customer centric merchandising

advertisement

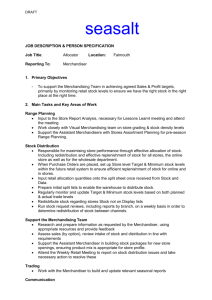

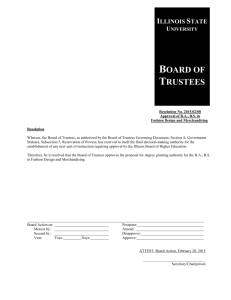

DECEMBER 2013 CUSTOMER-CENTRIC MERCHANDISING Customer-centric merchandising – a pipe dream or imminent reality? page 1 The next great evolution in retailing “The customer is always right” went the old retail slogan, but for many decades, what the customer wanted – or should want – was actually determined by merchandise buyers at corporate headquarters, not the shoppers themselves. Today’s consumers are much more informed and have higher expectations, requiring retailers to both better understand their needs and then determine what actions should be taken to satisfy those needs better than the competition. A number of retailers are making great strides with customer-centricity in marketing and customer service but merchandising has not made the same headway. Over the years, the buying organization has morphed from buying products and negotiating costs to determining where products should be located in the store and on shelves. This then evolved into category management where the category manager had responsibility for setting prices and planning promotions. A further evolution of category management took place with the incorporation of customer insights into the category management process to assist with determining price and promotion policies. But true customer-centric merchandising doesn’t attempt to graft customer insights onto the traditional category management approach. Instead, it completely rethinks the process by allowing customer preferences to guide category management decisions, which in turn facilitates the achievement of sales targets rather than hindering them. Still, skeptics wonder, if traditional category management has served the retail industry well in the past, why is customer-centric merchandising so important? The answer is, in an increasingly cluttered marketplace, the one sure way to stay ahead of the competition is to better and more accurately satisfy the needs of customers. www.loyalty.com page 2 What’s possible, and what’s not In the past, price, promotion and assortment planning was done on a category-by-category basis. But, customers don’t think about buying individual items from individual categories. They shop across multiple categories with a host of different agendas. In today’s increasingly sophisticated market, advanced analytical techniques coupled with powerful, costeffective computational abilities, retailers can factor in the customer perspective from the earliest stages of the planning process. These customer insights can play an integral role in determining price, promotion and assortment plans. This comprehensive, bottom-up approach ultimately creates price, promotion and assortment plans that best satisfy customer needs while achieving, with confidence, merchandising objectives and targets. Rich customer-level knowledge is the foundation for integrated customer-centric retailing These customer insights can play an integral role in determining price, promotion and assortment plans. Priority Customers Enterprise Customer Strategy: Prioritize Investments & Innovation Customer Segments & Cohorts Tactical Execution: Price, Promotion, Assortment Customer-Level Attributes & Scores Customer-Specific: One-to-One Marketing In addition, this approach also adds analytical rigor to one of the oldest merchandising strategies: using select items as loss leaders to drive increased store traffic and larger basket sizes. www.loyalty.com page 3 Previously, choosing a few items to drive store traffic required a big leap of faith, since there was no way to prove if the profit dollars lost on the traffic-driving items were outweighed by the increase in profit from other purchases. Customer-centric analytics greatly improve the precision and effectiveness of this tactic. Data-driven customer-centric merchandising does not, however, enable a retailer to change the price of an item on the shelf for each individual customer. While technologically possible, pricing products for individual consumers is rarely desirable for most retailers, due to concerns about being exposed to claims of bias Implementing customer-centric against one demographic over another. merchandising is an evolution Personalized pricing, as it currently exists, works more like traditional coupons. The twist with personalized pricing is that individual items for sale are tagged as being important to certain groups of customers. Then those customers are offered a personalized price on those targeted items typically through a digital coupon. The discounts are often similar to those on traditional coupons (e.g. $1 off per item), but are usually delivered via email or a smartphone app. As with traditional coupons, the special prices are offered to select groups of customers for select groups of items, but in a much more targeted fashion than was previously possible. rather than a revolution. Points of entry Short of ripping up the current organizational chart, job descriptions and compensation structures, how can retailers reconfigure their organizations to focus on the customer while still achieving their financial targets? Fortunately, implementing customer-centric merchandising is an evolution rather than a revolution. There are logical and low-risk places to start, and plenty of opportunities to change course along the way. With a well-thought-out plan, retailers can achieve their short-term financial targets while building toward and realizing their customer-centric merchandising objectives. Here are the first 5 steps: 1 Leverage customer-driven insights. Retailers will rarely have sufficient resources to pursue every opportunity that is available. Senior members of the merchandising team need to prioritize where to best allocate those resources. The first task is to determine where the largest opportunities reside, by category, based upon customer needs and buying behavior. www.loyalty.com page 4 2 Identify the most important categories. Dividing a retailer’s business into quadrants based on the categories that have the greatest value to both its best (and most loyal customers) and the overall business enables senior merchants to assign roles to each category: Retailers need to determine which categories are the most valued by their best customers and also to the overall business. Value to Overall Business How important are categories to overall business and to your best customers? HIGH Customer-Centric Merchandising Approach LOW OPPORTUNITY PRIORITY Business Performance Resource Investments LOW PRIORITY PRIORITY Cost Effectiveness Loyalty Value to Best Customers HIGH 3 4 5 Clarify the role that different brands and items play within those categories. Individual category managers can make better-informed decisions about brands and items using the same data and insights that have been used at higher levels of the product hierarchy. This process is not that different from the traditional one, but it is sharpened by access to hard insights generated from actual customer purchase data. Determine how the best customers respond to prices, promotions and assortments. When investing in lower prices and margins, it’s in the retailer’s best interest to make those investments in segments where loyal customers will value them most. Similarly, when category managers are making decisions about which brands or items should receive precious promotional space in a weekly circular or on secondary placement displays, they should do so with granular information about which customers are most drawn to those promotions. Translate strategic decisions into actions. Senior executives invest significant resources and time into developing the right strategies for growth. While a customer-centric outlook greatly benefits those strategies, even the best strategies have little value if the day-to-day business decisions do not effectively deploy those strategies. Bridging the gap between higher-level strategies and the lower-level decision-making is crucial to the success of a customer-centric merchandising approach. www.loyalty.com page 5 The power of data When structuring the best methods for maximizing the impact of price, promotion and assortment resources, customer-generated data serves as an invaluable tool. In each of the following tasks, the metrics derived from such data provide the fuel for optimizing the strategy, serving to enhance the knowledge and experience of key decision makers. Designing customer-centric price plans. Leading retailers have been using advanced econometric models and optimization technologies to set prices for years. But all too often, the customer’s perspective is not considered, which results in sub-optimal pricing, promotion and assortment decisions. By Long term loyalty is all about rewarding your best customers understanding how different customer segments respond to various merchandising actions, the At first glance it would appear that the retailer merchant can make better informed decisions. In the example to the right, if a category manager were only to look at the impact across all customers, he or she might decide to invest in lowering the price of ITEM A rather than lowering the price of ITEM B. But most of the volume increase for ITEM A comes from low-value tertiary customers, while most of the volume increase from lowering the price of ITEM B comes from more valuable primary and secondary customers. Armed with insights at the segment level, the category manager can make smart decisions about where to invest in lower prices. With customer-centric merchandising, items, brands and categories that drive traffic and basket size automatically receive the lower prices as part of a complete set of optimized customercentric prices. should go with lowering the price of ITEM A, however ITEM B offers a better choice for long term customer loyalty. Sales Volume Change Item A Item B 12% 10% Primary Segment 0% 12% Secondary Segment 3% 8% 20% 2% All Segments (overall lift) Tertiary Segment www.loyalty.com page 6 Designing customer-centric promotion plans. A similar logic applies to designing customer-centric promotion plans. By better understanding how different customers respond to different promotions, it’s possible to develop promotion plans that satisfy customer needs while also delivering maximum value for the retailer. Provided with information on how different customer segments respond to a particular promotion, a category manager can take the following steps: 1. Keep and expand promotions that appeal to the business’s most valuable customers. 2. Where possible, fix promotions that are not productive in attracting either the most valuable customers or enhancing the business overall. 3. When a promotion can’t be fixed, stop running it and reallocate the resources to betterperforming promotions. By taking these actions, senior decision-makers and category managers can highlight items and brands that address the needs of valuable customers while achieving shorter-term financial performance targets with greater confidence. Category managers can also It’s possible to develop promotion pinpoint the appropriate depth of discount needed to attract loyal customers without creating unwanted plans that satisfy customer needs incentives that encourage unprofitable behavior from customers cherry-picking deals. while also delivering maximum value Category managers are also better prepared to solicit for the retailer. promotions from manufacturers that are more relevant for their customer base, as opposed to simply allowing a manufacturer to push promotions that serve their brands. This puts the category manager in a stronger position when negotiating with manufacturers. Consequently, the category manager can ensure that trade funds are appropriately allocated to the right promotions. Designing customer-centric assortment plans. The traditional method of assortment management involves ranking all items in a category by sales and then cutting the bottom 5 to 10 percent or more. However, this approach falls short for a few different reasons: • Some low sales items are important to valuable customers. Cutting these items could lead a valuable customer to look to a competitor for these items. • Some of the lower sales items have low transferable sales. If items are cut and no reasonable alternatives are offered, all of the value from the cut items will disappear out the door. • Some of the lower sales items may be part of a group of items that are usually purchased together. If you cut these items, then you may lose all the associated sales. www.loyalty.com page 7 • A category-by-category approach may result in making too many cuts in some categories and too few in other categories. Some categories need to provide customers with more alternatives than other categories and, as such, shelf productivity can differ quite significantly between categories. • Taking a Chain or Banner-level approach may miss some of the differences that occur at lower levels of the store hierarchy. An item that performs well in a handful of stores in a particular district or region may not sell well in other districts or regions. Today’s customer-centric methods offer a lower-risk alternative by taking the guesswork out of which items to cut. Cutting-edge data analytics help prune low-productivity, low-risk items to make room for more productive items. This, in turn, produces better individual category and overall store performance. Spreading the word. Any retailer that starts down the path of customer-centricity must be able to communicate the insights gleaned from customer metrics throughout the organization. Simply providing category managers with the metrics alone is not enough. The metrics must be framed in a relevant context for all the different kinds of managers and decisions in the merchandising organization. The metrics also must be easy to understand and simple to use or else they will simply gather electronic dust in the computer files of merchants. Knowing your customer, today and tomorrow Creating and executing a well-crafted plan for implementing customer-centric merchandising is a key part of the process. Taking a crawl, walk, run approach ensures that the organization retains a focus on achieving short-term financial targets, even as it reconfigures the decision-making mechanism. To remain focused, retailers should prioritize their activities within three distinct stages: 1 Assess the potential benefits Customer-centric merchandising requires a commitment from the complete organization, so it’s important to outline the opportunities that this relatively new approach creates. The benefits of customer-centric merchandising are many-fold and significant in scope and can be grouped into the following areas: Strategic Putting customer-driven merchandising insights at the fingertips of merchants enables them to make more-informed decisions that are aligned with customer needs. Competitive Taking a customer-centric approach to merchandising provides a retailer with a sustainable way to differentiate and win in the marketplace. www.loyalty.com page 8 Operational Merchants can enforce operational rules in a more timely and cost-effective manner. Financial • Customer-centric pricing delivers incremental sales of 1 to 3 percent and incremental gross profits of 2 to 5 percent. • Customer-centric promotions produce incremental sales of 3 to 6 percent and incremental gross profits of 5 to 10 percent. • Customer-centric assortment replaces under-performing SKUs while minimizing risk and achieving incremental sales of 1 to 3 percent and incremental gross profits of 2 to 4 percent; it also delivers improvements in inventory turns, lowers working capital and improves cash flow. 2 Establish a game plan After understanding what is possible, retailers should develop a defined plan of action. Sorting ideas into the following categories will help clarify their importance: Strategy • Identify the categories with the greatest current and potential value. • Assign incremental resources to the categories that present the greatest value opportunities. • Align targets and incentives based on customer-driven category roles. Pricing • Generate price elasticities at the item/store/segment level. • Incorporate the customer dimension into identifying Known Valuable Items (KVIs). • Set price policies and execute those policies through price optimization that is simultaneously run across all categories – incorporating customer segments into the process enables an understanding of the impact of optimized prices on individual segments. • Over time, migrate price optimization rules and objectives to develop price plans that are aligned with valuable customers. Promotions • Hone in on which categories and segments respond best to discounts, weekly circulars and displays, and identify which are underperforming. • Where possible, fix under-performing promotions; where it is not possible to fix underperforming promotions, stop running promotions and reallocate promotion investments to better performing promotions. www.loyalty.com page 9 • Incorporate the customer dimension into promotion planning and direct promotional investments towards promotions that are valued by best customers. • Proactively drive the trade promotion planning process with manufacturers to ensure trade funds are allocated to promotions that are tailored for best customers. Assortment • After optimizing prices, run an assortment optimization to identify the low-risk, low productivity items that can be removed from the assortment. • Allocate more shelf space to more productive items. • Expand the distribution of high productivity items to additional stores. • Undertake product innovation either internally or with manufacturers to develop new items to introduce into the assortment – track trial and repeat on a pilot basis. • Monitor the performance of the assortment on an on-going basis, incorporating the customer dimension into relevant scorecards. • Incorporate assortment optimization into the category strategy and review process. 3 Organize and execute To achieve success with any customer-centric merchandising strategy, a retailer must mobilize its vision, its analytics and its employees in tandem. Here’s how the components should come together: Executive support: If a retailer wants to become truly customer-centric, the senior executive team must sign on and fully commit to the undertaking and the roadmap. Customer-centric foundations: There is a bare-minimum set of capabilities required to successfully transition to a customer-centric approach: • The ability to handle and assimilate large and complex data sets. • Advanced, proven customer analytics and segmentation capabilities. • A reliable, secure and scalable technology platform. • Easy-to-use and highly relevant software solutions that can be deployed throughout the organization. Executional ability: For customer-centric merchandising to work, team members need to understand the customer perspective and the analytic insights and be able to make decisions based on both. Before embarking on the transformation to customer-centric merchandising, it’s important to determine which kind of merchandising organization is currently in place: • Is the team focused on the complete buying process, from selecting products, managing the buying cycle and fine-tuning the supply chain? www.loyalty.com page 10 • Is the team adept at negotiating with manufacturers, driving the cost of goods down, minimizing freight costs and maximizing trade funds? • Does the team excel at planning and building out the annual and quarterly plans? • Does each category receive the same number of resources? • Where and how do pricing decisions get made? • Where and how are merchandising insights generated? The above factors will play a major role in determining the shape of the organizational structure to put in place to support customer-centric merchandising. Consequently the type of organizational structure will determine the processes that need to be put in place and how decisions are made. Some of the main questions to ask at this stage are: • Who can make recommendations? • Who can provide input into decisions? • Which parties have to agree before a decision can be made? • Who has the final decision authority? • Who will actually get things done? Here are a few common ways that merchandising insights are generated, interpreted and used: • Centralized Approach: Insights are interpreted and acted on by a centralized team. • Distributed: Insights are interpreted and acted on by a distributed team of merchants, marketers and store operations personnel. • Hybrid Approach: Insights are interpreted by a centralized team whose recommendations are handed off to the merchants who make decisions based on the insights. Finally, targets and incentives must be established. In some cases today, retailers give each category the same sales and profit growth targets (e.g. grow sales by 3 • Consultative Approach: A centralized percent and profits by 5 percent); in other instances, team acts as an internal consulting task the targets are adjusted for each category to take into force, working hand-in-hand with the account the ability of different categories to drive distributed category managers to make sales or profits. In a customer-centric ecosystem, there decisions collectively. are often specific categories that are used as loss leaders to drive overall traffic and therefore aren’t expected to increase sales and profits. Ensuring that category managers have their targets and incentives aligned with the role that their category has been assigned in the overall customer-centric merchandising plan is crucial to success. www.loyalty.com page 11 Customer-Centric Merchandising: a pipe-dream or imminent reality? Retailers have made good progress with satisfying customer needs in many aspects but merchandising has not carried it’s full weight. Traditional approaches to merchandising are not going to be sustainable for too much longer and merchants at leading retailers are going to embrace the customer more wholeheartedly than in the past. It is not an easy transition but it is possible with the right vision, roadmap and capabilities. And the rewards are significant – truly sustainable competitive advantage will be realized as a result of better satisfying the needs of customers to earn their genuine loyalty. The customer-centric merchandising train has been stuck in the station for too long – leading retailers are starting to work out how to get the train going and are starting to reap the benefits. Customer-Centric Merchandising is the next great evolution in retailing. www.loyalty.com page 12 ABOUT The Author Graeme McVie is Vice President, Business Development for LoyaltyOne US, where he helps clients drive improved sales and profits through insight-driven, customer-centric strategies and solutions. Graeme’s work prior to joining LoyaltyOne focused on applying a data-driven approach to helping a wide range of clients develop and implement revenue and growth strategies across international markets. He has worked extensively with both retailers and Consumer Packaged Goods manufacturers. ABOUT LoyaltyOne LoyaltyOne is a global leader in the design and implementation of coalition loyalty, customer analytics and custom loyalty services for Fortune 1000 clients around the world. LoyaltyOne’s unparalleled track record delivering sustained business performance improvement for clients stems from its unique combination of hands-on practitioner experience and continuous thought leadership. LoyaltyOne has over 20 years’ history leveraging data-driven insights to develop and operate some of the world’s most effective loyalty programs and customer-centric solutions. LoyaltyOne is an Alliance Data company. For more information, visit www.loyalty.com. Connect with LoyaltyOne linkedin.com/company/LoyaltyOne @LoyaltyOneInc facebook.com/LoyaltyOneInc www.loyalty.com