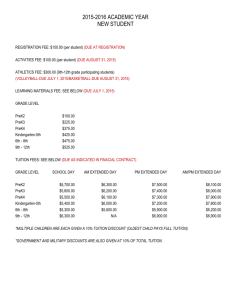

Fees Revenue MANUAL

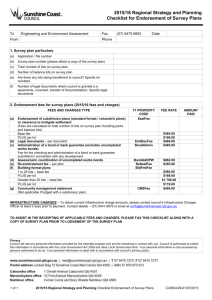

advertisement