kean university - School of Public Affairs and Administration (SPAA

advertisement

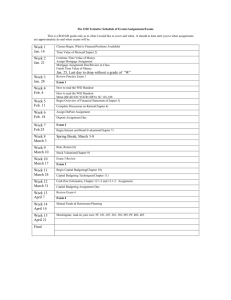

Rutgers University Public Budgeting Systems- 20:834:542 FALL 2015 Instructor: Dr. Patricia Moore (pemoore@optonline.net) Phone: 973-571-9280 Saturdays- 1:30pm- 4:25 pm Office Hours: By Appointments; always available by email COURSE DESCRIPTION: Budget concepts and processes used by the American government and its administrative units. Provides essential skills and experience in budgetary analysis and management applicable to nonprofit as well as public sector agencies COURSE OBJECTIVES: The broad objectives of the course are: -To understand the decision-making events which constitute the development and execution of a budget in the public sector -To provide hands on experience in the process of preparing a budget for a small program -To develop oral communication skills necessary to communicate budget information to the public - To understand the interrelationship between politics and budgeting -To understand the role of proper Financial Management in the public sector INSTRUCTIONAL APPROACH We will employ a variety of instructional approaches including lecture, case studies, group projects, and discussions. Writing is a very important part of graduate studies in public administration. You will be required to write a very comprehensive research paper. The details of the research paper will be posted on Blackboard by the second week of class. In the first part of the semester we will look at budget processes and procedures in the federal state as well as local government. In the second part of the semester we will use journal articles and case studies to learn about financial management in public sector organizations. REQUIRED TEXTBOOK BOOK Menifeld Charles. The Basics of Public Budgeting and Financial Management. University Press of America, Inc., New York 2013 REQUIRED READINGS Brown, Ken W. “The 10-Point Test of Financial Condition: Toward an Easy-to-Use Assessment Tool for Smaller Cities.” Government Finance Review vol. 9, no. 6 (1993): 21-26. Coe Charles. “Obtaining a Better Bond Rating: A Case Study,” Ch. 39 in Aman Khan and W. Bartley Case Studies in Public Budgeting and Financial Management. Ebdon Carol and Paul Landow. “The Balancing Act: Using Private Money for Public Projects. “Public Budgeting & Finance. Volume 32, Issue 1, spring (2012):58-79 Kloha, Carol S. Weissert and Robert Kleine. .Developing and Testing a Composite Model to Predict Local Fiscal Distress. Public Administration Review .Volume 65. Issue 3. May 2005 Mitchell A. Orenstein. Pension Privatization: Evolution of a Paradigm . Public Budgeting & 1 Finance .Volume 26, Issue 2, April (2013):259-281 Mitchell Olivia S. Managing Risks in Defined Contribution Plans: What Does the Future Hold? (Unpublished paper) Robbins Mark * and Bill Simonsen. *Do Debt Levels Influence State Borrowing Costs?” Public Administration Review. Volume 72, Issue 4, July/August (2012):498-505 Rodgers, Robert. and Philip Joyce. “The Effect of Under forecasting on the Accuracy of Revenue Forecasts by State Governments.” Public Administration Review, Vol. 56, n 1, (1996): 48-56. Thomas P. Lauth. “Zero-Base Budgeting Redux in Georgia: Efficiency or Ideology? “ Public Budgeting & Finance.Volume 34, Issue 1, spring (2014):1-17 ASSESSMENT 1. Writings – You will be required to do a research paper on specific to aspects of municipality or nonprofit budgets. I will provide more information on the requirements of the paper by the second week of class. 2. Midterm Exam- In class 3. Final Exams- In class 4. Homework 5. Attendance and Participation – Class participation is absolutely essential, as is completing the reading before each class. Must attend all classes (if you are absent for more than one assigned meeting dates you needed to have a decent excuse). Participation in seminar discussions, research paper and case study analysis and presentations will be factored into the evaluation process. Each student is expected to read the assigned chapters prior to the class period each week. Students will be expected to participate in discussions based on the readings. Members of the class will be asked to make brief oral presentations based on assigned cases and readings. There will be two (2) exams and a research paper. You will also have homework that will be graded. Each late work will be dropped one letter grade. Work sent via email will not be accepted. 1) Mid-term 30% 3) Research Paper – 25% 4) Homework- 15% 5) Final - 30% Mid-term and Final Exams: The midterm exams will consists of short budget problems to be completed on XCEL, multiple choice questions and short answer questions. The final exams will consists of essay questions designed to reinforce key ideas and give students practice in articulating their knowledge and views on the budgetary process issues in municipalities and state /nonprofit organizations. Students will be expected to demonstrate their understanding of course readings and lectures through their answers to exam questions. The exam will cover cases as well as other course material. Class Participation: The course requires active involvement. Students will interact to explore issues, apply ideas, and practice tools. Students who prepare and engage in the exercises and 2 discussions will learn the most and positively contribute to the learning environment of their fellow students. Attendance in class is necessary but not sufficient for a good participation grade. Outstanding Contributor: Contributions reflect exceptional preparation. Ideas offered are always substantive and provide major insights and direction for class. Arguments are persuasive. If this person were not a class member, the quality of the discussions and exercises would be significantly diminished. Good Contributor: Contributions reflect thorough participation. Ideas are usually substantive; provide good insights, and sometimes direction for the class. Arguments are often persuasive. If this person were not in the class, the quality of the discussions and exercises would be diminished considerably. Adequate Contributor: Contributions reflect satisfactory participation. Ideas are generally useful and substantive but seldom offer a new direction for the discussion. Arguments are fairly well substantiated and sometimes persuasive. If this person were not in the class, the quality of the discussions and exercises would be somewhat diminished. Non-participant: This person has said little or nothing in the class. If this person were not a member of the class, the quality of the exercises and discussions would not be changed. Unsatisfactory contributor: Contributions reflect inadequate preparation. Ideas offered do not provide a constructive direction for the class and often are obvious or confusing. Integrative comments and effective arguments are absent. If this person were not a class member, valuable air time would be saved. Academic Integrity Policy: Students must follow the school’s Integrity Policy (http://academicintegrity.rutgers.edu/) Properly acknowledge and cite all use of the ideas, results, or words of others. Properly acknowledge all contributors to a given piece of work. Make sure that all work submitted as his or her own in a course or other academic activity is produced without the aid of impermissible materials or impermissible collaboration. Obtain all data or results by ethical means and report them accurately without suppressing any results inconsistent with his or her interpretation or conclusions. Treat all other students in an ethical manner, respecting their integrity and right to pursue their educational goals without interference. This requires that a student neither facilitate academic dishonesty by others nor obstruct their academic progress. Uphold the canons of the ethical or professional code of the profession for which he or she is preparing. Please note that plagiarism and cheating will never be excused under any circumstances. Violation of these policies leads to immediate failure of the course. Be advised that all assignments will be checked for plagiarism using online software. Disability Services Accommodations, Auxiliary aids and Services enable qualified students with disabilities to receive the same information and opportunities presented to students without disabilities. They allow students who have disabilities to learn and convey knowledge of course materials in alternate formats. These aids and services make classroom courses, labs, and programs accessible and must not compromise the academic standards or essential requirements of the course or the program. Following lists provides some examples of accommodations, auxiliary aids, and services provided to post-secondary settings Extended time on exams A reduced distraction testing location Books on Tape 3 Interpreters Students should apply at https://disabilityservices.rutgers.edu/ and provide the instructor with a copy of the authorization form. Accommodations are not provided retroactively. SCHEDULE: Here is a tentative class schedule. September 12 Overview of class operations/Overview of budgets September 19 Public Finance Administrations and the Context of Public Sector Budgets Menifeld Chapter 1 Homework Manifold 4, 5 Reading: Zero-Base Budgeting Redux in Georgia: Efficiency or Ideology? Discussion leader______________________ September 26 Preparation of the Budget Proposal Menifeld Chapter 2 Homework: page 51 (Write down and Study the terms) October 3 Effectively Communicating Budget Data Menifeld Chapter 8 Homework Ques. 1- 4 October 10 Revenue and Expenditure Forecasting (Articles will be posted) October 17 Personnel Services and Operating Budgets Menifeld Chapter 3 Homework: 1 and 2 Homework Reading: The Balancing Act: Using Private Money for Public Projects October 24 Preparing a Capital Budget and a Capital Improvement Plan Menifeld chap4 Homework: Menifeld 2,3 Discussion leader: ________________________ October 31 Mid-Term November 7 Funding State and Local Budgets Menifeld chap5 Homework1, 4, 5 Research Paper Presentations November 14 Financial Management (Menifeld). -Developing and Testing a Composite Model to Predict Local Fiscal Distress -The 10-Point Test of Financial Condition: Toward an Easy-toUse Assessment Tool for Smaller Cities. Menifield Chapter 6 Discussion leaders: (2)________________________________ 4 November 21 Cash Management - Financial Management contd. And Aman Khan, “Learning From Experience: Cash Management Practices of a Local Government Debt Administration: Debt Management- Do Debt Levels Influence State Borrowing Costs? Discussion leaders: ____________________________ Research Paper Presentation November 28 Thanksgiving December 5 Financial Management Contd: Internal Controls - Big Bets Gone Bad: Derivatives and Bankruptcy in Orange County -Cash for the Sheriff’s Interest? -Obtaining a Better Bond Rating: A Case Study Discussion leaders :( 3) _______________________ Research Paper Due December 12 Personnel and Pension Administration December 19 Pension Privatization: Evolution of a Paradigm . Managing Risks in Defined Contribution Plans: What Does the Future Hold? Discussion leaders (2):_______________________________ FINALS Helpful websites of general interest: http://www.aspanet.org American Society for Public Administration http://www.icma.org International City Managers Association http://www.whitehouse.gov/omb U.S. Office of Management and Budget http://www.cbo.gov Congressional Budget Office http://www.gfoa.org Government Finance Officers Association http://www.ntanet.org National Tax Association http://origin.www.gpoaccess.gov/eop Economic Report of the President 3 http://www.ustreas.gov U.S. Treasury http://www.irs.ustreas.gov Internal Revenue Service http://www.taxadmin.org Federation of Tax Administrators 5 http://www.gao.gov Government Accountability Office 6