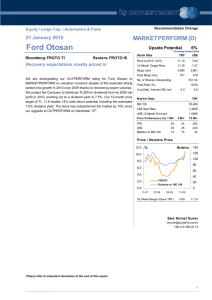

Ford Otosan

TURKISH EQUITIES / COMPANY UPDATE

Ford Otosan

Driving a better bargain

1 September 2015

Outperform

(upgraded from Neutral)

Close Price: TRY29.50

12m Target Price: TRY39.65

We are upgrading our recommendation for Ford Otosan from Neutral to

Outperform on the back of an improving margin outlook and a pick-up in export shipments. With a slowdown in the domestic market now highly likely, we believe exporters will again take centre stage, especially with the European commercial vehicle market still on a growth course. Ford Otosan’s sterling export performance and escalation in margins should overshadow any weakness in local sales while an interim dividend this year and the prospect of a 4.9% dividend yield next year could be additional catalysts. We have revised our 2015/2016 EBITDA forecasts up by 14% and our new TP of TRY39.65/share indicates a lucrative 34% upside potential following the 20% absolute fall in the share price over the last 3 months (21% underperformance against Tofas).

Q2 results confirm improvement in margins. Ford Otosan surprised us with strong operating margins in 2Q15, beating our EBITDA margin forecast by 1pp. With 8.3% EBITDA margin in 2Q15, the company’s 1H EBITDA margin realized at 8.4% compared to just 7.0% in 2014. The reasons behind the strong operating margins in 1H15 were i) higher sales volume (+43%

YoY), ii) rising CUR (+15pp), iii) favourable sales mix, iv) lower input costs on weak Euro and v) cost reduction activities. Two consecutive quarters of strong margin generation should confirm the turnaround in margins after the doldrums of the investment period. We forecast a 2015 EBITDA margin of

8.0% and a long-term EBITDA margin at 8.3% (still very conservative) thanks to a higher CUR and efficiency improvements.

A surge in export orders. Ford Otosan increased its export volumes by

23% YoY in 1H15 thanks to the completion of its product portfolio, a 13% rise in European commercial vehicle sales and Ford Europe’s stunning 33% sales growth performance, capturing 2pp of market share in Europe. With this impressive performance in 1H15 and a surge in orders for the rest of the year, the management has revised its 2015 export guidance up from 245k units to 262k units, marking 36% growth YoY. The company’s export volumes should continue to grow on the back of the rising use of commercial vehicles, Ford Europe’s aggressive market share strategy and the ramp-up of new products.

Stock data

Bloomberg / Reuters

12m expected total return (%)

52-week price range (TL/share)

Mcap (US$mn)

EV (US$mn)

FROTO TI/FROTO.IS

34

23.41-38.60

3,548

4,388

Trading data

Avg daily trading vol. (US$mn)

Weight in BIST100 (%)

Beta (3y, weekly returns)

Free float (%)

Foreign ownership (%)

Current

12m ago

Shareholder structure

4.6

1.2

0.8

18

66.6

69.3

Ford Motor Company

Koc Group

41%

41%

Free Float 18%

Company in brief

With a production capacity of 415,000 units, Ford

Otosan produces Light and Heavy commercial vehicles in Turkey. The company has been the market leader in Turkey for 12 consecutive years

(2002-2013) and is also Turkey’s largest auto exporter and producer.

Relative Performance to BIST100 (%)

80%

60%

64.1%

40%

14.5%

Financials

Revenues (TRYmn)

EBITDA (TRYmn)

Net profit (TRYmn)

2014 YoY 2015F YoY 2016F YoY

11,925 5% 17,124 44% 19,013 11%

831 12%

592 -8%

1366 64%

824 39%

1,551

1,028

14%

25%

2,754 23%

2014

3,277

2015F

19% 3,799

2016F

16%

EPS (TRY)

Key metrics

P/E (x) 15.0 12.6

EV/ EBITDA (x) 13.0 9.3

P/BV (x) 3.2 3.2

FCF yield (%) 3.6% -0.2%

Dividend yield (%) 2.0% 2.9%

Source: Company financials, FinansInvest estimates. *Average mcap used for past years

10.1

8.0

2.7

10.5%

4.9%

20%

0%

-20%

-5.0%

1M

-8.7%

3M

-1.1%

6M 1Y

5.1%

YTD 3Y

Ozgur Ucur

+90 212 336 7284 ozgur.ucur@finansinvest.com

Figure 1 – Key revisions with this note

Key estimates 2015E 2016E

(TRYmn)

Revenues

EBITDA

Net profit

Old New Chg. Old New Chg.

15,616 17,124 10% 17,160 19,013 11%

1,202 1,366 14% 1,376 1,551 13%

841 824 -2% 896 1,028 15%

Source: Bloomberg, FinansInvest

Notes

We have raised our forecasts both for 2015 and 2016 due to rise in export volume forecasts and operating margins following the guidance provided post 2Q15 results.

Figure 2 – Finansinvest vs. Consensus

Key estimates

(TRYmn)

Revenues

EBITDA

Net profit

Est.

Notes

17,124 15,195 13% 19,013 16,675 14%

We are more aggressive than the consensus both for

1,366

824

1,247

839

10%

-2%

1,551

1,028

1,455

968

7%

6%

2015 and 2016. We think that the consensus will also upgrade forecasts after incorporating higher export volumes and stronger Euro against Lira.

Source: Bloomberg, FinansInvest

Figure 3 – Peer Comparison

Company

TOFAS TURK OTOMOBIL FABRIKA

DAIHATSU MOTOR CO LTD

KIA MOTORS CORPORATION

MARUTI SUZUKI INDIA LTD

MAZDA MOTOR CORP

RENAULT SA

SUZUKI MOTOR CORP

TOYOTA MOTOR CORP

HYUNDAI MOTOR CO

HINO MOTORS LTD

MAHINDRA & MAHINDRA LIMITED

FORD MOTOR CO

GEELY AUTOMOBILE HOLDINGS LT

Average

Median

FROTO

Premium / (Discount)

2015E

Cons. Diff.

2016

9.1

4.6

4.2

8.9

7.0

4.8

8.9

12.0

4.0

3.9

4.5

3.3

3.0

6.0

4.6

8.0

52%

EV/EBITDA

2015

10.3

4.9

4.7

14.5

4.4

4.3

5.0

9.5

7.4

5.4

11.3

3.8

3.7

6.9

5.0

9.3

58%

Est.

2016E

Cons. Diff.

2016

13.2

9.7

6.2

19.2

6.8

6.3

16.0

8.2

5.4

7.9

13.8

6.8

6.7

8.9

7.1

10.1

26%

2015

P/E

13.2

10.8

6.6

24.6

7.7

7.7

18.3

8.8

5.6

9.1

18.4

7.8

8.2

10.5

8.4

12.6

33%

Figure 4 – Potential catalysts

(i) Continued positive trend in export shipments

(ii) A second dividend payment this year

Figure 5 – Risks

i) Volatility in the Lira

(ii) Contraction in domestic commercial vehicle market

Source: FinansInvest, Bloomberg

Ford Otosan / 1 September 2015 2

Valuation

Figure 6 – Valuation Summary for Ford Otosan

DCF-Driven Equity Value

Peer analysis implied Value

Blended Equity Value

12-month Target Value

12-month Target Price

Source Finansinvest

Figure 7 – DCF Valuation for Ford Otosan

2015

Domestic Sales Vol. (000 Units)

Export Sales Vol. (000 Units)

Total Sales Vol. (000 Units)

Revenues

Revenue Growth

EBIT

EBITDA

EBITDA Margin

Taxes

Inc./dec. in W/C

Capex

FCF

WACC

PV of FCFs

Terminal Growth Rate

Terminal Value

PV of TV

Value of Firm

Net Debt

Equity Value

Source: Finansinvest

2016 2017 2018 2019 2020 2021

TRYmn Weight

13,956 75%

6,952 25%

2022 2023

10,467

1,738

12,205

13,914

39.65

2024 2025

127

262

389

120

275

396

125

287

412

130

294

424

135

302

437

141

309

450

145

317

462

149

325

474

154

333

487

159

341

500

163

349

513

17,124 19,013 21,530 23,522 25,642 27,857 30,168 32,671 35,381 38,317 41,497

44% 11% 13% 9% 9% 9% 8% 8% 8% 8% 8%

980 1,127 1,316 1,452 1,598 1,750 1,910 2,085 2,276 2,485 2,779

1,366 1,551 1,769 1,936 2,115 2,300 2,497 2,710 2,941 3,191 3,460

8.0%

-39

-669

-675

-17

8.2%

-45

-119

-297

1090

8.2%

-53

-158

-318

1240

8.2%

-58

-125

-337

1417

8.2%

-320

-133

-356

1306

8.3%

-350

-139

-376

1436

8.3%

-382

-145

-397

1573

8.3%

-417

-157

-418

1718

8.3%

-455

-170

-441

1874

8.3%

-497

-184

-466

2045

8.3%

-556

-204

-737

1963

11.4% 11.7% 11.9% 12.1% 12.2% 12.3% 12.4% 12.5% 12.6% 12.6% 12.6%

8389

4%

23662

7540

15929

1973

13956

Ford Otosan / 1 September 2015 3

Figure 8 – Ford Otosan Summary Financials

Income statement

Revenues

Gross profit

EBITDA

Depreciation

EBIT

Net other income

Income from investing activities

Net financial income

Profit from associates

Profit before taxes and minorities

Taxes

Net income

Balance sheet

Current assets

Cash equivalents

Trade receivables

Inventories

Other current assets

Non-current assets

Tangibles

Intangibles

Other non-current assets

Total assets

Current liabilities

Short-term loans

Trade payables

Other current liabilities

Non-current liabilities

Long-term loans

Other non-current liabilities

Minority Interest

Shareholders' equity

Total liabilities and equity

Key metrics

Growth

Revenue growth

EBITDA growth

Net income growth

Margins

EBIT margin

EBITDA margin

Net margin

Return on equity (ROE)

Net debt / Equity

Source: Ford Otosan, FinansInvest estimates

2012

9,768

1,087

764

141

623

8

3

20

0

654

31

685

2012

414

4,647

1,633

364

1,120

149

1,018

896

2,438

302

1,231

678

227

2,209

1,556

238

122

0

1,996

4,647

2012

-6%

-12%

3%

6.4%

7.8%

7.0%

35%

0.48

2014

11,925

1,131

831

305

527

15

-6

-148

0

387

204

592

2014

628

7,235

2,972

990

1,796

185

1,509

1,360

2,958

577

1,606

585

190

4,277

3,128

520

149

0

2,754

7,235

2014

5%

12%

-8%

4.4%

7.0%

5.0%

24%

0.64

2013

11,405

1,128

744

186

558

112

-4

-213

0

452

189

641

2013

901

5,991

2,397

1,072

1,182

143

1,358

1,220

2,443

238

1,451

564

190

3,548

2,231

415

138

0

2,237

5,991

2013

17%

-3%

-6%

4.9%

6.5%

5.6%

30%

0.92

2016E

19,013

2,061

1,551

425

1,127

35

0

-31

0

1,131

-104

1,028

2016E

716

9,090

3,642

1,053

2,322

267

1,649

1,446

4,240

383

2,344

1,161

352

4,850

3,417

716

203

0

3,799

9,090

2016E

11%

14%

25%

5.9%

8.2%

5.4%

29%

0.56

2015E

17,124

1,833

1,366

387

980

44

1

-122

0

903

-79

824

2015E

671

8,510

3,481

1,137

2,095

250

1,752

1,562

3,767

279

2,111

1,047

330

4,743

3,408

664

190

0

3,277

8,510

2015E

44%

64%

39%

5.7%

8.0%

4.8%

27%

0.74

2017E

21,530

2,360

1,769

453

1,316

40

0

-47

0

1,309

-136

1,173

2017E

759

9,626

3,896

987

2,626

283

1,572

1,357

4,879

539

2,654

1,313

373

4,747

3,272

716

215

0

4,158

9,626

2017E

13%

14%

14%

6.1%

8.2%

5.4%

29%

0.43

Ford Otosan / 1 September 2015 4

FinansInvest Rating System

We employ a relative scale in our rating system (i.e. Market Outperform, Neutral, Underperform ) in order to better present relative value propositions and more actively pursue long vs. short ideas at the BIST. The relevant benchmark is the broader Turkish stock market, using the BIST-100 index as a basis. The ratings also incorporate a certain degree of relativity within the analyst’s own stock coverage universe due to asymmetric return expectations among the industries under our BIST coverage. The rating system combines analysts’ views on a stock relative to the sectors under coverage, and the sector call relative to the market, together providing a view on the stock relative to the market.

Individual ratings reflect the expected performance of the stock relative to the broader market over the next 6 to 12 months. The assessment of expected performance includes a function of near-term company fundamentals, industry outlook, confidence in earnings estimates and valuation, and other factors.

An essential element of our rating methodology involves benchmarking a 12-month expected return against the cost of equity. We set a required rate of return for each stock, calculated from our risk-free rate and equity risk premium assumptions. The price target for a stock represents the value that the stock is expected to reach or sustain over the performance horizon of 12 months, according to the view of the analyst.

We have separated the stocks under our coverage into two groups, mainly with respect to their liquidity (market cap, free float market cap and historical average daily trading volume) as small-cap stocks exhibit different risk/return characteristics to more-liquid large-caps. For the purposes of the relative stock rating, however, stocks within each group will be considered on an unweighted basis with regard to their market capitalization.

For a stock to be assigned an Outperform rating, the implied return must exceed the required rate of return by at least 5 percentage points over the next 12 months for our larger-cap stock coverage, or by 10 percentage points for the small-cap group. For a stock to be assigned an Underperform rating, the stock must be expected to underperform its required return by at least 5 percentage points over the next 12 months. Stocks between these bands will be classified as Neutral .

When the potential upside of an average stock in our coverage exceeds its required rate of return (i.e. the market upside exceeding the implied average cost of capital), a greater number of stocks would fall into the aforementioned Outperform (Buy) category, illustrating the significance of the “relative return” concept (vis-à-vis absolute return) in picking better investment ideas with a positive alpha. The same holds true when the potential upside of an average stock in our coverage falls short of its required rate of return.

In this regard, as a supplemental methodology, we rank the stocks in our coverage according to their notional target price with respect to their current market price, and then categorise the top group (approximately 40-50% of the companies under coverage) as Outperform, the next 40-50% as Neutral and the lowest 10-20% (and no less than 10%) as Underperform.

It should be noted that the expected returns on some stocks may at times fall outside the relevant ranges of the applicable respective rating category because of market price movements and/or other short-term volatility or trading patterns. Such interim deviations from specified ranges are permitted but becomes subject to review.

Also note that the analyst’s short-term view may occasionally diverge from the stock’s longer-term fundamental rating.

Outperform.

We expect the stock to outperform the BIST-100 over the next 6 to 12 months.

Neutral (Market Perform).

We expect the stock to broadly perform in line with the BIST-100 index over the next 6 to 12 months. (Although we would normally have a neutral assessment of stocks in this category, if a stock has gone through a period of market underperformance, it would be an indication that the stock may be expected to improve its performance relative to market averages in the coming period, and vice versa).

Underperform.

We expect the stock to underperform the BIST-100 over the next 6 to 12 months.

N/R.

Not Rated.

U/R.

Under Review.

Analyst Certification

The following analysts hereby certify that the views expressed in this research report accurately reflect their own personal views regarding the securities and issuers referred to therein and that no part of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in the research report: Ozgur

Ucur.

Unless otherwise stated, the individuals listed on the cover page of this report are research analysts.

Disclaimer

All information enclosed in this document has been obtained from sources believed to be reliable. While FINANSINVEST has spent reasonable care in verifying the accuracy and completeness of the information presented herein, it cannot be held responsible for any errors, omissions or for consequences arising from the use of such information.

This document is published for purposes of providing information to investors who are expected to make their own investment decisions without undue reliance on this report.

Therefore, no article or statement can be construed as an investment advice or a solicitation to buy or sell the securities mentioned herein. The affiliates, officers, partners and employees, including persons involved in the preparation or issuance of this material may have a direct or indirect position in any security mentioned in this report.

Disclosure

For U.S. persons only: This research report is a product of Finans Yatirim Menkul Degerler A.S. (“FINANSINVEST”), which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

This report is intended for distribution by FINANSINVEST only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934

(the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major

Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with

Major Institutional Investors, FINANSINVEST has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").

Transactions in securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer.

Ford Otosan / 1 September 2015 5