5

1.

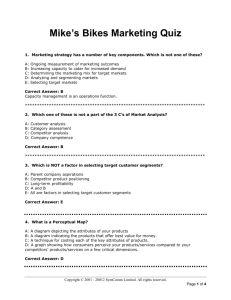

MARKETING

The Traditional View of Marketing

Traditionally, the marketing function is defined as “a process through

which people create, offer and exchange products of value with

others”. This implies that the primary role of the marketing

function is to maximize sales. So

Marketing strategy is…

“the set of plans and actions that an organization

undertakes to maximize the profitability of the sales of

its products.”

Marketing involves determining the product attributes which the

customers desire, and branding and positioning existing and new

products. Tactical decisions and actions then follow: prices must be

set, customers communicated with through advertising and other

means, distribution channels selected. These are the so-called “4 P’s”

of product, price, promotion and place.

The figure shown below represents the fundamental framework that is

used for marketing in Mike’s Bikes.

Marketing and the Business

Shareholder Value

ECONOMIC

CONDITIONS

Current Profit

COMPETITORS’

ACTIONS

Demand

Future Profit

Supply

Accounting

operating

decisions

investment

decisions

BUSINESS STRATEGY

Marketing

Strategy

Operations

Strategy

Finance

Strategy

Product

Development

Strategy

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

4

It illustrates the role of marketing relative to the other business

functions and its contribution to shareholder value. Specifically,

marketing complements decisions in operations, finance and product

development, and generates profits and shareholder value by

achieving a match between demand and supply.

Page 5-1

Copyright © 2001 - 2012 SymComm Limited. All rights reserved.

The MiniMBA l Marketing

2.

The Emerging view of Marketing

In response to a changing market place and the growth of information

and service-oriented businesses, a more sophisticated view of

marketing is now evolving. The trend towards a more team-orientated

and process-driven firm requires a broader role for marketing.

Marketers are no longer seen as purely functional specialists. Rather,

in the marketing- (or customer-) oriented firm, every employee is

seen as a marketer, whether on a full-time or a part-time basis.

Part-time marketers are found throughout the firm (for example, at

senior management and board level, and in customer service

personnel and technical departments at lower levels) while full-time

marketers are located in the marketing function – should this exist

(and increasingly it may not). All employees work together in some

way to maximize the long-term profits associated with sales.

The distinction between the traditional and emerging role for

marketing is subtle. In the first case marketers research the market,

determine customer needs and wants, and work with the production

department to arrive at a product offer that matches the market’s

requirements with the firm’s capabilities. Price and distribution

strategy are set, and the market is informed and persuaded of the

product’s competitive superiority. The end result is a transaction – the

customer makes a purchase.

Under the emerging view, the emphasis is on building long-term

customer relationships, or paying attention to streams of

transactions. The focus is directed at identifying and keeping the ‘right’

customers, rather than ‘getting’ customers indiscriminately on a oneoff transactional basis. To achieve this, consistently superior customer

value must be delivered over time, and this requires the firm to pay

close attention to all aspects of its performance, including achieving

lowest delivered cost. This in turn requires a cross-functional processoriented approach, and a great deal of interaction with both internal

and external parties. Excellent relationships must be built and

maintained inside and outside the firm with, for example:

The accounting and finance department (to ensure that the

firm monitors and controls delivery costs, among other

things)

The production department (to ensure performance in a

number of areas, including delivery and fitness for function)

External suppliers (eg, advertising agencies and packaging

suppliers).

While the trend towards service and relationship marketing is very

important, it is specifically excluded from this model. In Mike’s Bikes

the environment has been set up so that marketing tries to maximize

shareholder wealth by persuading people to purchase goods of value.

It is assumed that consumers buy according to a demand curve. Total

demand is determined by a range of factors – and marketing decisions

are just one of these. There are two other factors which affect the

demand for a product - its quality and its delivery time and

availability. For our purposes they are covered in the Operations

Function.

Page 5-2

The MiniMBA l Marketing

3.

Learning Objectives

In this chapter we explore some theory related to these issues, and

work through some simple numerical and more complex spreadsheet

examples.

The main learning objectives for this chapter are to understand the

following:

A framework for marketing

Market analysis and segmentation

The selection of target markets

The effect of branding

Product positioning using attributes and the perceptual

map

The perceptual map

The marketing mix (the 5 P’s)

Pricing strategy

Promotion/advertising

product PR

Distribution strategy and channel selection. (Product

quality and availability are covered in the Operations

Function.)

Determination of margin for channels

Determination of demand for products

Substitution of products

The marketing/operations interface

The marketing/finance interface

The marketing/product development interface

Strategic marketing

marketing plan.

strategy

control

and

and

media

selection,

development

of

a

While these issues may be considered in isolation, Mike’s Bikes

encourages users to view them as a part of the overall strategy and so

to think of the firm and industry as an interactive system.

4.

A Framework for the Marketing Process

The figure shown below represents the fundamental framework that is

used for marketing in Mike’s Bikes to generate profits and shareholder

value.

The strategic marketing process may be viewed as a number of

steps:

Analyze and segment markets

Select target market(s)

Determine branding and positioning strategy

Determine the best marketing mix to generate optimum

demand.

Marketing management implements the outcomes of the strategic

marketing process.

Page 5-3

The MiniMBA l Marketing

Marketing Strategy is…

“the

“theset

setof

ofplans

plansand

andactions

actionsthat

thatan

an

organization

organizationundertakes

undertakesto

tomaximize

maximizethe

the

profitability

profitabilityof

ofthe

thesales

salesof

ofits

itsproducts.”

products.”

And includes…

Marketing

Strategy

• Analysis of Markets

• Selection of Target Markets

• Marketing Mix

• Control

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

5.

6

Determining Strategic Objectives

From a strategic perspective, marketing has 3 main goals:

To determine which segments of the market to target

To achieve a certain number of sales in each market

segment

To achieve a given contribution margin (profit) from each

segment.

Sales performance then determines the required market share and

competitive position of the company in each of these market

segments.

To develop its strategic marketing objectives, the firm must do some

market analysis.

6.

Analyzing the Market

Market analysis considers the business environment in which an

organization operates, including the customer segments that could be

matched with the products that an organization produces or intends to

produce. Typically a lot of data is required to inform a sound market

analysis – and this data does not become a good basis for decisionmaking until it has been processed, structured and summarized.

Quality of information is vital. The most valuable information is current

information. However, this is generally also the most ill defined and

informal. It is better to be roughly right than precisely wrong, and the

art of analysis is to sort the nuggets of gold from the deserts of data.

In the case of Mike’s Bikes, this information is provided to you in the

form of some summary reports. In a real context, there is a lot of work

entailed in arriving at good summary information for effective

decision-making. The information provided in Mike’s Bikes can be

considered as the outcome of prodigious marketing research efforts.

A good way to cover key aspects of market analysis is to follow the

three C’s - Customer, Competitor and Company.

These are

discussed briefly below.

Page 5-4

The MiniMBA l Marketing

Analysis of Markets

Marketing

Strategy

Customer

Analysis

• Analysis of Markets

• Selection of Target Markets

• Marketing Mix

• Control

Competitor

Analysis

(see strategy)

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

Company

Competence

(see strategy)

9

CUSTOMERS - IDENTIFYING SEGMENTS

A good analysis should provide a map of the market. Management

can then use this map to decide how to segment the market and to

target a particular segment or segments with its product. The aim is

to achieve the best match with the organization’s capabilities and

resources.

Segmenting a market appropriately is as much an art as it is a

science. There are many ways to go about it. The ‘right’ way is the

one that results in the best insight into product sales! Many factors or

criteria may guide segmentation. These can be loosely categorized as

geographic, demographic, psychographic, and behavioral factors.

For example, the toothpaste market could be segmented in the

following ways:

Geographically: country or state user; rural or city user

Demographically: by family life cycle stage (eg, empty

nest user, young single user)

Psychographically: by attitude or lifestyle of users (eg.

educated green user or urban sophisticate user)

Behaviorally: by how many times per week the product is

used.

By looking at the requirements of the different segments, at

competitor activity and at the organization’s potential resources, the

firm can decide which segments of the market it wants to serve, and

the position it should adopt in each of these segments. There is a

strong need for consistency in these choices.

THE PERCEPTUAL MAP

The perceptual map is a useful tool for building understanding of

differing consumer needs in various segments or markets. This tool

identifies the product or service attributes which consumers value

most highly and positions a number of segments in relation to these

attributes. Several attributes may be important to a market (eg, in the

case of toothpaste these may include taste, sex appeal or whiteness,

appeal to children, ease of use). A perceptual map can only show 2 (or

3 if using a 3-D approach) of these attributes at any one time. Several

Page 5-5

The MiniMBA l Marketing

different maps may be constructed to get the overall picture. However

using more than 3 attributes makes it difficult to identify segments.

THE PERCEPTUAL MAP IN MIKE’S BIKES

Following extensive international research into the types of people who

purchase bikes, we have concluded that the potential bike market can

be broken into two key segments. The segments have been given the

names ‘Adventurer’ and ‘Leisure’.

Note that only the ‘Adventurer’ segment is currently being served by

RockHopper Bikes. ‘Adventurer’ customers desire trendy, highspecification, high quality mountain bikes and put them to reasonably

demanding use. They are prepared to pay retail prices ranging from

$500 to $4,000.

On the other hand, ‘Leisure’ customers purchase bikes for relaxed

Sunday afternoon bike rides. They want a lower spec, stylish bike with

a realistic retail price range from $100 to $600. As of 1998, no bikes

suitable for the Leisure segment are being sold.

THE

ADVENTURERS SEGMENT

The Adventurer segment is broadly typified by the young suburban

bicycle purchaser who wishes to buy a mountain bike. An Adventurer

is typically a young person, focused on fitness and the outdoors. He or

she wants a bike that will go anywhere and everywhere, and then

come back. Often the Adventurer will forego luxury features in favor of

a sturdy, high performance bike. The evidence is that the use of bikes

for fun adventures and blood-pumping action is very popular and in

fact this segment is experiencing strong growth. The people who buy

these bikes tend to be prepared to pay more for the right bike because

they have a specific purpose for it and do not want to be held back

with slow equipment or to have to stop for repairs. Given the many

and varied exciting opportunities for off-road biking in Erehwon, we

are confident this segment has good potential if appropriate bikes are

released into the market.

THE

LEISURE SEGMENT

The Leisure segment is made up of people who own a bike, but use it

only once or twice a month. These customers see their bike primarily

as a means of relaxation or leisure, and they go for a Sunday ride

every now and then, usually with others (often in family groups). The

Leisure segment therefore requires less in terms of high tech

components and accessories, with “leisurites” preferring comfort and

style. Purchasers who buy bikes for leisure purposes are not very

fussy, but they like to be able to buy a bike when they go out

shopping, so long as they’ve seen the bike on TV before. Consumers in

the leisure segment abhor having to wait to buy, even if it is the best

value for money. Because this segment is quite broad, it is also

typically very large. It accounts for 50% of new bike sales units

overseas.

Page 5-6

The MiniMBA l Marketing

THE RESULTS OF THE MARKET RESEARCH

To produce some data that would be useful in differentiating the

market segments, a market research house was commissioned to

undertake a survey. 1,000 potential bicycle purchasers were asked the

following questions:

Thinking about bicycles, what two factors would be most

important to you if you were to purchase a bike tomorrow?

How important would each factor be to you?

The two factors identified were:

The aesthetic style and design of a bike

The technical features and components

construction materials and strength).

(including

This research is ongoing. From year to year there may be slight

variations in the positioning of the segment points as customer needs

change. In general, it is safe to assume that people’s expectations will

increase with time.

INTERPRETING THE INFORMATION

The Perceptual Map Report shows the levels of Style/Design and

Technical Specs which each of the market segments (ie, Adventurers

and Leisure) desire. The circles indicate the acceptable ranges of

Style/Design and Technical Specs. The Perceptual Map Report shows

also how well your products (and unused product designs) match

these requirements. By selecting a different firm you can see this

information for its products too.

The segment centers are the best points on the map to aim for. These

are ‘ideal’ positions which satisfy all of the segment. You could of

course move away from these center points, and produce a product

which exceeds the style and technical specifications of the segment.

You could sell it at the same price as one that met exactly the needs of

that segment. However, the “better” product would not sell as well as

one exactly meeting the segment needs, because it is not what the

customer wants. Unnecessary features can be annoying for someone

who wants a simple bike. Extra style and design attributes can reduce

Page 5-7

The MiniMBA l Marketing

a bike’s performance and functionality for someone who uses the bike

for a specific purpose.

It is important to note that demand for a product is determined by

many factors in addition to the product’s attributes. These include

pricing, quality, advertising, and distribution. In most cases these

other factors are more significant than the closeness of a product to

the center of the circle on its perceptual map.

SEGMENT SUMMARY

Key information regarding each of the segments in Mike’s Bikes is

given in the tables below. The section below explains the process used

to collect this data.

Segment

Adventurers

Leisure

Segment

Sensitivity

Adventurer

Leisure

Est. Potential

Market Size

(Units)

70,000

50,000

Retail Price Range

Average Score

for Style/Design

Average Score for

Technical Specs

$500-$4,000

$100-$600

50

50

50

10

Price

Advertising

PR

Quality

Distribution

Delivery Time

Low

Med

Med

High

Med

Low

High

Low

Med

Med

Low

High

COMPETITORS

This section is covered in the Strategy Chapter. The content includes

the following analytical tools: environmental analysis, PESTE,

competitor profiles, and SWOT analysis and the concepts of vision,

mission, strategic intent, and core competencies.

COMPANY

This section is also covered in the Strategy Chapter. The content

includes issues such as the company’s mission, strategic intent and

core competencies.

CONJOINT ANALYSIS

OVERVIEW OF CONJOINT ANALYSIS1

Conjoint Analysis is a technique used specifically to understand how

respondents develop preferences for products or services. It is based

on the simple premise that consumers evaluate the value of a

product/service/idea by combining the separate amounts of value

provided by each attribute. It is unique in that the researcher first

constructs a set of hypothetical products or services by combining the

possible attributes at different levels. These hypothetical products are

then presented to respondents who provide only their overall

evaluations of the hypothetical products/services. Thus the researcher

is asking the respondent to perform a very realistic task - choosing

among a set of products. Because the researcher constructed the

hypothetical products/services in a specific manner, the importance of

1

Hair, J., Anderson, R., Tatham, R., Black, W., “Multivariate Data Analysis with Readings (3 rd Ed)”,

Macmillan, 1992

Page 5-8

The MiniMBA l Marketing

each attribute and each value of each attribute can be determined

even while having only the respondents’ overall ratings.

THE PROCESS OF DATA COLLECTION

Data collection in a conjoint study involves showing respondents a

series of cards that contain a written description of the product or

service. If a consumer product is being tested then a picture of the

product can be included along with a written description. Analysts are

able to use statistical manipulations to avoid having to make

consumers rate every possible combination. In a typical conjoint

study, respondents need rate only 10-20 cards. This data becomes the

input for the conjoint analysis. Analysts can then calculate consumer

preferences and perform simulations to identify which products will be

successful and which should be changed. Price simulations can also be

conducted to determine how sensitive the consumer is to changes in

prices.

AN EXAMPLE

The following card is an example of one of the cards which might make

up the set used in a conjoint study into the airline business traveler.

"On your next business flight overseas how likely would you be to choose a flight that has all the

following characteristics? Please circle the appropriate number from 1 to 10 to indicate your

feelings."

One stop en route

Extra-wide seats

Departure time: before 8:00 am

"Double" mileage points

$200 fee to change ticket

Would never choose this

flight

1

2

3

4

5

6

7

8

9

10

Would definitely choose this

flight

QUESTIONS CONJOINT ANALYSIS CAN ANSWER

Which new products will be successful?

Which features or attributes of a product or service drive

the purchase decision?

Do specific market segments exist for a product?

What advertising appeals will be most successful with these

segments?

Will changes in product

preference and sales?

What is the optimal price to charge consumers for a

product or service?

Can price be increased without a significant loss in sales?

design

increase

consumer

CONJOINT ANALYSIS IN MIKE’S BIKES

The results of a conjoint analysis survey conducted on members of

each of the segments identified in the Erewhon bike market are

available to firms in the industry. The attributes tested were price,

quality, delivery time, availability/distribution, style, and technical

specifications.

A summary of the results is shown in the table below.

Page 5-9

The MiniMBA l Marketing

Segment

Sensitivity

Adventurer

Leisure

7.

Price

Advertising

PR

Quality

Distribution

Delivery Time

Low

Med

Med

High

Med

Low

High

Low

Med

Med

Low

High

Selecting Target Segments

The selection of target segments follows once the groundwork (the

marketing analysis) is complete. Selecting a target segment is an

important decision. The basis for this is long-term segment

profitability. In real life, strategic criteria (such as fit with parent

company aspirations, or a desire to build competency in a particular

market) may also need to be considered.

Target

Segment

Required

Attributes

Segment

Potential

Racers

Style not

important (20

units on the

Perceptual Map)

Excellent

technical spec

(80 units on the

Perceptual Map)

25,000 units

per year

Expected

Competitor

Activity

Medium

2 competitors

willing to

maintain

profit

Company

Competence

Medium

compared

with others.

Need to

invest in

machinery

and hire

skilled staff

Profitability

$2,000,000

based on

10% market

share

SELECTING TARGET SEGMENTS IN MIKE’S BIKES

The table shows the process that one could go through to determine

the profitability of a segment in Mike’s Bikes. The first step is to assess

what the segment requires and its total sales potential. Total sales

potential must be assessed in view of likely competitor activity and the

ability of the firm to compete. This assessment will lead to an estimate

of the most profitable segment for the firm in that competitive

environment. It may be wise to start with a table using textual

descriptions and include the numerical measures later, as this data is

often difficult and/or expensive to obtain.

8.

Developing the Marketing Mix

The next step is to determine the details or tactics for achieving the

desired position in each of the segments. This involves considering the

appropriate marketing mix - loosely called the “four Ps” (product,

price, place, and promotion). More recently the importance of

relationships (often called People and the “fifth P”) has been

introduced. Mike’s Bikes focuses on the first four of these.

Product is the bundle of physical product and intangible service

benefits provided to the consumer (expressed in terms of the attribute

scores, ie, ‘stylishness’ and ‘technical specifications’). Price is the

retail price charged to the consumer. Place refers to the type of

distribution channel or store used to distribute the product.

Promotion entails communicating the total product bundle to the

target segments, resulting in brand and product awareness, and

(ideally) sales. People refers to the importance of building the trust

relationship with the customer that will lead to brand loyalty and

repeat sales.

These tactics will all influence segment demand. They are examined in

turn in the sections which follow. Demand will also be influenced by

Page 5-10

The MiniMBA l Marketing

delivery and quality.

Operations decisions.

In Mike’s Bikes these are assumed to be

PRODUCT2

Consumers base their purchase decisions on the attributes of the

products that are available to them. The closer these attributes to

what they require, the more likely they are to buy.

To manage these attributes, the firm needs to measure actual product

attributes and relate these to the ideal attributes desired by each

market segment and modeled using the Perceptual Map. The product

may then be modified (if necessary) to suit the market. This is shown

in the diagram below.

Positioning Strategy is...

“the development of the attributes of the

product so that it matches the

requirements of the target market.”

Product

Attributes

Position of

Segment

Price

Promotion

Distribution

(Place)

People

Attributes

of Product

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

In Mike’s Bikes, we have assumed that the most important physical

attributes of a bike are Style/Design and level of Technical

Specification (including components, construction materials and

strength). The product’s performance on these attributes (ie, its

actual attributes) can be assessed through market research and

compared to the segment’s ideal requirements (ie, its ideal attributes)

to compare the distance between the two. The closer the distance, the

more suited the product is to the segment’s requirements.

2

Price, quality, distribution, delivery, and product awareness are excluded from the perceptual map.

In general the more appropriate each of these is, the more likely all segments are to buy the bike.

In contrast, there are often other attributes where “better” is different for different market

segments. Consider seat height for example. Kids’ bike requirements are quite different from other

market segments. A higher (or lower) bike seat is not better for everyone!

Page 5-11

The MiniMBA l Marketing

THE PRODUCT DECISION IN MIKE’S BIKES

In Mike’s Bikes, you are restricted to selling bikes only. You need to

make decisions about when and how new bike products will be

launched and existing products modified and deleted. This is done on

the Products Screen shown above.

NEW PRODUCTS

New products can be launched at any time. These products are based

on the physical characteristics of a completed Product Development

Project (sometimes called a New Product Development Project). New

products can be used to enter new segments of the market or to

attempt to dominate a current segment. In general, firms should be

wary of product proliferation (ie, of producing many different

products). This increases complexity and costs. It may also increase

factory lead times, resulting in poor delivery performance. A direct

effect of product proliferation is that more head office marketing staff

are required. Depending on your workforce effectiveness, you may

need one head office marketing staff member for each product you

launch.

PRODUCT MODIFICATION

Current products can be modified using a completed Product

Development Project. Modifications can be made for a number of

reasons:

To adapt the product to the changing needs of a segment

To improve an existing well known product so that it

appeals to new market segments

To re-engineer processes - retaining the product’s same

physical

characteristics

but

simplifying

production

requirements and lowering costs.

Bear in mind that consumers may not always react positively to such

modifications!

Where the firm holds obsolete stocks of finished goods for a product

that has since been modified, the obsolete stocks are automatically

dumped at prime cost (material plus labor costs).

Page 5-12

The MiniMBA l Marketing

See the Product Development Chapter for information on how to

develop new products.

PRODUCT DELETION

Products can be abandoned at any time if they prove no longer

consistent with a firm’s strategy. Where the firm holds inventories of

finished goods for deleted products these are dumped at prime cost.

PRICE

Price is usually a key determinant of demand.

Several pricing

strategies are listed below. Price to suit your strategy.

Mark-up Pricing:

and above costs.

The firm applies a fixed margin over

Target Return

return/margin.

Perceived-Value Pricing:

consumer is willing to pay”.

Going Rate Pricing: The firm prices at the price which is

being charged in the market.

Pricing:

The

firm

sets

a

specific

The firm prices at “what the

THE PRICE DECISION IN MIKE’S BIKES

Pricing can be determined in any way that is considered appropriate.

This decision can be made on the Products Screen for each individual

product, as shown above. A price decision must be made for each

product. These prices should take account of the price sensitivity of

consumers in your target segments and the prices of competing

products.

PROMOTION

Marketing communications (or promotion) is important in generating

product demand. Marketing communications can include advertising,

Page 5-13

The MiniMBA l Marketing

public relations, personal selling, direct marketing, Internet activities,

outdoor signage and many other tactics and techniques. The aim of

marketing communications is to create consumer awareness, product

and brand recognition, and intention to purchase.

Promotion Strategy is...

“The ways in which an organization

generates a positive perception of its

products. It usually consists of product

advertising, branding and public relations.”

Product

Attributes

Price

Promotion

Advertising

Distribution

(Place)

People

Public

Relations

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

Brand advertising and product advertising work together. For

example, Toyota’s brand advertising creates an image and

communicates brand values for the Toyota brand as a whole. This

brand covers all of Toyota’s product variants or models.

By

comparison, specific model or product advertising (eg, for the Corolla

and Corona models) informs the consumer about the features and

benefits of a particular model. Brand advertising, in effect, leverages

the effectiveness of product advertising.

In Mike’s Bikes, brand awareness, product awareness and the

influence of product public relations (PR) depend on current budget

and the carryover effect from previous periods. The effectiveness of

product advertising and PR depends on choosing media that match the

target market’s media consumption habits. Brand advertising increases

the effectiveness of product advertising and results in increased

product awareness.

AN EXAMPLE

Given the S-curve shown below what increase in TV viewers’

awareness will an expenditure of $2m on TV advertising achieve?

How much product awareness will there be if we assume that product

awareness last period was 10% but half of this is lost each period, all

our target consumers watch TV, and brand advertising is ignored?

SOLUTION

$2m will achieve an increase of 35% among TV viewers.

Last period awareness = 10%; loss for this period = 5%; total product

awareness for this period = 10% - 5% +35% = 40%.

Page 5-14

The MiniMBA l Marketing

Advertising Awareness Curve for TV

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

00

0

$1

,0

00

,0

00

$1

,2

50

,0

00

$1

,5

00

,0

00

$1

,7

50

,0

00

$2

,0

00

,0

00

$2

,2

50

,0

00

$2

,5

00

,0

00

00

0

$7

50

,

00

0

TV Advertising Expenditure

$5

00

,

$0

0%

$2

50

,

Awareness Increase in TV Watchers

Work a Simple Example

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

31

PROMOTION IN MIKE’S BIKES

There are three forms of promotion (or marketing communications) in

Mike’s Bikes:

Brand advertising

Product advertising

Product PR

BRAND ADVERTISING

Only one brand is permitted (the name of the manufacturer, ie, Real

Cool Cycles) and this contributes to the effect of any other product

advertising that is carried out.

A budget can be allocated to brand advertising (as shown). This

determines the effectiveness of the advertising. In the next period,

consumers “forget” the advertising to some extent, but any new brand

advertising adds cumulatively to what is left.

PRODUCT ADVERTISING

Analyzing the Erehwon bike market has revealed that there are three

media choices for advertising bikes– TV, newspapers and magazines.

In general, consumers in the Adventurer segment are relatively heavy

readers of magazines, while the Leisure segment tend to be relatively

heavy readers of newspapers.

Both segments watch television.

Newspaper advertising is about half as expensive as TV and magazine

advertising per person reached.

Page 5-15

The MiniMBA l Marketing

As of 1998, Real Cool Cycles and MountainTop Cycles have

concentrated advertising for RockHopper bikes on television.

Newspapers will be utilized more if and when Leisure bikes are

released onto the market. A brief description of each medium is given

below.

Segment

TV Reach

Newspaper Reach Magazine Reach

Adventurer

50%

10%

60%

Leisure

60%

60%

20%

Television: Erehwon has only one national TV network.

Television is a good way of reaching most market

segments.

Newspaper: There is one main newspaper in Erehwon - a

monthly called the Erehwon Herald. An awareness curve

like the one shown earlier for TV is available for newspaper

and magazine advertising in the Mike’s Bikes Help.

Magazines: There is a variety of monthly magazines in

Erewhon. Magazines related to the bike market range from

a specialist racing bike magazine through general outdoor

adventure magazines to very general leisure magazines.

PRODUCT PUBLIC RELATIONS

Product public relations related to the bike market include product

reviews and press releases. The idea is that consumers will give more

weight to news and independent reviews than advertisements. The

Adventurers are more sensitive to this kind of product promotion (see

the Media Reach table above).

MAKING THE PROMOTION DECISION

The brand advertising expenditure decision can be found on the

Marketing Decisions tab of the Main Decision Screen.

The

resulting brand awareness applies to all the firm’s products.

Specific product-related media advertising and public relations are

budgeted for each product on the Product Decision Screen.

Advertising activity affects the awareness levels of the product. It

should be remembered that awareness takes time to build and will

decline over time as consumers “forget”. Advertising experts estimate

that an investment of around $2m is required to achieve initial

awareness levels of 25%-50%. Less is required to maintain these

levels.

In deciding the level of investment in advertising, it is

important to remember that certain segments are more responsive to

advertising than others. The investment includes money spent on

advertising research to develop advertising messages.

Product PR works in a similar way to product media advertising.

However each market segment’s sensitivity to advertising may be

different from its sensitivity to PR.

PLACE (DISTRIBUTION)

Distribution (place) relates to the ability of the firm to make products

accessible to its target segments. This is achieved through distribution

channels – in this case through retail outlets. The effectiveness of

distribution (and hence its impact on demand) is determined by the

shopping habits of the target market and the number of stores in the

required channels that carry the product.

Page 5-16

The MiniMBA l Marketing

For example, if Adventurers are being targeted, then it is more

effective to have a greater number of sports stores and bike shops in

the distribution channel.

Distribution Logic

Marketing

Marketing

Strategy

Strategy

Product

Attributes

• Analysis

of Markets

• Analysis

of Markets

• Selection

of Target

Markets

• Selection

of Target

Markets

• Marketing

MixMix

• Marketing

• Control

• Ongoing Management

Price

Promotion

Distribution

Number of

Stores

Expected

Sales

Shopping

Habits

Retailer

Margin

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

Extra

Support

37

The number of stores persuaded to stock a firm’s products is

determined by margin offered, expected product sales, and extra

support provided.

DISTRIBUTION CHANNELS IN MIKE’S BIKES

Distributors carry a complete line of products. You will need to decide

on broad or narrow coverage (ie, many or few different channels), and

the intensity of distribution (ie, number of stores in each channel).

This will be influenced by the shopping habits of the market segments

you are targeting. Another small influence on your decision is the fact

that the greater the number of distributors, the higher the number of

head office marketing staff that you will need.

(A head office

marketing staff person will be required for approximately every

hundred stores stocking your products.)

The number of stores in the channel which decide to stock your

products will depend on the retail price, margin, unit sales history, and

extra support offered. You must specify what margin and what extra

support (eg, in terms of special promotions and discounts) you are

going to offer the retailers in each channel. Note that the retailer

margin decision refers to the percentage of the retail price that the

retailer keeps. So a percentage of 60% means that they keep 60% of

the sales revenue and give you the remaining 40%.

Maintaining existing distributors and acquiring new ones requires

considerable resources. Costs associated with distribution include:

hiring and training retailers, field sales representatives and head office

sales staff; providing promotional literature; organizing delivery and

ordering of products; following up complaints; collecting accounts.

Distribution

costs

vary

with

the

number

and

types

of

distributors/retailers used.

Analyzing the Erehwon bike market has revealed that the vendors of

bikes may be broken into two categories: Bike Shops and Department

Stores. In general, the Adventurer segment favors the specialty bike

Page 5-17

The MiniMBA l Marketing

shops while the Leisure segment simply shops in the familiar

department stores. An analysis of the costs of supporting retail stores

in the two channels has revealed that the Bike Shops are more

expensive to support per store, but this is balanced by the fact that

there are many more Department Stores.

In 1998, the majority of bikes sold are sold through Bike Stores.

Department Stores would be expected to be deliver more sales when/if

Leisure bikes are released onto the market. A brief description of each

channel is given below.

BIKE SHOPS

The bike shop (often called ‘the bike boutique’) is a specialty store

dedicated to bikes and bike-related products. Store assistants are

trained bike specialists, able to tailor specific bikes to specific

customers. People unsure of which bike to buy will usually go to a

bike shop, especially if the bike is required for a specific purpose. Bike

shops stock an extensive range of different models, catering to all

types of purchasers. Bike shops generally stock bikes in the mid to

high price range and bikes they stock in common with the department

stores are often priced slightly higher than in the department stores.

They are thus perceived as the quality bike vendor (at the cost of

being perceived as the most expensive bike vendor). Bike shops rely

on their higher margin to gain a profit, so are less likely to discount

their stock. Their customers tend to be less price sensitive than those

of department stores.

DEPARTMENT STORES

Department stores (eg, chain retailers such as Wal-Mart) stock a wide

range of goods - from consumer durables (such as refrigerators and

televisions) to apparel and kitchenware. They often specialize in

budget or exclusive items.

Department stores appeal to people

wanting to complete their weekly shopping in one store. They are

increasingly being built in mall sites surrounded by smaller satellite

stores catering to other shopping requirements. The typical shopper

at a department store is out with his or her family on Saturday or

Sunday afternoon. Often they do not have a definite purchase in

mind, but in walking around may see something that appeals. The

busiest time of year for department stores is prior to Christmas, when

gifts are in everyone’s thoughts.

In terms of support, department stores seem to offer little support to

bike manufacturers. They do not have salespeople who are bike

experts to give the customers information, nor do they take part in

many of the promotions that the manufacturers propose. They

typically stock a wide range of mid-priced bikes, stocking competing

brands side-by-side.

SUMMARY

Number of Dealers

Annual cost to support each dealer

Bike Shops

Department Stores

120

$450

300

$200

The costs of distributing through each distribution channel are shown

in the table above. Other distribution costs not shown here are the

salaries of head office marketing staff, and any extra support that you

allocate to either of the distribution channels.

Page 5-18

The MiniMBA l Marketing

Estimates of the shopping habits of the different segments in the

different distribution channels are also given for use in deciding on a

distribution strategy.

Adventurers

Leisure

Bike Shops

Department Stores

70%

25%

30%

75%

AN EXAMPLE

Assume you are targeting the Adventurer segment. Assume that 20%

of consumers prefer to purchase in department stores and 40% prefer

bike shops. Your margin means that 50% of department stores and

80% of bike shop stock your product. Roughly what coverage of the

Adventurer segment do you have?

SOLUTION

Approximate coverage of the Adventurer segment = (0.2 x 0.5) + (0.4

x 0.8) = 0.42%

MAKING THE DISTRIBUTION DECISION

The Distribution Channels Screen is shown below. This is where

you enter your decisions about distributing your products for the

coming year. Here you decide the importance of the different channels.

To allocate the number of stores for a particular channel, click on

either the Bike Shops or Department Stores Icon. A summary of

decisions for the selected distribution channel appears towards the

bottom of the screen.

Then click the Allocate Button and enter your decision in the

dialogue box that appears.

You must specify what margin and what extra support (eg, in terms of

special promotions and discounts) you are going to offer the retailers

in each channel. This is the margin the retailers keep - so don’t

increase it too much!

The number of stores in each channel which decide to stock your

products will depend on the retail price, margin, unit sales history, and

extra support offered.

Page 5-19

The MiniMBA l Marketing

9.

Generating demand

Traditional economics

Demand = Alpha – (Beta x Price)

Demand vs Avg Price for Adventurer Segment 1996-1999

200,000

y = -82.144x + 195182

150,000

100,000

50,000

0

$0

$500

$1,000

$1,500

$2,000

Can extend to include product specs, awareness, PR,

distribution, quality, delivery

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

42

Arguably, the objective of marketing activity is to generate demand.

This idea overlaps heavily with economic theory. The ‘Traditional

economics’ diagram above shows market demand, based on average

price. The higher the average price, the lower the demand (ie, this is

an elastic demand curve, or one where the level of demand is

relatively sensitive to changes in price). It is assumed that the

relationship is linear for a realistic range of prices.

The formula for demand is given. Obviously this is simplistic: in reality

price is not the only determinant of demand. To enrich our model to

include other factors (eg, relative product quality, consumer

awareness), we have defined a variable labeled ‘Value For Money’

(VFM) and have adjusted the market demand model to include these

factors.

The logic we follow in modeling demand for the bike scenario is shown

in the diagram below entitled ‘Generating Demand for the Adventurer

Segment’.

Page 5-20

The MiniMBA l Marketing

Generating Demand for the Adventurer

Segment

Awareness

Product Specs

PR Influence

Distribution

Price

Delivery

Quality

Value for Money

Product’s Segment Share

Segment Demand

Total Product Demand

Copyright © 2001 - 2004 SymComm Limited. All rights reserved.

41

The steps involved in the calculation are as follows:

Step One: calculate a VFM or segment attractiveness score

for each product, based on attributes of price, advertising,

PR influence, quality, distribution and product delivery;

Step Two: calculate segment share for each product,

achieved by comparing VFM scores for different products.

(Note that products from the same firm selling to the same

segment cannibalize each other.)

Step Three: calculate segment share-weighted indices for

average price, quality, distribution, etc;

Step Four: calculate segment demand (based on the

weighted average indices).

The higher the index, the

greater the segment demand generated;

Step Five: calculate product demand – share of segment

demand, determined by the ratios of the VFM indices;

Step Six: calculate total product demand - the sum of all

segment demands for the product.

10. Ongoing Management and Control

None of this is a ‘set and forget’ one-off exercise. The market changes

over time. There is a constant requirement for feedback, updating of

market data, and modifications to plans in response. Planning and

strategy need to take into account the actions of competitors, and the

improved understanding of the environment that comes from

feedback. Internal consistency between marketing, operations and

finance is also critical to success.

Some key reports that could be used to assess market changes are

Sales

Market share

Margins

Customer satisfaction surveys.

Important organizational decisions relate to the desired position or

strategic posture which the company wishes to take – whether as

market innovators, followers, best-price firm or differentiators. These

Page 5-21

The MiniMBA l Marketing

decisions cannot be made by the marketing department in isolation

but must be consistent with other organizational functions, and

recognize both organizational and competitor capabilities.

11. An Example of a Good Strategy for Mike’s

Bikes Using the Marketing Function Only

There is no one “correct” way to maximize shareholder value in

Mike’s Bikes. Please bear this in mind when you read through

this model answer!

NOTES

We arrived at this model answer by making decisions in the Decision

Screen of only one of the functional areas of the Mike’s Bikes

environment: the Marketing Function. We did not alter the decision

screens of the Operations, Finance or Product Development Functions.

At the end of each subsequent chapter, we give a model answer that

we have achieved by altering not only the Marketing Function but also

the function discussed in that particular chapter and in previous

chapters. That is:

At the end of the Operations Chapter (Chapter 6), the

model answer reflects decisions in the Marketing and

Operations Functions.

At the end of the Finance Chapter (Chapter 7), the model

answer reflects decisions in the Marketing, Operations

and Finance Functions.

At the end of the Product Development Chapter (Chapter

8), the model answer reflects decisions in the Marketing,

Operations, Finance and Product Development

Functions.

We have provided these model answers for several reasons:

The answers demonstrate very clearly that you achieve the

best results when you take an integrated approach (ie,

when you use all the functional tools available to you, and

ensure that all your functional strategies are internally

consistent, consistent with one another and consistent with

your overall strategy).

The answer that we give at the end of Chapter 8 (ie, using

this integrated approach) is a “good” answer in the sense

that it achieves shareholder value in excess of $50. It

shows that it is possible to achieve shareholder value of

over $50 (for all you doubters!)

The commentary that we provide after each chapter may

give you some ideas about how you should proceed with

the work you’ve already done in the Mike’s Bikes

environment. You may be able to get a better result than

we have here!

STRATEGY

Marketing Strategy

Since we can’t change capacity (no Operations Function),

the strategy that we choose to take is to be a low volume

high margin manufacturer.

We will produce the Adventurer bike only.

Page 5-22

The MiniMBA l Marketing

We will invest heavily in promotion to convince our target

consumers that our bikes are worth paying extra for.

TACTICAL DECISIONS

Marketing Decisions

Pricing

Increase unit price from $1,700 to $2,100

Promotion

Increase branding from $100K to $500K

Increase media advertising from $800K to $1.5m for first

period, then scale back to $1m

Increase PR from $500K to $1.5m for first period, then

scale back to $1m

Distribution

We can't afford to offer large margins to attract lots of

stores. Leave the 50% margin unchanged at present.

RESULTS AFTER 5 YEARS

Sales 15K units, profit $3.4m, shareholder value approximately

$15.

12. Questions to Assist Learning

1. Write a draft marketing plan for the Mike’s Bikes

environment for the next 2 years (2-3 pages). You should

include the following issues and use bullet form.

a)

What are your target segments? Why?

b)

For each of your market segments, what are your objectives

for products, price, advertising, and distribution?

Where

appropriate, indicate how you will achieve these objectives.

c)

Look at your competition. What is their sales potential?

d)

Make sure that you think about consistency – of marketing

objectives, with the overall strategy, and with the operations

and finance strategies.

2. Construct an advertising and promotion strategy for the

Mike’s Bikes environment for the next 2 years. This should

consider the following.

a)

What segments are you aiming at?

b)

What do the consumers in these segments watch/read and

what types of promotion are appropriate?

c)

How much do these promotions cost?

d)

How much awareness do they generate per dollar of cost?

e)

What is your plan, how much will it cost and how much extra

demand will it generate?

f)

Is this consistent with the distribution, operations and finance

strategies?

3. Write a draft distribution strategy for the Mike’s Bikes

environment for the next 2 years. This should consider the

following.

a)

What segments are you aiming at?

Page 5-23

The MiniMBA l Marketing

b)

Where do your consumers go to make their purchases?

c)

How much do these distribution channels cost?

d)

How much coverage do they provide per dollar of cost?

e)

What is your plan, how much will it cost and how much extra

demand will it generate?

f)

Is this consistent with the advertising, operations/production

and finance strategies?

4. Write a draft pricing strategy for the Mike’s Bikes

environment for the next 2 years. This should consider the

following.

a)

What segments are you aiming at?

b)

With what products?

c)

How sensitive are the segments to price?

d)

What type of pricing strategy are you going to adopt?

e)

How will you react to competition?

f)

Is this consistent with the advertising,

operations/production and finance strategies?

promotion,

5. When positioning products, what are three key issues?

6. What is the difference between branding and product

advertising and how would you decide the correct mix

between the two?

7. What is the purpose of distribution channels and how do you

decide on the appropriate mix?

8. Why is it vital to coordinate marketing and production and

how is this achieved?

13. Appendix – Generating Demand in Mike’s Bikes

EXAMPLE ONE

Assume that segment demand for Leisure is given by:

Segment Demand = alpha

average awareness index.

+ beta * average price index + beta *

The numbers for this are:

Segment Demand = 20,000 + 10,000 x average price index + 5,000 x

average awareness index.

If average price index = 0.6 and average awareness index = 0.2, what

is the demand from the segment?

Which factor (price or awareness) has more effect on demand and by

how much?

SOLUTION

Segment Demand = 20,000 + (10,000 x 0.6) + (5,000 x 0.2) =

27,000.

Because the beta for price is twice that for awareness, price has twice

as much effect on demand as awareness per unit change in index.

Page 5-24

The MiniMBA l Marketing

EXAMPLE TWO

Assume that the total potential demand from the Leisure segment is

24,000 units.

Assume that there are two products that sell to the segment - Cruiser

1 and Cruiser 2.

If the Value for Money of Cruiser 1 is 10 and for Cruiser 2 is 20, how

much potential demand will each get?

SOLUTION

Potential demand for Cruiser 1 = 10/(10+20) x 24,000 = 8,000 units.

Potential demand for Cruiser 2 = 20/(10+20) x 24,000 = 16,000

units.

14. References

1. Hair, J., Anderson, R., Tatham, R., Black, W., Multivariate

Data Analysis with Readings (3rd Ed), Macmillan, 1992

Page 5-25

The MiniMBA l Marketing

Page 5-26