appendix-14 l norms of scrap/waste material for an export product

advertisement

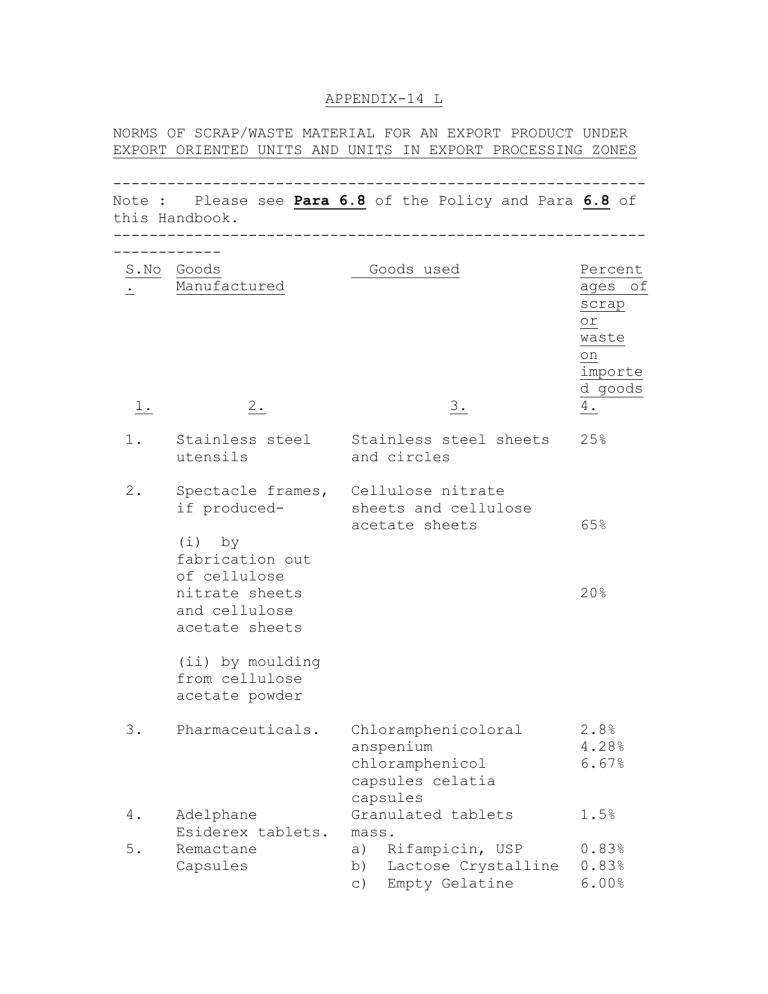

APPENDIX-14 L NORMS OF SCRAP/WASTE MATERIAL FOR AN EXPORT PRODUCT UNDER EXPORT ORIENTED UNITS AND UNITS IN EXPORT PROCESSING ZONES ----------------------------------------------------------Note : Please see Para 6.8 of the Policy and Para 6.8 of this Handbook. ---------------------------------------------------------------------Percent S.No Goods Goods used . Manufactured ages of scrap or waste on importe d goods 1. 2. 3. 4. 1. Stainless steel utensils Stainless steel sheets and circles 2. Spectacle frames, if produced- Cellulose nitrate sheets and cellulose acetate sheets (i) by fabrication out of cellulose nitrate sheets and cellulose acetate sheets 25% 65% 20% (ii) by moulding from cellulose acetate powder 3. Pharmaceuticals. 4. Adelphane Esiderex tablets. Remactane Capsules 5. Chloramphenicoloral anspenium chloramphenicol capsules celatia capsules Granulated tablets mass. a) Rifampicin, USP b) Lactose Crystalline c) Empty Gelatine 2.8% 4.28% 6.67% 1.5% 0.83% 0.83% 6.00% 6. Embroidery on fabrics Imported nylex fabrics and other embroidery materials like straw yarn, metallic yarn and sequences 4.23% 7. Salted peanuts and cashewnuts Hand Knitting Machines Imported tin sheets 8.9% Imported components such as selectors, carries, needles, beds and brushes a) PVC Plastic b) Metal Parts for hand bags c) Metal Parts for Jewellery d) Glass Chatons and Beads 0.40% 8. 9. Imitation Jewellery 8.0% 1.3% 3.5% 2.7% App-173 10. Polythene Bags PVC Granules 5% 11. Ivory Carvings Raw Ivory 30% 12. Raw ivory 10% 13. Plain ivory bangles Industrial chains Cold rolled steel -do- 40% 35% 14. (I)1/2” pitch chain (ii) 3/4” pitch chain Soap 5% 15 PVC pipes 16. Lead Glass tubing Fatty Acid, Oils and perfumes PVC resin, PVC Stabilizer PVC lubricants, filter processing acids, pigments and plasticisers Glass Tubes 20% 17. Lead in Wire Wire 15% 18. Fluorescent a) 14.96% Lead Glass tubings. 5% starter 19. Builders hardware 20. Combs and brushes 21 Jeens 22. Bed Linen sets 23. Jacket 24. 25. b) Bimetal c) Lead in wire(small) d) Lead in wire(big) e)Glow lamps f) Capacitors g) Revetting h) Aluminium alloy rods I) Bakelite sheets Brass rods, profiles sections of brass etc. 24.70% 25.00% 23.50% 6.5% 7.5% 5.5% 25% 35% Cellulose nitrate and acetate sheets 100% cotton denim 50.00% 34.00% 16.00% 100% cotton printed sheeting Knitted fabrics 5.37% 23.00% Shirts Plain fabrics Check (printed)fabrics 19.16% 20.00% PVC reinforced hoses,extruded moulded plastic products PVC Resin PVC Stabiliser PVC Lubricants Filter processing aids, Pigments and plasticisers. 5.00% App-174 26. Kraft paper & flutting media Lactose Analgin 10.00% 27. Corrugated sheets and boxes. Baraglin tablets. 28. Skirts Fabrics 20.00% 29. 65% polyester/35% cotton fabrics. M.S.Plates 22.00% 30. Embroidered Kaftan Air compressors 31. Detergent Powder Alkyl benezene, soda ash, caustic soda, 5.00% 3.00% 4.20% 5.00% sodium tripry phosphate, carbonyl methyl cellulose perfumes. Diazionon stablised Neocidol bulk Stainless steel sheets. 35.00% i)Copper enamelled ii)Insulating paper 1.5% 23% Aluminium Rod and Steel Wire HDFE,PP, LDPE, & PVC 1.75% 5% L.D.P.E. Granules 10% Woollen Pullovers and other Knitted Garments. Agarbatti Woollen and other yarn 10.02% (a) Packing Tubes for Agarbatti MIS Sheets/Tin Plates 5% Foil Board Sheet(Paper Board-Gold) -do-do- 22.5% 32.7% 37.5% 32. Neocidol 60 Ex. 33. Stainless steel Cutlery Domestic Mixers 34. 35. 36. 37. 38. 39. AAC/ACSR Overhead Conductors Injection/blow moulded plastic articles. Flexivial (b) Packing Cartons for Agarbatti (i) 15” agarbatti Unit Carton (ii) 10” Agarbatti Unit Carton (iii) 5 Tola 55 Series Unit Carton (c) Bamboo Sticks Waste Bamboo Sticks 3.00% 21.78% App-175 40. HRC Fuses 41. Carry Strappings 42. Polypropylene Bags Fire Hoses 43. 44. Processed Vegetable Oil 45. Lipsticks (a) Resistance Wire (b) Indicator (c) Contact Knives (d) Exconal (Aluminium Profiles) (e) Shrinkage Plastic (f) Pull Lugs (g) Hexagonal-1 Nut (h) Cylinder Head Screw (I) Spring Washer (j) Name Plates (k) Silicon Rubber (l) Striker Plat (m) Striker Hose (n) Striker Pin (o) Extractor Rivets (p) Compression Spring (q) Support Card Boards (r) Soldering Wire (s) Phenol Chalk Mineral (t) Copper Strips Polypropylene,Colour and pigments Polypropylene Aluminium Coupling(nut & tail piece) (a) Oil Blend (b) Tins/Jars (c) Outer Cartons (d) Cellophane Sheets/Bopp Rolls (e) Gum Tape/Cello Tape (f) Carry Stripping Rolls (a) Base Mechanisms/Case (b) Inner Cartons 10% 10% 1% 13% 15% 2% 1% 1.05% 5.25% 1% 2% 1% 1% 1% 3% 5% 3% 10% 5% 8 to 10% 7.5% 5.5% 1% 0.62% 5% 5% 3% 1% 1% 5% 5% 5% 46. Powder Compacts (c) Outer Cartons (d) Labels/Stickers (e) Gum/Cello Tapes (f) Carry Stripping Rolls (a) Raw Bulk Powder (b) Holding Cases (c) Godets (d) Pressing Cloth (e) Acetate Sheets (f) Applicators/Brushes (g) Labels/Stickers (h) Innner Cartons (I) Outer Cartons (j) Gum/Cello Tapes (k) Carry Stripping Rolls 1% 1% 1% 5% 5% 5% 5% 1% 5% 5% 1% 1% App-176 47. Eyebrow /Eye Shadow Pencils 48. Perfumary Products 49. Shampoo/Condition er (a) Raw Pencils (b) Foils (c) Caps (d) Trays (e) Inner Cartons (f) Plastic Cover for Trays (g) Outer Cartons (h) Gum/Cello Tapes/Carrystrap Rolls (a) Bottles/cans (b) Caps (c) Valves (d) Actuators (e) Lables/Stickers (f) Inner/Outer Cartons (g) Gum/Cello Tapes (h) Carrystrap Rolls (a) Bottles (b) Inner Cartons/Polybags (c) Outer Cartons (d) Cellophane Sheets/Bopp Rolls 5% 5% 5% 5% 1% 5% 5% 2% 5% 1% 5% 1% 1% 5% 5% 5% 3% 1% 1% 50. Hand Bags (e) Gum Tape (f) Cello Tape (g) Carry Stripping Roll 1% (a) Gobelin Tapestry/Fabric(Basic Fabric) (b) Nylon Lining Fabric (c) Frames (d) Chains 65% Polyester/35% Cotton and all types of Fabrics Aluminium Sheets 27.15% 30.83% Polyester Pongee cloth 30% Steel 4.6% Plastic Shets 4% Polyester/Cotton Fabrics 19.48% Printed Fabrics 17.04% 35.75% 7.40% 6.30% 51. Ladies Nighties 52. 57. Aluminium Claded Stainless Steel Utensils Artificial Flowers Marine Freight Containers Disposable Food Containers Overalls(Industri al & Institutional Garments) Bags 58. Pareos 59. Shorts Fabrics 22.82% 60 Polycarbonate Cans Polycarbonate granules 06.00% 53. 54. 55 56. -do- 11.27% 06.12% App-177 61. Polyester Film Capacitors I) Aluminium Foils ii) Polyester Foils iii)Coply wire iv)Resin v) Adhesive Tapes vi) Capacitors 02.00% 01.50% 02.50% 05.00% 100% 04% 62. 63. Domestic sewing machine needles Silver High Carbon Steel wire 44.86% Lithographic Films(different sizes) 105.23 % 64. Carved Limestones Unifinished Limestones 33.33% 65. Carved marbles Unfinished Marbles 22.75% 66. Bone China Tablewares a) b) c) d) e) f) g) 7.8% 67. Printed cartons Duplex Board 31.18% 68. Leaflets (Folder) Maplitho paper 15.06% 69. Shirts Band Art paper 20.00% 70. Sticker Presumed paper 27.00% 71. Jackets Quilted 21.42% 72. Night shirts 73. Dressing Gown 100% polyester Filler Taffata 100% Nylon 100% polyester Satin fabrics 100% polyester Terry Fleece Fabrics 74. Quilted House Coats/Dressing Gown Bone Ash Ball Clay China Clay Feldapar Quartz Vir.Body CER.GLAZE a) 100% Polyester Fabrics b) 100% Polyester Wadding c) Nylon Fabrics: 15.00% 18.98% 22.42% App-178 75. Stainless Steel Utencils a) Colander in 4 size b) Colander stand in 3 size c) Colander handle in 2 size d) Multi Cookerware set- a set of 4 pcs e) Cocktail Shaker f) Thala g) Stainless steel Boerner Ring h) Zara in 5 size I) Thavetha in 5 size j) Laddle 4 size k) Bhaji spoon pan in 4 size l) Champage Bucket m) Charni n) Vegetable Steamer o) Supreme Bowl p) Cannister in 8 size q) Pickle Tray r) Double body cup and saucer s) Tiffin 28 swg Dabba, Frame, Lock clip t) Pasta Cannister u) Tea Kettles v) Q Tip Container w) Charge Plate x) cotton Container y) Kettle Covers z) Pressure Cooker aa)Stock pot bb)Butter Warmer cc)Mixing Bowl, Serving Bowl Stainless Steel Coil 39.00 76. 77. dd)Cookware set Sandwich BottomCasserol in 6 size saucepan in 2 size and Frypan in 3 size. Hings with Ball Bearings Syringes with or without needles I) Brass Sections 39.00 Plastic film medical disposable film 422mx100micron 11% App-179 78 . Synethic yarn/blended yarn Input material for synthetic/blended yarn 2% 79 Plastic granules & plastic articles LDPE, HDPE, LLDPE, EPPS, ABS & HIPs etc. 5% 80 Hot water bottles of rubber Rubber 5% 81 Denim fabrics Waste in the form of cotton(from cotton to yarn 14% Waste in the form of hard waste(from yarn to fabric) 82 83 Surimi(minced fish paste) fresh and frozen fish etc. Bicycle Frames and forks 4% 9.23% Waste in the form of fabrics(fents, rags/chindies during the process of finishing and packing Surimi fish paste 60% Steel sheets Bicycle frames(wt.3000 gms) Model genius Bicycle ii) frames(wt.3000 gms) Regular model MTB Fork MTB (wt.1061 Iii) gms) ERW Steel tubes 7.69% ESW Steel tubes 6.25% ERW steel pipes 12.53% 84 Input material for Halogen Lamps 5% i) Halogen Lamps App-180 85 Barium Ferrite Powder/Strontum Ferrite Powder Input powder 30% 86. Terry Towels i) Terry Towel without border Input thread 5.66% ii) Terry Towel with border Import thread 10.80% 87. Embroidered fabrics 15% Base cloth(Blended/100%polyes ter) 9% Yarn waste(Embroidered 88. Rice yarn) Waste of out put allowed Bran Broken Rice Sortex(Rejects) Impurities(Organic/Inorg anic 8% 20% 15% 2% App-181 89. Wire wheels HR sheet for Rim HR sheet for shell Billets for shell Spoke wire 21% 41% 69% 13% 90. Servo Control Mechanism and components Nipple wire 39% Stator Housing G4x2 32.7% Stator Housing G4x3 29.5% Stator Housing G4x4 26% Front Flage G4x4 11.9% Resolver Housing G4x2 19.56% Resolver Housing G4x3 15.6% Resolver Housing G4x4 15.6% Nozzie Block as per drgB65804 18.46% 6.25% G4x2 Stator Complete copper wire Radex cable 1% 4% Stator Core scrap 4.3% G4x3 Stator Complete copper wire Radex cable Stator core scrap 1% 4% 5% G4x4 Stator Complete copper wire Radex cable Stator Core Scrap 91. 92. Knitted cotton sports and dress socks Upto 24s carded yarn 1% 2.4% Nylon and lycra yarn 10% Cotton Cotton 14% 13% 24s to 60s carded yarn App-182 93. Bulk drugs/intemediate s Acetone Methanol Isoprophy Alcohol Acetic Acid 30% 6% 65% 90% 94. Paper Cone for Yarn Bicycle and bicycle components(Rims) Input material 40% 95. Aluminum alloy rims profiles 26” 24” 20” Watch screws Watch pinions Watch reverts 7.75% 6.34% 7.24% 96. Watch screw and parts 97. Charge Chrome Charge Chrome 50%(of granulate d slag.) 98. Acrylic Blankets(one ply and two ply) Printed books and related products Acrylic yarn 17% Paper Graphic films Pre-sensitized Aluminimum plates 11.9% 4.6% 2.6% 100 (a) Combed cotton yarn Cotton 30% 101 Disposable Gas Cylinders CRC Sheets 31% 102 Oil Seal plates Stainless steel Journal Bearing Steel bar SS bar (i) Phosphor bronze tube (ii) Phosphor bronze bar 50% 43% 40% 50% 99. 82.66% 92.72% 78.24% 103 Engg &Textile machinery components i)Iron castings, Steel Bars non ferrous metals and non-Metals and aluminum ii) CR/HR Sheets 10% 15% App-183 104 Double throttle Check valve Casting Steel bar 0.974/Kg 0.036/Kg Double check Valve Casting Steel bar 0.594/kg 0.663/kg Gear Pump Aluminum Extrusion 0.830/kg 105 Guar Gum refined splits Guar Seeds 1.3% 106 100% Cotton gauze Swabs Cotton yarn 11% 11% Cotton bandage & Length wise elastic cloth 107 Silk fabrics 108 Silk Garments i)Ladies skirt ii)Ladies blouse iii) Ladies dress iv) Ladies Jacket v) Ladies Cotton yarn Mulberry raw silk/Douppion yarn 35% 100% silk fabric -do-do-do-do-do-do- 10% trousers vi) Men's shirt vii)Ladies shirt 109 100% silk fabric 100% silk 2% 110 Plain Jewellery and articles and ornaments like Mangalsutra containing gold and black beeds/imitation stones, cubic zirconia etc. but excluding diamonds, precious, semiprecious stones. (i) Gold/ Platinum (by weight) 3.5% (ii) Silver (by weight) 4.5% App-184 111 112 113 Studded jewellery other then those covered by S.No.110 above and articles thereof Mountings and findings manufactured indigenously i) Gold/ Platinum (by weight) Chains/Bangles manufactured by a fully mechanised process and i) Gold/ Platinum (by weight) (ii) Silver (by weight) i) Gold/ Platinum (by weight) (ii) Silver (by weight) 9% 10% 3.5% 4.5% 1.25% 113 114 115. 116 unstudded. (ii) Silver (by weight) 1.25% Mountings whether imported or indigenously procured/manufact ured, used in the studded jewellery Gold/silver/plati num medallions and coins (excluding the coins of the nature of legal tender) Repair/remaking of plain /studded gold/silver/plati num jewellery i) Gold/ Platinum (by weight) 2.5% (ii) Silver (by weight) i) Gold/ Platinum (by weight) 2.5% (ii) Silver (by weight) 0.25% Gold /silver/ platinum jewellery 2% Garbare bass Carry bars with handle Ethylene(HMHDPE) Ethylene(LD/LLDPE) 5% 12% 0.25% App-185 117 Semi woolen yarn Woolen Fibres/sliver/roving etc 7.13% 118 Decorative glass window panels Glass 20% 119 Bulk drugs and bulk drugs intermediates Acetone, Methanol Isoprophy, Alcohol, Acetic Acid 40% 120 Timing Gears Gear Lubricant Oil RH, Gear Water Pump RH, Gear Crank RH, Gear Idler LH, Gear Accessory RH, Gear Idler RH, Gear Hyd. Pump LH, Gear Cam Shaft(Hobbed) 24.56% 121 Items not covered above (excluding Gem & Jewellery) As applicable Upto 5% App-186 TO BE PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY (PART-I, SECTION-1) GOVERNMENT OF INDIA MINISTRY OF COMMERCE AND INDUSTRY PUBLIC NOTICE No 21 /2002-07 NEW DELHI: the 1st July, 2002 In exercise of powers conferred under paragraph 2.4 of the Export and Import Policy, 2002-07, the Director General of Foreign Trade hereby makes the following amendment/correction in the Handbook of Procedures (Vol.1): 1) Paragraph 3.6 pertaining to the “Export Promotion Council” is amended as under: “ The general policy relating to the Export Promotion Councils is given in Chapter – 2 of the Policy. A list of Export Promotion Councils/ Commodity Boards is given in Appendix 27.” 2) Paragraph 6.15 (a) to (f) pertaining to the provision of “Sub Contracting” is corrected. The corrected paras would read as under: (a) EOU/ EPZ/ EHTP units may be permitted to remove moulds, jigs, tools, fixtures, tackles, instruments, hangers and patterns and drawings to the premises of the sub contractors subject to the conditions that these shall be brought back to the bonded premises of EOU/ EPZ/ EHTP unit on completion of the job work within a stipulated period. (b) Export of finished good directly from the job worker’s premises may be permitted provided the job worker’s premises is registered with the Central Excise authorities. However, export of such products from the job worker’s premises shall not be allowed through third parties as provided under paragraph 6.10 of the Policy. Accordingly para 6.15 (g) pertaining to “ Contract farming” is renumbered as 6.15 (c). 3) Paragraph 7.12 pertaining to the provision of “ Sub Contracting” for SEZ units is corrected. The corrected para would read as under: (a) Export of finished goods directly from the job worker’s premises may be permitted provided the job worker’s premises are registered with the Central Excise authorities. Export of such products from the job worker’s premises shall not be allowed through third parties as provided for under paragraph 7.10 of the Policy. (b) In case of SEZ units undertaking job work for export on behalf of DTA unit in terms of paragraph 7.12 of the Policy, the finished goods shall be exported directly from the SEZ unit and export documents shall be in the name of DTA unit. (c) SEZ units may be permitted to remove moulds, jigs, tools, fixtures, tackles, instruments, hangers and patterns and drawings to the premises of sub contractors subject to the conditions that these shall be brought back to the bonded premises of SEZ units on completion of the job work within a stipulated period. 4) The last sub- para of paragraph 8.6.1 is deleted without making any alterations in the first two sub paras. Hence para 8.6.1 is amended as under:8.6.1 In respect of supplies under paragraph 8.2 (b) of the Policy, the DTA unit shall claim the Advance Licence for deemed export from the concerned licencing authorities. Alternatively, the DTA unit may claim deemed export drawback from the concerned Development Commissioner. However, for supplies to EHTP/ STP , the DTA unit shall claim deemed export benefits from the licencing authorities concerned. Such supplies shall be certified by the receiving agencies. 5) S.No 2 of the documents to be enclosed with the application form in Appendix 10 B pertaining to the “Application Form for Grant of Advance Licence under Duty Exemption Scheme” is amended as under: 2. Project Authority Certificate in case of application for Advance Licence for deemed export (except in the case of supplies to an EPCG licence holder wherein the invalidation letter would suffice) or a copy of invalidation letter in case of application for Advance Licence for intermediate supply. 6) Four new Agri Export Zones are added at S. Nos 25, 26, 27 & 28 in Appendix 15 pertaining to “Agri Export Zone”. Similarly the Agri export zone at S.No 6 which was restricted to 13 mandals of Chitoor district of Andhra Pradesh has been expanded to cover the entire Chitoor district. All these amendments/ additions are tabulated as under: S.No Product State Districts covered 6 Mango Pulp & Fresh Andhra Pradesh Chitoor Vegetables 25 Flowers (Orchids) & Cherry Sikkim East Sikkim Pepper 26 Ginger Sikkim North, East, South & West Sikkim 27 Rose Onion Karnataka Bangalore (Urban), Bangalore (Rural), Kolar 28 Flowers Karnataka Bangalore (Urban), Bangalore (Rural), Kolar, Tumkur, Kodagu and Belgaum This issues in public interest. (N.L.Lakhanpal) Director General of Foreign Trade (A.B.Menon) Dy.Director General of Foreign Trade (F.NO. 01/94/180/26/AM03/PC-IV) (TO BE PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY (PART-I, SECTION-1) GOVERNMENT OF INDIA MINISTRY OF COMMERCE AND INDUSTRY PUBLIC NOTICE No. 16/2002-07 NEW DELHI: the 5th June, 2002 In exercise of powers conferred under paragraph 2.4 of the Export and Import Policy, 2002-07, the Director General of Foreign Trade hereby makes the following amendment in the Handbook of Procedures (Vol.1):1. Para 6.2 (j) is corrected as under: “(j) The unit shall be able to account for the entire quantity of goods imported/procured duty free, by way of exports and sales in DTA or transfer to other EOU/EPZ/ EHTP/ STP/ SEZ units, and balance in stock. However, at no point of time the units shall be required to co-relate every import consignment with each category of homogenous goods exported, transferred to other EOU/ EPZ/EHTP/STP/SEZ units, sales in DTA and balance in stock. In case of doubt the matter shall be referred to BOA for decision.” 2. Note (i) of paragraph 6.5 is corrected as under:(i) If any goods are obtained from another EOU/EPZ/EHTP/STP unit, or procured from an international exhibitions held in India and precious metals procured from nominated agencies, the value of such goods shall be included under B. 3. Paragraph 6.8 (c) is corrected as under:“ DTA sale shall be admissible only to similar goods as that of the goods manufactured and exported from the unit. In case of doubt in regard to similar nature of goods, the matter shall be referred to the BOA for decision”. 4. In paragraphs 6.8(e) and 6.8 (f), the words and expression “Appendix 14-M” is corrected to read as “Appendix 14-L”. 5. A new paragraph 6.9 (d) is added as under: “ ITA –I items to be cleared in the DTA shall undergo tariff change at four digit level. Only the value added products, which have undergone the process of manufacture would be allowed to be clear in the DTA. 6. Paragraph 6.20 (d) is corrected as under: “The depreciation norms for capital goods of units, including electronics, would be subject to an overall limit of 90% as notified by the Department of Revenue. (i) Depreciation for computers and computer peripherals for all types of electronic units would be as follows: 10% for every quarter in the first year; 8% for every quarter in the second year; 7% for every quarter in the third year; (ii) For capital goods, other than the above, the depreciation rate would be as follows: 4 % for every quarter in the first year; 3 % for every quarter in the second and third year; and 2.5 % for every quarter in the fourth year and thereafter. 7. Paragraph 6.22 (a) is corrected as under : “ (a) NFEP and EP shall be monitored in terms of paragraph 6.22 of the Policy as per the guidelines given in Appendix 14-E of the Handbook (Vol.1).” 8. The sub- paras of Paragraph 6.27 b) (v), are re-numbered as (a), (b),(c),(d),(e) & (f). 9. Paragraph 6.29 is corrected as under: “A fast track procedure will be separately notified for EOU/EPZ units with actual investment in plant and machinery, both imported and indigenous imported of Rs.5 crores and above.” 10. A) The Note at S.No 1. of Appendix 14-A pertaining to the “Application for setting up EOUs or Units in Export Processing Zone / SEZ” is corrected as under: “1. Please see Paras 6.7 and 7.7 of EXIM Policy & Paras 6.7 and 7.7 of this Handbook.” B) In Annexure to Appendix 14 A pertaining to “Proforma to be filled in by the existing DTA units seeking conversion into the EOU/ EPZ/ SEZ Scheme” , clause “(h)” is deleted and the existing entry “(i)” is renumbered as “(h)” 11. A) The Note at the beginning of Appendix 14-D pertaining to “Form of Legal Agreement for Export Oriented Units and EPZ/ SEZ Units” is corrected as under: “Please see paras 6.6 & 7.6 of EXIM Policy and Paras 6.6 & 7.6 of the Handbook of Procedure.” B) The words and expression “Central Excise and Salt Act 1944” at S.No 7 of Appendix 14 D, is substituted by the words and expression “Central Excise Act, 1944”. 12. Appendix 14-E pertaining to the “Guidelines for monitoring the performance of EOU/ EPZ/ SEZ/ STP/ EHTP units” is corrected as per the Annexure to this Public Notice. 13. Appendix 14-F pertaining to the “Guidelines for sale of goods in the Domestic Tariff Area (DTA) by EOU/ EPZ/ SEZ/ STP/ EHTP units” is corrected as per the Annexure to this Public Notice. 14. A) The note at the beginning of Appendix 14-G pertaining to “Procedure to be followed for reimbursement of Central Sales Tax (CST) on supplies made to Export Oriented Units (EOU’s) and units in Export Processing Zones (EPZ), Electronic Hardware Technology Park (EHTP), Software Technology Park (STP) and Special Economic Zones (SEZ) from Domestic Tariff Area (DTA)” is corrected as under : “ Please see Paras 6.12 & 7.9 of EXIM policy and paras 6.12 & 7.9 of this Handbook.” B) Clause (c) in the Undertaking and Declaration to Annexure 1 of Appendix 14 G, is deleted and the exiting clause (d) is renumbered as (c). 15. The note at the beginning of Appendix 14-K pertaining to “ Guidelines on revival/ debonding of sick EOU/ EPZ units” is corrected as under: (Please see Para 6.28 of EXIM Policy & Para 6.28 of this Handbook) 16. A) The note at the beginning of Appendix 14-L pertaining to the “Norms of Scrap/ Waste Material for an export product under export oriented units and units in export processing zones” is corrected as under: “Please see Para 6.8 of Policy and 6.8 of this Handbook.” B) S.No 107 of Appendix 14 L is amended as under: S.No Goods Manufactured Goods Used Percentage of scrap or waste on imported goods 107 Silk fabrics Mulberry raw silk/ 35% Douppion yarn 17. The email ID of Development Commissioner, Cochin at S.No 36 of Appendix 24 pertaining to “List of Licensing Authorities and their Jurisdiction”, is corrected as under : “dc@csez.com” 18. The following corrections are made in Appendix 35 pertaining to the List of Agencies Authorised to issue GSP Certification” S.No. Agencies Authorised to issue GSP Authorized for Certification 8. Madras Export Processing Zone, All products manufactured by Units Administrative Office Building, National in Madras EPZ and EOUs. Located Highway 45, Tambaram, Chennai within the respective jurisdiction of 600045 Development Commissioner 9. Kandla Special Economic Zone, All products manufactured by Units Gandhidham, Kutch, in Kandla & Surat SEZs. and EOUs. Gujarat, 370230 located within the respective jurisdiction of Development Commissioner 10. SEEPZ Special Economic Zone Andheri All products manufactured by Units (East), Mumbai, 400096 in SEEPZ SEZ and EOUs. located within the respective jurisdiction of Development Commissioner 11. Cochin Special Economic Zone All products manufactured by Units Kakkanad Cochin 682037 in Cochin SEZ and EOUs. located within the respective jurisdiction of Development Commissioner 12. Noida Export Processing Zone Noida All products manufactured by Units Dadri Road, Noida 201305 in Noida EPZ and EOUs. located within the respective jurisdiction of Development Commissioner *14. Visakhapatnam Export Processing Zone, All products manufactured by Units Administrative Building, Duvvada in Visakhapatnam EPZ and EOUs. Visakhapatnam 530046 located within the respective jurisdiction of Development Commissioner 15 Falta Export Processing Zone 2nd MSQ All products manufactured by Units Building 4th Floor Nizam Palace, in Falta EPZ and EOUs. located Kolkata 700020 within the respective jurisdiction of Development Commissioner * At present Visakhapatnam and Falta EPZs. are combined at S.No. 14. 19. The following corrections are made in Appendix 35 A pertaining to the “List of agencies to issue Certificates of Origin for SAPTA and Bangkok Agreement” 29. SEEPZ Special Economic Zone Andheri (East), Mumbai, 400096 30 Kandla Special Economic Zone, Gandhidham, Kutch, Gujarat, 370230 32. Cochin Special Economic Zone Kakkanad Cochin 682037 This issues in public interest. (N.L.Lakhanpal) Director General of Foreign Trade Annexure to Public Notice No dated Appendics E & F AMENDMENTS IN HOP 1. Para 6.2 (j) is corrected as under: “(j) The unit shall be able to account for the entire quantity of goods imported/procured duty free, by way of exports and sales in DTA or transfer to other EOU/EPZ/ EHTP/ STP/ SEZ units, and balance in stock. However, at no point of time the units shall be required to co-relate every import consignment with each category of homogenous goods exported, transferred to other EOU/ EPZ/EHTP/STP/SEZ units, sales in DTA and balance in stock. In case of doubt the matter shall be referred to BOA for decision.” 2. Note (i) of paragraph 6.5 is corrected as under:(i) If any goods are obtained from another EOU/EPZ/EHTP/STP unit, or procured from an international exhibitions held in India and precious metals procured from nominated agencies, the value of such goods shall be included under B. 3. Paragraph 6.8 (c) is corrected as under:“ DTA sale shall be admissible only to similar goods as that of the goods manufactured and exported from the unit. In case of doubt in regard to similar nature of goods, the matter shall be referred to the BOA for decision”. 4. In paragraphs 6.8(e) and 6.8 (f), the words and expression “Appendix 14-M” is corrected to read as “Appendix 14-L”. (e) Norms for disposal of Waste/scrap/remnants arising out of production process and in connection therewith, including wastage or manufacturing loss on gold/silver/ platinum jewellery and articles thereof, is given in Appendix 14-L of the Handbook (Vol.1). (f) In respect of items not covered by Appendix- 14-L, Development Commissioner shall fix the wastage keeping in view the norms notified under Duty Exemption Scheme. For items not covered by these two, the Development Commissioner shall send proposals to the Board of Approval for decisionAll cases where wastage norms have not been fixed by the Development Commissioner within 45 days from the date of receipt of application, the same shall be referred to the Board of Approval for information alongwith reasons for delay. 5. A new paragraph 6.9 (d) is added as under: “ ITA –I items to be cleared in the DTA shall undergo tariff change at four digit level. Only the value added products, which have undergone the process of manufacture would be allowed to be clear in the DTA. 6. Paragraph 6.15 is amended as follows:- (a) EOU/ EPZ/ EHTP units may be permitted to remove moulds, jigs, tools, fixtures, tackles, instruments, hangers and patterns and drawings to the premises of the sub contractors subject to the conditions that these shall be brought back to the bonded premises of EOU/ EPZ/ EHTP unit on completion of the job work within a stipulated period. (b) Export of finished good directly from the job worker’s premises may be permitted provided the job worker’s premises is registered with the Central Excise authorities. However, export of such products from the job worker’s premises shall not be allowed through third parties as provided under paragraph 6.10 of the Policy. c) EOUs in agriculture/horticulture engaged in contract farming may on the basis of annual permission from the Customs authorities take out inputs and equipments to the DTA farm subject to the following conditions: i) Supply of inputs by the EOU to the contract farm(s) shall be subject to the input-output norms notified by the Directorate General of Foreign Trade. ii) There shall be contract farming agreement between the EOU and the DTA farmer(s); iii) The contract farm(s) shall be within the jurisdiction of the same Commissioner of Customs/Excise under whose jurisdiction the unit is registered. iv) The unit has been in existence for at least two years and engaged in export of agriculture/ horticuture products; otherwise it shall furnish bank guarantee equivalent to the duty foregone on the capital goods/inputs proposed to be taken out to the Assistant Commissioner of Customs/ Central Excise till the unit completes two years. 7. Paragraph 6.20 (d) is corrected as under: “The depreciation norms for capital goods of units, including electronics, would be subject to an overall limit of 90% as notified by the Department of Revenue. (i) Depreciation for computers and computer peripherals for all types of electronic units would be as follows: 10% for every quarter in the first year; 8% for every quarter in the second year; 7% for every quarter in the third year; (ii) For capital goods, other than the above, the depreciation rate would be as follows: 4 % for every quarter in the first year; 3 % for every quarter in the second and third year; and 2.5 % for every quarter in the fourth year and thereafter. 8. Paragraph 6.22 (a) is corrected as under : “ (a) NFEP and EP shall be monitored in terms of paragraph 6.22 of the Policy as per the guidelines given in Appendix 14-E of the Handbook (Vol.1).” 9. The sub- paras of Paragraph 6.27 b) (v), are re-numbered as (a), (b),(c),(d),(e) & (f). (v) Change of location/expansion: To permit change of location from the place mentioned in the LOP/LOI to another and/or include additional location provided that: (a) no change in other terms and conditions of the approval is envisaged. (b) the new location is within the territorial jurisdiction of the DC. (c) other locational, zoning, land-use or environmental conditions are also complied with; (d). Extension of validity of LOP/LOI: To extend validity period of LOP/LOI by two years beyond the initial validity period of the LOP/LOI (except in case where there is a restriction on initial period of approval, like setting up of oil refinery projects) ; (e). To recommend extension of LOP/LOI to BOA along with field inspection report of the unit for the sixth year. (f). The Development Commissioner may also cancel LOI/LOI/IL wherever warranted. 10. Paragraph 6.29 is corrected as under: “A fast track procedure will be separately notified for EOU/EPZ units with actual investment in plant and machinery, both imported and indigenous imported of Rs.5 crores and above.”