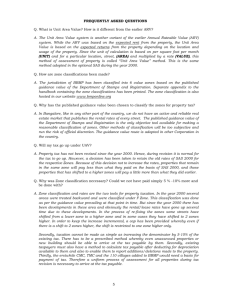

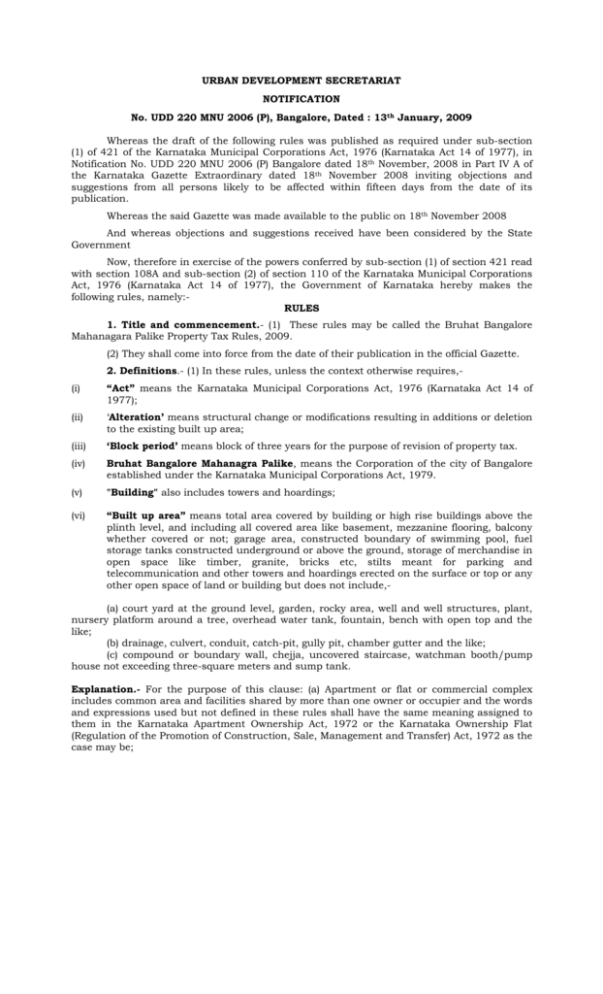

The Bruhat Bangalore Mahanagara Palike Property Tax Rules, 2009.

advertisement