Dubai Government Human Resources Management Law

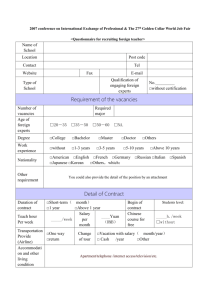

advertisement