C:\Documents and Settings\Caitlin\Desktop\InterpVTN339\2009

advertisement

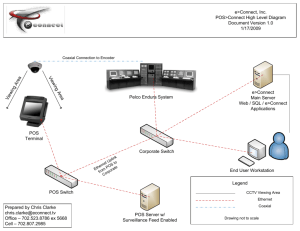

LANGIND E DOCNUM 2009-0311501E5 AUTHOR Rafuse, Charles DESCKEY 25 RATEKEY 2 REFDATE 090713 SUBJECT CCA-Point of Sale systems SECTION $$$$ Please note that the following document, although believed to be correct at the time of issue, may not represent the current position of the CRA. Prenez note que ce document, bien qu'exact au moment émis, peut ne pas représenter la position actuelle de l'ARC. PRINCIPAL ISSUES: What is the CCA class for computers and software used for Point of Sales systems or computer hardware and systems for taking customer orders, transmitting orders to kitchens, and producing restaurant cheques? POSITION: Class 45, 50 or 52 depending on the acquisition date and other conditions being met. REASONS: From our review of POS systems advertised on the internet it was noted that, on one website, an economy system consisted of a computer, touch screen monitor, cash drawer, receipt printer and software. In was also noted that the computer was the main component of the price. A POS computer could qualify as general-purpose electronic data processing equipment and the other components of a POS system could qualify as ancillary data processing equipment. A POS system could be included in class 52 depending on the acquisition date and if the other conditions for inclusion in the class are met. 2009-031150 XXXXXXXXXX Charles Rafuse 613-247-9237 July 13, 2009 file:///C|/Documents%20and%20Settings/Caitlin/Desktop/InterpVTN339/2009-0311501E5.txt[05/11/2009 12:19:41 PM] Dear XXXXXXXXXX : Re: Capital Cost Allowance This is in response to your email of February 24, 2009, regarding the proper class in Schedule II of the Income Tax Regulations ("Regulations") in which a computer system should be included. A temporary 100% capital cost allowance (CCA) rate for computer hardware and software acquired after January 27, 2009 and before February 1, 2011 was proposed in the 2009 Federal Budget and enacted into law by adding class 52. You have asked whether computers and software used for Point of Sales (POS) systems used in restaurants would qualify for the temporary 100% CCA rate. As you have not provided a complete description of the equipment XXXXXXXXXX in the restaurant industry, our understanding of a POS system is based on information obtained on the internet. From our review of POS systems advertised on the internet it was noted that, on one website, a one station system varied in price from about $1,500, for an economy system, to about $3,800, for the more expensive system with an additional back office computer, while multi-station POS systems costs were available at basically multiples of these prices. The economy system consisted of a computer, touch screen monitor, cash drawer, receipt printer and software. It was also noted that the computer was the main component of the price as the price for an additional cash drawer was less than $200, receipt printer was about double that amount and a credit card reader was about $100. Our Comments Written confirmation of the tax implications inherent in particular transactions is given by this Directorate only where the transactions are proposed and are the subject matter of an advance income tax ruling request submitted in the manner set out in Information Circular 70-6R5, Advance Income Tax Rulings, dated May 17, 2002. Where the particular transactions are completed, the inquiry should be addressed to the relevant Tax Services Office (the "TSO"). We are, however, prepared to offer the following general comments, which may be of assistance. Schedule II of the Regulations provides the various classes for depreciable capital property and the applicable rates of CCA. In particular, paragraph (i) in class 8 includes all tangible capital property that is not found in any other class. Property acquired after March 22, 2004 and before March 19, 2007, that is general-purpose electronic data processing equipment and systems software for that equipment, including ancillary data processing equipment, is included in Class 45 with a 45% CCA rate, and if acquired after March 18, 2007 it is included in class 50 with a 55% CCA rate. file:///C|/Documents%20and%20Settings/Caitlin/Desktop/InterpVTN339/2009-0311501E5.txt[05/11/2009 12:19:41 PM] In addition, the new class 52 generally provides for a temporary 100% CCA rate for property acquired after January 27, 2009 and before February 2011 that is general-purpose electronic data processing equipment and systems software for that equipment, including ancillary data processing equipment that: * is situated in Canada; * is new equipment; and * is acquired by the taxpayer either o for use in a business carried on by the taxpayer in Canada or for the purpose of earning income from property situated in Canada; or o for lease by the taxpayer to a lessee for use in a business carried on by the lessee in Canada or for the purpose of earning income from property situated in Canada. However, the property falling into classes 45, 50 and 52 does not include property that is principally or is used principally as electronic process control or monitor equipment (including related system software), electronic communications control equipment (including related system software), or data handling equipment (other than such equipment that is ancillary to general-purpose electronic date processing equipment). The expression "general-purpose electronic data processing equipment" is defined in subsection 1104(2) of the Regulations as follows: "general-purpose electronic data processing equipment" means electronic equipment that, in its operation, requires an internally stored computer program that (a) is executed by the equipment, (b) can be altered by the user of the equipment, (c) instructs the equipment to read and select, alter or store data from an external medium such as a card, disk or tape, and (d) depends upon the characteristics of the data being processed to determine the sequence of its execution. Examples of general-purpose electronic data processing equipment are a desktop computer system and a laptop computer. file:///C|/Documents%20and%20Settings/Caitlin/Desktop/InterpVTN339/2009-0311501E5.txt[05/11/2009 12:19:41 PM] Neither the phrase "ancillary data processing equipment" nor the word "ancillary" (both found in the description of property falling into classes 45, 50 and 52) is defined in the Income Tax Act. However, the Black's Law Dictionary defines the word "ancillary" as "aiding, attendant upon, auxiliary or subordinate". In general, equipment can be said to be ancillary when it is necessarily auxiliary or subordinate to general-purpose electronic data processing equipment. An example of ancillary equipment is a small printer connected to and used to print the output from a desktop computer. A POS computer would generally qualify as general-purpose electronic data processing equipment and in situations where the touch screen monitor, receipt printer, cash drawer and card reader are used with the POS computer they could be considered ancillary data processing equipment. Accordingly, a POS system used in the restaurant industry could qualify as class 52 assets depending on the acquisition date and if the other conditions for inclusion in that class explained above have been met. We trust that these comments will be of assistance. Yours sincerely, S. Parnanzone For Director Business and Partnerships Division Income Tax Rulings Directorate Legislative Policy and Regulatory Affairs Branch file:///C|/Documents%20and%20Settings/Caitlin/Desktop/InterpVTN339/2009-0311501E5.txt[05/11/2009 12:19:41 PM]