Investor Presentation

advertisement

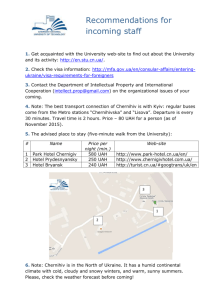

Oschadbank Investor Presentation May 2015 | Strictly Private & Confidential YE2014 IFRS Financial Highlights and Financial Trends 2010-2014 • • • • • • • • • • • • 2 Oschadbank‘s market position (page 3) 2014 Balance Sheet (page 4) 2014 Profit and Loss Statement (page 5) Balance Sheet Composition (page 6) Loan Portfolio Analysis (page 7) Corporate Banking (page 8) Oschadbank and Naftogaz (page 9) Retail Banking (page 10) Financial Performance Trend (Balance Sheet) (page 11) Financial Performance Trend (P&L) (page 12) Assets and Liabilities Maturity and Currency Profile (page 13) Cooperation with International Financial Institutions (page 14) Oschadbank’s Market Position Among Peers By Total Assets UAH Bln By Loans to Customers (Gross) By Impairment Allowances UAH Bln UAH Bln 184,8 204,6 25,8 128,1 24,5 23,4 126,0 95,1 13,9 12,3 76,6 60,3 PRIVAT OSCHAD UKREXIM DELTA 52,7 48,6 48,3 PROMINV UNICREDIT PRIVAT OSCHAD UKREXIM DELTA 44,8 44,3 UNICREDIT PROMINV 5,8 OSCHAD UKREXIM PRIVAT By Securities Portfolio By Total Equity By Retail Deposits UAH Bln UAH Bln UAH Bln 42,0 22,8 40,0 22,7 RAIFF UNICREDIT PROMINV 107,7 13,5 36,6 6,2 UKREXIM OSCHAD 5,0 4,9 SBER RUSSIA RAIFF 3,6 6,1 24,0 21,9 3,4 UNICREDIT PROMINV OSCHAD Source: National bank of Ukraine [http://bank.gov.ua]; UAS as of 1 January 2015. 3 6,2 PRIVAT UKREXIM UNICREDIT RAIFF PROMINV PRIVAT OSCHAD DELTA UKREXIM 14,2 12,3 RAIFF UNICREDIT 2014 Balance Sheet Gross loans book picked up by 46.7% YTD driven by UAH devaluation and increased volume of new loans granted. In monetary terms, net amount of increase in loans to customers (without effect of UAH depreciation) during 2014 comprised UAH 8.3 bln (2013: UAH 2.1 bln) Allowance for impairment losses for loans to customers grew almost twice mainly due to situation with loans provided by the branches in Donetsk, Lugansk and Crimean regions. As of 31.12.2014 their total gross value comprised UAH 12.5 bln (or 13.3% of total gross loan portfolio) and allowance - UAH 10.8 bln (incl. 100% allowance under loans granted to Crimean customers). This led to increase of NPL ratio: as of 31.12.2014 and 2013, NPL constituted 17.9% and 10.8% of the total gross loan portfolio, respectively; other than loans granted to the customers of the Crimean branch – 7% and 11%, respectively. UAH devaluation was another factor that influenced allowance for impairment losses for loans granted to customers Naftogaz remains the largest borrower of the Bank with 16% stake in the total gross loan book as of 31.12.2014, but with tendency to decrease caused mainly by UAH devaluation (2013: 23.7%) Customer Accounts grew by 21.1% mainly due to UAH devaluation. As of 31.12.2014 net loans-to-deposits ratio comprised 125.0% in comparison with 112.4% as of beginning of 2014 Amounts of Eurobonds and Other borrowed funds increased by 131.3% mainly due to UAH devaluation. During 2014 net cash inflow comprised UAH 3.0 bln Despite loss-making activities in 2014, Total Equity was slightly increased by 0.2% due to recapitalisation by the State of Ukraine. Capitalization remains strong and well above the regulatory minimum with CAR 18.57% and Tier 1 ratio 17.97% (24.69% and 23.15% as of YE2013, respectively) Source: Oschadbank Financial Statements, IFRS (consolidated). 4 124.31 YE 2013 (IFRS) 101.70 YTD, % 22.2 4.53 4.82 (5.9) Due from Banks 8.02 7.65 4.9 Gross Loans. incl. 94.26 64.27 46.7 Corporate 89.31 59.71 49.6 Individuals 4.95 4.56 8.5 (24.02) (12.09) 98.7 33.12 33.25 (0.4) 105.07 82.50 27.4 Due to Banks and NBU 22.18 24.08 (7.9) Customer Accounts, incl. 56.21 46.41 21.1 Corporate 19.12 10.57 81.0 Individuals 37.09 35.84 3.5 24.59 10.63 131.3 Total Equity 19.24 19.20 0.2 CAR, % 18.57 24.69 NPLs/Gross Loans, % 17.9 10.8 7.1 pp NPLs/Gross Loans, % (excl. Crimea Loan Portf.) 7.3 10.7 (3.4) pp (UAH Bln) Total Assets Cash and Balances with NBU Allowance for impairment losses Securities Total Liabilities Eurobonds and Other borrowed funds YE 2014 (IFRS) (6.1) pp 2014 Profit and Loss Statement Net interest income before provision slightly decreased by 3.5% during 2014 and reached UAH 5.3 bln (2013: UAH 5.5 bln) causing decrease of Net interest margin from 5.7% to 4.3%, which nevertheless still remains strong Provision for impairment losses on interest bearing assets grew almost 4 times during 2014 mainly due to increase of provision under loans granted by UAH 11.9 bln (2013: UAH 2.1 bln). This material increase occurred due to the loans granted to the customers of Crimean, Donetsk and Lugansk branches. UAH devaluation also significantly influenced amount of provision Net non-interest loss increased significantly in comparison with 2013 due to negative forex effect resulted from respective devaluation of UAH against major world currencies during 2014 Operating expenses rose by 21.5% y-o-y to UAH 4.2 bln, due to extraordinary expenses mainly caused by losses of the Bank’s assets (cash, property and equipment) in Crimea and certain arrears of Donetsk and Lugansk regions. As result of these changes cost-toincome ratio grew substantially to 111.9% during 2014 (2013: 50.9%). At the same time, after excluding extraordinary expenses and negative forex effect this ratio would comprise 54.8% Due to reasons described above, bank reported Net Loss of UAH 10.0 bln in 2014 Source: Oschadbank Financial Statements, IFRS (consolidated). 5 YE2014 (IFRS) YE2013 (IFRS) 5.32 5.51 Provision for Impairment Losses (9.66) (2.44) 296.4 Net non-interest (loss) / income (1.53) 1.34 (214.2) Total Operating (loss) / income (5.88) 4.41 (233.1) Operating Expenses (4.24) (3.49) (UAH, bln) Net Interest Income Before Provisioning YoY, % (3.5) 21.5 Profit (Loss) Before Tax (10.11) 0.93 (1192.5) Net Profit / (Loss) (10.02) 0.71 (1508.3) 4.34 5.69 111.9o 50.91 Net Interest Margin, % Cost to Income, % (1.4) pp 61.0 pp Balance Sheet Composition 2012-2014 YE 2012 YE 2013 Funding Mix Other Eurobonds 1% 9% IFIs, Subdebt 2% Corporate Customers Account 14% Due to NBU 28% Due to Banks 2% Retail Customer Accounts 44% Eurobonds 12% Assets Mix 6 Due to NBU 25% Due to Banks 4% Retail Customer Accounts 43% Fixed Assets 3% Cash 5% Fixed Assets 4% Cash 5% Loans to Customers 61% Source: Oschadbank Financial Statements, IFRS (consolidated). IFIs, Subdebt 2% Other 1% Eurobonds 18% IFIs, Subdebt 7% Due to NBU 19% Due to Banks 2% Corporate Customer Accounts 18% UAH 82.5 Bln Due from Banks 18% UAH 83.4 Bln Other 1% Corporate Customer Accounts 13% UAH 65.7 Bln Securities 12% YE 2014 Due from Banks 8% Retail Customer Accounts 35% UAH 105.1 Bln Loans to Customers 51% Due fromEmbedded Other Fixed Banks Derivative 1% 3% Assets 6% 3% Cash 4% Securities 27% Securities 33% UAH 101.7 Bln UAH 124.3 Bln Loans to Customers 56% Loan Portfolio Analysis YE 2014 Net Loans by Currency Gross Loans by Borrower Type YE 2014 Net Loans by Remaining Maturity YE 2014 UAH 67.3% EUR 1.8% Retail 5.2% USD 30.9% YE2014 5% 26% YE2013 5% 8% 24% 23% 31% 14% 46% 18% Corporate 94.8% <1 Month 1–3 Months 3 Months–1 Year 1–5 Years >5 Years Gross Loans by Sector NPL Overview UAH Mln 10.8% 17,9% 10.7% 7.1% 3.6% 7.3% 153,30 8,03 4,02 2010 2011 2013 Write-offs of Interest Bearing Assets NPLs NPLs excluding Crimean Loan Portfolio Source: Oschadbank Financial Statements, IFRS (consolidated). 7 23% YE2013 25% 5% 23% 21% 10% 18% 7.3% 147,78 25,98 2012 YE2014 7% 18% 21% 9% 2014 Oil, Gas and Chemical Production Energy Food and Agri Individuals Construction and RE Other 20% Corporate Banking • Oschadbank provides corporate banking products and services to a variety of state-owned and private clients Corporate Gross Loan Book UAH Bln • Corporate banking products include corporate lending, overdraft facilities, revolving lines of credit, guarantees, promissory notes, letters of credit, deposit accounts, foreign exchange, payment and account services, internet client bank, cash collection services, trade finance 89,3 • The Bank intends to expand products and services offered to its clients in food and agri business, energy, retail, production of natural resources such as mineral sands and clays, other export-oriented sectors with growth potential, as well as to SMEs 54,4 Mining and Metallurgy 5% Trade 9% Other 4% Food & Agri 11% 2011 2012 2013 2014 Corporate Deposits and Curr. Accounts by Sector YE2014 Engineering 8% Oil & Gas 24% 59,7 44,1 2010 Corporate Gross Loans Breakdown by Sector YE2014 56,8 Transport Fin services 5% 8% Food and Agri 6% Construction and RE 2% Other 7% Oil & Gas 10% Trade 9% Investing activities 17% Construction & RE 22% Energy 25% Source: Oschadbank Financial Statements; IFRS (consolidated). 8 Media & Coms 3% Energy 19% Services 6% Oschadbank and Naftogaz Loans Extended to Naftogaz Since 2008 Government UAH 29.1 billion UAH12.8 billion capital injections UAH18.0 billion of credit lines YE 2009 IFRS YE 2014 IFRS Naftogaz Gross Loans 29.1 bln 15.1 bln (48.1)% % of Equity 190.2% 78.5% - % of Gross Loan Book 58.4% 16.0% - Reserves for Naftogaz 1.8 bln 2.8 bln +56.0% % in Total Reserves 43.5% 11.6% - Naftogaz Net Loans (after reserves) 27.3 bln 12.3 bln (54.9%) % of Net Loan Book 59.7% 17.5% Change NBU Exposure Collateral New Gov’t Strategy for Naftogaz in 2014–2015 Oschad’s Strategy for 2015 Rights under commercial sales contracts Profitable non-deficient activity until 2017 and further, as well as gradual increase of retail gas tariffs in accordance to IMF Memorandum In accordance with the Memorandum between the IMF and the Government of Ukraine, the MFU, and the NBU, the Bank has decided to extend the final maturity date in respect of the loans granted to National Joint Stock Company “Naftogaz of Ukraine to 10 June 2015 Gas in storage Government guarantees Funding Structure Most loans are pledged to and funded by NBU under refinancing facility with matching terms In the second half of 2013 the matured portion of the loans were repaid by cash (UAH 250 mln) and state guaranteed bonds (UAH 4.8 billion) with maturity in Dec 2016 9 State commitment to support Naftogaz with UAH29.7 bln in 2015 state budget for new capital injections Planned re-organisation in two separate transportation and storage companies in order to be in compliance with EU’s 3rd Energy Package. Attracting foreign investment into the main gas transportation system and upstream assets and development licenses Encouraging international commodity traders to supply the Ukrainian gas market Naftogaz financial performance was weak in recent years given its mandate to distribute public utilities to Ukrainian households with a significant discount, while the company’s losses were compensated from Ukrainian budget. As per the updated IMF program the company will cancel all discounts in 2015-2016, while budgeted capital injections from the state (UAH 96 bln in 2015-2016) will allow the company to improve its core financial metrics and restore its financial position Close dialogue with Naftogaz and full board level involvement in all strategic discussions and decisions Further focus on working with Naftogaz on non risk banking products: increasing fee and commission income through offering a range of other services such as trade finance, cash management, deposits, payment cards for employees etc Retail Banking • Full range of retail products, including term deposits, current accounts, personal loans, mortgage finance, auto loans, credit and debit card services, money transfers, utility payments, pensions as well as web and mobile-banking Retail Gross Loan Portfolio Breakdown YE2014 Collateralised Consumer Loans 34% Other Secured Loans 27% • Bank serves over 4 million of individuals and has the largest distribution network in the country. As of 31.12.2014 bank had 24 regional branches and 4 949 separate operational outlets within Ukraine Car Loans 9% • Despite market-wide deposit outflow trend, during 2014 bank managed to increase retail accounts by 3.3% YTD Mortgages 30% • Practically all of Retail Loans are secured and denominated in UAH Retail Accounts Dynamics Retail Lending Dynamics (Gross Loan Portfolio) UAH Bln UAH Bln 5,0 35.9 37.1 4,9 29.5 25.2 19,5 2010 2011 2012 Source: Oschadbank Financial Statements; IFRS (consolidated). 10 4,6 4,6 2012 2013 4,5 2013 2014 2010 2011 2014 Financial Performance Trend 2010-2014 (Balance Sheet) Loans to Deposits Ratio Total Assets % UAH Bln 185 173 124.3 155 101.7 132 83.4 125 73.9 112 57.6 2010 2011 2012 2013 2014 2009 2010 Total Customer Accounts Total Equity UAH Bln UAH Bln 2011 2012 Net Loans to Deposits 2013 2014 56,2 46,4 38,9 16,0 17,4 17,8 26.7% 25.1% 19,2 19,2 23.2% 17.97% 32,6 24,6 30.7% 2010 2011 2012 Source: Oschadbank Financial Statements; IFRS (consolidated). 11 2013 2014 2010 2011 Tier I Ratio (Basel I) 2012 2013 Book Value of Equity 2014 Financial Performance Trend 2010-2014 (P&L) Net Interest Income Net Fee And Commission Income 1 UAH Bln UAH Bln 5,29 5,51 5.32 4,60 1.23 1,26 2013 2014 1,04 4,14 0,94 0,91 7.1% 6.8% 6.4% 5.7% 4.4% 2010 2011 2012 2013 2014 Net Interest Margin 2010 2011 2012 Net Interest Income Profit After Tax Cost/Income Ratio UAH Mln % 1 092 663 711 112.0 458 2010 2011 2012 2013 2014 38.2 44.0 48.0 50.9 2011 2012 2013 - 10 015 2010 Source: Oschadbank Financial Statements, IFRS (consolidated). 1. Net interest income before provision for impairment losses on interest bearing assets. 12 2014 Assets and Liabilities Maturity and Currency Profile 2014 Financial Assets vs. Financial Liabilities by Maturity Financial Assets vs. Financial Liabilities by Currency UAH Bln 32,0 32,4 30,8 28,0 26,8 Financial Assets 1 19,8 19,1 72% 2% 26% 15,2 14,4 Financial Liabilities 2 2,6 0.1 Up to 1 Month 1 Month to 3 Months 3 Months to 1 Year Financial Assets 1 Year to 5 Years Over 5 Years 0.0 56% 6% 38% Maturity Undefined Financial Liabilities UAH USD Other Liquidity/Maturity Gap UAH Bln 20,33 17,26 16,81 11,12 3,95 3,08 0,11 (0,87) (8,75) (18,07) Up to 1 Month (8,94) (17,69) 1 Month to 3 Months Liquidity Gap 3 Months to 1 Year 1 Year to 5 Years Over 5 Years Cumulative Liquidity Gap based on Expected Withdrawal Dates for Current Customer Accounts Maturity Undefined Source: 2014 Oschadbank Financial Statements, IFRS (consolidated). 1 Financial assets comprise of cash and balances with the NBU, due from banks, loans to customers, investments available for sale, investments held to maturity and other financial assets 2 Financial liabilities comprise of due to banks, customer accounts, Eurobonds issued, other borrowed funds, other financial liabilities and subordinated debt 13 Cooperation with International Financial Institutions Starting from 2013 Oschadbank prioritises cooperation with international financial organisations that run programmes in Ukraine European Investment Bank SME Support Programme In December 2013 Oschadbank and European Investment Bank concluded a longterm finance contract that stipulates EUR 220 mln credit line with 10-year maximum tenors for disbursements. As of 01.01.2015 the disbursed amount equaled to EUR 198 mln Trade Support Programme Oschadbank was selected by EIB among intermediaries under the new trade support programme in the aggregate amount of up to EUR 400 mln, aiming at supporting Ukrainian importers and exporters. The parties started negotiations on the relevant financial contract Potentially interesting areas of cooperation with other IFIs: 14 SME Support Trade Facilitation Programme Energy Efficiency Programme Global Trade Finance Programme Annexes • • • • • 15 Oschadbank’s Management Board (page 16) Oschadbank’s Branch Network (page 17) Latest Technological Development (page 18) Relationship with the Government (page 19) Risk Management (page 20) Oschadbank’s Management Board Mr. Andriy Pyshnyy Chairman of the Management Board Directly supervises Treasury, Legal Dpt., Banking Security Dpt.,Risk Management and Public Relations; Chairs ACLO; 14 years in banking (Oschad, Ukrexim) Mr. Grygorii Borodin First Deputy Chairman Areas of responsibility: HR, Procurement, Financial Monitoring; Chairs Tender Com. 20 years with Oschad Ms. Iryna Zemtsova Deputy Chairman Areas of responsibility: Corporate Business, Structured Trade Finance; Chairs CC 28 years in banking (15 years with Oschad) Mr. Anton Tyutyun Deputy Chairman Areas of responsibility: Retail, Marketing, E-commerce; Chairs Retail CC and Tariff and Product Com 14 years in banking (UniCredit, Oschad) 16 Mr. Anatolii Barsukov Deputy Chairman Areas of responsibility: Finance Dpt., Accounting, Internal Control; Chairs Financial Com 20 years in banking (19 years with Oschad) Mr. Yevgenii Drachko-Yermolenko Deputy Chairman Mr. Volodymyr Lytvyn Deputy Chairman Areas of responsibility: Int. affairs, External Financing, Custody Business 12 years in banking (World Bank, Societe Generale, EBRD) Mr. Andriy Stetsevych Deputy Chairman Areas of responsibility: IT, Back-Office, Currency Control, Cash and Valuables Transportation; Chairs Operational Risks and IT Com Areas of responsibility: Problem Assets, Collection 20 years in banking (Privat, Oschad) 16 years in banking Oschadbank’s Branch Network • Largest branch network in the country with 24 regional branches and 4 949 outlets1 • Current focus on network efficiency increase, optimisation and comprehensive modernization Rivne (135) Lutsk (117) Chernihiv (194) Sumy (145) Zhitomyr (84) Kiyv (549) Lviv (346) Ternopil Ivano(64) Frankivsk (125) Uzhgorod (155) Poltava (201) Khmelnytsky (124) Kharkiv (287) Lugansk (224) Cherkassy (266) Vinnytsa (161) Kirovograd (119) Chernivtsi (157) Odesa (255) Dnepropetrovsk (317) Donetsk (485) Mykolaiv (181) Zaporizhia (175) Kherson (83) >300 branches 200–300 branches 100–200 branches <100 branches Simferopol* * Source: According to NBU’s Resolution # 260 Oschadbank has terminated its activity in Crimea According to NBU’s Resolution #466 Oschadbank has temporary stopped its activity on the territories uncontrolled by the Ukrainian government in the Donetsk and Lugansk Regions 1. Distribution network split by region on the map as of 1 January 2015. 17 Latest Technological Developments Branch Network Aiming to simplify and optimise the management and control over the bank’s branch network and to implement unified corporate standards and processes as well as to improve cost efficiency, the Bank has completed two-year reorganisation of sub-branches into outlets (units without own balance sheet) Comprehensive modernization of bank’s branches is on track (“new type” branches ) Alternative Sales Channels 24/7 customer support Call-centre up and running Trade POS-terminal network substantially widened with the best growth rate in this segment among the banks in Ukraine Renewed corporate website put into use New Web-banking and Mobile-banking for Retail customers launched IT and Technology Development Remain on Track Switch of all regional branches to the single core banking system completed High-powered processing center on WAY4 base successfully launched One of the first in Ukraine implemented contactless payment technologies Visa payWave and MasterCard payPass A new advanced Centralised storage facility based on IBM BDW model is being implemented Further developing and integration a broad range of up-to-date internal software in progress 18 Relationship with the Government 100% State owned with full Government support Bank operates commercially, on an arm’s-length basis, with the Government Full Government commitment shown through capital injections, funding from the NBU, and engagement of Oschadbank in mutually attractive and beneficial programmes The state of Ukraine exercises its right as a sole shareholder through Supervisory Council. According to the Clause 32 of the Articles of Association approved by the Government, Supervisory Council may not intervene in operating activity of the Bank According to the Clause 5 of the Law of Ukraine on Banks and Banking Activity, government authorities are prohibited from influencing the Bank’s management in any way The Government provides capital injections for Oschadbank to enable business expansion and maintain high capital adequacy. A new injection of UAH 11.6 billion was made by the Government in December 2014. Bank maintains strong cooperation with state-owned and strategically important entities in Ukraine, however exposure to the state-related sector keeps on decreasing from 71.3% in 2010 and 50.6% in 2011 to 37.1% in 2013 and 33.4% in 2014 despite the amendment to “state exposure” definition (threshold of Government’s stake for an entity to qualify as “state-related” lowered from 50% to 20%) Oschadbank is participating in a number of nationwide state programmes – Bank acts as a financial agent for the State in cash settlement for the Pension Fund and other social payments – Performs operations with accounts of participants of the wholesale electricity market, natural gas suppliers, state transportation and communication companies, serves Ukrposhta (Ukraine state post company) 19 Risk Management Risk management policies are approved by the Management Board, and implemented by ALCO, Credit Committee, Retail Credit Committee and Operational Risks Committee Supervisory Council (5 Members Appointed by Parliament, 5 Members by President, 5 Members by Cabinet of Ministers) Internal Audit ALCO Corporate, Retail Banking and Treasury 20 The Bank’s risk management policies are aimed to identify, analyse and manage risks, as well as to set risk limits and monitor them Management Board Credit Committee ALCO is a corporate operational body managing the assets, liabilities and market risks Retail Credit Committee Operational Risks Committee Credit Committee and Retail Credit Committee carry out management of assets, optimization of credit risks, fulfillment of decisions taken on risky operations including credit risks, and their execution control ORC manages operational risks, aiming at their minimization, implementation of relevant limits, internal rules and procedures Decisions beyond committees’ authority are subject to the Management Board approval Legal and Compliance, Accounting Risk Management Department Security, NPL Dpt. IT and Operations Risk Management Department is the operational unit assisting ALCO on the implementation of its functions and provides independent opinions to the Credit Committees and ORC Contact Details Public Joint Stock Company “State Savings Bank of Ukraine” 12-G Hospitalna Street, Kyiv, 01001, Ukraine Tel: +380 44 247 8540 Fax: +380 44 247 8537 E-mail: iref@oschadbank.ua http://www.oschadnybank.com/en/about/ Oleksandr Buglak Head of External Financing Tel: +38 044 249 3103 E-mail: abuglak@oschadbank.ua Andrii Garbar, ACCA Head of International Financial Markets Unit External Financing Tel: +38 044 249 3126 E-mail: GarbarAM@oschadbank.ua Oksana Markuta Head of Funding Support Unit External Financing Tel: +38 044 249 3126 E-mail: MarkutaOP@oschadbank.ua 21 DISCLAIMER This presentation is not an offer or solicitation of an offer to buy or sell securities. It is solely for use at this investor meeting and is provided for information only. By attending the presentation you agree to be bound as follows: This presentation has been prepared by Public Joint Stock Company “State Savings Bank of Ukraine” (the “Company”). and is confidential and does not constitute or form part of, and should not be construed as, an offer or invitation to sell securities of the Company, or the solicitation of an offer to subscribe for, underwrite or otherwise acquire, or a recommendation regarding, any securities of Company or any member of its group or an inducement to enter into investment activity, nor should it or any part of it form the basis of or be relied on in connection with (I) any contract to purchase or subscribe for any securities of the Company or any member of its group or (II) any other contract or commitment or investment decision whatsoever. This presentation has been made to you solely for your information and background for discussion purposes only and may be amended and supplemented and may not be relied upon for the purpose of entering into any transaction. This presentation and its contents are confidential and proprietary to the Company, and no part of it or its subject matter may be reproduced, redistributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other person or published in whole or in part for any purpose without the prior written consent of the Company. This presentation is not for distribution to private clients. If this presentation has been received in error it must be returned immediately to the Company. This presentation is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. Neither this presentation nor any copy hereof may be sent, or taken or distributed in the United States, Australia, Canada, Japan, or to any U.S. person (as such term is defined in the U.S. Securities Act of 1933, as amended (The “Securities Act”)), except as provided below. This presentation is only being provided to persons that are (I) "qualified institutional buyers" as defined in Rule 144A under the Securities Act that are also qualified purchasers as defined in section 2(A)(51) of the U.S. Investment Company Act of 1940 or (II) persons outside the United States that are not "U.S. persons" within the meaning of Regulation S under the Act. By attending this presentation the attendant warrants and acknowledges that it falls within the category of persons under (I) or (II)above. This presentation and the information contained herein are not an offer of securities for sale in the United States. This communication is directed solely at (I) persons outside the United Kingdom or (II) persons with professional experience in matters relating to investments falling within article 19(5) of the Financial Services And Markets Act 2000 (“Financial Promotion”) order 2005 (The "Order") or (III) High Net Worth Entities and other persons falling within article 49(2)(A) to (D) of the Order or (IV) those persons to whom it may otherwise lawfully be communicated or caused to be communicated (all such persons in (I)-(IV) above together being "relevant persons"). Any investment activity to which this communication relates will only be available to and will only be engaged with relevant persons. Any person who is not a relevant person should not act or rely on this communication. This presentation contains forward-looking statements. The words "believe", "expect", "anticipate", "intend", "plan“, “target”, “aim”, “will”, “may”, “would”, “could” and similar expressions identify forward-looking statements. All statements other than statements of historical facts included in this presentation including, without limitation, those regarding the Company's financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives related to the Company's products), are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which the Company will operate in the future. Furthermore, certain forward-looking statements are based on assumptions or future events which may not prove to be accurate. The forward-looking statements in this presentation speak only as of the date of this presentation. This presentation contains market share data based on internal management estimates (referred to herein as “Management Estimates of Market Share Data”) as no reliable market share data regarding the consumer finance sector is currently available from third party sources. Public information varies on definitions of segmentation and the Company may define certain product segments differently than its competitors, which may result in a different interpretation of the same information by different market participants. If a third party were to evaluate the market share data for the consumer finance sector in any jurisdiction in which the Company operates it may result in a different conclusion to the Management Estimates of Market Share Data presented by management herein. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. The information in this presentation has not been independently verified. Information other than indicative terms (including market data and statistical information) has been obtained from various sources. All projections, valuations and statistical analyses are provided to assist the recipient in the evaluation of matters described herein. They may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results and to the extent they are based on historical information, they should not be relied upon as an accurate prediction of future performance and the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. Neither the Company, nor any of its agents, employees or advisors intends or has any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this presentation. None of the Company or any of its affiliates or representatives, their respective advisers, connected persons or any other person accepts any liability whatsoever for any loss howsoever arising, directly or indirectly, from this presentation or its contents. The information contained herein is subject to change without notice. 22