Advanced Financial Analysis Series

advertisement

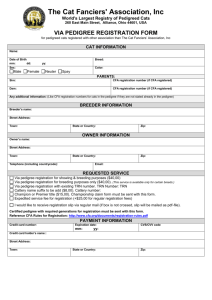

Advanced Financial Analysis Series CFA Singapore, in collaboration with SVCA, is proud to present our “Advanced Financial Analysis Series” held in conjunction with Wall St. Training. The Advanced Financial Analysis Series will provide practical, career-enhancing programs related to fundamental analysis, valuation and financial modeling. This series of hands-on workshops will consist of the following full-day programs: Advanced Financial Modeling – Core Model M&A Deal Structuring & Merger Modeling Techniques Bank Industry Analysis: Primer & Basic Bank Modeling Dates: Venue: 11 March 2013 12 March 2013 13 March 2013 11 to 13 March 2013 M Hotel The goal of these programs is to improve and elevate the skill sets of the financial analyst and the investment professional. Heavy emphasis is placed on being as effective and efficient as possible with Excel. If you are interested in improving your financial modeling and valuation skills, or are in the midst of a career transition, these courses are for you! Wall St. Training (www.wallst-training.com) provides professional financial training solutions to Wall Street through hands-on classroom training and customized corporate training programs for financial analysis which take a hands-on, interactive, practical, non-theoretical approach. The instructor, Wall St. Training’s President and Founder, Hamilton Lin, CFA, has trained numerous major financial services firms including Bank of America/Merrill Lynch, Capital Group, CLSA, Credit Suisse, Deutsche Bank, Fidelity, GE Business Development & Private Equity, Goldman Sachs, Greenhill, ING, JPMorgan, Lazard, Morgan Stanley, Oppenheimer, TD Securities, TIAA-CREF, TPG, UOB, Wells Fargo, World Bank – IFC and many others. Wall St. Training also provides financial modeling training courses to most of the largest CFA Institute societies around the world. Funding The Monetary Authority of Singapore (MAS) administers grants to financial sector organisations that sponsor eligible participants to training programmes that meet qualifying criteria. For enquiries, please contact the MAS at 6229-9396 or via email at fsdf@mas.gov.sg. Refer to next page for more information Monday, March 11, 2013 Advanced Financial Modeling – Core Model 9:00 AM - 5:00 PM Prerequisite: Intermediate proficiency using Excel and a solid grasp of basic accounting fundamentals are required. Build a fully integrated financial statement projection model with income statement projections, a self-balancing balance sheet, an automated cash flow statement, and the balancing cash flow sweep/debt schedule. While knowledge of advanced accounting concepts is not required for this course, you should possess knowledge of basic accounting ratios and a basic understanding of how the major financial statements are inter-related. Emphasis is placed on the integration of the major financial statements and becoming experts in Excel. Incorporate different methodologies to forecasting the different types of assets on the balance sheet and compare and contrast with projecting liabilities. Learn how to balance a model utilizing the debt sweep and the revolver and not using any “plugs”. Appreciate the danger of and properly control for circular references. Avoid messy nested “if” statements!! You will leave the classroom with a fully constructed model that can be customized and applied to other companies. The final model is a fully scalable model that can be added upon. Learning Objectives: • Build an integrated set of financials, including IS, BS & CF statements • Learn how to balance a model utilizing debt sweep and no “plugs” • Become super-efficient in Excel through intensive use of keyboard shortcuts • Intensive focus on correct financial modeling approaches & best practices Learning Goals: 5-Year Financial Statement Projection Model: • How do you project an IS from revenues and expenses down to Net Income? • What are the different methodologies to forecasting the different types of assets on the balance sheet and how do they compare and contrast with projecting liabilities? • How do you project the shareholders’ equity account? • What is the importance of financial ratios in building the balance sheet projections? • How do you approach building an integrated cash flow statement? • How do you build each component of the cash flow statement and why is cash the last item to project? Integration and Balancing of Financial Model: • Balance the model using the debt schedule and debt sweep logic – the most important analysis in terms of balancing the model!! • How does the cash actually flow through the model? • Incorporate automatic debt payments and use cash generated to either pay down debt or build cash • How does the revolver facility actually balance the model? • Avoid messy nested “if” statements!! • How does the BS and financial statements balance without the use of “plugs”? • How are the financial statements integrated using the Interest schedule? • What are circular references, why should they be avoided and how to get around circular references **IMPORTANT - PLEASE NOTE FOR ALL PROGRAMS** To maximize the educational value of this program, we strongly recommend that you have an intermediate understanding of Excel. Lack of basic Excel skills will impede your ability to effectively acquire and implement the techniques and shortcuts that are presented in this program. Bring your PC laptop with a working USB slot and Microsoft Excel installed. Macs may not be as effective. As a participant in the CFA Institute Approved-Provider Program, CFA Singapore has determined that this event qualifies for 7 credit hours. If you are a CFA Institute member, CE credit for your attendance at this event will be automatically recorded in your CE diary. Refer to next page for more information Tuesday, March 12, 2013 M&A Deal Structuring & Merger Modeling Techniques 9:00 AM - 5:00 PM Learn about mergers and acquisitions and how deals are structured. The first half of this course focuses on the mergers and acquisitions process and the basics of deal structures, presenting the main tools and analyses that M&A investment bankers and acquirers Prerequisite: utilize. It covers the following modules: (i) in-depth analysis of the entire M&A process, Intermediate proficiency including due diligence and legal issues; (ii) common structural issues including cash vs. using Excel, a solid grasp of stock, upfront payments vs. earn-outs, and stock vs. asset deals; (iii) crucial merger basic accounting consequence analysis including detailed accretion/dilution and contribution analyses; fundamentals and an and (iv) detailed analysis of transaction case studies to illustrate various deal structures understanding of basic and demonstrate detailed alternative earn-out structures and methodologies. finance & financial modeling techniques are required. No previous insurance industry expertise required. The second half of this course builds on the first half and is hands-on, interactive, Excelbased and covers different ways to model out financial combinations. Different techniques are covered including the most basic and widely used back-of-the-envelope method, accretion / dilution and more robust analyses. Build dynamic models that account for different transaction structures, learn how to sensitize financial projections and the financial impact on a transaction and construct a pro forma merger model. Calculate estimated combined income statement for target and acquiror, key pro forma balance sheet items, cash flow for debt repayments and other relevant items in a merger and acquisition context. M&A Deal Structuring: • Review of various deal considerations and deal structuring options (cash vs. stock) • Common structural issues in a transaction (stock vs. asset) • Buyer and seller preferences for various deal structures and rationale • Tax implications of transactions based on structure & IFRS #3 goodwill amortization • Merger consequence analysis including accretion / dilution & financial implications • Analysis of breakeven PE for both 100% stock and 100% cash considerations Accretion / Dilution Modeling: • Build dynamic merger consequence analysis (accretion / dilution) incorporating: • Synergies switch, cash vs. stock sensitivity • Amortization of goodwill switch (depending on purchase price allocation) • Common structural issues: Stock vs asset deals • Analysis of breakeven PE for both 100% stock and 100% cash considerations • Calculate pre-tax and after-tax synergies / cushion required to breakeven Simple Merger Modeling: • Construct a merger model, simple combination of IS for target and acquiror • Project simple stand-alone Income Statement for both target and acquiror • Analyze selected balance sheet figures and ratios and multiples • Estimate target valuation and deal structure • Calculate selected Pro Forma balance sheet items • Combine target and acquiror’s Income Statement and estimated synergies • Calculate cash flow for debt repayments and cash balances • Compute interest expense and interest income based on paydowns • Calculate accretion / dilution and credit ratios As a participant in the CFA Institute Approved-Provider Program, CFA Singapore has determined that this event qualifies for 7 credit hours. If you are a CFA Institute member, CE credit for your attendance at this event will be automatically recorded in your CE diary. Refer to next page for more information Wednesday, March 13, 2013 Bank Industry Analysis: Primer & Basic Bank Modeling 9:00 AM - 5:00 PM Balance sheet based companies, such as banks, play by different rules and methodologies based on the unique nature of their business. Focus is placed on our Commercial Banks financial statements primer which dives deep into a bank’s unique Prerequisite: financial statement terminology and drivers. Understand how to analyze a bank and why Intermediate proficiency the standard financial analysis and valuation methodologies that apply to most using Excel and a solid grasp companies do not apply to industries that “use money to make money”. Start with a of basic accounting, finance brief overview of the main banking functions (commercial, investment, asset and valuation fundamentals management) and quickly turn to the quality of book of loans and analysis of net vs gross are required. charge-offs vs provisions, etc. Understand the critical credit ratios and capital adequacy analysis as well as Tier 1 and II definitions and Basel II impact. Crystallize the impact of Interest Rates, importance of term structure and credit spreads and implications on a bank's profitability. Examine best practices in calculating net interest income via average asset and liability balances on the income statement. Dive into an analysis of Balance Sheet assets & liabilities and articulate the drivers of EPS growth. Wrap up by analyzing valuation parameters: key banking valuation multiples (PE, PEG, Book Value, ROE). Banking Industry Overview • Overview of main banking functions (commercial, investment, asset management) • Quality of book of loans and analysis of net charge-offs • Critical credit ratios and capital adequacy analysis; Tier 1 and 2 definitions and Basel II impact • Impact of Interest Rates, importance of term structure and credit spreads Banking Financial Statement Terminology & Drivers • Net Interest Income Margin (Interest Expense net against Revenue not COGS) • Analysis of Balance Sheet Assets & Liabilities • Drivers of EPS growth • Valuation Parameters: key banking valuation multiples (PE, PEG, Book Value, ROE) Basic Bank Financial Modeling Build a basic, streamlined bank financial model that builds upon the bank terminology in our Bank Industry Primer course. Before diving deep into the complex nuances of our Advanced Bank Financial Model, really solidify your understanding of developing the logic in loan losses and provisions and its impact on the rest of the larger bank financial statements. Perform quick back-of-the-envelope calculations for key Balance Sheet items such as Interest Earning Assets and Interest Bearing Liabilities, which yield Net Interest Income. Estimate and calculate capital adequacy ratios to wrap up your summary simplified basic bank model. **IMPORTANT - PLEASE NOTE FOR ALL PROGRAMS** To maximize the educational value of this program, we strongly recommend that you have an intermediate understanding of Excel. Lack of basic Excel skills will impede your ability to effectively acquire and implement the techniques and shortcuts that are presented in this program. Bring your PC laptop with a working USB slot and Microsoft Excel installed. Macs may not be as effective. As a participant in the CFA Institute Approved-Provider Program, CFA Singapore has determined that this event qualifies for 7 credit hours. If you are a CFA Institute member, CE credit for your attendance at this event will be automatically recorded in your CE diary. Refer to next page for more information Instructors Biography Instructor Biography Mr. Hamilton Lin, CFA Hamilton Lin, CFA, is President of Wall St. Training (www.wallst-training.com), a corporate training firm that teaches the fundamentals of financial analysis, modeling and valuation. Clients include prestigious firms including some of the largest investment banks, many boutique investment banks, buy-side asset managers, research firms and commercial banks, such as Bank of America/Merrill Lynch, Capital Group, Citigroup, CLSA, Credit Suisse, Deutsche Bank, Fidelity, GE Business Development & Private Equity, Greenhill, ING, JPMorgan, Lazard, Oppenheimer, TD Securities, TIAA-CREF, TPG, UOB, Wells Fargo, World Bank – IFC and many others. Hamilton has a broad background in investment banking and mergers & acquisitions in diverse industries ranging from oil & gas to insurance to asset management and related sectors. He has worked on over six dozen deals and closed over three dozen deals, ranging from plain vanilla deals, to squeeze-outs, LBOs and distressed situations ranging in deal value from $10 million to over $6 billion. Prior to founding his firm, he worked at Goldman Sachs Investment Banking, where he standardized his group's best practices; Banc of America's M&A department, where he customized many of the firm's models; various boutique middle-market investment banks, executing private transactions; and Ryan Labs, an asset-liability asset management firm. Hamilton teaches globally, from all major cities in the USA including New York City, San Francisco, Chicago, Boston, to Toronto and Montreal in Canada, as well as Asia, including Hong Kong, Singapore, Shanghai, to Europe including London and most major financial hubs. Hamilton is currently a Professor at NYU Stern and has also taught at Baruch College and Hunter College in New York City. He graduated from NYU Stern in Finance and International Business, is a Chartered Financial Analyst and has taught all levels and all study sessions of the CFA exam. He also teaches all of the financial modeling and valuation courses (dozens of classes a year) at the following CFA Institute member societies: - New York Society of Securities Analysts - San Francisco CFA Society - Chicago CFA Society - Boston Security Analysts Society - Toronto CFA Society - Stamford CFA Society - The Hong Kong Society of Financial Analysts - Singapore CFA Society - CFA-China: Shanghai & Beijing **IMPORTANT - PLEASE NOTE** To maximize the educational value of this program, we strongly recommend that you have an intermediate understanding of Excel. Lack of basic Excel skills will impede your ability to effectively acquire and implement the techniques and shortcuts that are presented in this program. Bring your PC laptop with a working USB slot and Microsoft Excel installed. Macs may not be as effective. Refer to next page for Registration Form Registration Form For participation, please complete the fields below and fax to CFA Singapore: 63237657 Please indicate membership ID to enjoy members' rate Alternatively, Reservation can be made via email: programs@cfasingapore.org Refund and Cancellation Policy: Refunds and cancelation received on the following: *4 weeks before the workshop date: 10% Cancellation Fee *2 weeks before the workshop date: 50% Cancellation Fee *1 week before the workshop date: No Refund *Members/Guests without registration will NOT be admitted; Admission/Seats are subject to availability Name:Mr./Mrs./Ms./Dr./__________________________________________________________________ CFA/ SVCA Membership No.: ________________ Email: _________________________________________ Mobile: ___________________ Fax: ____________________ Affiliate Organisation & Membership No: _____________________________________________________ Company:____________________________ Designation: _______________________________________ Address:________________________________________________________________________________ _________________________________________________________Postal Code: ___________________ Food Preferences: None Halal Vegetarian Others (please specify):_______________ Payment Details I would like to attend: (Please mark a tick () in the relevant box) Please Tick Programmes Advanced Financial Modeling – Core Model (11 March 2013) M&A Deal Structuring & Merger Modeling Techniques (12 March 2013) Bank Industry Analysis: Primer & Basic Bank Modeling (13 March 2013) 1 Day Courses Membership Type CFA Singapore & SVCA Members Non Members Fees Per Module/Per Day (SGD) Early Bird Special (By Feb 11) Standard Fees (after Feb 11) 700 900 900 1,100 (Bank, *Cheque No.): __________________________________________ Amt Due: SGD$______________ *All cheques to be made payable to ‘CFA Singapore' c/o 10 Shenton Way #13-02 MAS Building, Singapore 079117 Please charge to my credit card I, ______________________________________ hereby authorize CFA Singapore to charge my credit card account for the amount $_____________SGD Credit Card (VISA/AMEX/MC): ____________ ___________ ____________ __________ (Expiry:__ /20_ _) Signature/ Date _______________________________________ CFA Singapore (a member society of CFA Institute) 10 Shenton Way, MAS Building, #13-02, Singapore 079117 Phone: 6227 8594 Fax: 6323 7657 Email: programs@cfasingapore.org