2014-15 - National Aboriginal Capital Corporations Association

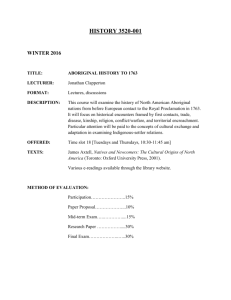

advertisement

2014-15 Annual Report National Aboriginal Capital Corporations Association NACCA’s Members 2014-15 The National Aboriginal Capital Corporations Association is a Canadawide network of Aboriginal Financial Institutions dedicated to stimulating economic growth for First Nations, Métis and Inuit people by promoting and underwriting Aboriginal business development. Aboriginal Business and Community Development Centre Akaitcho Business Development Corporation Alberta Indian Investment Corporation Apeetogosan (Métis) Development Inc. Arctic Co-operative Development Fund Atuqtuarvik Corporation Baffin Business Development Corporation Beaver River Community Futures Development Corporation Burns Lake Native Development Corporation Cedar Lake Community Futures Development Corporation Community Futures Development Corporation of Central Interior First Nations Clarence Campeau Development Fund Community Futures Treaty Seven Corporation de développement économique montagnaise Dakota Ojibway Community Futures Development Corporation Däna Näye Ventures Deh Cho Business Development Centre Eeyou Economic Group/ Community Futures Development Corporation Inc. First Peoples Economic Growth Fund Inc. Haida Gwaii Community Futures Indian Agricultural Program of Ontario Indian Business Corporation Kakivak Association Kitayan Community Futures Development Corporation Kitikmeot Community Futures Inc. Kivalliq Business Development Centre Louis Riel Capital Corporation Métis Voyageur Development Fund Inc. NWT Métis Dene Development Fund Native Fishing Association Nishnawbe Aski Development Fund North Central Community Futures Development Corporation Manitoba Northwest Manitoba Community Futures Development Corporation Northern Enterprise Fund Inc. Nunavik Investment Corporation Ohwistha Capital Corporation Rainy Lake Tribal Area Business and Financial Services Corporation Sahtu Business Development Centre Saskatchewan Indian Equity Foundation Inc. SaskMétis Economic Development Corporation Settlement Investment Corporation SOCCA National (Native Commercial CreditCorporations Corporation)Association Aboriginal Capital Southeast Community Futures Development Corporation 15 2014-15 Annual Report Tale’ Awtxw Aboriginal Capital Corporation Tecumseh Development Corporation Tewatohnhi’saktha Business Loan Fund Thebacha Business Development Services Tribal Resources Investment Corporation Tribal Wi-Chi-Way-Win Capital Corporation Two Rivers Community Development Centre Ulnooweg Development Group Inc. Visions North Community Futures Development Corporation Wakenagun Community Futures Development Corporation Waubetek Business Development Corporation Map of Aboriginal Financial Institutions National Aboriginal Capital Corporations Association 2014-15 Annual Report 15 Table of Contents i NACCA’s Members 2014-15 1Introduction 15 2 Highlights of the Aboriginal Financial Institutions in 2014 3 I. Aboriginal Entrepreneurship Program Results 8 II. Corporate Development 10 III. Financial Results 14 IV. Corporate Information National Aboriginal Capital Corporations Association 2014-15 Annual Report Introduction The National Aboriginal Capital Corporations Association (NACCA) is the national voice serving a Network of Aboriginal Financial Institutions (AFIs) from coast to coast to coast. The 2014-15 year brought some banner moments and an end to the on-going transitional activity that prepared the Network to undertake new strategic directions and lay the groundwork for renewal and future business. The most noteworthy moment was the celebration of the AFI Network’s success when collectively, the AFIs surpassed the $2 Billion milestone in providing developmental loans to Aboriginal entrepreneurs since the network was founded. This achievement attests to the important role the AFIs and Aboriginal entrepreneurs play in the economy, in growing Aboriginal businesses, and in creating prosperity in communities across the land. The year also saw the completion of program renovation discussions and activity and a change in focus with the launch of Aboriginal Developmental Lending Assistance, a product designed by AFIs and NACCA to offset the high costs of developmental lending. This performance-based lending support initiative enhances the capacity of the AFIs to support Aboriginal small and medium enterprises. Almost half of NACCA’s members used the Aboriginal Developmental Lending Assistance subsidy to offset the costs of providing 626 developmental loans to Aboriginal entrepreneurs, and exceeded the performance targets. Another important network result in 2014-15 was achieved when the AFIs reached consensus on the delivery mechanism for the Aboriginal Business Financing Program, the equity financing product, which NACCA will administer. Nation-wide coverage will be achieved through the collaboration of regional groups of AFIs to ensure knowledgeable and responsive service to entrepreneurs based on local needs. Two significant governance enhancements were also accomplished. The Board of Directors established the Aboriginal Entrepreneurship Program Committee, as an advisory body that will contribute expertise on policy development for NACCA’s suite of lending products. Second, the work of the Board of Directors on the organization’s by-laws led to the introduction of the National Nominating Committee to oversee a competency-based selection process for Board Directors which will strengthen the organization as it begins its next phase of growth. With all of this work now finished, NACCA is well positioned to support the AFI network as it continues to grow financial professionals while strengthening the capacity of the small and medium size businesses in First Nation, Métis and Inuit communities throughout Canada. National Aboriginal Capital Corporations Association National Aboriginal Capital Corporations Association 2014-15 Annual Report 1 Highlights of the Aboriginal Financial Institutions in 2014 Record year for lending • Aboriginal Financial Institutions surpassed $2 Billion in loans to Aboriginal entrepreneurs since the AFIs were established, providing over 38,000 small business loans to Aboriginal entrepreneurs. • Repayment of loans by Aboriginal small businesses to AFIs is now beyond $1.6 billion. Investment in Aboriginal businesses The results achieved in the network: • Over 1,361 loans were provided to Aboriginal businesses in 2013-14, totalling $111 million. • The 2013-14 consolidated AFI gross loan portfolio is comprised of 4,468 loans, totalling $311 million. • The total direct economic impact of AFI activity was $305 million. Growing Aboriginal business development and creating jobs • A total of 4,257 full-time equivalent (FTE) jobs were created and maintained by new small business loans. • Loans to start-up businesses created 1,200 new FTE jobs and new loans to existing businesses created and maintained a further 3,057 FTE jobs. • The consolidated AFI gross loan portfolio supports 13,000 FTE jobs on a continuous basis. 2Billion in loans 4,257 jobs created Data is drawn from the 2014 AFI Portrait published by NACCA and is derived from a comprehensive analysis of 2013-14 financial statements shared with NACCA by its members, AFIs. 2 National Aboriginal Capital Corporations Association 2014-15 Annual Report I. Aboriginal Entrepreneurship Program Results NACCA continued to build a strong corporate foundation that focused activities on the development of key policy frameworks, governance structures and the launch of a new product, Aboriginal Developmental Lending Assistance. NACCA’s Technical Advisory Group concluded an examination of the transfer of the Aboriginal Business Financing Program to NACCA as the program manager. The Aboriginal Entrepreneurship Program (AEP) is a comprehensive range of complementary products designed to strengthen the network of Aboriginal-controlled developmental lending institutions and to foster increased availability and affordability of capital for developmental lending. The Aboriginal Entrepreneurship Program lending products and services include: • Aboriginal Developmental Lending Assistance • Aboriginal Capacity Development Program • Interest Rate Buy-Down • Enhanced Access Loan Fund • Aboriginal Business Financing Program (implemented over 2015-16) Aboriginal Developmental Lending Assistance In 2014-15, NACCA successfully rolled out the Aboriginal Developmental Lending Assistance program, an AFINACCA-designed initiative to enhance AFI sustainability. Robust risk measurement and management instruments were designed including new application processes to assess lending risk and client needs. The AEP Policy and Procedures manual was developed, refined, and translated into French. Aboriginal Developmental Lending Assistance Results • 23 AFIs utilized the lending assistance product with approved claims nearly $4M. • 1,910 jobs were created/maintained with ADLA with an overall investment of $47,450,119 from Aboriginal entrepreneurs, commercial, and government sources. • Investment per job was $24,843. • 287 on reserve businesses accessed ADLA while 230 off reserve businesses accessed the ADLA product. • Rural businesses accounted for the majority of ADLA claims (327), with urban businesses next (227), and remote businesses (68) last. Aboriginal Developmental Lending Assistance Borrowers • ADLA was accessed by 482 First Nation entrepreneurs, 137 Métis entrepreneurs, and one Inuk entrepreneur. • 483 of the borrowers were men, 118 were women, and 79 borrowers were youth under the age of 36 years. • The majority of ADLA supported entrepreneurs used the loans to expand their business (392), start a new business (141) or acquire a business (48). • Two-thirds (438) of the businesses that received ADLA lending support were sole proprietor companies with the remainder partnerships and limited companies (200), including thirty-seven that are First Nation owned. National Aboriginal Capital Corporations Association 2014-15 Annual Report 3 Aboriginal Developmental Lending Assistance Performance Measures 2014-15 Target Total 500 626 Value ($) of developmental loans supported $3,500,000 $33,606,125 Value ($) of funds committed and disbursed $4,470,000 $3,871,903 Total number of developmental loans supported by ADLA Aboriginal Developmental Lending Assistance Leverage Details 2014-15 $12,971,011.04 $24,298,478.04 Client contribution to loan Commercial debt financing $8,918,413.15 $4,551,583.00 Other government contributions Non-repayable contribution to loan Aboriginal Developmental Lending Assistance Job Creation/Maintenance Full time Part time Seasonal Total Projected Aboriginal jobs created 370 184 94 648 Existing Aboriginal jobs maintained 711 285 66 1062 Total Aboriginal jobs created/maintained 1710 Projected non-Aboriginal jobs created 83 49 25 157 Existing non-Aboriginal jobs maintained 471 64 7 542 Total non-Aboriginal jobs created/maintained 4 National Aboriginal Capital Corporations Association 2014-15 Annual Report 699 The Aboriginal Capacity Development Program The product is designed to enhance the role of AFIs to optimize efficiencies and increase capacity to engage unused capital for developmental lending. The product enables AFI employees and board members to obtain education and training focused on the effective and consistent delivery of developmental lending across the Network. ACDP funds individual training and professional development opportunities as well as business support requirements identified by AFIs. Aboriginal Capacity Development Program Results • ACDP was accessed by most of NACCA’s members, 42 AFIs. • ACDP supported the education and training of 343 AFI employees and 241 board members. Groups of AFIs collaborated to provide shared training opportunities when possible. Aboriginal Capacity Development Program Professional Development AFI employees received training on: • loan management systems training and customization for ADLA products • cash flow workshops • policy development • community fund development • enhanced management training • human resources management • standard administrative and audit procedures for financial institutions • investment of surplus funds • strategic planning • board training on legal responsibilities • loan policy • e-commerce • enhanced management training, human resources management, administrative or audit procedures for financial institutions Aboriginal Capacity Development Program Performance Measures 2014-15 Target Total Number of AFIs accessing professional development training 35 42 Number of AFI staff and board receiving professional training 360 employees 250 board 343 employees 241 board Value ($) of funds committed $ 1,300,000 $ 1,274,934 Value (%) of funds committed 100% 98 % National Aboriginal Capital Corporations Association 2014-15 Annual Report 5 Interest Rate Buy-Down Program The product is designed to encourage an increase in developmental lending to Aboriginal businesses by providing a subsidy to qualified AFIs wishing to secure additional loan funds from sources of capital such as banks, trust companies, and private lenders. Interest Rate Buy-Down Results • Twelve AFIs have lines of credits, with 6 AFIs drawing down on these lines of credit. Interest Rate Buy-Down Performance Measures 2014-15 Target Total Number of active credit lines 13 12 Value ($) of active credit lines $ 7,600,000 $ 17,357,476 Value ($) of active credit lines drawn down $ 4,000,000 $ 4,611,803 Value ($) of developmental loans made $ 1,600,000 $ 4,611,803 Enhanced Access Loan Fund The Enhanced Access Loan Fund provides existing AFIs access to capital and financial support for administrative costs, to provide commercial lending in these areas that may not be covered by a specific service area. Enhanced Access Loan Fund Results • Four AFIs accessed the Enhanced Access Loan Fund that resulted in 17 developmental loans. Enhanced Access Loan Fund Performance Measures 2014-15 Target Total $ 8,000,000 $ 9,010,234 Number of AFIs accessing product 3 4 Number of developmental loans supported 10 17 Value ($) of funds committed and disbursed $ 950,000 $ 1,262,052.30 Value of EA Gross Loan Portfolio 6 National Aboriginal Capital Corporations Association 2014-15 Annual Report Aboriginal Business Financing Program In 2014, the Technical Advisory Group, comprised of general managers from the network and the CEO prepared the business case, business plan, and performance management framework that would enable the organization to proceed with management and delivery of the Aboriginal Business Financing Program (ABFP).1 The plan outlined options, design principles, and the business case. The ABFP product delivers non-repayable contributions to a maximum of $99,000 for Aboriginal entrepreneurs and $250,000 for community-owned Aboriginal businesses. The product provides equity, quasi-equity, and business support services to enable Aboriginal clients to expand, acquire or startup businesses and to secure additional third party debt financing. A plan for nation-wide coverage was achieved through the collaboration of regional groupings of AFIs to ensure knowledgeable and responsive service based on local needs. The AFI regional leads will coordinate the regional activities and program delivery in 2015-16. Regional collaborating groups of AFIs provided feedback on fund allocations, development of internal policies and procedures consistent with the national policy framework, and supporting NACCA with respect to performance management and quality assurance. 1 Formerly delivered by Aboriginal Affairs and Northern Development Canada as the Program Delivery Partners initiative. National Aboriginal Capital Corporations Association 2014-15 Annual Report 7 II. Corporate Development NACCA continued to build a strong corporate foundation and grew its internal capacity to provide an effective national support role for its membership. Key research partnerships were established to generate evidence from which to make informed decisions and to better understand the AFI capital needs and impacts of lending practices. Advocacy Capital Attraction Tool Pilot Project NACCA launched a pilot project with the goal of securing private sector investment to enhance AFIs sustainability. Deloitte LLB was engaged to undertake a study to examine options for developing a fund model and treasury design to attract private sector capital. The Capital Attraction Tool Pilot Project is designed to assist AFIs to access additional low-cost loan capital to service the increased demand for capital from Aboriginal small and medium enterprises and to maintain adequate liquidity. NACCA will continue this work-in-progress and further assess the tool’s viability and to gauge the securitization and return on investment requirements. 8 National Aboriginal Capital Corporations Association 2014-15 Annual Report Some Lessons Learned from Capital Attraction Tool Pilot Project • The capital needs for Aboriginal small businesses remain great. Analysis conducted by NACCA revealed that out of 53 AFIs, 18 have a need for additional, affordable capital in the amount of $78,058,927. • The need for capital for developmental lending amongst certain AFIs was significant and there is limited liquidity in the AFI system that could be used to invest in such a fund. • The IRB product is essential for some AFIs to leverage different sources of capital and that IRB must continue to be available to AFIs in the future. • Investors view the Government of Canada’s support for such an initiative to be important for the duration of the fund’s life, and want evidence of the long-term commitment. General Managers Meeting The Network celebrated the $2 billion lending milestone with the AFI General Managers, Minister of Aboriginal Affairs and Northern Development and other Members of Parliament at a reception held in Gatineau, Quebec during the 2014 General Managers’ Meeting. The General Managers’ Meeting also featured a session on social impact financing, designed to connect AFIs with mainstream experts in social impact financing, featuring presentations by AFIs and the MaRS Centre on Social Impact Investing. Partnerships Carleton University’s Centre for Community Innovation worked with the Aboriginal Financial Officers Association to investigate thriving Aboriginal communities. NACCA partnered with Carleton University to build on this research and trace the impact AFIs have by providing financial and other assistance to Aboriginal entrepreneurs in selected thriving First Nation communities. The research will tell the story of business development and social change related to the activities of AFIs to be published in 2015-16 and shared with AFIs. Governance AFI members approved amendments to By-law No. 5 during the 2014 Annual General Meeting, to respond to Network proposals and changes to the Canada Not-for-Profit Corporations Act. These new measures will enable the Network to adopt a competency-based selection process for the election of Board members, and reduce the size of the Board of Directors to create greater efficiencies. The Board of Directors of the National Aboriginal Capital Corporations Association also established the inaugural National Nominating Committee as it continued its work to adopt a competency-based selection process. Other important governance activities undertaken by the NACCA Board of Directors in 2014 included creating the Aboriginal Entrepreneurship Program Committee, to advise the Board on necessary policy amendments to the framework that governs all funding delivered by NACCA. Finally, in bringing to an end the last five years of program renovation, NACCA’s Board of Directors engaged in a strategic planning session using an enterprise-wide risk management approach to review the Board’s stewardship and duty of care. This work set the stage for developing the strategic priorities for the period of 2015 to 2020. In summary this year marked an end as well as new beginnings. National Aboriginal Capital Corporations Association 2014-15 Annual Report 9 III. Financial Results 10 National Aboriginal Capital Corporations Association 2014-15 Annual Report National Aboriginal Capital Corporations Association 2014-15 Annual Report 11 12 National Aboriginal Capital Corporations Association 2014-15 Annual Report National Aboriginal Capital Corporations Association 2014-15 Annual Report 13 IV. Corporate Information National Aboriginal Capital Corporations Association’s Board Of Directors Shelly Anderson Chris Googoo Harry J. Morrisseau Alberta Region Atlantic Region Northern Ontario Region Apeetogosan (Métis) Development Ulnooweg Development Group Inc. Rainy Lake Tribal Area Business and Corporation Financial Services Corporation Ike Haulli Elaine Chambers Nunavik/Nunavut Region Muriel Parker Treasurer, Yukon Region Baffin Business Development Secretary, Manitoba Region Däna Näye Ventures Corporation Louis Riel Capital Corporation / Cedar Lake Community Futures Geri Collins Paul LaPage British Columbia Region, Quebec Region Warren Sault Community Futures Development Nunavik Investment Corporation Chair, Southern Ontario Region Corporation of Central Interior First Nations Two Rivers Community Linda Martin Development Centre Northwest Territories Region Donald E. Dugan Thebacha Business Development Sandy W. Wong Vice-Chair, Saskatchewan Region Services British Columbia Region SaskMétis Economic Development Tale’Awtxw Aboriginal Capital Corporation Corporation Technical Advisory Group Aboriginal Entrepreneurship Program Committee Francine Whiteduck Terry Brodziak Brian Davey Michael Ivy Kevin Schindelka Alan Park David Vince Jean Vincent 14 CEO, NACCA Saskatchewan Indian Equity Foundation Inc. Nishnawbe Aski Development Fund Apeetogosan (Métis) Development Inc. NACCA Tribal Wi-Chi-Way-Win Capital Corporation Two Rivers Community Development Centre Société de crédit commercial autochtone National Aboriginal Capital Corporations Association 2014-15 Annual Report Lucy Pelletier, Chair Jane Aupaluktuq Paul Devillers Bill Kordyback Don Sieben