The body mass index, or BMI, helps clarify

advertisement

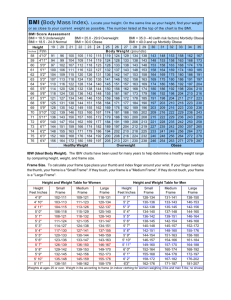

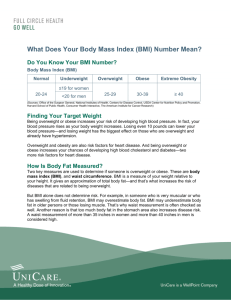

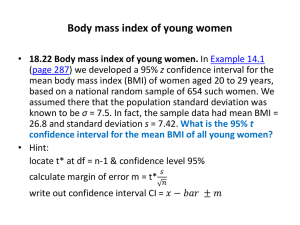

Title: Body Mass Index (BMI): Are You at a Healthy Weight? Word Count: 435 Summary: The body mass index, or BMI, helps clarify an important distinction between being overweight or being obese. Keywords: body mass index, BMI, body mass index calculator, BMI calculator Article Body: The body mass index, or BMI, helps clarify an important distinction between being overweight or being obese. If you weigh too much, you're obviously overweight. But if you have a very high proportion of body fat, you're obese. Based on your body mass index, your doctor or other health professional will classify your weight as healthy, overweight, or obese. According to the National Heart, Lung and Blood Institute (NHLBI), the BMI "describes body weight relative to height and is correlated with total body fat content in most adults". In almost all cases, this means that the BMI will accurately reflect your weight and proportion of body fat as a function of your height and weight when categorizing you as healthy, overweight or obese. Calculating your approximate body mass index is relatively straightforward, although you'll probably need a calculator just to save time. To get your BMI, multiply your weight in pounds by 703. Next, divide that result by your height in inches. Then divide that result by your height in inches one more time. As an example, let's say you weigh 180 pounds and are 5 feet 10 inches tall. Multiply 180 by 703 to get 126,540. Next, divide this by 70 (70 inches is the same as 5' 10") to get 1807.7. Now, divide 1807.7 by 70 one more time. The result -- 25.8-- is your approximate BMI or body mass index. If you don't have a calculator handy, you can get the same result using the free interactive BMI calculator at www.nhlbisupport.com/bmi/bmicalc.htm. If the above example sounds you, you might be surprised to learn that you're ever so slightly heavier than your doctor might like. A BMI from 18.5 up to 25 is considered healthy, from 25 up to 30 is classified as overweight, and 30 or higher is obese. Generally, says the NHLBI, the higher a person's BMI, the greater the risk for health problems. In addition to causing your BMI to skyrocket, excess body fat is a well recognized health risk. Men and women with waist lines in excess of 40 and 35 inches, respectively, are much more at risk for health problems like Type 2 diabetes, high blood pressure and high cholesterol. Like every rule of thumb, this one also has it exception. Body builders, for example, often have a body mass index above 25 and sometimes even above 30. In this case, however, the higher BMI reflects the fact that body builders have more muscle mass without having more fat. Finally, there's still only one sure way to lower your BMI if you're overweight or obese: Eat less and exercise more. Your body will burn more calories than you eat and your body mass index will go down over time. Title: Health Insurance For Small Business Owners Word Count: 454 Summary: If you are a small business owner and you need to purchase health insurance, you may be surprised by how much a policy covering just you can cost. If you need to find a plan that also covers your family, the cost may be even higher. Because of rising health insurance premiums, restrictions about how much coverage you can receive due to pre-existing conditions, and other rules, many small business owners are unable to afford basic health insurance. If you have a small business... Keywords: Article Body: If you are a small business owner and you need to purchase health insurance, you may be surprised by how much a policy covering just you can cost. If you need to find a plan that also covers your family, the cost may be even higher. Because of rising health insurance premiums, restrictions about how much coverage you can receive due to pre-existing conditions, and other rules, many small business owners are unable to afford basic health insurance. If you have a small business that employs a few people, you may not be able to offer health insurance coverage because the premiums are too high. You have a few options, however, when it comes to health insurance coverage. There are smaller companies that offer plans with higher deductibles or those that cover hospital stay and other emergency care, but do not cover routine check-ups and other appointments. Some plans cover these doctor visits, but require you to pay a higher copay. Even though these plans are not the best, they may be enough to provide you with adequate coverage until you begin earning more money or if your business grows. If you have employees and want to offer them health insurance, you can sign up for a plan that offers flex options. You pay a smaller premium and each employee receives a certain amount of money each year to cover basic medical needs. Flex plans are also offered to employees who work for larger companies as a way to supplement existing health plans. Employees will still have to pay a copay and pay for major medical emergencies, but other costs will be lower. Paying for health insurance can be a burden if you are just starting your business. If you have a spouse with an insurance plan you can be added to it. This is a good idea that will save you a lot of money in the long run. Other options when looking for health insurance include joining local community organizations, academic organizations, or alumni organizations. Many times these organizations may be able to offer limited coverage for at least six months. This can help you establish your business and find adequate healthcare coverage in the meantime. Once your business is generating a profit, you should find out more about health insurance, especially if you aren currently covered. Because health issues can occur at any time, you need to be prepared. Having surgery after an accident or illness can cause you to lose your business. Medical costs can take their toll as well. Finding affordable health insurance is possible if you look at smaller agencies and local groups who can provide you with more information or less coverage for the time being. 抰 Title: Sick of Paying Your Employer to Cover Your Health Insurance? Word Count: 411 Summary: Many employers offer expensive insurance. If you or a dependent has a medical condition, it probably makes sense to stay with your employer's plan. But if you rarely visit the doctor, why pay more for an expensive health plan with benefits you won't use? Keywords: Sick of Paying Your Employer to Cover Your Health Insurance? Article Body: Health insurance costs have been skyrocketing for years. Many employers can't afford it and have no choice but to pass the increased costs along to you. If the money taken out of your paycheck seems to go up and up, that's why. But what can you do about it? Take Control of Your Health Insurance Dollars Every company has an open enrollment period when employees are allowed to review health insurance options and make changes or drop coverage. Do your homework first! Look at your deductions and talk to your HR person to find out what percentage of your monthly premium the company covers. With these numbers in mind, look at private health insurance. A good place for advice and free health insurance quotes is www.ehealthinsurance.com. Believe it or not, you may find that it makes more sense to opt out of your employer's plan and use the money they would have taken out of your paycheck to pay for your own insurance. Suffering From Coverage Overkill? The truth is, many employers offer expensive insurance. If you or a dependent has a medical condition, it probably makes sense to stay with your employer's plan. But if you rarely visit the doctor, why pay more for an expensive health plan with benefits you won't use? Imagine if auto insurance included coverage for repairs. You'd probably pay twice as much and, if your car is reliable, you'd never use that extra coverage. You'd be better off putting the money you would spend on insurance into the bank. Health insurance works the same way. You can lower premiums by finding a high-deductible health plan. Put that savings in the bank in case you need medical care until you reach your deductible. Think About Your Kids Even if you keep your own employer coverage, you might save money by putting your dependents on a private health insurance plan. Most employers only cover a small percentage of the premium for your dependents, while you're left paying the rest. Individual plans for your kids are another way to save money. For example, a nine-year-old in Toledo, Ohio can get a policy for under $50 a month! An easy way to compare rates from insurance companies is on eHealthInsurance.com. You can find quotes for just one child or for your entire family just by entering your zip code. Karen Auby is a personal finance expert. A high-deductible health plan is one way to lower your premiums.