITHM Courant, New York University (2001) This project studied the hypothesis of survivorship in financial market and provided a simulation using genetic algorithm. Source code is available in Perl. A MARKET WITH THE NO SHORT-SALE RESTRICTIONS Working paper , with Hong Song, University of Kentucky(2001) This paper studied the equity market of China to investigate the mechanism and effect of its no short-sale restrictions. An empirical analysis based on the major stocks is provided. COMPUTER SKILLS C/C++, Fortran, Perl, Visual Basic, Java, SQL, HTML, ASP SAS, Stata, MATLAB Numerical computations involving PDE, ODE, and stochastic-DE Professional experience with MS Office and SAP platform Very familiar with Unix, Linux, and various Windows platforms LING [William] WU 61-30 Palmetto Street Ridgewood, NY 11385 Email: lw429@nyu.edu Phone: 1-718-628-6899 PROFESSIONAL EXPERIENCE PROCTER & GAMBLE Financial Analyst (1998 – 1999) Consolidations, budgeting and profit/tax planning; modeling and maintaining spreadsheets/database and intranet-reporting system among 6 subsidiaries in Greater China Transfer Pricing and Risk Exposure Calibrating between US/Asia for 4 key brands (Tide, Olay, Pantene and Rejoice); Designing MS Access structural database generating from SAP/R3 shared by 13 branches. Designing and Maintaining of Interactive On-line Corporate Training Program on transfer pricing and tax regulations. Researching on the US, PRC, HK, TW currency exchange policy and corresponding risk and tax reduction opportunities for P&G FX trading/inter-company money pool schedule. REUTERS (1997) Summer Associate (intern) Economic policy report and daily regional stock market review. SHANGHAI FUTURES EXCHANGE (1996) Junior Trader (intern) Support Senior Trader in domestic mineral and agricultural commodity futures market. TEACHING EXPERIENCE UNIVERSITY OF KENTUCKY, DEPARTMENT OF MATHEMATICS Instructor, “College Algebra” Summer 2001 Instructor, “Calculus III” Spring 2001 Instructor, “Calculus II” Fall 2000 AFFILIATION Member, American Mathematics Society Member, International Association of Financial Engeneer Member, Internaiional Webmaster Assoiciation Chair, Student Government, People's Univesity of China, Department of International Economics