THE GfK MRI PSYCHOGRAPHIC SOURCEBOOK

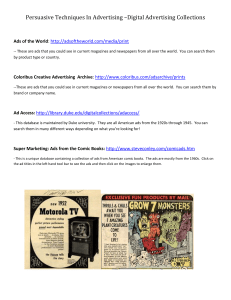

advertisement