ING in Society

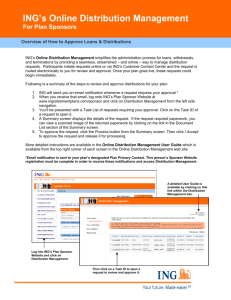

advertisement