the bermuda triangle approach : the spanish reaction to

advertisement

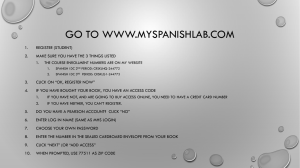

REVISTA PERUANA DE DERECHO TRIBUTARIO UNIVERSIDAD DE SAN MARTÍN DE PORRES. TAX LAW REVIEW ALEJANDRO GARCÍA HEREDIA Doctor de Derecho Tributario, Profesor Contratado Universidad de Cádiz España THE BERMUDA TRIANGLE APPROACH: THE SPANISH REACTION TO UNCOOPERATIVE AND LOW-TAX COUNTRIES” Año 4 / Nº 15 / 2010 C E T CENTRO DE ESTUDIOS TRIBUTARIOS Universidad de San Martín de Porres Facultad de Derecho CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW En este número: DOCTRINA FISCAL "The Bermuda Triangle Approach": The spanish reaction to uncooperative and low-tax countries Dr. Alejandro García Heredia Las directivas y las circulares en la legislación aduanera en el Perú José Antonio Martel Sánchez La retroactividad de la ley tributaria en la Constitución Política de 1993 Marco Chávez Gonzales ACTUALIDAD TRIBUTARIA - Jurisprudencia Extranjera Jurisprudencia Constitucional Tributaria Legislación Resoluciones del Tribunal Fiscal Posición Institucional de SUNAT Proyectos de Ley en Materia Tributaria DOCTRINA MULTIDISCIPLINARIA Los procesos de integración Alfredo Saavedra Sobrados “REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW” Año 4 / Número 15 / 2010 ISSN 2073-2902 © Editada por: CENTRO DE ESTUDIOS TRIBUTARIOS Universidad de San Martín de Porres Facultad de Derecho Lima - Perú Av. Alameda del Corregidor 1865 Urbanización La Ensenada – La Molina www.derecho.usmp.edu.pe/cet cet_derecho@usmp.edu.pe 2 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia THE BERMUDA TRIANGLE APPROACH: THE SPANISH REACTION TO UNCOOPERATIVE AND LOW-TAX COUNTRIES” ALEJANDRO GARCÍA HEREDIA 1 SUMARY: I. Introduction. II. The OECD, EU and Spanish Approaches. III. Spanish Law and Countering Harmful Tax Practices. 1. Introductory remarks. 2. Tax havens. 3. Zero-tax countries. 4. Effective exchange of information. IV. Analysis. V. Application of Unilateral Defensive Measures. 1. Introductory remarks. 2. Spanish tax residence for entities in low-tax countries. 3. Non-resident legal representatives tax liability. 4. Real estate holding companies. VI. Conclusions. I. Introducción Low and no-tax countries represent a threat to the economies of many countries. The Spanish Law for the Prevention of Tax Fraud (hereinafter: the Law) 2 has developed three concepts to counter the erosion of tax bases arising from the use of such countries, i.e. (1) tax havens, (2) zero-tax countries and (3) the effective exchange of information. 3 These three categories are autonomously defined in the Law, but are closely related, as they have been designed to be mutually applicable. The approach could be compared to a triangle in which the three sides can be independently identified, but only make sense once they are combined to create the triangle. Bermuda can be used to understand the coordinated application of the three concepts to prevent international tax fraud. For this reason, the author refers to the Spanish legislation to counter harmful tax practices as the "Bermuda Triangle" approach (see Diagram). En: Revista Peruana de Derecho Tributario. Universidad de San Martín de Porres Tax Law Review. Editada por el Centro de Estudios Tributarios de la Facultad de Derecho de la Universidad de San Martín de Porres (USMP). Año 4 / Número 15 / 2010. Lima Perú. www.derecho.usmp.edu.pe/cet - ISSN 2073-2902. Las opiniones expresadas en este documento son de la exclusiva responsabilidad de su autor y no representan opinión del Centro de Estudios Tributarios. Nota: Artículo publicado en European Taxation, núm. 11, noviembre 2007, pp. 529-536 y traducido posteriormente al chino para su publicación en Taxation Translation Journal. 1 Professor of Tax Law, University of Cádiz. The author can be contacted at alejandro.garcia@uca.es. Comments are welcome. 2 First Additional Disposition of the Law 36/2006 of 29 November 2006. 3 With regard to the terms used in this article, the following must be noted: (1) references to "countries" should be taken to apply equally to "territories", "dependencies" or "jurisdictions", as necessary, (2) low taxation may also refer to non-taxation as appropriate and (3) it should be noted that "zero taxation" is the author's translation of the Spanish concept of "nula tributación". 3 CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW Diagram Zero-tax countries (no similar or identical income taxes to taxes levied in Spain) Effective exchange of information (tax treaty with exchange of information clause or agreement on the exchange of information for tax matters) The Bermuda Triangle Tax havens (black list) Bermuda is a UK overseas territory in the North Atlantic. There are currently no income taxes, profit taxes, capital gains taxes, withholding taxes, value-added taxes or similar taxes in Bermuda. The Bermuda Minister of Finance generally provides assurances to exempt undertakings that any legislation imposing tax on profits or income or any capital assets, gain, or appreciation will not apply to such undertakings until 28 March 2016. 4 The three concepts developed by Spain to counter harmful tax competition, i.e. tax havens, zero-tax countries and the effective exchange of information, can be illustrated by considering Bermuda. Bermuda is included in the Spanish black list of tax havens. As discussed in 3.2., the Spanish definition of a tax haven allows countries entering into exchange of information agreements with Spain to be removed from the black list. This would mean that such cooperative countries (formerly deemed to be tax havens) are not the target of defensive measures. As a result, if Bermuda signed an exchange of information agreement with Spain, it would not be regarded as a tax haven and the defensive measures targeted at tax havens in Spanish legislation would not apply to Bermuda. Bermuda could, however, remain the target of Spanish defensive measures, as Spain has developed the concept of tax havens, i.e. zero-tax countries. This is intended to apply to countries in which there are no identical or similar income taxes to those levy in Spain. Bermuda would fall within this category, as it levies no income taxes. The concept of zero-tax countries demonstrates how Spain not only requires the exchange of information, but also a given level of taxation to prevent the erosion of tax bases. Accordingly, if Bermuda were to be removed from the Spanish tax havens list as a result of an exchange of information agreement with Spain, this would not mean that Bermuda would not be subject to Spanish defensive measures, as it could be targeted as a zero-tax country, not as a tax haven. In addition to tax havens and zero-tax countries there is another autonomous but linked category that relates to the effective exchange of information. Spain has drafted specific defensive measures tailored for countries in which there is not the effective exchange of information, regardless of whether or not they are considered to be tax havens. As Bermuda has not signed 4 D CAMPBELL (ed.), International Taxation of Law-Tax Transactions, Vol. 1, (London: BNA International, 2001), p. 169. 4 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia any exchange of information agreement with Spain, it would be subject to the Spanish defensive measures, either as a tax haven, a zero-tax country or a country without an effective exchange of information. All aspects of the triangle are, therefore, covered. This article first considers the Spanish approach in the context of the OECD and EU criteria (see 2.). The concepts developed by Spain to limit harmful tax practices are then considered (see 3. and 4.). The article then focuses on the specific defensive measures adopted by Spain (see 5.). Finally, some conclusions are drawn (see 6.). II. The OECD, EU and Spanish Approaches The OECD has developed an initiative to limit the spread of tax havens. Since the initial report in 1998, 5 several progress reports have been issued to monitor the evolution of the project (in 2000, 2001, 2004 and 2006). 6 As the impact of tax havens is closely related to exchange of information issues, the OECD has specially focused on improving transparency and establishing the effective exchange of information for tax purposes so that countries can ensure compliance with their domestic tax laws. 7 The OECD's intention is to create a "level playing field" that prevents erosion of tax bases and permits fair competition between all countries. In this respect, the OECD distinguishes between tax havens and harmful preferential regimes in Member countries. There are currently no tax regimes deemed as harmful by the OECD, either because they have been abolished, amended or found not to be harmful. 8 As far as Spain is concerned, Basque Country and Navarra coordination centres have been abolished and the Spanish holding companies regime (ETVE) has been found not to be harmful. As to the tax havens in the OECD list, most have entered into commitments and agreements to attain standards of transparency and exchange of information. The OECD has decided to recharacterize these as cooperative tax havens. Only three tax havens (Andorra, Liechtenstein and Monaco) have not yet made commitments to transparency and effective exchange of information. The OECD has reclassified these as uncooperative tax havens. These tax havens are, therefore, targeted by the coordinative defensive measures of the Member countries of the OECD. The OECD has not, however, neglected to give these countries another chance and is engaged in an ongoing dialogue. It must always been remembered that to be cooperative or uncooperative is only one feature of tax havens and that tax havens remain tax havens, as they are zero or low-tax countries, regardless of their cooperative or uncooperative status, which only relates to transparency and exchange of information. The OECD approach emphasizes the importance of transparency and the exchange of information in countering harmful tax practices. As a result, the OECD does not consider a zero or low-tax country to be harmful in itself as long as it provides for the effective exchange of information and develops transparency standards. Accordingly, what may be a material or substantive tax haven criterion, such as zero or low taxation, is ignored by the OECD with regard to a tax practice deemed to be harmful, as to levy taxes is a sovereign decision of each country. Conversely, the OECD emphasizes what may be a formal tax haven criterion, i.e. transparency 5 OECD, "Harmful Tax Competition: An Emerging Global Issue", (1998). OECD, "Towards Global Tax Co-operation. Report to the 2000 Ministerial Council Meeting and Recommendations by the Committee on Fiscal Affairs. Progress in Identifying and Eliminating Harmful Tax Practices", (2000); "The OECD's Project on Harmful Tax Practices: The 2001 Progress Report", (2001); "The OECD's Project on Harmful Tax Practices: The 2004 Progress Report", (2004); and "The OECD's Project on Harmful Tax Practices: 2006 Update on Progress in Member Countries", (2006). 7 OECD, "Tax Co-operation: Towards a Level Playing Field", (2006). 8 OECD, "The OECD's Project on Harmful Tax Practices: 2006 Update on Progress in Member Countries", (2006). 6 5 CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW and the effective exchange of information. The OECD's definition are illustrative of this concept, i.e. The decision on the appropriate rate of tax is a sovereign decision of each country. OECD member countries do not seek to dictate to any country, either inside or outside the OECD, whether to impose a tax, what its tax rate should be or how its tax system should be structured. The aim of this work is to create an environment in which all countries, large and small, OECD and non-OECD, those with an income tax system and those without, can compete freely and fairly thereby allowing economic growth and increased prosperity to be shared by all. Transparency and international cooperation through effective exchange of information are important elements of such an environment. 9 The OECD approach is, therefore, that coordinative defensive measures do not apply to all tax havens, but only to those regarded as uncooperative. The European Union has also emphasized the issue of harmful tax competition, but with a different approach to the OECD's. The Code of Conduct for business taxation 10 regards a tax measure as harmful if there is low or zero taxation and there is a lack of transparency. 11 The European Union, therefore, considers both material and formal criteria to deem a measure to be harmful, whilst the OECD emphasizes the criterion relating to transparency and the exchange of information. Notwithstanding this, the OECD and European Union contexts differ in many aspects and cannot be compared. The Spanish approach differs from the OECD criteria in two aspects. First, the list of Spanish tax havens does not coincide the OECD list, as there are countries included in the former that are not included in the latter and vice versa (for the Spanish tax haven list, see 3.2.). Second, and most importantly, the OECD approach to harmful tax practices is built on transparency and the exchange of information and disregarding the substantive fact of zero or low taxation is not strictly adopted by Spain. Spain counters harmful tax competition in two ways, i.e. from the effective exchange of information criterion and the substantive taxation criterion. For this reason, Spain only partly follows the OECD approach. With regard to the part of the Spanish approach that is line with the OECD, the following should be noted. The Spanish legislation envisages a list of tax havens and allows countries included in the list to be removed by entering into exchange of information agreements with Spain, for example, either a tax treaty containing such a clause or a specific exchange of information agreement on tax matters. Under this approach, "cooperative" countries are not deemed to be tax havens by Spanish tax authorities and are not subject to defensive measures aimed at tax havens. The Spanish legislation also defines when the effective exchange of information is considered to exist for tax purposes. By defining the "effective exchange of information" Spain creates, along with the concept of tax havens, a new category and may, therefore, draft defensive measure against countries not providing for the effective exchange of information. In a way, this is the core of the OECD approach, which emphasizes the exchange of information as a condition for not being the target of coordinative defensive measures. 9 Id. p. 3, (Para. 6). See Annex 1 of the Council Conclusions of the ECOFIN Council Meeting on 1 December 1997 concerning taxation policy (98/C 2/01). See also the Report of the Code of Conduct Group (Primarolo Group) as submitted to ECOFIN Council on 29 November 1999 (Council Press Release 4901/99, 29 February 2000) 11 Code of Conduct for Business Taxation, Para. B. 10 6 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia Up to this point, Spain adheres to the OECD approach. The Law has, however, introduced, in addition to tax havens, a new category to limit harmful tax practices, i.e. "zero-tax countries". Accordingly, Spain does not disregard the substantive tax regime of a given country, but also considers that it may erode Spanish tax bases. In the author's opinion, this new category implies that countries regarded as zero-tax countries could also be the target of Spanish defensive measures, regardless of whether or not they are cooperative in terms of the exchange of information. This is the point at which the Spanish approach diverges from the OECD's. Notwithstanding this, the author's view is that the category of "zero-tax countries" is only aimed at "zero-taxation", but excludes low-tax countries. For this reason, Spain only attacks those countries in which there are no taxes at all similar to those that would be levied in Spain on individuals, companies or non-residents. For a more on the concept of "zero-taxation", see 3.3. III. Spanish Law and Countering Harmful Tax Practices 1. Introductory remarks The Law provides for three concepts to counter international tax fraud arising from the use of non-cooperative and low-tax countries, i.e. tax havens, zero-tax countries and the effective exchange of information. These are autonomously defined, but are linked concepts. Defensive measures endorsed by domestic tax law may, therefore, refer to any of these concepts to eliminate harmful tax practice. The problem is that the implementation of three autonomous but related concepts may result in interpretation issues and, therefore, to legal uncertainty for taxpayers. 2. Tax havens Spain has a black list of tax havens. It is, however, possible to be removed from the list if a country concludes a treaty with Spain involving a certain standard of exchange of information. This may be either a tax treaty containing an exchange of information clause or a specific agreement on the exchange of information in respect of tax matters. In the latter case, the agreement must expressly state that the country will not be regarded as tax havens. 12 Accordingly, if a country included in the black list concludes one of such a treaty with Spain, it is not regarded as a tax haven. If, however, for some reason the treaty does ultimately not apply, the country is again deemed to be a tax haven. It may then be thought that the exchange of information and its effectiveness is the primary issue, regardless of whether or not the country is a low-tax country. This is, however, only true to a certain extent. If the kind of treaty that must be concluded so that a country may be excluded from the black list is taken into account, the Spanish government still has in mind a material criterion to deem a country to be a tax haven, i.e. low taxation, and not just a formal criterion, i.e. exchange of information. As previously noted, the two kinds of treaties that may be concluded to be excluded from the list are (1) a tax treaty containing and exchange of information clause and (2) a specific exchange of information agreement in respect of tax matters in which the fact that a country is excluded from the list is expressly stated. With regard to (1), the author agrees with Prof. Calderón Carrero and Prof. Martín Jimenez when they note that the conclusion of a tax treaty between a Member country of the OECD, like Spain, and a tax haven implies that the latter should have previously modified its tax system and have at least implemented income 12 Para. 1 First Additional Disposition of the Law. 7 CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW taxes that are quantitative and qualitatively comparable to those of the Member country. 13 Consequently, the conclusion of a tax treaty with a tax haven involves the fact that the tax haven has lost its low or zero-tax features. With regard to (2), the material criterion is also taken into account, as an express reference stating that the country is not a tax haven is required. In this case, the exchange of information agreement (the formal criterion) is insufficient to exclude a country from the black list, as an express reference to exclude the country is also required (the material criterion). It can be inferred that such a reference is decided on the basis of whether or not the country is still a low-tax one. The Spanish black list of tax havens was created by Royal Decree 1080/1991 of 5 July 1991 , as amended by Royal Decree 116/2003 of 31 January 2003. The list is envisaged to be an open list, as the preamble states that "it is subject to modifications arising from the practice, the change of economic circumstances and the experience of international relations" (author's unofficial translation) 14 . Royal Decree 1080/1991 currently includes 48 countries and has not been modified. It only sets out a list of countries regarded as tax havens and does not refer to the criteria have been used by the Spanish government to include these countries in the list. In other words, there is no a definition of a tax haven, as tax havens are those deemed to be such in the list. The issue is then why these countries are considered to be tax havens and why others are not. The Spanish black list includes the following countries: Andorra, the Netherlands Antilles, Aruba, Bahrein, Brunei, Cyprus, the United Arab Emirates, Gibraltar, Hong Kong, Anguilla, Antigua and Barbuda, the Bahamas, Barbados, Bermuda, the Cayman Islands, the Cook Islands, Dominica, Grenada, Fiji, Guernsey and Jersey, Jamaica, Malta, the Malvinas/Falkland Islands, the Isle of Man, the Mariana Islands, Mauritius, Montserrat, Nauru, the Salomon Islands, St. Vincent and the Grenadines, St. Lucia, Trinidad and Tobago, the Turks and Caicos Islands, Vanuatu, the British Virgin Islands, the US Virgin Islands, Jordan, Lebanon, Liberia, Liechtenstein, Luxembourg (for income received by companies referred to in Para. 1 of the Protocol annexed to the Luxembourg-Spain tax treaty of 3 June 1986), 15 Macau, Monaco, Oman, Panama, San Marino the Seychelles, and Singapore. Spain does not, therefore, deem low-tax countries not in the list to be tax havens. This is, for example, the case with countries, such as Belize, the Marshall Islands, Niue, Samoa, St. Christopher and Nevis, and Tonga. Currently, these counties may be used to erode Spanish tax bases without attracting the defensive measure aimed at tax havens, as they are not regarded as such because they is not included in the list. These counties may, however, fall within the new category of "zero-tax countries" envisaged in the Law and may, therefore, be the target of defensive measures. With regard to the countries in the black list, certain other considerations must be briefly noted. First, there are some countries that have signed a tax treaty with Spain containing an exchange of information clause, such as Malta 16 and the United Arab Emirates 17 (Art. 25). In both cases, this is a first-time income tax treaty with Spain. Accordingly, these countries should 13 J.M. CALDERÓN CARRERO and A. MARTÍN JIMENEZ, "La normas antiparaíso fiscal españolas y su compatibilidad con el Derecho Comunitario: el caso específico de Malta y Chipre tras la adhesión a la Unión Europea", Crónica Tributaria, No. 111/2004, pp. 46-48. 14 Para. 4 Introduction to the Royal Decree 1080/1991. 15 Para. 1 of the Protocol states that the Luxembourg-Spain tax treaty does not apply to holding companies as defined in the Luxembourg special legislation that is currently contained in the Law of 31 July 1929 and in the Grand Duchy Decree of 17 December 1938 (that implements Art. 1(7b), Paras. 1 and 2 of the Law of 27 December 1937). 16 Malta-Spain tax treaty of 8 November 2005. The tax treaty entered into force on 12 September 2006. 17 Spain-United Arab Emirates tax treaty of 5 March 2006 The tax treaty entered into force on 2 April 2007. 8 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia not be regarded as tax havens, although they are still in the list. Spain is also negotiating exchange of information agreements with other tax havens, such as the Netherlands Antilles 18 . Second, it should be noted that despite the fact Switzerland is not included in the black list and concluded a tax treaty with Spain in 1966, this tax treaty has recently been renegotiated to include an exchange of information clause.19 Third, the presence in the list of EU Member States, such as Cyprus and Malta, is legally inadmissible, as these countries are subject to the EU rules on the exchange of information and should, therefore, be removed from the black list, regardless of whether they have entered into a tax treaty or an specific exchange of information agreement with Spain. 20 Notwithstanding this, the Spanish tax authorities regard Cyprus 21 and Malta 22 as tax havens. Finally, Luxembourg is only deemed to be a tax haven with regard to its 1929 holding company regime. This may, however, change, as this regime was abolished on 22 December 2006, albeit with transitional rules for certain existing beneficiaries up to 31 December 2010. 23 This means that Luxembourg should be removed from the list on that date. The Spanish black list of tax havens is not a closed list, as countries may be removed from the list if they sign a treaty with Spain containing the requirements set out previously in this section. The black list of tax havens should, therefore, be updated on the basis of the new treaties concluded with counties in the list, such as Malta and the United Arab Emirates. The author contends that the tax haven status of these countries should automatically be removed from the date on which the tax treaty with Spain enters into force, despite of the fact that the counties still appear in the list. Notwithstanding this, if the countries remain on the list, this may be confusing for taxpayers, especially when new tax treaties are concluded. The taxpayer should know which of the countries in the list have concluded a tax treaty containing an exchange of information clause or a specific agreement on the exchange of information that allows them to lose their tax haven status. The fact that Spanish black list has never been updated has resulted in a lack of legal certainty for taxpayers. The list should be subject to revision by both including new countries and excluding others. This appeared to be the primary objective of the list when it was enacted by the Royal Decree, as it was stated that the list was subject to "modifications arising from practice, change of economic circumstances and experience of international relations" (author's unofficial translation). The list has, however, never been updated. 3. Zero-tax countries The Law states that zero taxation exist if a given country does not apply a tax identical or similar to Spanish income taxes (individual income tax, corporate income tax and non-resident income tax). 24 The concept of "identical or similar tax" is made clear by three statements in Para. 2 of the relevant interpretation. First, taxes considered to be "identical or similar" are those levied on income and also partially, regardless of whether or not the tax is levied on income, profits or other forms indicative of income. Second, for individual income tax purposes, social security contributions may be regarded as an "identical or similar tax". Third, a tax is deemed to 18 See WENDELA M.M. VAN DEN BRINK-VAN Agtmaal, "Proposed and Enacted Amendments to Netherlands Antilles Tax Law", 47 European Taxation 2 (2007), p. 87. The author considers the process of amending the Netherlands Antilles tax legislation to adapt its tax system to international standards and be removed from the tax havens lists. As a result, treaties are being negotiating with several countries. As far as Spain is concerned, the author reported that an exchange of information treaty would be signed and, once signed, Spain would remove the Netherlands Antilles from its black list and would enter into negotiations to sign a comprehensive tax treaty. 19 Art. 25 bis of the Spain-Switzerland tax treaty and Para. IV of the Protocol. 20 For more regarding Malta and Cyprus, see Calderón Carrero and Martín Jimenez, note 12, pp. 41-98. 21 Resolutions of the General Directorate of Taxation, 31 August 2006 (0027-06 and 0028-06). 22 Binding Resolution of the General Directorate of Taxation, 25 January 2006 (V0141-06). 23 Memorial Journal Officiel du Grand-Duché de Luxembourg of 29 December 2006 (Loi du 22 décember 2006). 24 Para. 2 First Additional Disposition of the Law. 9 CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW be "identical or similar" if the country concerned has signed a tax treaty with Spain. These three statements reveal that the definition of "identical or similar tax" is broad and, therefore, disconcerting. Further specifications are not provided. The author, therefore, contends that practically all tax or fees somehow related to income in the broadest meaning could confirm the existence of an identical or similar tax. It should be noted that not all the countries deemed to be tax havens are regarded as zero-tax countries according to the Spanish definition, as some may be considered to be low-tax countries or at least countries with some kind of contribution, tax or fees levied on income in the broadest sense that might apply in this respect. The concept of "identical or similar tax" is referred to in other Spanish tax law provisions and is incorporated to the definition of zero-tax countries. The Spanish Corporate Tax Law, for example, provides for an exemption in respect of dividends distributed by a non-resident entity to a Spanish entity if certain requirements are satisfied. 25 One of these refers to the fact that the non-resident entity must have been subject to a foreign tax of an identical or similar nature to Spanish corporate income tax. A similar definition to that in the zero-tax country provisions as to what is an identical or similar tax is included with regard to the dividends exemption. 26 Accordingly, the resolutions of the tax authorities regarding the dividends exemption may be taken into consideration in interpreting the concept of identical or similar tax in respect of the definition of zero-tax countries. The primary problem is the issue of the comparability of taxes, i.e. in ascertaining what criteria must be taken into account to determine if the foreign tax is identical or similar to the Spanish corporate income tax. 27 A case involving Costa Rica may illustrate the problems posed by the concept of identical or similar tax. The Spanish tax authorities have considered a case in which a Spanish subsidiary located in Costa Rica distributes dividends to its Spanish parent company. 28 The Resolution states that in Costa Rica there is no identical or similar tax, as worldwide income is not taxed in Costa Rica due to its territorial tax system. Accordingly, income from outside of Costa Rica and obtained by a Costa Rican company is not taxed in Costa Rica. Consequently, a Spanish subsidiary in Costa Rica is not taxed there in respect of income derived from abroad. Dividends repatriated to its parent company in Spain cannot, therefore, benefit from the exemption. The same could be said for other countries with territorial tax systems. Cases in which the Spanish tax authorities have deemed a tax to be identical or similar tax to Spanish corporate income tax should also be noted, such as those relating to Egypt 29 and Guatemala. 30 In the author's opinion, Costa Rica should not (as it is) be in the black list, as Spain has signed a first income tax treaty with Costa Rica (not yet in force). A signed tax treaty means that Costa Rican taxes should be classified as identical or similar to Spanish taxes for the purposes of the zero-tax countries definition, as it is stated that a tax is deemed to be "identical or similar" if the country concerned has signed a tax treaty with Spain. It would have to be seen how the Spanish tax authorities and courts applied this with regard to zero-tax countries. As Costa Rica is not included in the current Spanish black list and should not be regarded as a zero-tax country due to its tax treaty with Spain, Costa Rica may, 25 Art. 21 Corporate Tax Law. The conditions to benefit the exemption provided for in this article are also required in respect of the other Corporate Tax Law provisions that refer to Art. 21, such as the Spanish holding company regime (ETVE) (Art. 117 and Art. 119) or the exemption in respect of income obtained by a permanent establishment located abroad (Art. 22). 26 Art. 21(1)(B) Corporate Tax Law. 27 This issue is outside of the scope of this article. For an in depth view, see J.M. Calderon Carrero, "La planificación fiscal internacional basada en el artículo 20 bis LIS: la sujeción a un impuesto de naturaleza idéntica o análoga" in José María GONZÁLEZ GONZÁLEZ (ed.), Tributación de los Beneficios Empresariales, (Valencia: CISS, 2006), pp. 311-362 and A.J. Martín Jiménez, "Oportunidades de planificación fiscal para la empresa española derivada de los arts. 21 y 22 TRLIS" in the same publication, pp. 365-376. 28 Resolution of the General Directorate of Taxation, 4 December 2002 (1907-02). 29 Resolution of the General Directorate of Taxation, 13 February 2001 (0269-01). 30 Resolution of the General Directorate of Taxation, 16 September 2003 (1327-03). 10 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia therefore, be an attractive country for Spanish investments and create tax planning opportunities based on its territorial tax system. It can be easily inferred how the zero-tax concept has been envisaged to apply defensive measures to no-tax countries that have not been included in the Spanish black list. Accordingly, a defensive measure may use in respect of the concepts of both a tax haven (the black list) and zero-taxation (the open concept). For example, Belize is not included in the Spanish black list, but it is considered to be a no-tax country for non-residents. It may, therefore, be regarded as a zero-tax country and may be subject to defensive measures. A no-tax country excluded from the black list due to an exchange of information agreement may also be subject to a defensive measure that refer to zero-tax countries, despite the fact that it is not regarded as a tax haven. This could be the case for Bermuda (see 1.). The concept of zero-taxation opens a door to countries not included in the black list and permits the tax authorities to counter no-tax countries. The concept of zero-taxation also reveals the importance of the material criterion, i.e. the level of taxation, in countering harmful tax practices. An example of a Spanish defensive measure containing both the concept of a tax haven and that of zero-taxation is set out in 5.2. Accordingly, those dealing with tax havens in Spain must not only take into consideration the Spanish black list of tax havens but also the concept of a zero-tax country. In other words, with the new concept of zero-taxation, the Spanish black list is a "grey area", as no-tax countries not included in the list may fall within the defensive measures as "zero-tax countries". 4. Effective exchange of information In addition to the concepts of tax havens and zero-tax countries, the Law has developed a third concept, i.e. the effective exchange of tax information. This concept reveals the importance of the formal criterion in dealing with harmful tax practices, i.e. the exchange of information is based on effectiveness. The effective exchange of information is considered to exist with those countries that have concluded with Spain either a tax treaty containing an exchange of information clause (provided that the tax treaty does not expressly state that the level of exchange of information is insufficient to these purposes - sic) or an exchange of information agreement on tax matters (provided that the agreement expressly states that the level of exchange of information is sufficient for these purposes – sic). 31 The tax authorities may also use this concept to apply defensive measures to high-tax countries with opaque systems of information, such as bank secrecy. The author is of the opinion that the OECD standards on transparency and exchange of information should be taken into account by the Spanish authorities in ascertaining whether or not there is effective exchange of information. 32 IV. Analysis The three sides of the Bermuda triangle, i.e. tax havens, zero-taxation and the exchange of information, must be regarded as different but compatible concepts in countering harmful tax practices. In the author's view, the intention of the provisions is to combine the material and the formal approaches. The material approach relates to countries with a low or zero level of taxation that may reduce tax bases of high-tax countries and that undertake harmful tax competition. The formal approach refers to countries that do not provide information on tax matters or do so in a very limited way. Countries and international organizations take into account both criteria in deeming a given country to be a tax haven. The OECD has implemented the concept of "cooperative tax havens", i.e. a tax haven remains as such since there is zero or 31 Para. 3 First Additional Disposition of the Law. The OECD standards are primarily contained in the Report "Tax Co-operation. Towards a Level Playing Field" (2006) and in the 2002 Model Agreement on Exchange of Information on Tax Matters. 32 11 CET - REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW low taxation, but is cooperative as it is involved in supplying information. Accordingly, a cooperative tax haven should be removed from the Spanish black list due to the existence of the effective exchange of information, but the Spanish authorities are concerned about the low level of taxation in such countries and could apply defensive measures as zero-tax countries. A country not included in the Spanish black list may also be the target of a defensive measure due either to low taxation or restrictions in providing information. In the former case, the concept that would be used would be that of zero-taxation and, in the latter, that of the effective of exchange of information. The zero-tax concept emphasizes the material approach. Conversely, the effective of exchange of information concept relies in the formal approach. The concept of a tax haven is the base of the pyramid. The concepts of zero-taxation and effective exchange of information are the two sides that provide the tax authorities with additional means to counter harmful tax competition. These concepts, i.e. a "base concept" (tax haven), a "material concept" (zero-taxation) and a "formal concept" (the effective exchange of information), make it possible to draft tailor-made defensive measures, depending on the country in question. Notwithstanding this apparent advantage, excess zeal in creating new concepts and categories may result in problems of interpretation, legal uncertainty and an unnecessary difficulty in drafting defensive measures. A more reasonable and simpler approach would be the integration of the formal and material concepts within the general concept of tax haven. In this case, it would be sufficient to state that tax havens are (1) countries included in the black list (with the possibility of removal) and (2) countries with zero-taxation or/and without the effective exchange of information (as currently defined). Accordingly, there would only be a concept of a tax haven and the list would not then be closed but open. Defensive measures to counter harmful tax practices could, therefore, refer generally to tax havens and would harmonize dispositions on this matter. V. Application of Unilateral Defensive Measures 1. Introductory remarks The three definitions to counter harmful tax practices, i.e. tax havens, zero-taxation and the effective exchange of information, have been developed with the aim of drafting specific defensive measures. These may be aimed either at tax havens, zero-tax countries and countries without the effective exchange of information or combinations of these, depending in which countries the Spanish authorities intend to deter investment. 2. Spanish tax residence for entities in low-tax counties The Spanish Corporate Income Tax Law has developed a defensive measure specifically aimed at base companies located in low or no-tax countries. 33 In line with the OECD reports and according to the "substance-over-form" provisions, Spain regards a base company as a Spanish resident because its place of effective management or assets are located in Spain. 34 The Spanish Corporate Income Tax law states that entities located either in zero-tax countries or tax havens, whose main assets consist, directly or indirectly, of goods located in Spain or rights to be executed in Spanish territory or whose main activity is developed in Spain are deemed to be resident in Spain, unless the entities can demonstrate that (1) their management is effectively carried out in the zero-tax country or the tax haven and (2) their incorporation and activities correspond to economically valid motives and substantive business reasons other than the mere 33 34 As amended by Art. 1 of the Law. OECD, "Double Taxation Conventions and the Use of Base Companies", (1986), p.11. 12 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia management of a portfolio or other assets. 35 The burden of proof lies with the taxpayer. There is, therefore, a legal assumption of Spanish tax residence for these entities and this can only be disproved by presenting evidence of the aspects indicated both in (1) and (2). The assumption is wide and may lead to numerous problems of interpretation and legal evidence, such as the definition of "economically valid motives and substantively business reasons" as well as the evidence required to substantiate this. It should be noted that this applies if entities have their main assets or their main activity in Spain. The question then arises as to when an asset or an activity is in Spain and when an asset or an activity may be considered to be the purpose of a company. Attention should be paid to the use of the concept of "place of effective management" as evidence to disprove this presumption. 36 Accordingly, the interpretation must be implemented on a case-by-case basis and depends on future resolutions of the tax authorities and court decisions. A specific issue may arise as to whether or not the Spanish controlled foreign company (CFC) legislation is compatible with the assumption of Spanish tax residence. Specifically, a CFC located in a tax haven could be deemed to be resident in Spain by applying this assumption and it would be then be subject to ordinary taxation in Spain as a resident. This would mean that the CFC legislation would not apply, as the company would be deemed to be resident in Spain. The Italian tax authorities have already considered a similar issue. Under Italian tax law, it is assumed that foreign holding companies meeting certain requirements are resident in Italy. In this respect, the Italian tax authorities have stated that the presumption of residence generally makes the CFC rules inapplicable. 37 The presumption of Spanish tax residence raises similar issues, although in a different context, with regard to the Spanish autonomous regions. The Spanish Law for the Financing of Autonomous Regions states that, for individuals, changes of residence between different regions are irrelevant for legal purposes if the primary objective is to benefit from lower taxation. 38 Accordingly, an individual moving residence from region A to region B with the primary objective of paying less or lower taxes remains resident in region A. The author agrees with one of the leading Spanish scholars in criticizing this in stating that each individual has the right to choose his own residence and has free of movement as recognized by the Constitution. This scholar even states that tax reasons may not even be concealed, as they are as valid as other reasons. 39 This is a defensive measure intended to avoid the reduction of the tax bases of Spanish corporations that have been relocated to low-tax countries. It should be noted that this refers only to zero-taxation and tax havens and omits the concept of the effective exchange of information. This is not envisaged so much to counter the lack of information as to avoid the erosion of Spanish tax bases through the use of low-tax countries. The importance of the effective exchange of information as employed in respect of defensive measures is considered in 5.3. and 5.4. 35 Art. 8.1 Corporate Tax Law. Issues may also arise in the context of parent-subsidiary relationships. The OECD has considered that, in some cases, the place of effective management of a subsidiary is in the state of the parent company and the subsidiary may, therefore, be deemed to be resident there. See OECD, "Restricting the Entitlement to Treaty Benefits", (2002), pp. 5-7. 37 With regard to the Italian approach, see Giuseppe Campolo, "Deemed Italian Tax Residence for Foreign Holding Companies", 47 European Taxation 1 (2007), pp.55-57. The author discusses in depth the Italian disposition (Decree-Law 223) and the Italian tax authorities' interpretation in Ministerial Circular No. 28/E of 4 August 2006. 38 Art. 20.4 Law 21/2001 of 27 December 2001. 39 Manuela FERNÁNDEZ JUNQUERA, "El Poder Tributario de las CC.AA. a los 25 años de la Constitución", in Ana María Pita Grandal (ed.), Hacienda Autonómica y Local (III Seminario Iberoamericano de Derecho Tributario), Tórculo Edicións, pp. 72-73. 36 13 CET - 3. Non-resident legal representatives tax liability REVISTA PERUANA DE DERECHO TRIBUTARIO, UNIVERSIDAD DE SAN MARTÍN DE PORRES TAX LAW REVIEW Non-residents must appoint a legal representative resident in Spain in respect of their tax obligations. 40 If non-residents fail to comply with this obligation, the tax authorities regard certain persons as the legal representatives of the non-residents. If there is no effective exchange of information between Spain and the country in which the non-resident is located, the Spanish tax authorities regard the depositary or manager of the non-resident goods or rights as the legal representative of the non-resident. 41 The fine for not appointing a legal representative is EUR 2,000, increased to EUR 6,000 if the non-residents are located in countries with which there is no effective exchange of information.42 The importance lies in the fact that the non-resident Spanish representative is jointly and severally liable. This means that the Spanish tax authorities may seek a tax debt either from the legal representative or the non-resident. It is usually the former, as it is easier to claim a debt from a resident representative than from a non-resident. The tax authorities may also claim the tax debt of the non-resident directly from legal representative, i.e. without any previous administrative procedure. 43 Accordingly, the emphasis of this defensive measure is on countering countries that do not cooperate regarding the exchange of information. 4. Real estate holding companies The ownership of real estate is sometimes moved indirectly by transferring the shares of a real estate holding company. The Spanish laws are intended to prevent the avoidance of tax on capital gains on the transfer of real estate by means of the sale of the shares of a real estate holding company. This is achieved by deeming that the capital gains derived from the sale of shares of Spanish or foreign company are subject to tax in Spain if the main assets consist of real estate in Spain or the owner has the right to use such real estate. A specific provision aimed at uncooperative countries in terms of the exchange of information has been introduced in the Spanish legislation by the Law. This disposition states that capital gains arising from transferring shares of real estate entities that are resident in countries with which there is no effective exchange of information in respect of tax matters are estimated on the basis either of the market value of the real estate located in Spain or of the enjoyment rights in respect of such properties. 44 Real estate owned by these entities is affected by the payment of the non-resident income tax in respect of the capital gains arising from the transfer of shares. If the real estate is not owned by a non-resident entity but by a Spanish entity, the shares are affected by the payment of the tax debt. 45 This is another example of a particular defensive measure specifically envisaged in respect of uncooperative countries, regardless of whether or not they levy high, low or no taxes. In addition, as this results from the application of the defensive measure aimed at base companies (see 5.2.), if a real estate holding company is located in a tax haven or a zero-tax country, it could be deemed to be resident in Spain and income derived from the transfer of shares would not be non-resident income, but, rather, 40 Art. 10.1 Law for Non-Resident Income Tax. The obligation to appoint a legal representative is for nonresidents with a permanent establishment in Spain, non-resident partnerships operating in Spain, non-residents providing services in Spain (such as, technical assistance) and if the tax authorities require such an appointment due to the amount and features of income arising from the Spanish territory. The use of expressions, such as "the amount and features of income obtained in Spain", allows the tax authorities to require, as they consider, the appointment of a legal representative by non-residents. 41 Art. 10.2 Law for Non-Resident Income Tax. 42 Art. 10.3 Law for Non-Resident Income Tax. 43 Art. 9.3 Law for Non-Resident Income Tax. 44 Art. 24.4 Law for Non-Resident Income Tax. 45 Art. 25.3 Law for Non-Resident Income Tax. 14 The Bermuda Triangle approach: The Spanish Reaction to Uncooperative and Law-Tax Countries” – Alejandro García Heredia ordinary income subject to Spanish corporate income tax. A real state holding company located in Gibraltar and owning real state properties in Spain could, therefore, be deemed to be resident in Spain according to the anti-base company provision in 5.2. VI. Conclusions Spanish domestic tax laws provide for defensive measures to counter harmful tax practices. Problems may, however, arise regarding the limits of the sovereignty of states to tax income derived from low-tax countries and establish defensive measures to deter investments there. As the decision on the appropriate rate of tax is a sovereign decision for each country, defensive measures aimed at low-tax countries would not be justified if they only countered zero or low taxation in a given country. The OECD, therefore, emphasizes principles of transparency and the effective exchange of information. A country lacking these standards may be stigmatized as uncooperative and be the target of coordinated defensive measures. Despite the fact that the rate of tax is a sovereign decision for each country, countries appreciate that a reduced level of taxation may erode tax bases, despite the existence of the effective exchange of information. The Spanish approach, therefore, takes into consideration both a formal criterion, i.e. the exchange of information, and a material criterion, i.e. the level of taxation. This approach has been developed on the basis of a triangle using three different but coordinated concepts, i.e. tax havens, zero-tax countries and the effective exchange of information. The three definitions provide the Spanish authorities with a more flexible and broader scenario so as to discourage taxpayers from using low-tax countries. Interpretative problems may, however, arise regarding the definition of these concepts and may result in the lack of legal certainty for taxpayers. The author is of the opinion that a general concept for tax havens involving both zero-taxation and the effective exchange of information criteria would reduce the complexity of this triangular approach. Time would reveal the effectiveness such a measure. ***** 15