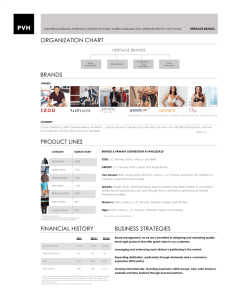

JC Penney Company, Inc. Equity Valuation and

advertisement