Final Year B. Comm., B. Comm. (Accounting) & B. Comm.

advertisement

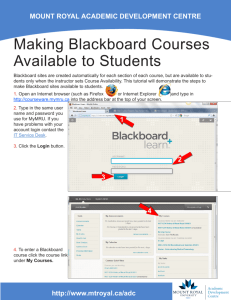

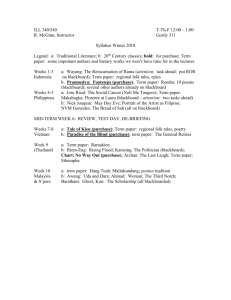

Final Year B. Comm., B. Comm. (Accounting) & B. Comm. (International) Semester One 2012 - 13 Management Accounting II (AY 321) Lecturers: John Currie Gillian Morrow Accountancy & Finance Room 377, Cairnes Building john.currie@nuigalway.ie gillian.morrow@nuigalway.ie Objectives: This course builds on the foundations of the second year introductory course in Management Accounting, and is designed to extend the student's understanding of the concepts and techniques of Management Accounting. In particular, the course is designed to achieve the learning outcomes specified separately under each of the topic headings below. The second-year course, Management Accounting I (AY207), or an equivalent introductory course in Cost and Management Accounting, is a prerequisite for this course. Texts: The basic texts for the course are: (7th Edition South-Western 2008 or 8th edition Colin Drury: Management and Cost Accounting. Cengage 2012) Willie Seal, Ray H. Garrison and Eric W. Noreen: Management Accounting (3rd Edition) McGraw Hill Education (UK). 2009. Copies of these texts should be available in the University Bookshop, and it is strongly recommended that you purchase ONE of these texts. A small number of copies of these texts are available for borrowing from the library (maximum one day). Some additional readings are from these texts which are also available in the Library for one-day borrowing:. Kaplan and Atkinson: Advanced Management Accounting. 3rd Edition, 1998. Emmanuel, Otley & Merchant: Accounting for Management Control. 2nd Edition, 1990. AY321 Management Accounting II: Course Outline 2012 - 13 Page 1 of 7 Blackboard: Lecture notes, problem material and outline solutions, and links to relevant articles will be available on the AY321 course pages on Blackboard. Copies of this course outline, as well as copies of some past examination papers with solutions to quantitative questions are also available on Blackboard. Links to the supporting websites for the recommended textbooks are available in the ‘External Links’ section on Blackboard. (Note that access to the supporting website for the Drury text is restricted to those with a valid access code obtained with a new copy of the textbook, or those who purchase an access code online). Organisation: The course will have three class sessions per week, as follows: Tuesday: 4.00 pm – 5.00 pm Ó Thnúthail Theatre (Arts Millennium Building) Wednesday: 3.00 pm – 4.00 pm D’Arcy Thompson Theatre (Concourse, Arts & Science Building) Thursday: 5.00 pm – 6.00 pm D’Arcy Thompson Theatre (Concourse, Arts & Science Building) Normally, the Tuesday and Wednesday sessions will be used as lecture sessions, taken by John Currie as per the list of course topics below. You are expected to study the assigned readings and review the lecture notes (on Blackboard) before class. Please download copies of the lecture notes in advance and bring them along to class. Lectures will cover selected aspects of the reading material to integrate the elements of the topic. The Thursday sessions will generally be used as ‘workshop’ sessions to review problem material, and will be taken by Gillian Morrow as per the list of course topics below. It will be announced in advance on Blackboard which problems will be reviewed at workshops and you are expected to attempt these problems in advance. Solutions to the Drury and Seal questions listed on the course outline will be available on Blackboard. Additional questions are also listed on the course outline, and these questions together with outline solutions will also be available on Blackboard. Note: The workshop (and other problems) are used to develop a deeper understanding of the course topics and supporting analytical methods, and are not necessarily prototype examination questions. A thorough understanding of all of the course topics (developed through covering the assigned readings, studying lecture notes, and developing skills of analysis through practice with problem material) will be required, and you are expected to be able to apply these principles and analytical methods to novel situations in examination questions. Assessment: Examination: The end-of-semester examination for the course will be a 2½ hour written examination. You will be required to answer one of the two questions in Section A, for 20 marks, and two of the three questions in Section B, for 40 marks each. Cross-module assignment: Your grade in AY321 Management Accounting II will be based wholly on the final examination. However, there will be an assignment in the module AY322 Management Accounting III which will require students to draw on their knowledge of material from AY321 Management Accounting II. Details of this cross-module assignment will be announced early in Semester 2. AY321 Management Accounting II: Course Outline 2012 - 13 Page 2 of 7 Topics, Readings, and Problems: 1. Process Costing: Lectures (5): John Currie Workshops (3): Gillian Morrow Learning Outcomes: On completion of this topic you should be able to: Describe and explain when Process Costing systems are appropriate; Explain the accounting treatment of normal and abnormal losses; Explain and calculate ‘equivalent units’ in the operation of process costing systems; Prepare process cost calculations and accounts involving normal and abnormal losses (including losses occurring midway through processes), and opening and closing work in process, using the alternative First-in-First-out, and the Weighted Average cost flow assumptions; Critically evaluate the usefulness of process costing information for managerial planning and control. Read: Problems: Drury: Chapter 5 (including Appendix 5.1). Seal: Chapter 4. Blackboard: Set (A): Peppone, Cedarwood Industries, Arena, Malta. Set (B): Blue Angel, Puffin Foods, Military, Newby, Borg, Albo, Black Belt, Gloucester, Armenia Ltd, Koura. Set (C): Tarpan, Kurtka, Cyprus, FIFO Ltd., Valparaiso, Reality, Pamplona, Partner, Band Care, Narbonne. AY321 Management Accounting II: Course Outline 2012 - 13 Page 3 of 7 2. Cost Estimation and Prediction: Lectures (6): John Currie Workshops (3): Gillian Morrow Learning Outcomes: On completion of this topic you should be able to: Describe and implement the various methods for estimating costs; Identify and explain the steps involved in estimating cost functions based on past data observations; Apply simple and multiple linear regression approaches in estimating overhead cost functions; Interpret the regression output from computer software and evaluate the goodness of fit and the statistical significance of the cost model as a whole and of individual parameter estimates using R-squared, and the F-tests and t-tests of statistical significance. Develop confidence intervals for cost forecasts; Describe the learning curve, and the circumstances in which learning may take place; Explain and demonstrate how a learning curve may be estimated from past data observations; Apply the learning curve in estimating the incremental time and cost required to manufacture additional output, and the feasible production output under learning conditions when the supply of operative lime is limited. Explain the importance of the learning curve for managerial planning and control. (a) Estimating Cost Functions: Read: Drury: 7th Ed: Chapter 23, pp. 595 – 606, plus Appendix 23.1. 8th Ed: Chapter 23, pp. 609-619, plus Appendix 23.1. Problems: Seal: Chapter 5. Drury: IM 23-5; IM 23-6. (Note: Use 'Excel' for regressions and R2 calculations). Blackboard: Karol; Jackson; Maryville Products; Mike Byrnes; County Choppers; Cratlow Engineering; Zeepiem; Atkinson Perkins, Clarepark. (b) The Learning Curve: Read: Drury: 7th Ed: Chapter 23, pp. 607 – 609. 8th Ed: Chapter 23, pp. 619-622. Problems: Drury: IM23-8; IM23-9; IM23-10. Blackboard: National Avionics; Pelikan; Mediquip; Guzuki; Robotnik; JSME; DRK; Atkinson Perkins; Toucan; Silves; Ozark; Helium, Valetta, Skreptonite. AY321 Management Accounting II: Course Outline 2012 - 13 Page 4 of 7 3. Cost Accounting Systems & Their Incentive Effects: Lectures (4): John Currie Workshops (2): Gillian Morrow Learning Outcomes: On completion of this topic you should be able to: Describe and explain the sequence of cost allocations involved in dealing with manufacturing overhead in costing systems; Explain and implement the various methods available for the allocation of service department costs to production departments, including reciprocal services and self service methods; Explain the tangible benefits of using reciprocal services methods of service cost allocations. Explain the circumstances in which budget (rather than actual) data is appropriate as the basis for service department cost allocation; Explain and demonstrate the use of reciprocal service department cost allocation for decisionmaking; Describe and explain the differences between absorption costing, variable costing, and supervariable (backflush) costing systems, and explain the arguments for or against these alternatives; Prepare profit statements based on absorption, variable, and backflush costing systems, and deal appropriately with under-applied or over-applied fixed overhead in absorption costing statements; Describe the incentives for behaviour implicit in the determinants of the profits reported under each of these alternative costing systems. Read: Drury: 7th Ed: th 8 Ed: Problems: Chapter 3 (including Appendix 3.1); Chapter 7; Chap. 4 (pp. 90-92). Chapter 3 (including Appendix 3.1); Chapter 7; Chap. 4 (pp. 93-95). Seal: Chapter 3 (Appendix 3A only); Chapter 6. Johnson: ‘Just-in-time operations and backflush costing’. Cost assignment & service department costs: Drury: IM 3-10; IM 3-11. Blackboard: Alltech, Catalan, Tatra, Newcastle Industries, Grand Union Manufacturing, Blacklion, Savannah, Pathway, Optimax, Neptune, Foxbat, Georgia, Constant, Jungle, Comino. Problems: Absorption, variable & backflush costing: Drury: IM 7-5; IM 7-6 Blackboard: Sonigarr, Cyclops, Westside Engineering, Ostrich, Stabilo, Mirage, Anthony Rowley, Polarity. AY321 Management Accounting II: Course Outline 2012 - 13 Page 5 of 7 4. Responsibility Accounting, Control Systems and Incentives: Lectures (3): John Currie Workshops: None Learning Outcomes: On completion of this topic you should be able to: Describe and explain the concept of management control; Explain the concept of ‘goal congruence’ and its importance as a feature of control systems; Describe and explain the various types of controls which may operate in organisations; Explain the potential dysfunctional effects of controls; Describe the structure of responsibility accounting systems and the alternative specifications of financial responsibility within the planning and control system; Explain the controllability principle and how it may be implemented in the planning and control system; Explain and discuss the behavioural effects of various features of the budget setting and performance evaluation processes on employee motivation and performance. Discuss the motivational effects of various performance-dependent reward systems. Read: Drury: Chapter 16. Kaplan and Atkinson: Chapter 7: “Decentralisation”. Emmanuel, Otley and Merchant: Chapter 5: “Controls in Business Organisations" and Chapter 10: “Rewarding Managerial Performance” Kaplan and Atkinson: Chapter 13: ‘Incentive and Compensation Systems’. Otley: ‘Management control and performance management’. AY321 Management Accounting II: Course Outline 2012 - 13 Page 6 of 7 5. Financial Performance Measures for Business Units: Lectures (5): John Currie Workshops (3): Gillian Morrow Learning Outcomes: On completion of this topic you should be able to: Distinguish between functional and divisional organisational structures, and explain the strengths and weaknesses of each in various circumstances; Discuss the factors to be considered in determining the appropriate financial performance measures for decentralised business units; Explain why it is desirable to distinguish between managerial performance and business unit performance; Explain and calculate measures of financial performance, including profit performance, return on investment (ROI), residual income (RI), and economic value added (EVATM); Evaluate the strengths and weaknesses of the various measures of financial performance; Evaluate particular measures of financial performance in terms of their motivational effects and their goal congruence characteristics in various situations; Identify and explain the various approaches which might be used to reduce the dysfunctional effects of the use of short-run measures of financial performance; Describe the ‘Balanced Scorecard’ and explain the performance perspectives of the scorecard; Provide examples of performance measures for each of the performance dimensions of the scorecard; Explain how the Balanced Scorecard provides a set of hypothesised cause and effect linkages between strategic lead indicators and the achievement of ultimate financial outcomes. Read: Drury: 7th Ed: Chapter 19; Chapter 22 (pp. 576 – 585). 8th Ed: Chapter 19; Chapter 22 (pp. 584 – 595) Kaplan & Atkinson: Chapter 10. "Financial Measures of Performance". Problems: Seal: Chapter 14; Chapter 16 (pp. 684-691). Brabazon: ‘The Balanced Scorecard’ CIMA: ‘The Balanced Scorecard: An Overview’. Drury: IM 19-5; IM 19-6; IM 19-7. Blackboard: Connemara; Knocknacarra; Barefield; Clare; Cinciano; Zetland; Cappagh; Bohermore; Durrus; Leitrim; Balcon; Ekotek; Arctic Resources; Glasgow. Washington AY321 Management Accounting II: Course Outline 2012 - 13 Page 7 of 7