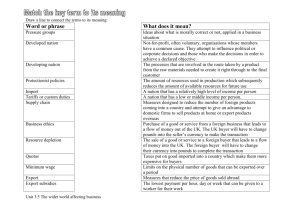

Uses of Funds

advertisement

Funding the Takeovers – “The Investment Banking Perspective” BIPIN K DIXIT ASSISTANT PROFESSOR (FINANCE AND ACCOUNTING) INDIAN INSTITUTE OF MANAGEMENT TRICHY Role of Investment Bankers in M&A Investment bankers put together merger models to analyze the financial profile of two combined companies The primary goal of the investment banker is to figure out whether the buyer’s earnings per share will increase or decrease as a result of the merger (EPS) An increase in expected EPS from a merger is called Accretion (and such an acquisition is called an Accretive Acquisition) A decrease in expected EPS from a merger is called Dilution (and such an acquisition is called a Dilutive Acquisition). Merger Model Steps Starting Who is the Seller? Publicly traded stock, or privately held? Insider ownership or sizable public float (i.e., is a large portion of the company’s shares available for sale in the open market)? Who are the potential Buyers? Strategic Buyer (an existing company able to gain from potential synergies)? Financial Sponsor (a Private Equity firm looking to generate an attractive return via a Leveraged Buyout)? What is the context of the transaction? Privately negotiated sale or auction? Hostile or friendly takeover? What are the market conditions? Acquisition currency (Cash or Equity)? Historical premiums paid for Comparable Transactions? Mergers Consequences Analysis A Merger Consequences Analysis consists of the following key valuation outputs: Analysis of Accretion/Dilution and balance sheet impact based on pro forma acquisition results Analysis of Synergies Type of Consideration offered and how this will impact results (i.e., Cash vs. Stock) Goodwill creation and other Balance Sheet adjustments Transaction fees Type of synergies Increase and diversify sources of revenue by the acquisition of new and complementary product and service offerings (Revenue Synergies) Increase production capacity through acquisition of workforce and facilities (Operational Synergies) Increase market share and economies of scale (Revenue Synergies/Cost Synergies) Reduction of financial risk and potentially lower borrowing costs (Financial Synergies) Increase operational efficiency and expertise (Operational Synergies/Cost Synergies) Increase Research & Development expertise and programs (Operational Synergies/Cost Synergies) Valuation Methods A critical component to evaluating an M&A transaction is to determine the Purchase Price for the Target company. In particular, how much of a Control Premium should be paid for the Target (relative to the current valuation of the target)? One very important method is to look at recent Comparable (Precedent) Transactions to determine how much of a premium has been paid for ownership of other, similar companies in recent M&A transactions. Other methods used to establish a fair value for a target company in an M&A transaction include: Comparable Company Analysis Discounted Cash Flow Analysis Accretion/Dilution Analysis Valuation Methods Typically, all of these valuation methods will be used to value the equity of the target company These methods will hopefully lead to a reasonable, narrow range of Purchase Prices and Control Premiums for the Target It will then be up to the management of both the Buyer and Target (along with their respective M&A investment banking advisors) to argue for and agree upon a precise price/premium. TRANSACTION ASSUMPTIONS Make assumptions about important parameters affecting the deal a vital step in determining a feasible range for the Purchase Price/Control Premium: Current Share Price & Number of Shares Outstanding for the Buyer Current valuation information for the Seller Expected Purchase Price/Control Premium for the Seller in the proposed transaction Portion of consideration arising from Equity/Cash M&A transaction fees Financing Fees from new Equity and/or Debt issuance Expected interest rate on new Debt Method of payment Important issue is the type of consideration being offered to the Seller’s shareholders. Buyer can offer Cash, Equity (shares of the Buyer’s common stock) or a combination of both as the consideration for the Purchase Price. Which should the Buyer use? – Typically, if the Buyer’s current stock price is considered undervalued relative to its peers, the Buyer may decide to not use Equity as consideration, because it would have to give the stockholders of the Target a relatively large number of shares to acquire the company. On the flip side, the Target shareholders may want to receive Equity consideration in this case, because they might feel it is more valuable than receiving Cash. If the Buyer feels that its current stock price is trading at high levels, the Buyer will likely want to use Equity for the consideration of the Purchase Price, because issuing new stock for the transaction is relatively inexpensive (i.e., the stock has a high value in rupee terms). Target might be hesitant to receive the Equity as consideration in this case depending on the terms of the deal, the Seller’s shareholders may end up suffering a loss on the sale relative to Cash consideration in the event that the Buyer’s stock price falls between the time that the deal is announced and the time that the acquisition is completed (usually several months, but in some cases closing can take as long as a year) As you can see, finding a combination of consideration that is agreeable to both the Buyer and the Seller is an important part of structuring the deal. Method of payment Note that if a Buyer with a relatively low Price/Earnings Ratio acquires a Target company with a relatively high Price/Earnings Ratio, the transaction will generally be dilutive to the Acquirer on a pro forma basis. This is because for each rupee of Price used to acquire the Target company, the Buyer is receiving fewer rupees of Earnings. If the Buyer has an Earnings Yield ([Earnings Per Share ÷ Share Price], or simply [1 ÷ Price/Earnings Ratio]) lower than the expected Cost of Debt (the interest rate on new Debt, after accounting for the tax shield from the Debt) then using Equity as consideration will be more accretive (less dilutive) than using Cash Reason: a lower Earnings Ratio necessarily implies a high Price/Earnings Ratio. As a result, the higher the Price/Earnings Ratio of a company, it is more likely that company will want to pursue an acquisition strategy, and use Equity as consideration for the deal (all other things being equal, of course) Funding through debt In one of the acquisition funding was secured by the assets and future cashflows of the company to be acquired Acquirer wanted to retain BBB+ credit rating Need to think carefully about how you could raise as much debt as possible while not breaching the rating agencies’ criteria for a BBB+ rated company BUILDING ―SOURCES & USES‖ TABLE The Sources & Uses section of an M&A Model contains the information regarding flow of funds in an M&A transaction— specifically, where the money is coming from and where it is going. Sources of Funds: An investment banker determines the amount of money raised through various equity and debt instruments, as well as from Cash on Hand (i.e., existing Cash owned by the Buyer to help pay for the transaction) to fund the purchase of the Target. Uses of Funds: cash that is going out to purchase the Target, as well as various fees needed to complete the transaction. Importantly, the total Sources of Funds must always balance with the total Uses of Funds Example Sources of Funds Assume that Company X, the Buyer, will raise $30 million in New Senior Debt and $60 million in new Equity in order to raise money to purchase the Company Y, the Target company. This will trigger fees for the financing of this Debt and Equity, and these figures are located in the boxes on the left. Uses of Funds the buyer will purchase the Equity of the target business, which is approximately $91.2 million. M&A transaction fees are 2.0% of the Purchase Price (approximately $1.8 million) Financing fees include 4.0% of the $30 million in new Senior Debt raised and 6.0% of the $60 million in new Equity raised Note that the total capital raised is only $90 million. The rest of the money used to pay for the transaction will have to come from Cash on Hand Example To get the Sources of Funds to equal the Uses of Funds, we build the following ―plug‖ formula for Cash on Hand: Cash on Hand = Total Uses of Funds – Total Sources of Funds excluding Cash on Hand = (Purchase of Equity + Transaction Fees + Financing Fees) – (Newly Raised Equity + Newly Raised Debt) Thus, approximately: Cash on Hand = [$91.2 million + $1.8 million + ($1.2 million + $3.6 million)] – [$30 million + $60 million] = ($91.2 million + $1.8 million + $4.8 million) – ($30 million + $60 million) = $97.8 million – $90 million = $7.8 million In this scenario Company X will need to use approximately $7.8 million of Cash from its own Balance Sheet to complete the transaction. Accretion/Dilution Analysis After the transaction has closed, the Buyer will own all of the assets, as well as the financial performance (Profit/Loss), of the Target company Accretion/Dilution Analysis is used to determine how the Target’s financial performance will affect the Buyer’s Earnings Per Share a transaction is accretive if the buyer’s expected future EPS increases as a result of the acquisition the transaction is dilutive if the buyer’s expected future EPS declines as a result of the acquisition. Thus it is important to estimate the Accretion/Dilution potential from a deal before the Buyer can agree to the proposed transaction. Accretion/Dilution Analysis If the consideration used for the acquisition of the Target company is the Buyer’s common stock, the transaction will often be dilutive to the buyer’s EPS due to the fact that the new shares issued to buy the Target will increase the number of outstanding shares of the Buyer In this case, a combination of Equity and Cash may be used to for the consideration of a Purchase Price to minimize the effect of dilution on EPS. Precedent Transaction Analysis Overview Precedent Transaction Analysis, also known as ―M&A Comps,‖ ―Comparable Transactions,‖ or ―Deal Comps,‖ uses previously completed mergers and acquisitions deals involving similar companies to value a business. Precedent Transaction Analysis typically uses the same multiples as Comparable Companies’ Analysis (or ―Comps‖) In particular, Enterprise Value/Sales, Enterprise Value/EBITDA and Earnings/Earnings Per Share (EPS) are the most commonly used metrics. However, unlike in Comparable Company Analysis, the basis for value comparison is the price paid by the purchaser for a business, rather than the traded market values of the company’s securities. These prices can be different because there is a control premium Thus, Precedent Transaction Analysis will typically result in valuations that are higher than standard Comparable Company Analysis. Precedent Transaction Analysis Overview Precedent Transaction Analysis tends to focus on the value of a business as of the time an acquisition of the business can be completed, rather than today This is because deals take time to close, whereas current market values for a business can be assessed on any day Sometimes, deals can take as long as a year (or more!) to close, so the Precedent Transaction Analysis should reflect that fact WHY USE PRECEDENT TRANSACTIONS? To value a private business that does not have public trading comparables To evaluate the market demand for acquiring a company, based on the total dollar volume and number of recent transactions in a certain industry. To provide data analytics in assessing M&A activity and consolidation trends. To identify potential bidders if the company is looking to be acquired or identify potential sellers if a company is looking to buy a business. To provide a fairness opinion to a Board of Directors when a company is acquiring or selling all or part of a business, or is being acquired Sources of Information Previous valuation analyses: A great source for previous transactions is presentation material that has previously been compiled in a certain industry. This can be a great way to save time, so be sure to check whether such analyses have recently been conducted at your bank—chances are high that they have. Public tender documents and merger proxy statements: Fairness opinions disclosed in public tender documents and merger proxy statements can provide a wealth of information about other closed transactions. SDC database: Securities Data Corporation compiles a database of all completed M&A transactions and can be used to search for relevant transactions. Capital IQ or Factset: This database is a widely used internet-access financial database that has a search feature for M&A transactions that can be filtered by many factors including target company geography, size, etc. News internet searches: Try a Google search for industry M&A news. Equity research: Typically transaction information can be found in initiation reports. Finding Right Precedent The best Precedent Transactions to use are those in which the target companies and the company one is valuing have the most similar business and financial characteristics. These characteristics include the following: Same business & industry Similar business size Similar sales growth rates and profitability margins Similar capital structure Similar reasons for transaction (e.g. fire sale, bankruptcy, or strategic motive). Same geographic location of operations ADVANTAGES AND DISADVANTAGES PROs and CONs of Using Precedent Transactions PROs CONs •Typically based on publicly •Public data is based on past transactions available information that may not be indicative of current market •Multiples reflect actual payments conditions for real-life deals, rather than •Information available from industry and traded multiples that are subject to news sources can be misleading supply and demand pressure •Precedent transaction dynamics are rarely •Useful in M&A negotiations and perfectly comparable discussions •Values and multiples obtained may vary •Provide guidance to assess what a over a wide range and the summary metrics buyer may be willing to pay for a may be of limited usefulness business •Other factors may affect the multiples such •Can reveal valuable information as governance issues, specific agreements, such as industry consolidation synergies, and intangible values (such as trends, and potential buyers and patents and other intellectual property) sellers Pitfalls To Avoid in Precedent Transactions Be sure to review this checklist of pitfalls to avoid before completing the analysis: INCONSISTENT ANNOUNCEMENT DATE OR EFFECTIVE TRANSACTION DATE INCLUDING EXTRAORDINARY ITEMS INCLUDING MINORITY INTERESTS IN FINANCIAL RESULTS TAKING THE NUMBERS STRAIGHT FROM AN ONLINE FINANCIAL DATABASE FAILING TO CALCULATE THE PREMIUM OVER MARKET VALUE Always footnote any exclusion THANK YOU