Non-residential real estate and economic activity: The case of Greece

advertisement

Non-residential real estate and

economic activity: The case of Greece

Economic Analysis & Markets

January 2014

Ilias Lekkos

Lekkosi@piraeusbank.gr

Irini Staggel

Staggelir@piraeusbank.gr

Kostas Kefalas Kefalask@piraeusbank.gr

Paraskevi Vlachou Vlachoupar@piraeusbank.gr

Piraeus Bank

4 Amerikis Street, 105 64, Athens, Greece

Tel: (+30) 210 328 8187, Fax: (+30) 210 328 8605

researchdivision@piraeusbank.gr

Bloomberg Page: <PBGR>

Our aim is to discuss developments in non-residential real estate in Greece. Given the lack of

existing literature, we start by discussing at length the data sources available, and analyzing the

stylized facts of non-residential real estate activity in Greece. Finally, we examine the degree of

covariation (using the Index of Concordance methodology) between non-residential real estate and

the business cycle.

Our results indicate that

i)

the structure of non-residential sector is highly fragmented into various sub-categories and

ii)

at the initial stages of its developments it was strongly affected by the preparations for the 2004

Athens Olympic Games.

iii)

Finally, despite its small share of total GDP, non-residential real estate shows a significant

degree of covariation with the business cycle.

NB: This brief presentation is based on our research paper on “Non-residential real estate and economic activity: the

case of Greece” which was published in the Journal of Property Investment & Finance Vol. 32 No. 1, 2014 pp. 35-55

2

The first step of this analysis is to present the stylized features of non-residential construction activity in

Greece, compare its evolution to the corresponding activity in the Euro Area and finally analyze its relationship

to the Greek business cycle. Given the multi-dimensional nature of non-residential investment activity, we used

a number of different sources in our research:

§

We used quarterly data on Gross Fixed Capital Formation (GFCF) from ELSTAT for Greece and

Eurostat for the Euro Area. Furthermore we decompose GFCF into its main components, namely

“Dwellings”, “Other buildings and structures” – which track closely non-residential investment- and

“Other Investment”.

§

A more detailed picture regarding non-residential activity is provided by the Number of nonresidential building permits, the volume (measured in cubic meters, m3) of non-residential building

permits and the Building permits indicator based on the useful floor area measured in square meters

(m2).

§

An alternative way to analyze the construction sector is through the Production Index in

Construction (PIC), which shows the quarterly activity in the production of building construction and

the production of the civil engineering sector. The index compares the volume of the quarter’s output

with the corresponding figure for the given base period (2005=100) and measures the evolution of

volume trend in value added at factor cost of production in construction for any given reference period.

The main sub-indices of the PIC are the Production Index of Building Construction and the

Production Index of Civil Engineering.

§

Finally, we used the Construction Confidence Index estimated by DG EcFin.

3

Our intention is to determine the general pattern of the data and analyze long-term trends. In order to

examine the relationship between non-residential construction and economic output, we need a

measure of the business cycle for Greece and the Euro Area. The most well established metric for the

evolution of the business cycle is the so-called output gap. In broad terms, the output gap measures

the deviation of GDP from a measure of its long-term trend.

Output Gap Indicators, Greece – Euro Area

2

0

-2

-4

-6

00

01

02

03

04

05

06

Euro Area

Source: European Commission DG ECFIN, EL.STAT., Eurostat, Piraeus Bank Research

07

08

09

10

11

12

Greece

4

According to the system of National Accounts (Eurostat, 1999), total investment in the economy is measured

by Gross Fixed Capital Formation (GFCF). In turn, GFCF can be broken down into residential investment

(“Dwellings”), non-residential investment (“Other buildings and structures”) and “Other investment”. The

evolution of these three components of GFCF is illustrated in the Figure below.

The total GFCF (in real terms) peaked in 2007 and has been declining rapidly ever since. Furthermore, it

becomes obvious that up until 2007, the most significant component of total investment expenditure was

residential investment, with other investment following in second place and non-residential investment

occupying third place.

GFCF Components Cumulative Evolution, Greece,

constant prices 2005, mn €

16,000

12,000

8,000

4,000

0

2000

2001

2002

2003

2004

Other investment

2005

2006

Dwellings

2007

2008

2009

2010

Other buildings and structures

2011

2012

Source: ΕLSTAT, Piraeus Bank Research

5

Total GFCF peaked at 26.6% of GDP in 2007, but due to the severe economic recession has declined to 13.1%

in 2012. Nevertheless, non-residential investment follows a completely different pattern. Non-residential

investment was exceptionally high (as a % of GDP) at the beginning of the century due to the preparations for

the 2004 Athens Olympic Games, peaking at 6.8% in 2001. After the end of the Olympic Games, it declined

sharply in 2005 to 3.6% of GDP and remained around this level until 2007. In 2008 and 2009, it enjoyed a brief

renaissance, just when residential investment was plummeting, resulting in an increase of the non-residential

share of total GDP. After 2009, non-residential investment declined sharply and currently contributes only

3.2% of GDP.

Contribution of GFCF main components to its

rate of change, Greece, constant prices 2005

GFCF in Greece, as % of GDP

28.0%

7.5%

26.0%

7.0%

20.0

24.0%

6.5%

15.0

22.0%

6.0%

10.0

20.0%

5.5%

18.0%

5.0%

16.0%

4.5%

14.0%

4.0%

12.0%

3.5%

25.0

%

5.0

0.0

-5.0

-10.0

-15.0

3.0%

10.0%

2000

2001

2002

2003

Total (LHS)

2004

2005

2006

2007

2008

2009

2010

2011

Other buildings and structures (RHS)

2012

-20.0

-25.0

2001

2002

Dwellings

2003

2004

2005

2006

Other buildings and structures

2007

2008

2009

Other investment

2010

2011

2012

Total (YoY change)

Source: ΕLSTAT, Piraeus Bank Research

6

The different behavior in non-residential investment between Greece and the Euro Area is clearly

demonstrated in the Figures below.

At the beginning of the previous decade Greek non-residential investment was clearly driven by the

need for Olympic Games related infrastructure projects, while after 2006, it follows Euro Area trends but

with a 2-year lag. Similarly the construction sector’s confidence at the beginning of the period is much

higher in Greece that in the Euro Area.

Construction Confidence Index,

Greece and Euro Area

GFCF of Other Buildings and Structures, Greece

and Euro Area, constant prices 2005, mn €

40

128,000

2,600

124,000

2,400 20

120,000

2,200

116,000

2,000

112,000

1,800

108,000

1,600

104,000

1,400 -60

0

-20

-40

100,000

1,200

2001

2002

2003

2004

2005

2006

Euro Area (LHS)

2007

2008

2009

Greece (RHS)

2010

2011

2012

Figure 8.

GFCF of Other Buildings and

Structures, Greece and Euro

Area, constant prices 2005,

mn euros

-80

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Euro Area

Greece

Source: ΕLSTAT, Eurostat, European Commission DG EcFin, Piraeus Bank Research

7

Two of the best documented features of residential construction activity are the high degree of covariation its

exhibits with overall economic activity within each economy as well as the high level of response to global

economic shocks (Cesa – Bianchi, 2011).

On the contrary, the examination of building permits per m2 both in Greece and the Euro Area (see Figures)

reveals the rather idiosyncratic behavior of non-residential activity. One possible explanation for this

difference in the behavior of residential versus non-residential activity is the rather fragmented nature of nonresidential activity. Whereas residential activity is more or less homogeneous, non-residential construction

consists of many extremely heterogeneous sub-groups.

Building Permits Index, Greece,

m2 of useful floor area (2010=100)

500

Building Permits Index, Euro Area,

m2 of useful floor area (2010=100)

320

280

400

240

300

200

200

160

100

120

0

2004

2005

2006

2007

T otal

2008

2009

Non residential

2010

Residential

2011

2012

80

2004

2005

2006

2007

T ot al

2008

2009

Non-residential

Source: Εurostat, Piraeus Bank Research

2010

2011

2012

Residential

8

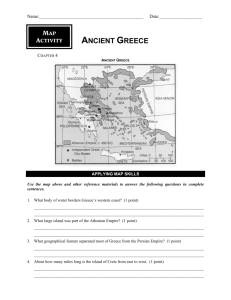

According to the breakdown of the number of non-residential building permits, 32% of the total is for retail spaces,

i.e. shops and shopping malls, 10% for industrial structures and 9% for offices. Indicative of the heterogeneity of

non-residential real estate activity is the fact that unclassified structures comprise 29% of all permits while the

“Others” category, which consists of classified yet too small to report structures, accounts for 12% of the total.

Furthermore, the decomposition of non-residential activity based on volume – reveals an even more nuanced

picture. When examined from this perspective, industrial structures dominate making up 38% of total, with retail

second at 19% and offices at a distant 5%. Again unclassified and Others account for 14% and 10% respectively.

Greece, Number of building permits

(% of total, average 1997 -2011)

Collective

0%

Livestock

2%

Hotels

3%

Greece, Building permits volume in m3

(% of total, average 1997 -2011)

Medical care

0%

Collective

0%

Medical care

1%

Hotels

6%

Others

10%

Others

12%

Non Specified

29%

Livestock

3%

Retail Spaces

19%

Retail Spaces

32%

Industrial

38%

Industrial

10%

Offices

Educational 9%

Institutes

1%

Agricultural

2%

Non Specified

14%

Educational

Institutes Offices

1%

5%

Agricultural

3%

Source: ΕLSTAT, Piraeus Bank Research

9

A final, but equally important question relates to the degree of comovement between the variables

that track non-residential investment and the business cycle given by the output gap.

The most common method of measuring the degree of association or comovement uses the

standard linear correlation, “ρ” coefficient. Although correlation is the most well known and

intuitive measure of association it suffers from a well documented shortcoming. It is affected by both

the duration of the comovement of two variables as well as the size of the comovement. In other

words, a high correlation value can be estimated when either both variables move for a long time in

the same direction, or when the two variables move briefly but sharply in the same direction

(McDermott and Scott 2000).

One statistic that is immune to this shortcoming is the concordance index proposed by Harding

and Pagan (2001). According to Harding et al (2001) the concordance index measures the

fraction of time two variables spend in the same phase of the cycle. In what follows we first

estimate the turning point of the cycle for all variables under examination and then proceed

to make an estimation of the correlation and concordance indices.

10

The turning points are derived according to a Bry - Broschan algorithm (BBQ). According to the

BBQ algorithm (Bry and Boschan, 1971 & Harding, and Pagan, 2002), in the BBQ algorithm, turning

points are identified when a local peak (trough) is observed around two quarters. Each phase of a

cycle should have a minimum duration of 2 quarters, and a whole cycle should have a minimum

duration of five quarters.

In the case of output gap, a contraction (expansion) period is defined as the period between a peak

(trough) and a trough (peak) indicating declining (increasing) GDP growth rates. The turning points of

the business cycle in Greece and the Euro Area are reported below, with the shaded regions indicating

periods of recession.

Euro Area

Greece

2.0

16.0

12

2.0

14.0

10

1.0

12.0

1.0

8

10.0

0.0

8.0

-1.0

6

0.0

6.0

4

4.0

-2.0

2.0

-3.0

2

-1.0

0.0

-2.0

-4.0

0

-2.0

-2

-4.0

-5.0

-6.0

-4

-3.0

-8.0

-6

-6.0

-10.0

2000

2001

2002

2003

2004

GDP growth rate (RHS)

2005

2006

2007

2008

Output Gap - Greece

2009

2010

2011

2012

Turning Points

Note: shaded areas represent recession periods.

Source: ELSTAT, Eurostat, European Commission DG EcFin, Piraeus Bank calculations

-8

-4.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-12.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-7.0

2000

2001

2002

2003

2004

GDP growth rate (RHS)

2005

2006

2007

2008

Output Gap - Euro area

2009

2010

2011

2012

Turning Points

11

Having identified the periods of expansion and contraction of all relevant variables we turn our

attention to the analysis of the relationship between the cyclical behavior of non-residential

activity and economic activity.

In order to review the similarity of the economic cycles and to measure how closely the cycles

of the indicators are synchronized to the output gap index we use the index of concordance.

The index of concordance (IC) measures the portion of time that two business cycles

spend in the same phase and is defined as:

1

ICir

T

å {S S + (1 - S )(1 - S )}

T

i r

t t

i

t

r

t

i =1

where, Si/t and Sr/t denote the state variable of the business cycle of the indicator i and the

reference variable (i.e the output gap). St: takes the value 1 in expansions and zero in

contractions.

An initial analysis was conducted with the use of the correlation coefficient. The results of this

analysis showed that the correlation index is in rather low levels in a range of 0.23 to 0.51. On

the contrary, the concordance index indicates a relative strong synchronicity between the

business cycles of the variables and the reference variable (i.e output gap).

12

Based on the concordance index we see that in Greece, the GFCF is on average roughly three quarters

of the time in the same cyclical phase as the output gap and in most cases follows the cyclical

fluctuations of the reference variable with an average lag of 2 quarters.

An interesting finding is that, even though all three indicators have entered the recession phase of the

economic cycle, the GFCF followed a downward trend with a 4 - period lag, showing some kind of

resistance to the overall decline of the economic activity.

At the same time, according to GFCF, only one cycle is noted in the Euro Area.

Euro Area

Greece

3.0

3.0

2.0

2.0

1.0

1.0

0.0

-1.0

0.0

-2.0

-1.0

-3.0

-4.0

-2.0

-5.0

-3.0

-6.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-4.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-7.0

2000

2001

2002

2003

2004

2005

GFCF of other buildings & structures - GR

Output Gap - Greece

2006

2007

2008

2009

2010

GFCF - Turning Points

Output Gap - Turning Points

2011

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2012

GFCF of other buildings and structures - EA

Output Gap - Euro Area

GFCF - Turning Points

Output Gap - Turning Points

Source: ΕLSTAT, Eurostat, European Commission DG EcFin, Piraeus Bank Research

13

The production index both in Greece and the Euro Area, seems to be in the same cyclical phase with

the output gap throughout most of the observed period. However, in the case of Greece, we note that in

the output gap there is a cycle fluctuation in 2001, which is not reflected in the production index.

Regarding the Euro Area, the production index of civil engineering implied more cycles than all the other

indices.

Greece

Euro Area

2.0

2.0

1.0

1.0

0.0

-1.0

0.0

-2.0

-1.0

-3.0

-4.0

-2.0

-5.0

-3.0

-6.0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

-4.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-7.0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Production index of civil engineering

PIC - Turning Points

Production index of civil engineering - EA

PIC - Turning Points

Output Gap - Greece

Output Gap - Turning Points

Output Ga p - Euro Area

Output Gap - Turning Points

2011

2012

Source: ΕLSTAT, Eurostat, European Commission DG EcFin, Piraeus Bank Research

14

In Greece, the building permits indicator shows a significant degree of concordance with the

business cycle.

In the case of the Euro Area, the concordance index between the time-series is strongly positive,

but still in levels below the respective in Greece.

Greece

Euro Area

3.0

3.0

2.0

2.0

1.0

1.0

0.0

-1.0

0.0

-2.0

-1.0

-3.0

-4.0

-2.0

-5.0

-3.0

-6.0

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Non residential building permits (M2) index – GR

M2 - Turning Points

Output Gap - Greece

Output Gap - Turning Points

2011

2012

-4.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-7.0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Non residential building permits (M2) index – EA

M2 - Turning Points

Output Gap - Euro Area

Output Gap - Turning Points

2011

2012

Source: ΕLSTAT, Eurostat, European Commission DG EcFin, Piraeus Bank Research

15

We presented one of the first comprehensive discussions regarding the evolution of non-residential real estate activity in

Greece.

§

The first of our key findings is the documentation of the highly fragmented nature of the non-residential real

estate sector.

§

Furthermore, we present evidence that, at least at the beginning of the last decade, non-residential real estate

development in Greece was highly affected by the preparations for the 2004 Olympic Games. That fact in

combination with differences in the rates of economic growth between Greece and the Euro Area meant that

Greek non-residential real estate displays little connection with non-residential activity in the rest of the Euro Area.

§

Regarding the degree of covariation (using the Index of Concordance methodology) between non-residential real

estate and the business cycle, our findings suggest that, despite its small share of total GDP, the various

indicators of non-residential real estate activity show a significant degree of covariation (or concordance) with

the business cycle.

Based on the concordance index we see that in Greece:

§

GFCF is for, on average, roughly three quarters of the time in the same cyclical phase as the output gap and in

most cases follows the cyclical fluctuations of the reference variable with an average lag of 2 quarters.

§

The production index and the building permits indicator seem to be in the same cyclical phase as the output

gap throughout most of the observed period.

§

Even though all three indicators have entered the recession phase of the economic cycle, the GFCF followed a

downward trend with a 4-period lag, showing some kind of resistance to the overall decline in economic activity.

On the contrary, non-residential permits of useful floor usage index (in m2) reacted with a one-period lead.

16

Disclaimer: This note constitute an investment advertisement, is intended solely for information purposes and it cannot in any way be considered investment

advice, offer or recommendation to enter into any transaction. The information included in this note may not be construed as suitable investment for the holder,

nor may it be considered as an instrument to accomplish specific investment goals or relevant financial needs of the holder and may neither be reckoned as a

substitute to relevant contractual agreements between the Bank and the holder. Before entering into any transaction each individual investor should evaluate the

information contained in this note and not base his/her decision solely on the information provided. This note cannot be considered investment research and

consequently it was not compiled by Piraeus Bank according to the requirements of the law that are intended to ensure independence in the sector of investment

research. Information comprised in this note is based on publically available sources that are considered to be reliable. Piraeus Bank cannot be held accountable

for the accuracy or completeness of the information contained in this note. Views and estimates brought forward in this note represent domestic and international

market trends on the date indicated in the note and they are subject to alteration without previous warning. Piraeus Bank may also include in this note investment

research done by third parties. This information is not modified in any way, consequently the Bank cannot be held accountable for the content. The Piraeus Bank

Group is and organization with a considerable domestic and international presence, and provides a great variety of investment services. In cases where conflicts

of interest issues should arise while Piraeus Bank or the rest of the companies of the group provide investment services in relation to the information provided in

this note, Piraeus Bank and the companies of the Group should be underlined that (the list is not exhaustive): a) No restrictions apply in dealing for own account,

or with regards to trading in relation to portfolios managed by Piraeus Bank or companies of its group before the publication of this note, or with regards to trading

before an initial public offer. b) It is possible that investment or additional services are provided to the issuers included in this note against a fee. c) It is possible

that Bank or any of its subsidiaries participate in the share capital of any of the issuers included in this note or may attract other interests financial or not from them.

d) The Bank or any of its subsidiaries may act a market maker or an underwriter for any of the issuers included in the note. e) Piraeus Bank may have issued

similar notes with different or incompatible content with the content of this note. It should be explicitly noted that: a) Figures refer to past performances and past

performances do not constitute a safe indication for future performances. b) Figures constitute simulation of past performances and they are not a safe indication

of future performances. c) Any projections or other estimates are not safe indications for future performances. d) Taxation treatment of information provided in this

note may differ according to the rules that govern each individual investor. Therefore the holder should seek independent advice in relation to taxation rules that

may affect him/her. e) Piraeus Bank is not under any obligation to keep data and information provided herein updated.

17