(re)Emerging Discounters

advertisement

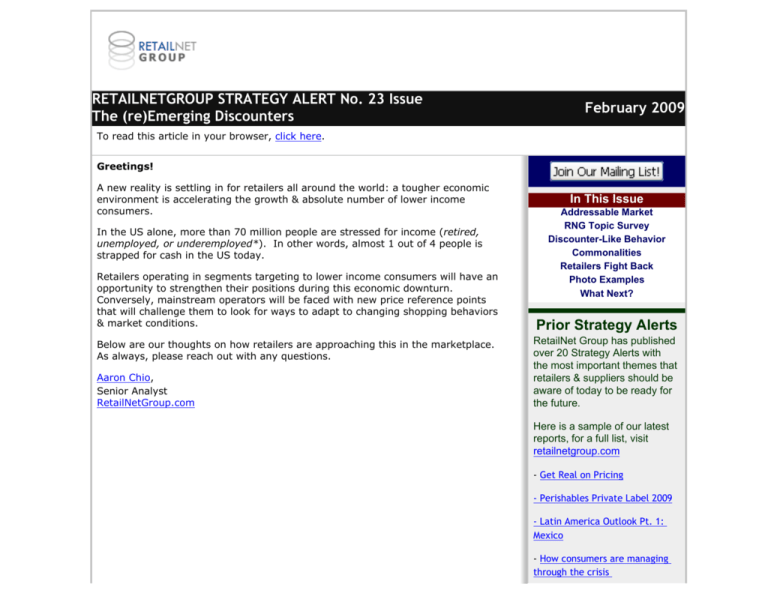

RETAILNETGROUP STRATEGY ALERT No. 23 Issue The (re)Emerging Discounters February 2009 To read this article in your browser, click here. Greetings! A new reality is settling in for retailers all around the world: a tougher economic environment is accelerating the growth & absolute number of lower income consumers. In the US alone, more than 70 million people are stressed for income (retired, unemployed, or underemployed*). In other words, almost 1 out of 4 people is strapped for cash in the US today. Retailers operating in segments targeting to lower income consumers will have an opportunity to strengthen their positions during this economic downturn. Conversely, mainstream operators will be faced with new price reference points that will challenge them to look for ways to adapt to changing shopping behaviors & market conditions. Below are our thoughts on how retailers are approaching this in the marketplace. As always, please reach out with any questions. Aaron Chio, Senior Analyst RetailNetGroup.com In This Issue Addressable Market RNG Topic Survey Discounter-Like Behavior Commonalities Retailers Fight Back Photo Examples What Next? Prior Strategy Alerts RetailNet Group has published over 20 Strategy Alerts with the most important themes that retailers & suppliers should be aware of today to be ready for the future. Here is a sample of our latest reports, for a full list, visit retailnetgroup.com - Get Real on Pricing - Perishables Private Label 2009 - Latin America Outlook Pt. 1: Mexico - How consumers are managing through the crisis The Addressable Market Meet Our Analysts This group of cash-strapped and typically lower income shoppers - what we call the addressable market - totaled 72.5 million in 2008 and could easily grow to 77.6 million by 2012E. (Figure 1). The group is comprised of unemployed, underemployed (i.e., people wanting to work full-time but only working part-time), and retirees (typically people on fixed income, savings might be devastated, and might be emotionally distressed due to the latter) Figure 1: Addressable Market (click images to enlarge) Dan W. O'Connor is the President & CEO of the RetailNet Group. He also is the Founder of Management Ventures, Inc. (MVI), a WPP Group company. Dan is a widely known industry speaker and thought leader. Email | LinkedIn Source: BLS, RetailNet Group This group of consumers naturally grows & shrinks with each economic cycle. However, 2007-2008 marked only the first year of a period typically lasting 3-4 years and characterized by rapid growth for this group consumers. Simply put, most forecasts point toward hefty growth for this group of consumers in the US. (Figure 2). Figure 2: Group is likely to continue to grow in the next 3-4 years Aaron Chio is a Senior Analyst leading RNG's development of new research, insights and growth strategies in Latin America. Email | LinkedIn | Twitter Tim O'Connor is Vice President at RNG, currently responsible for RNG's Growth Strategies Curriculum and European market insights. Email | LinkedIn Source: BLS, RetailNet Group RNG Topic Survey What do you want to learn more about in 2009? Keith Anderson is a Senior Analyst and responsible for RNG's North American research practice and transformational capabilities curriculum. Email | LinkedIn | Twitter | Windows Live Messenger Click here for our short survey which will help us deliver the most important and relevant topics to you. Discounter-Like Behavior As a response to the difficult economic times and a growing number of fixedincome consumers, RNG is seeing more and more retailers engaging in behaviors traditionally associated more with discounters than mainstream operators. This is happening not only in markets where discounters are already highly developed (like Europe/UK) but also in the US and to some extent even in Latin America (subscribers see RNG's recent store visit of Bodega Aurrera Express in Mexico, non subscribers contact us for information on buying this report) In the US, we have segmented some of these retailers into an 'extreme value' group, which when put together, is expected to grow 2x faster than the US chain retail average for the 2009E-2011E period (Figure 3). Individually their stories are significantly different, but put together, that are some common traits that are worth exploring. Figure 3: Sample of extreme value retailers (click to enlarge) Symantha Chow is a Research Analyst and supports RNG's North American and Latin American research, including its database of chain retailers. Email | LinkedIn Source: RetailNet Group Extreme Value Retailer Commonalities These retailers, despite belonging to a wide variety of segments, have several things in common. Most of them actually fit somewhere in between a traditional discounter and a mainstream supermarket operator (Figure 4). Figure 4: RNG's framework for extreme value retailers Source: RetailNet Group Here are some highlights that differentiate these extreme value retailers from their mainstream competition: ● ● Clear value positioning targeting extremely value-conscious, incomechallenged, and/or lower-income consumers. Competing directly with OPP (opening price point) food retailers. ● ● ● ● ● ● ● Fewer assortment trade-offs compared to limited assortment grocers (particularly true for retailers like Winco, Kroger's Food4Less). Narrow merchandising ladders in private label but high price differentials on OPP vs. branded, meaning there aren't 3-4 tiers of private label within the same category. Focus on convenient shopping. For example good real estate, colocated to retailers that drive a lot of traffic, convenient hours (most Winco's open 24 hrs). Offer a dignified shopping experience: Treasure hunt feel with a focus on food; clean stores with wide aisles, and no frills experience to reflect their pricing image & value proposition. Focus on simple affordable food offerings, offering easy-to-make meals requiring 1 or 2 ingredients with little/no preparation. Availability of bulk food & global palette of food offerings. Unique labor & economic model, requiring high velocity & low cost operations. Scroll down to the bottom of this newsletter to see some in-store example photos of how retailers are doing this. Mainstream Retailers Fight Back As new reference price points become available in the marketplace driven by a lot of these 'extreme value' retailers, mainstream operators are experimenting with ways to fight back and lure consumers back into their stores, including: ● ● ● Rapid private label extension with the introduction of new discounter brands, particularly in the UK, but also in the US with more SKUs showing up at the OPP level. Improvements in private label packaging & shelf presentation. Visible in almost every store around the US, retailers are focusing more on trying to deliver extra benefits at a lower price. Big push in perishables private label growth. RNG is seeing the advent of 4-5 tiers of private label in some categories (such as perishables) becoming more and more prominent globally. See this report we wrote a few weeks ago. ● ● ● ● ● Increasing in-store value communications. Retailers getting more tactical at the store level around communicating value to consumers. So the function here is shifting not only to offering relevant price points but more importantly making sure the message is heard across the shopper base. Comparable pricing. In line with communicating value to consumers, retailers are becoming more aggressive around highlighting the areas where there are price gaps vs. competition. With January 2009 CPI increasing over December 2008 numbers, demand will pressure prices down while inflation might pressure prices up, meaning retailers will have to be efficient & right on price. Price point merchandising (i.e., even dollar price points) We reported on this a few weeks back (see this short PDF), but we continue to see and hear retailers focusing more on price point merchandising all over the world. Deflating aspirational goods whenever possible. As consumers shift their buying habits from wants to needs, retailers are focusing on delivering aspirational goods at more accessible price points. Re-configured essentials. Retailers pushing for re-configuring the essentials as a way of freeing up discretionary spending and converting shoppers to higher margin impulse/seasonal/aspirational goods. Extreme Value & Mainstream Examples Retailers hitting hard on opening price points: In the US, shoppers can get breakfast, lunch, and a small dinner for $1 each at Dollar Tree. Retailers establishing new price point references. $0.99 cents perishables at 99 Cents Only; Aldi's Super 6 in the UK; Winco's perishables for under $1 Focus on offering affordable essentials. Winco a clear winner on this, Publix trying hard to communicate this value to shoppers Winco Publix Price point merchandising. See ASDA (slide 9 in this document) or RNG subscribers click here to see full store visit. Source for all photos: RetailNet Group store visits Final Thoughts Retailers that are defending & enhancing their position stand to come out of the economic downturn stronger than in the past. Those that are overtly changing strategies risk their longer-term plans & vision, especially if the stray from their core business & capabilities, or optimize too aggressively. At the same time, retailers who are blending value positioning with continued sensitivity to consumer interest in good taste, global flavors, fresh foods, and health and wellness lifestyles will retain trips and volume through the recession, and more importantly, be prepared for eventual growth. Those who compromise long term strategies for price-only differentiation risk being at the bottom of consumer interest once income and spending rebound. * These are not mutually exclusive, but overlap is a relatively small percentage of this total calculation. RetailNet Group is the leading insight and advisory firm focused on retail growth strategies and consumer-facing transformational capabilities. We are deeply experienced retail/consumer analysts and strategists working exclusively to help brand-led businesses and large-scale retailers grow. Sincerely, RetailNet Group Note: Articles contained in this newsletter are collected from a variety of sources and links can expire over time. Email Marketing by

![[DATE] Mary Ziegler Director Division of Regulations, Legislation](http://s3.studylib.net/store/data/007212021_1-b96b03cd98cadfc74a22865c0247494d-300x300.png)